Joe Raedle

Carvana (NYSE:NYSE:CVNA) is a rapidly growing brand people recognize as a go-to platform for buying and selling used cars. Carvana is generally more straightforward and quicker to manage than other platforms, making it a top choice for younger car buyers and sellers. Carvana also markets itself as creating significant savings for buyers through its streamlined online platform.

Carvana saw rapid growth over the past two years as the lockdown caused many people to avoid in-person car dealerships. Additionally, as new car production declined due to numerous supply-chain shortages, Carvana benefited from a boom in used car prices and sales. However, the company’s financial losses have risen dramatically as the more cars it sells, the more money it appears to lose. To make matters worse, the boom in used vehicles seems to be over as used car prices have become far more expensive, causing demand to move lower. Even more, the rapid rise in interest rates has caused used vehicle financing to become far more costly, driving demand for all vehicles to decline significantly.

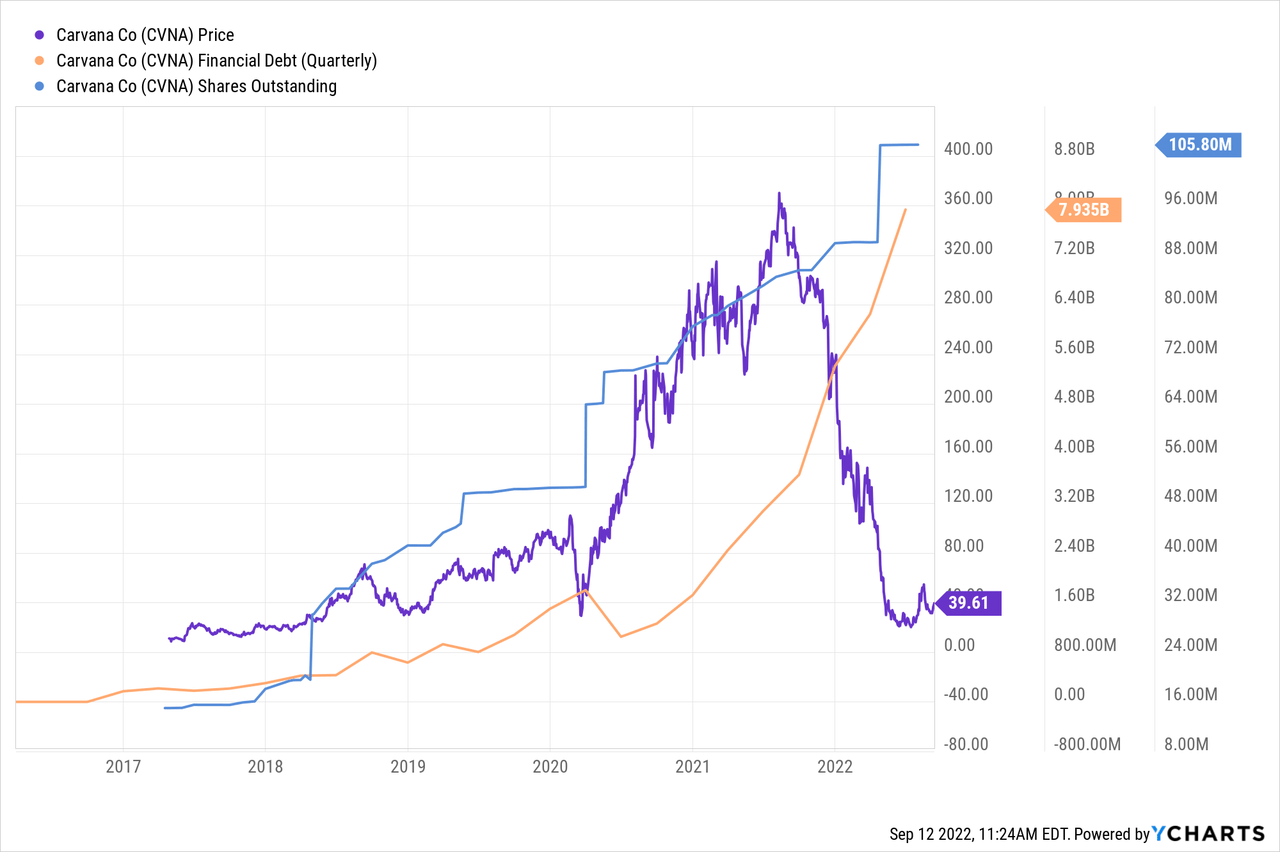

To offset the massive decline in cash flows, Carvana has relied on immense equity dilution and debt financing to maintain a positive cash balance. There are, in my view, no signs the company will see positive operating profits in the next few years. Even more, the firm’s significant interest costs may make actual bottom-line profits untenable given today’s higher borrowing rates. CVNA has already lost around 85% of its value and, I believe, will likely go bankrupt within the next year as it becomes impossible for the company to continue to borrow while losing billions. While the slowing economy (particularly in autos) may accelerate this trend, I believe it is inevitable due to the competitive nature of Carvana’s core business model.

Used Auto Market Likely To Slow Further

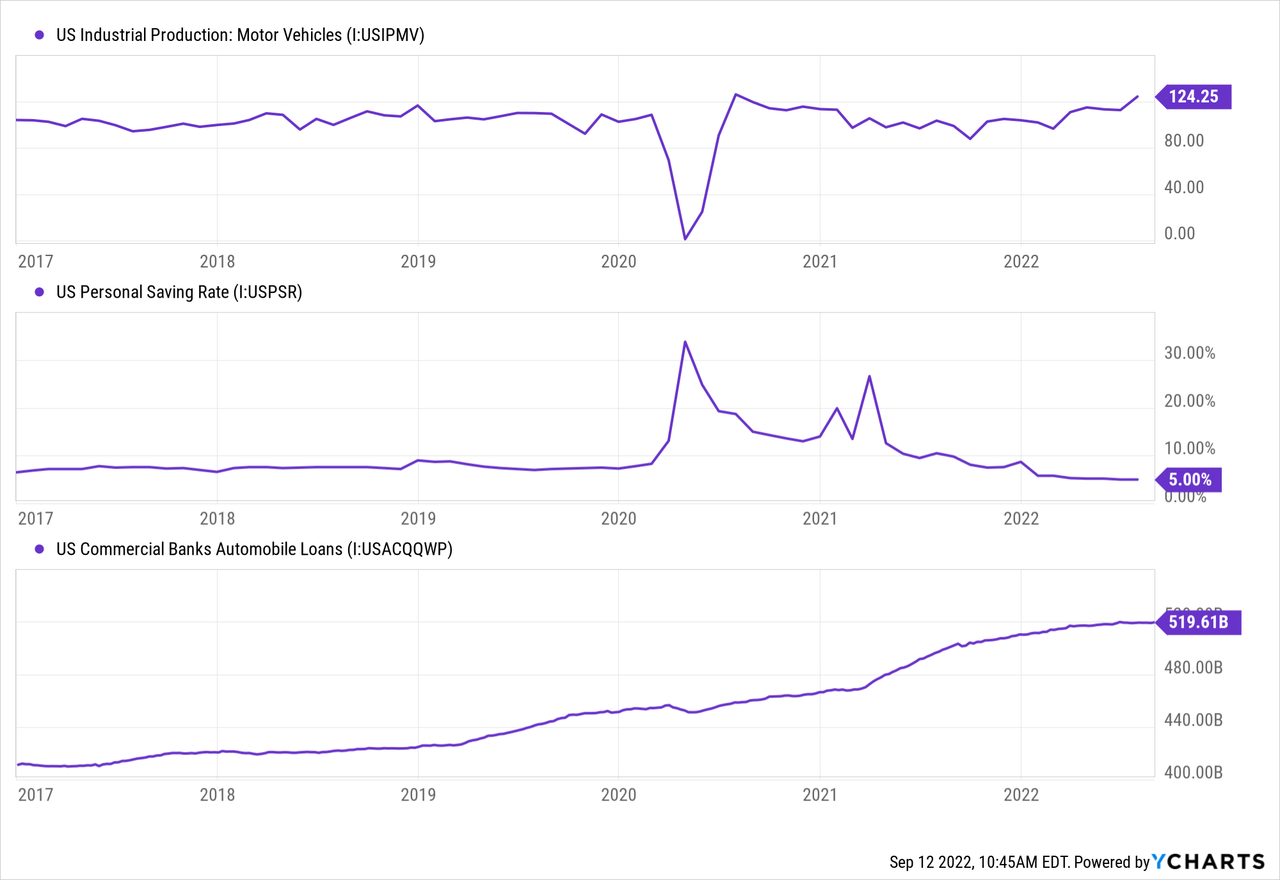

In 2020, Carvana saw immense revenue growth due to a boom in used auto sales. The spike was created by various factors, including a significant decline in new vehicle production, a considerable rise in personal savings, and a massive decline in borrowing costs. See below:

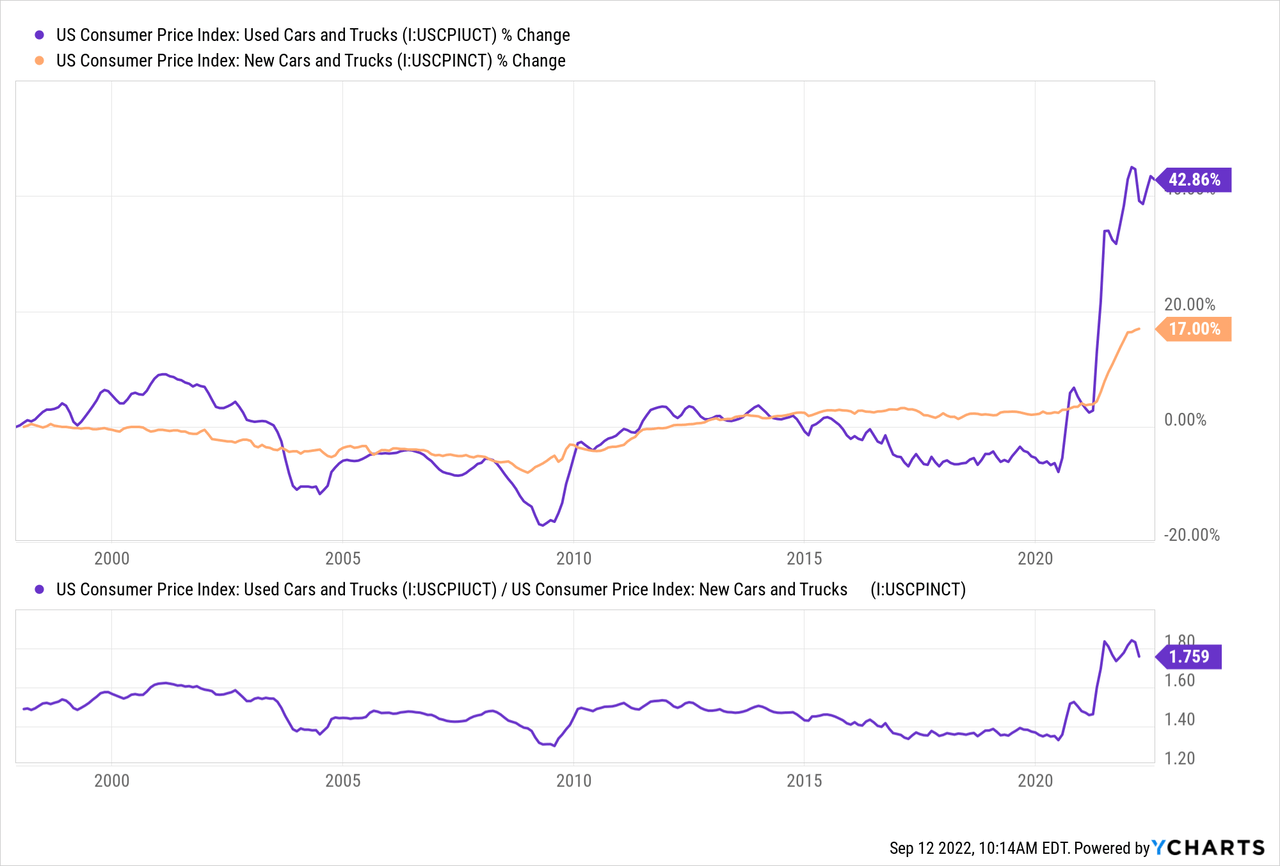

In 2020, there was a sharp decline in vehicle production combined with a significant rise in personal savings. The increase in savings was driven by stimulus checks, added unemployment benefits, and a reduction in spending outlets. This trend triggered a sharp rise in vehicle demand, as seen in the spike in auto-loan debt in 2021. New vehicles became more expensive, but used cars rose faster due to the lack of new vehicle inventories. See below:

After declining for years, used vehicle prices rose dramatically over the past two years. The price ratio of used-to-new vehicles also proliferated (note that the unit on the price ratio chart is arbitrary). However, during 2022, the price ratio of used cars to new vehicles has flattened and shown signs of lower reversing. As seen in the first chart, new U.S. vehicle production is rising quickly as supply chain shortages end. At the same time, flattening auto loan data and low personal savings implies demand for all vehicles has declined dramatically. Altogether, these data indicate that Carvana is likely facing weaker demand and may soon have to offload inventory at a significant loss.

Carvana’s Bankruptcy Risk is Very High

The overall direction of the U.S. economy today is a controversial subject. That said, it is abundantly clear that the general direction of the U.S. vehicle market is down. Various factors promote the “auto recession,” including renewed supply growth, high vehicle prices, higher financing costs, falling real wages, low personal savings, and poor consumer sentiment. The auto industry is highly cyclical, so its bust should not be surprising given its recent boom.

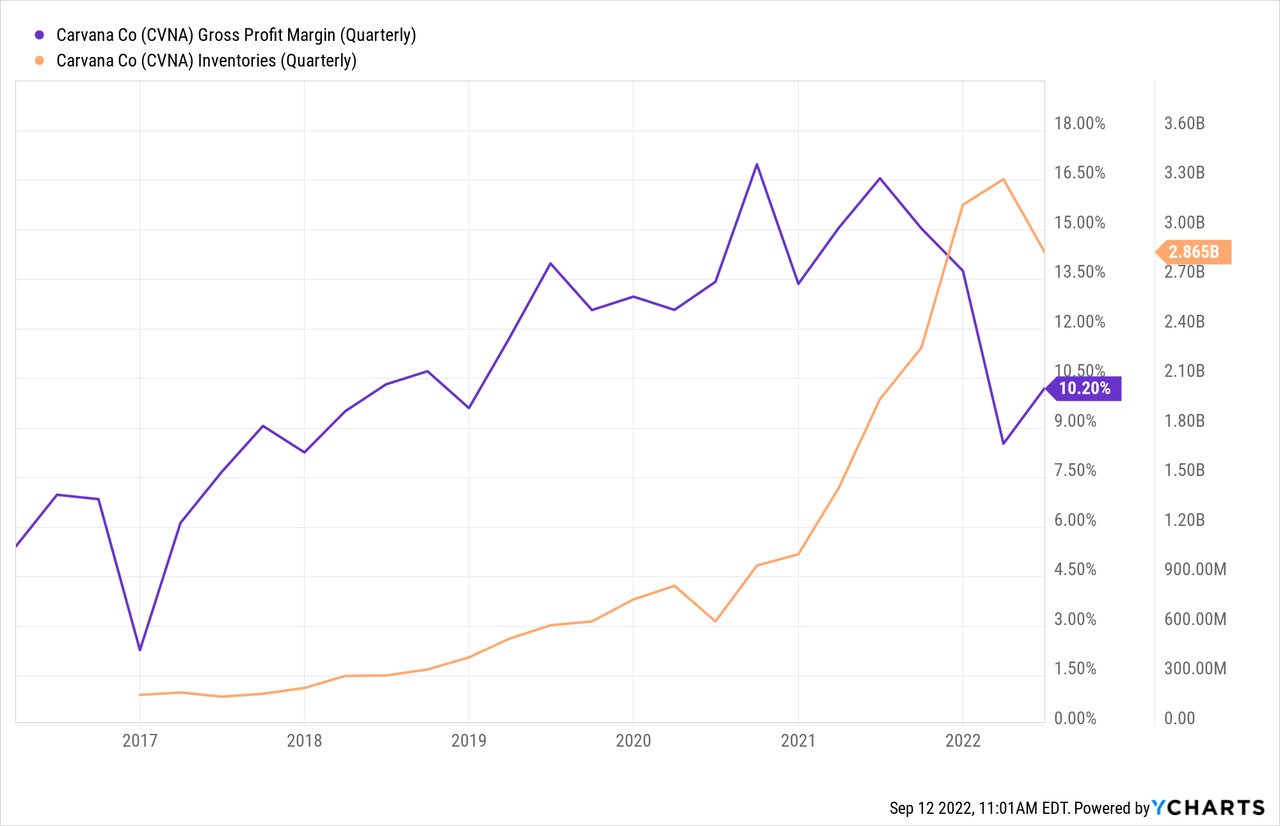

In my opinion, Carvana is not likely to survive this bust. To earn a consistent profit, Carvana must sell vehicles at a higher price than it purchased, with the difference being significant enough to offset all of the company’s numerous overhead costs. The company does have a positive gross profit of about 10%, implying it sells cars above purchase price, but this ratio has declined dramatically over the past year as demand for used vehicles has slowed. At the same time, Carvana’s inventories remain very high, implying the company may need to reduce selling prices further to maintain cash balances. See below:

Last quarter, Carvana posted a larger earnings loss of $238M but had a positive operating cash flow due to declines in inventory. The firm’s ability to restore its balance sheet relies on continued declines in its inventory. However, with used car prices peaking and likely declining, Carvana will probably be selling into a weakening market, meaning its gross profit margins may slip further over the coming quarters.

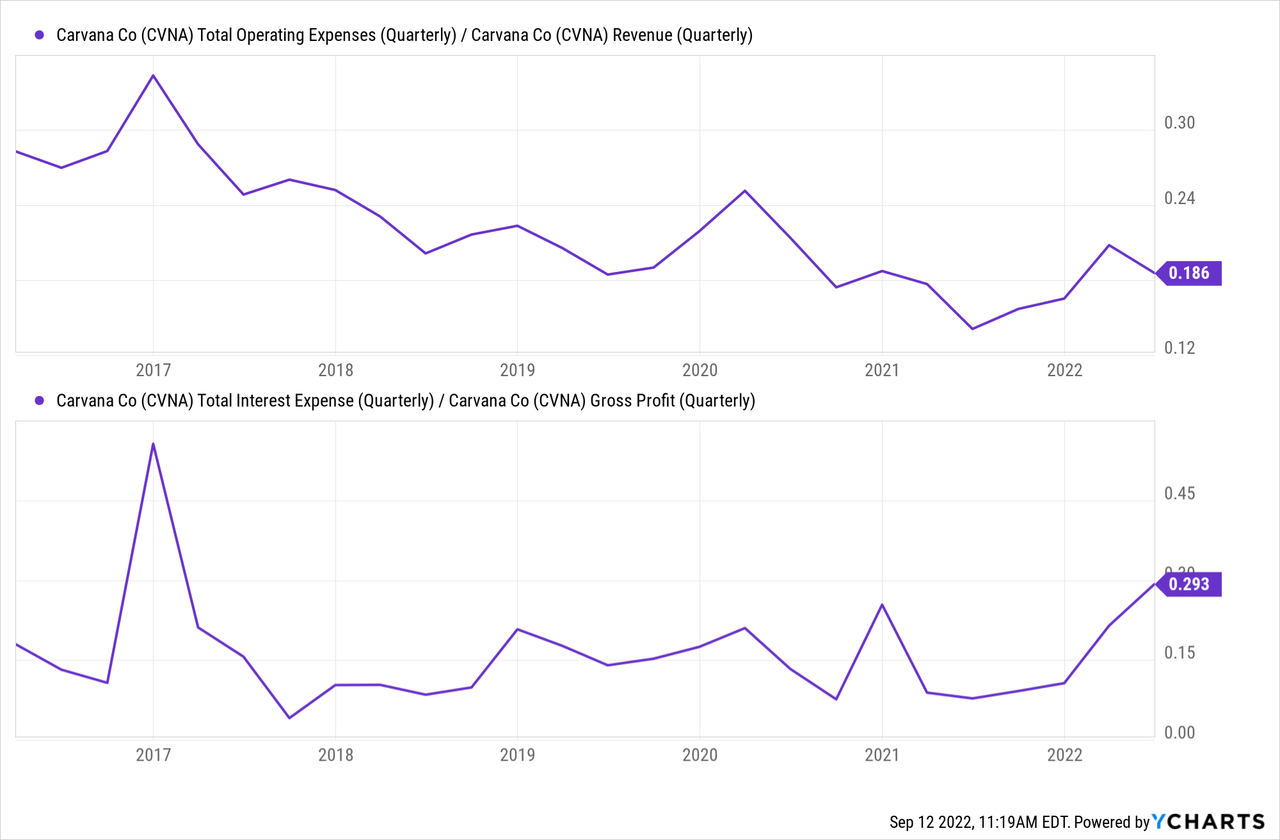

To generate a positive operating profit, I believe Carvana will need to maintain gross earnings of at least 16-18%, though potentially higher, as it is unclear where its operating expense-to-sales ratio will settle at. At this point, it is unclear if Carvana can generate a consistent operating profit as its business model may not be able to sustain sufficiently high gross margins to offset operating costs. Further, in my view, it is doubtful Carvana can generate a consistent profit considering that much of its gross profits also go to interest costs. See below:

The ratio of operating costs to revenue appears to be stabilizing at around 18%, while a growing portion is going toward interest expenses. This trend will likely rise as long as Carvana faces negative cash flows as it dilutes shareholders and raises debt significantly. See below:

Overall, I believe it is clear that Carvana is sitting at the edge of insolvency. Views on this matter likely differ, and many analysts believe the company’s earnings will eventually become positive. Indeed, the stock rose dramatically on Monday after Piper Jefferies stated it was undervalued due to its hefty price decline, though agreed bankruptcy risk was a “real” probability. To me, given Carvana’s falling gross margins, high inventory, the slowing used auto market, rising borrowing rates, and staggering debt growth, Carvana’s bankruptcy is nearly inevitable and may occur within the coming year, given the confluence of negative catalysts.

The Bottom Line

Overall, I believe investors would be wise to steer clear of Carvana as it seems likely CVNA will decline toward zero as it sinks deeper into insolvency. The macroeconomic shift against the used car market certainly accelerates this potential. However, I believe its eventual failure is nearly inevitable due to its business model.

In my opinion, Carvana’s business model is great in theory and works well for buyers and sellers, but it cannot generate sufficient gross profits to offset operating costs. Even more, Carvana’s online footprint opens the potential for competition, and with expensive purchases like vehicles, people will almost always gravitate toward the platform where they find the best prices. With this in mind, it may be impossible for Carvana to raise sales prices sustainably. Of course, a positive operating profit may be feasible if the company could lower overhead operating costs enough.

Even then, I believe Chapter 11 bankruptcy risk is still high due to its burgeoning interest expense and financial debt. Still, I would not personally short CVNA today. The stock is roughly 90% below its 52-week high and has a substantial short interest level of 30%. These factors give CVNA relatively high short-squeeze risk, particularly considering its brand popularity. However, I may be more willing to bet against the stock if the stock does face a short squeeze large enough to lower its short interest level below 10-15%,

Be the first to comment