jetcityimage

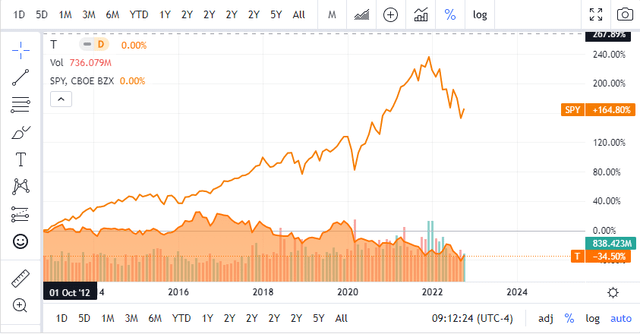

Putting the dividend aside, AT&T (NYSE:T) has been a disappointment as shares have severely underperformed the S&P 500. For shareholders of T, this has been a lost decade as shares have declined by -34.5% while just investing in an S&P 500 index fund such as the SPDR S&P 500 Trust (SPY) would have generated a 164.80% return. No matter what T did, regardless of the large levels of free cash flow (FCF) produced, T was looked at as a mismanaged conglomerate saddled with an extreme amount of debt. Each time T started to gain traction, the rally was short-lived, and shares retreated back into negative territory. Just prior to earnings on 10/17, I published an article discussing how shares of T had hit rock bottom and why I was still bullish. Over the next week, shares jumped 12.95% after an earnings beat and 2022 guidance raise compared to the S&P 500, appreciating 3.14%. After Q3 results were announced, analysts started to complement T, and after reading through the earnings release and conference call, a decade of lost opportunity could finally be in the past.

AT&T delivered a beat and raise in Q3 2022

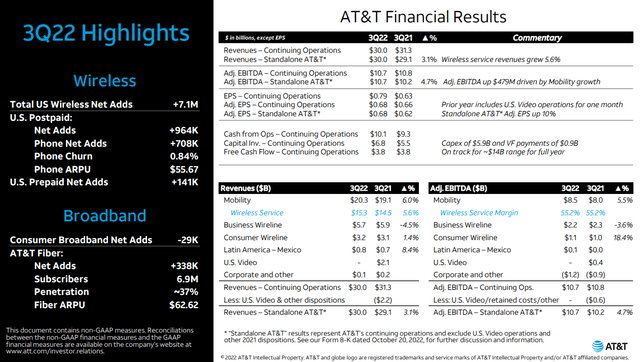

T delivered in Q3, and the market responded positively to not just the earnings release but the commentary from management. Whatever T’s perception was in the past, should live in the past because T is absolutely delivering. T delivered a quarterly beat on the top line, generating $30 billion of revenue, $140 million more than the consensus estimates, and a large surprise on the bottom line, as they generated $0.68 of EPS which was a $0.07 beat. The news that could be a major contributor to T’s share price bump is their raised guidance. Previously, T had anticipated that standalone T (AT&T after the WarnerMedia spinoff and other divestitures) would generate EPS in the range of 2.42 – $2.46. The street was looking for $2.55 as this was the EPS number formulated by the consensus estimates. Within the Q3 earnings release, T raised its 2022 EPS guidance as they expect EPS from continuing operations to come in at $2.50 or higher for the 2022 fiscal year.

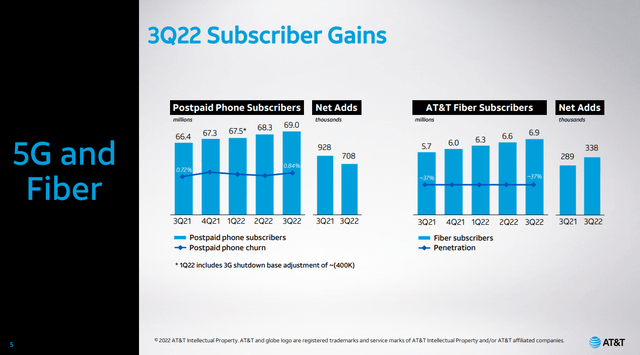

After going through the quarter, I believe T is positioned to prove the market wrong and that this valuation is too low. YTD T produced 2.2 million postpaid phone net adds in their 5G wireless segment, and nearly 1 million net adds in fiber. In Q3 alone, T added 708,000 postpaid phones and 338,000 net adds in fiber which is their 2nd best quarter for fiber. Q3 also become T’s 11th consecutive quarter of more than 200,000 net fiber adds. T isn’t the zombie some make it out to be, as its wireless revenue has increased by 5.6%, which is its largest growth in more than a decade, while its broadband revenue has increased by 6.1%. Standalone T, has had an impressive Q3 as its revenue increased 3.1% YoY, and the Adjusted EBITDA produced also increased 4.7% from $10.2 billion to $10.7 billion.

T is performing well in an inflationary environment, and while many had speculated that rising rates would negatively impact T due to its debt load, cost efficiencies and larger average revenue per user (ARPU) has more than offset impacts from inflation. T is on track to deliver on its run-rate cost savings target of roughly $6 billion. In Q3 alone, total operating expenses declined by -4.2%, dropping to $24.03 billion from $25.09 billion. YTD total operating expenses have declined by -11% as $8.11 billion is non-existent from broadcasting, programming, and operations, while T has reduced its cost in other cost of revenue -1.57 billion and -$856 million from its general administrative costs.

While many readers of my articles have discussed why they have decided to exit their position in T in the comment section, I am not of the same mindset. Every investor is the steward of their capital and their capital alone, and if they think a better return can be found elsewhere, that’s a decision only they can make. If T’s ability to generate large amounts of revenue and FCF were impacted, I would need to rethink this investment. T operates a business that is more of a utility, as everyone needs communication services, and this isn’t an industry that has low barriers to entry. People can speculate on T’s past decisions, and regardless of why T hasn’t been a good investment over the past decade, it doesn’t mean history will repeat itself. I found T’s earnings report to be upbeat, and I am bullish on its ability to grow its consumer base, and increase the amount of FCF generated over the next several years. The combination of cost efficiencies, debt reduction, and subscriber growth has reaffirmed my personal bullish sentiment around T, and I still believe its valuation is too low.

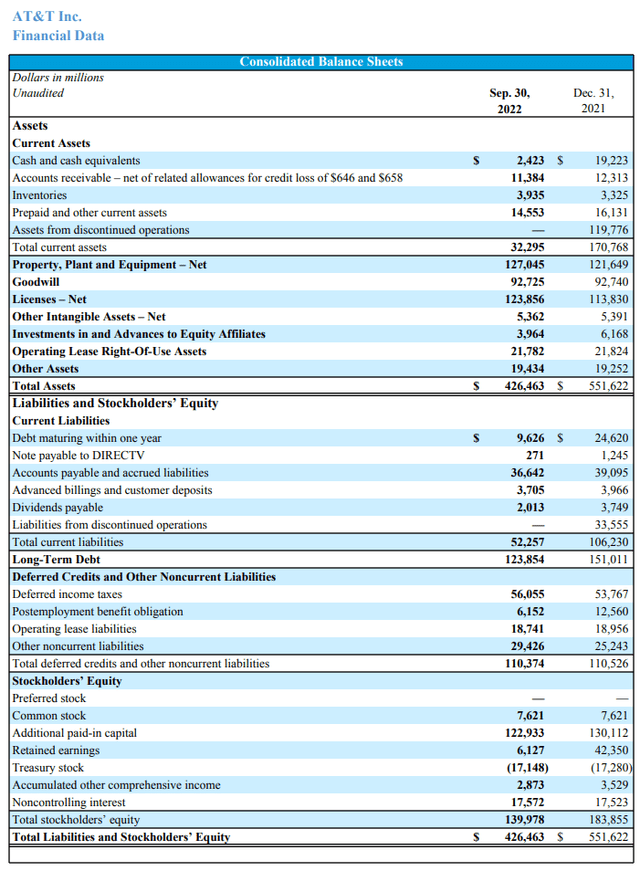

AT&T continues to reduce its debt load

Debt has been the largest criticism of T followed by its failed acquisitions. Yes, I would like to see less debt on the balance sheet, and I believe T is demonstrating fiscal responsibility as it works to lower its debt load. At the close of 2021, T had $151.01 in long-term debt, and $24.62 billion in debt maturing in 1 year. $175.63 billion in debt was too much for some investors regardless of T’s ability to service the debt. On the Q3 earnings call, Pascal Desroches was clear that T’s debt tower consists of 4% yielding debt, and 95% of it is fixed. He also specifically indicated that T’s debt maturities over the next several years are easily covered by the FCF remaining after $8 billion is allocated to the dividend.

At the end of Q2, T had reduced its debt load by -22.59% as it declined from $175.63 billion to $135.96 billion. Long-term debt declined by -14.08% from $151.01 billion to $129.75 billion, while debt maturing in 1-year decreased -74.78% to $6.21 billion from $24.62 billion. T continued reducing its debt load in Q3, holding true to its promise of financial discipline and reducing debt. In Q2, T retired an additional $2.48 billion of debt, reducing its debt load to $133.48 billion.

T’s FCF was in line with their expectations in Q3, and has 100% confidence they will deliver $14 billion in FCF in 2022. T generated $3.8 billion of FCF in Q3 and expects its EBITDA and FCF to grow in 2023. In Q3, T grew its cash from operations by roughly 10%, and its flywheel of businesses should continue generating additional FCF in the coming years as revenues grow, and synergies causing expenses to decline are recognized. In the past, T has stated that they believe they will achieve roughly $20 billion in FCF, and I believe that regardless if it’s $18, $20, or $22 billion, it’s more than enough FCF to cover the dividend and service its debt obligations. T has a large debt load, but it’s manageable, and 2022 should convince investors who were on the fence that management was serious about its commitment to reducing its leverage.

AT&T’s dividend is not at risk

On the Q3 earnings call, management was crystal clear that T’s dividend is not at risk. They made it a point to discuss how its FCF is utilized and that there is enough FCF after the dividend allocation to meet its debt service obligations and then some. T’s CFO stated that management is comfortable with its cash levels after the dividend commitment, and it should improve throughout the coming years as they expect cash conversion to increase.

T had a long history of paying a large dividend that was increasing YoY. Along the way, T lost its Dividend Aristocrat status, and 36 years of annual dividend increases became meaningless. T reduced the dividend due to spinning off WarnerMedia and divesting other income-producing assets. T didn’t reduce the dividend because they were in trouble, the reduction was because their FCF declined due to T exiting specific businesses.

T is paying a dividend of $1.11 per share which is a 6.49% yield. $8 billion of T’s FCF is allocated toward its dividend program, which is a 57.14% payout ratio from its FCF. Looking at T’s revised EPS guidance, $1.11 is the equivalent of 44.4% of the $2.50 EPS projection for 2022. T’s dividend is not in danger, and management has done more than enough to reassure investors that the dividend will not be eliminated or reduced further.

AT&T’s valuation is still too low

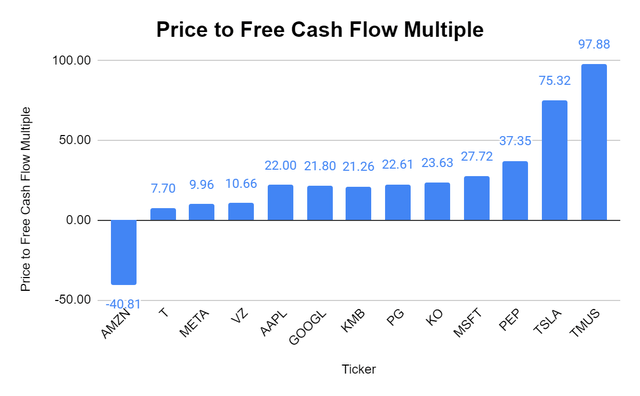

As I outlined in my previous article, I like looking at a company’s valuation based on its FCF. FCF, in my opinion, is the hardest profitability measure to manipulate or manufacture because buybacks and write-offs don’t impact it. T is still trading at 7.7x its FCF of $14 billion. Verizon (VZ) just reported earnings and is trading at 10.66x, and T-Mobile (TMUS) trades at a multiple of 97.88x its FCF. I believe T and VZ are both undervalued based on the level of FCF generated and the multiple they trade at.

PepsiCo (PEP) generates 6.38 billion of FCF and trades at a 37.35x price to FCF multiple, while the Coca-Cola Company generates $10.24 billion of FCF and trades at a 23.63x multiple. VZ and T both generate more FCF, and trade at less than 50% of the multiple KO and PEP. While these are different businesses and the financials look different, T trading at 7.7x its FCF is very low in my opinion. Based on the valuations Mr. Market has thrown on other businesses, especially T-Mobile, which only generates $1.71 billion of FCF, I believe T should trade at a minimum of 18x its FCF, maybe even into the 20x range.

|

Price to Free Cash Flow |

|||

|

Ticker |

Market Cap |

Total Free Cash Flow |

Price to Free Cash Flow Multiple |

|

AMZN |

$1,215,578,462,891.00 |

-$29,784,000,000.00 |

-40.81 |

|

T |

$107,740,000,000.00 |

$14,000,000,000.00 |

7.70 |

|

META |

$349,408,100,716.00 |

$35,087,000,000.00 |

9.96 |

|

VZ |

$152,870,000,000.00 |

$14,340,000,000.00 |

10.66 |

|

AAPL |

$2,366,739,421,161.00 |

$107,582,000,000.00 |

22.00 |

|

GOOGL |

$1,323,267,810,661.00 |

$60,697,000,000.00 |

21.80 |

|

KMB |

$38,475,425,602.00 |

$1,810,000,000.00 |

21.26 |

|

PG |

$306,727,465,787.00 |

$13,567,000,000.00 |

22.61 |

|

KO |

$242,006,290,840.00 |

$10,242,000,000.00 |

23.63 |

|

MSFT |

$1,805,704,290,384.00 |

$65,149,000,000.00 |

27.72 |

|

PEP |

$238,426,316,176.00 |

$6,383,000,000.00 |

37.35 |

|

TSLA |

$671,941,314,450.00 |

$8,921,000,000.00 |

75.32 |

|

TMUS |

$166,890,000,000.00 |

$1,705,000,000.00 |

97.88 |

Steven Fiorillo, Seeking Alpha

Conclusion

After reading through Q3’s earnings report and conference call, I am extremely bullish on T, and not because of the points I have written about previously. I believe a growing population among the analyst community is having a change of heart and will start increasing their price targets on T as more progress is made. T has built upon Q2 by adding subscribers, reducing debt, and raising its 2022 guidance. I believe T is a diamond in the rough and is currently a steal at these levels, as a single-digit multiple on its FCF is just too low compared to many other businesses that generate a fraction of the FCF that T does.

Be the first to comment