Adam Gault

The stock market is attempting another bear market rally. I was bullish for the previous bear market rally – the summer rally from June to August – before reversing to a bearish outlook leading to the Powell speech at the Jackson Hole symposium. This time around, as I explain in this article, I am not buying the unfolding bear market rally, and I remain bearish.

The bullish case for the summer rally

My outlook for SPDR S&P 500 Trust ETF (NYSEARCA:NYSEARCA:SPY) is by default bullish, unless there is a high probability of one of these shocks: 1) the Fed-induced liquidity shock, which I define as the Phase 1 of the bear market; 2) the recessionary selloff, or the Phase 2 of the full bear market; or 3) the credit crunch selloff, or the Phase 3 of the bear market.

S&P 500 was in a Phase 1 selloff from January 2022 to June 2022, as the expectations of the more hawkish monetary policy sharply increased during the period.

However, on June 16th, the monetary policy tightening expectations appeared to have peaked, which indicated that the Phase 1 selloff was possible finished. At the same time, the probability of an imminent recession was still very low, given the wide spread of the 10Y-3mo yield curve.

Thus, my expectations were that the stock market had a high probability of a sharp rally. Specifically, this bullish outlook was based on the expectations of the peak inflation, and the peak Fed hawkishness, which eased the liquidity risk, while the risk of an imminent recession was still low. Further, given the deep 24% drawdown, I expected the 15-20% rally (which actually was 17%).

More specifically, the Fed at the time indicated the willingness to make a minor dovish pivot – or the possibility to pause the hiking cycle to evaluate the effect of the prior interest rate hikes, before inverting the yield curve. This was the prescription for a possible soft-landing, which could have even extended the summer rally to the second-half rally, and even bring the SPY to the previous highs.

The bearish case (that ended the summer rally)

The summer rally essentially ended after the August 26th Fed Chair Powell speech at the Jackson Hole Economic Symposium, where the Fed Chair ruled out the dovish pivot. It essentially changed the soft-landing target with the “growth recession” target. The bullish scenario for SPY was completely invalidated. Here is what the Fed Chair Powell specifically said (emphasis added):

Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy…Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation.

This speech essentially increased the probability of the further Phase 1 liquidity-shock selloff, since the Fed apparently still had not reached its peak hawkishness. But more importantly, the reference to the “pain” and the “softening labor market” significantly increased the probability of a recession, and thus the Phase 2 recessionary selloff.

Thus, within my model, I view the outlook for S&P 500 as bearish, and I am not buying the attempted bear market rally.

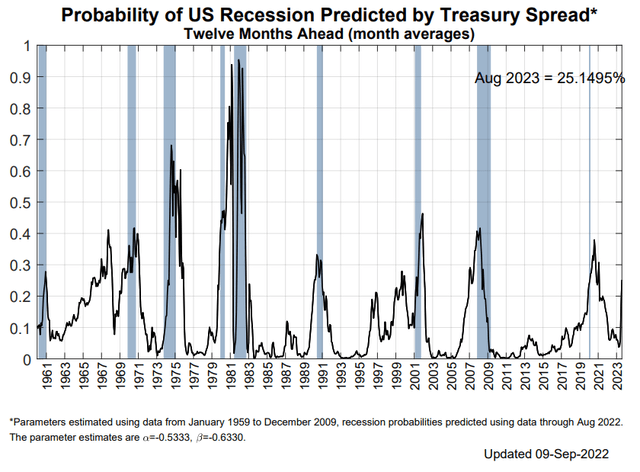

In fact, the Fed’s official probability of an imminent recession is now very high at 25%, while historically a reading above 30% has resulted in a recession. This supports my bearish theses of the expected Phase 2 selloff. Also note, the Fed’s recession probability was only 4% in June when I called for a summer rally. Thus, the macro environment is much different now compared to the June bottom. Here is the chart with the NY Fed recession probability:

What’s behind the recent bear market rally attempt?

As I explained, there are no fundamental justifications for the stock market rally from here. However, note, the stock market does not go down in a straight line. There are violent bear market rallies, which are usually caused by short covering and technical setups.

- Short covering by hedge funds

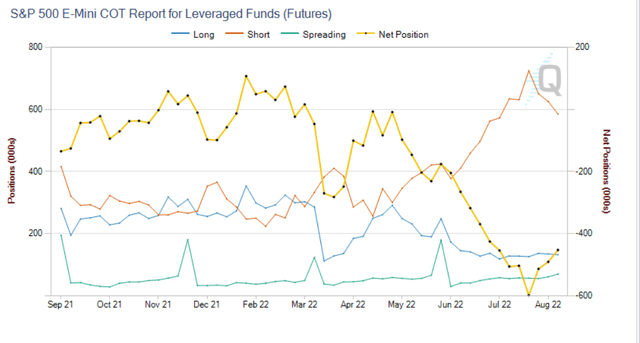

Hedge funds have been terribly wrong about the stock market this year. If you look at the chart below, you’ll see that hedge funds were heavily shorting S&P 500 futures SPX (red line) from June to August as the market was rising, which created a very large net-short position (yellow line) which is now unwinding.

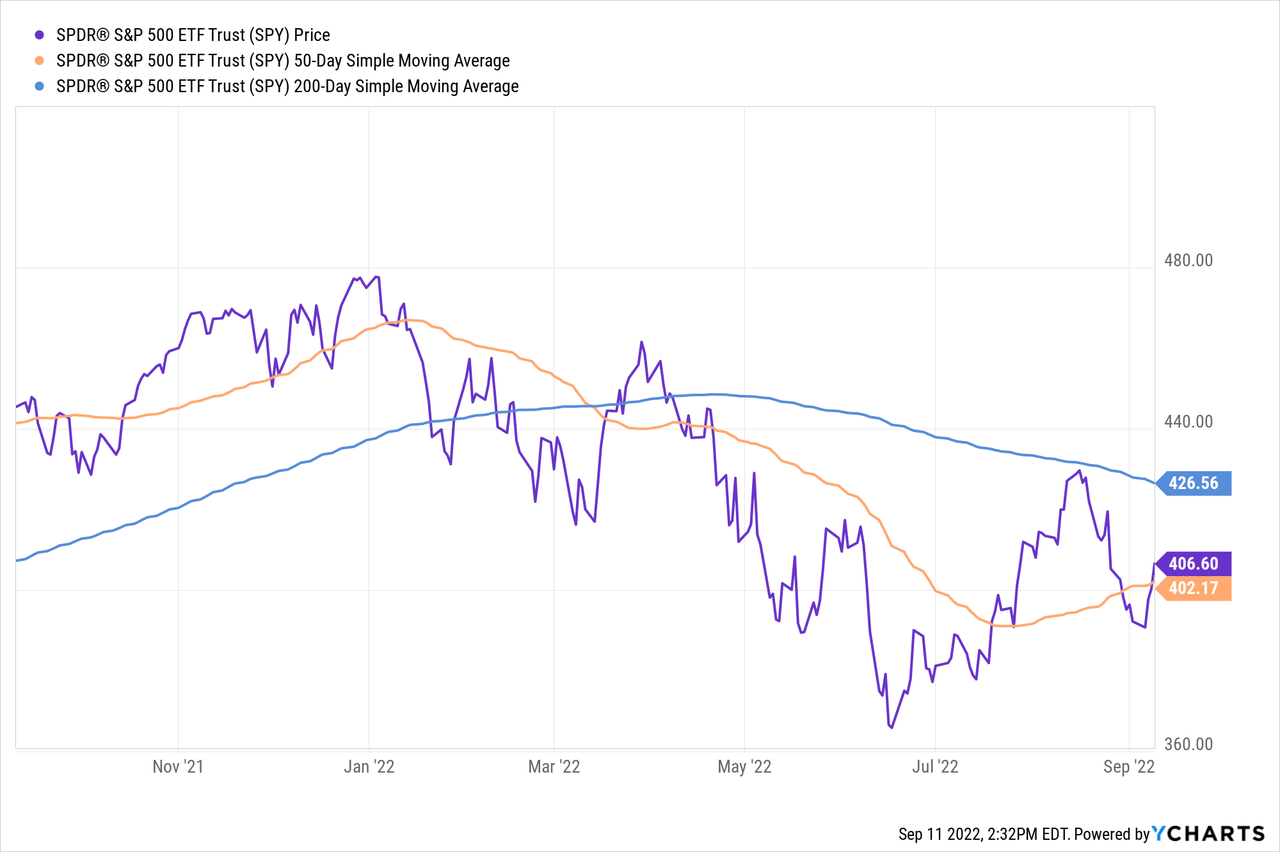

This is not a technical analysis article, but it is important to understand the behavior of other market participants. The army of trend followers, including the algos, closely follow the charts, and last Friday they acted upon the 100dma breakout. Here is the chart of SPY, an exchange-traded fund (“ETF”) that tracks the performance of S&P 500 – the red line is the 100dma, which was broken on Friday. Thus, trend followers see this as a bullish setup for the rally to continue to at least the 430 level, which is the 200dma (blue line).

Specific analysis of S&P 500 sector performance

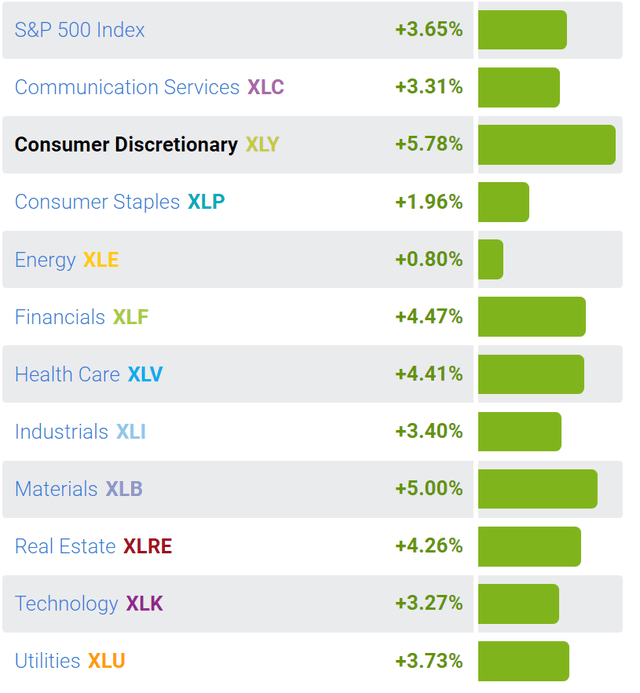

Last week, SPY went up by 3.65%, but the performance was led by the consumer discretionary sector (XLY), which was up by 5.78%. More importantly, highly shorted consumer stocks such as Royal Caribbean (RCL) (up by over 15%) led the rally. Given the high recession probability, consumer discretionary stocks are very vulnerable, and the bounce last week was likely just due to short covering. However, the bounce last week was very broad-based, and all sectors went up.

Implications

The probability of a recession is very high now, while the SPY P/E ratio of 22 and the forward P/E of 18 are both very expensive. The expected recession should result in an earnings downgrade, and, given the valuation, the SPY has not priced the recession yet. Thus, the unfolding bear market in SPY will likely continue. Any short-term bear market rally in an opportunity to sell.

Be the first to comment