Sundry Photography

Investment Thesis

Analog IC leader Texas Instruments Incorporated (NASDAQ:TXN) stock has been hammered as the broad semi industry went into a bear market. In addition, headwinds from its revenue concentration in China and exposure to personal electronics (24% in FY21) have caused semi investors to be skittish as they parsed their valuations.

Notwithstanding, TXN has been a remarkable long-term winner for investors with its focus and leadership on cost-effective matured nodes. Despite the intense rivalry with Analog Devices (ADI), management believes its portfolio’s breadth and technological advantage remains well ahead.

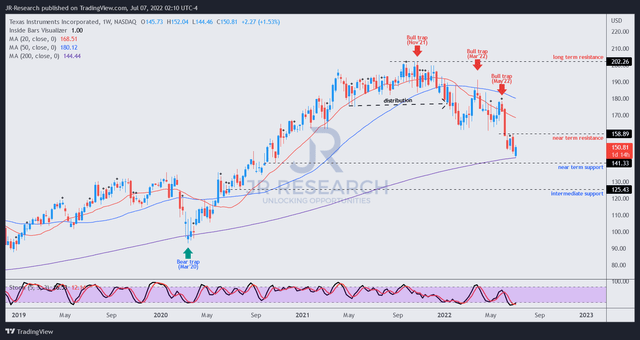

Our price action analysis suggests that TXN is well-entrenched in a bearish bias, even though it could be at a near-term bottom. But there’s no bear trap (significant rejection of selling momentum) observed yet to help stanch its downside momentum.

Our valuation model indicates that TXN could underperform the market at the current levels. Therefore, investors are urged to continue exhibiting patience before adding it.

As such, we rate TXN as a Hold for now.

Texas Instruments’ Growth Has Already Peaked in FY21

An IC insights report in early June confirmed the market leadership of Texas Instrument with a market share of 19% in analog IC in 2021. However, Analog Devices has kept pace with Texas Instruments, with a market share of 12.7%.

BofA (BAC) is also more confident of Analog Devices’ profitability growth and expects its “free cash flow generation to exceed Texas Instruments going forward.”

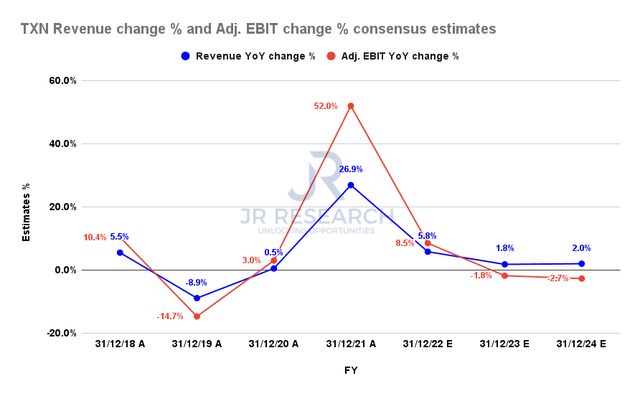

TXN revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

Notably, the consensus estimates (generally neutral) suggest that Texas Instruments’ revenue growth has likely peaked in FY21, despite its robust exposure to the growing industrial and automotive segment. As a result, TXN is projected to post revenue growth of 5.8% in FY22 before moderating to 1.8% in FY23.

Notwithstanding, the impact of its revenue slowdown is not expected to worsen its operating leverage markedly.

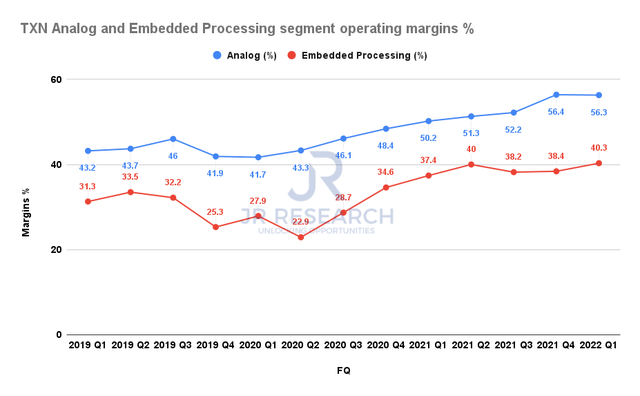

TXN segment operating margins % (Company filings)

As seen above, Texas Instruments has been operating at markedly higher margins than its pre-COVID metrics, given the strength in its Analog segment and the demand/supply dynamics. However, despite its pricing leadership, we caution that a broad slowdown in the semi industry could still impact its overall profitability.

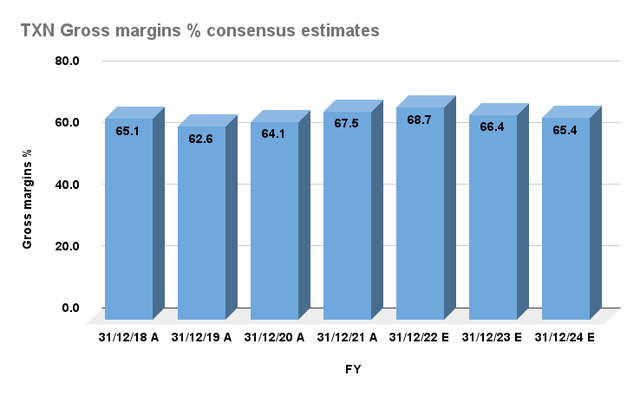

TXN gross margins % consensus estimates (S&P Cap IQ)

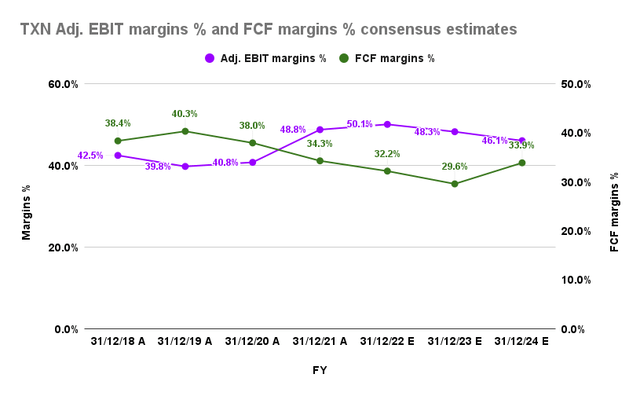

TXN adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Therefore, investors should consider the decelerating gross and adjusted EBIT margins estimates as its topline growth slows. Also, its renewed focus on CapEx expansion is expected to impact its free cash flow (FCF) profitability markedly, as seen above. As such, we believe the market has been modeling for lower margins in the near- to intermediate-term, given the impact on its valuation.

Notwithstanding, management remains steadfast on its CapEx expansion, as CEO Richard Templeton articulated in an early June conference (edited):

Almost all companies are starting to rethink their supply chains and what do they have to do differently to get them more resilient, be more focused, make sure they’ve got the right partnerships and relationships on that front. The reaction that we’ve had from customers and the progress that the team is internally making to get this stuff in place. And then lastly, I think, it does tremendous things to our internal business people and product line managers because they can operate with great confidence that they know where they can put designs and what they will have to support. So that’s all really been very effective. (Bernstein 38th Annual Strategic Decisions Conference)

TXN – Valuation Is Not Attractive Yet

| Stock | TXN |

| Current market cap | $139.07B |

| Hurdle rate (CAGR) | 17% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 4.5% |

| Assumed TTM FCF margin in CQ4’26 | 33.6% |

| Implied TTM revenue by CQ4’26 | $37.68B |

TXN reverse cash flow valuation model. Data source: S&P Cap IQ, author

We applied TXN’s 5Y total return CAGR of 17% as our hurdle rate and the 5Y mean of its FCF yield of 4.5% to understand its current valuation dynamics.

Using a markedly lower blended TTM FCF margin of 33.6%, we believe the market could be asking for even higher FCF yields moving forward. Our model suggests that Texas Instruments is unlikely to meet our TTM revenue target of $37.68B by CQ4’26. Therefore, we believe the market has astutely de-rated TXN stock to account for the broad semi slowdown and lower FCF profitability due to its CapEx plans.

As a result, we believe that TXN is likely to underperform its 5Y average performance and the market moving ahead.

TXN – Price Action Still Suggests Caution

TXN price chart (TradingView)

TXN is testing its critical 200-week moving average. So, we believe it’s close to its near-term support, which could even attract long-term investors to buy the dip.

Notwithstanding, a dominant bearish bias, coupled with a series of bull traps, has prevented the retaking of its bullish momentum. Therefore, investors looking to layer out/cut exposure should first watch for a possible short-term rally that could form a potential bull trap.

Is TXN Stock A Buy, Sell, Or Hold?

We rate TXN as a Hold for now.

TXN has been justifiably battered as it could underperform, as our valuation model suggests. However, it’s likely at a level that could attract long-term investors to add the dip, lending further support to its consolidation zone.

Notwithstanding, given its potential for underperformance, we encourage investors to consider other beaten-down stocks for adding exposure, given the tech bear market.

Be the first to comment