Michael Vi

Chinese equities have been under more pressure lately, with the tension between the US and China worsening and the internal Zero-Covid politic shutting down significant parts of the economy. China sees downgrades in the economic forecast of its economy, for example, with the Asian Development Bank downgrading its 2022 forecast from 5% to 3.3% and 2023 from 4.8% to 4.5%.

This is a follow-up article on my past coverage of Prosus (OTCPK:PROSF) and Tencent (OTCPK:TCEHY) and I will explain why I sold out of Prosus in August.

Chinese Tech Industry decapitated

Two weeks ago, the Biden administration put new sanctions on the Chinese Tech industry by limiting sales of semiconductor technology used for advanced nodes. This has been a devastating strike against the Chinese Tech industry. A week later, this Tweet went viral, naming the state of China’s semiconductor manufacturing industry a complete collapse overnight with no chance of survival. The new sanctions aren’t just limited to selling new equipment in China. It also forces American workers in the Chinese semiconductor industry to either resign or be at risk of losing their American citizenship. This resulted in an “immediate operations paralysis” in the industry. An example is Lithography machine maker ASML (ASML) telling its US employees to stop working with specific customers in China immediately.

This should also negatively impact Tencent, which relies on advanced chips to build out its cloud infrastructure. The company does manufacture some chips itself, but they need the equipment for that and the most advanced machines have been restricted for a while.

Tencent is Struggling

In my initial Tencent coverage this February, I predicted that Tencent would continue to change its once-brilliant capital allocation strategy. Tencent used to be one of the few Big Tech companies that managed to effectively reinvest its cash flows, while most others, like Alphabet (GOOG), Microsoft (MSFT) and Apple (AAPL), are sitting on gigantic mountains of cash and no way to spend it all. Tencent invested its cash into equity investments in the public and private markets, generating significant returns. Tencent continues to divest assets and buys back its own stock. The investment portfolio was valued at $185 billion on 30th September 2021 and since then came down to $90 billion (30th June 2022) due to divestitures and multiple contractions in publicly listed equities.

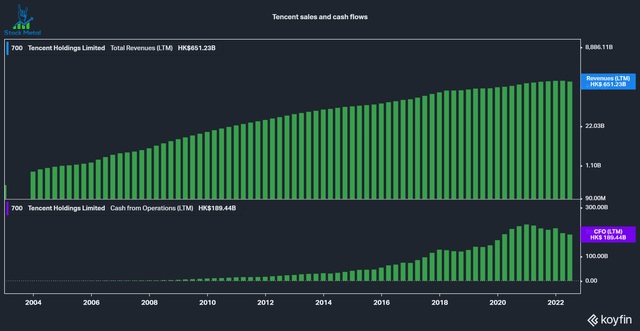

Tencent also saw its first-ever Y/Y revenue decline in Q2 22 and significant declines in its operating cash flow since December 2020.

Tencent sales decline (Koyfin)

Prosus buyback program

In June 2022, Prosus announced an open-ended buyback program to close the discount to its NAV. I published an article about my investment in Prosus on May 22, when shares traded at a 61% discount to NAV. This was a short-term trade for me (something I usually do not do) and I considered Prosus a buy, while shares are at an elevated discount to NAV (above 30%, more details are found in my prior coverage of the stock).

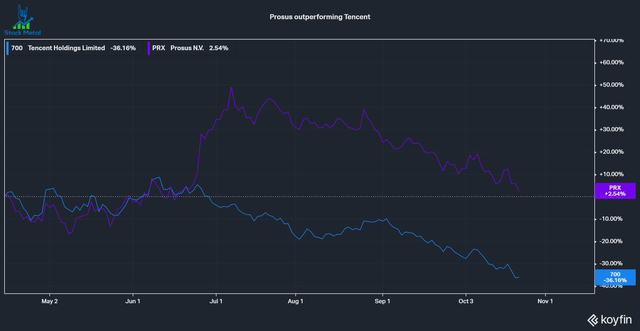

We can see that after the Buyback program was announced in late June, Prosus skyrocketed and disconnected from Tencent for a while. Tencent has since suffered a significant decline in its share price by around 40%, even though they have been committed to buying back the shares Prosus is selling to fund its buybacks.

Prosus outperforming Tencent shares (Koyfin)

Why I sold out of Prosus

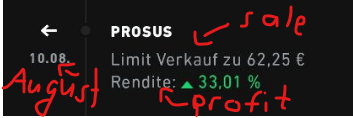

In my initial coverage, Prosus traded at a 61% discount to its NAV and a 49% discount just to the value of its Tencent shares. After the run-up following the buyback program, this gap closed much faster than I anticipated with the weak performance of Tencent. In early August, Prosus already traded below a 45% discount to its NAV and around 25% discount to its stake in Tencent.

With the narrowing gap, the increasing tensions in China and my position being 33% in the green, I decided to sell before my initial goal of a discount to NAV below 30%. I provided a screenshot of my sale, excuse the German; I added translations to the essential parts. Also, remember that we use a different calendar format here in Germany (Day.Month.Year). After all, I decided I’d rather lock in a profit on this trade rather than be greedy amongst worsening conditions.

Sale of Prosus on 10th of August (Authors Stock broker)

Valuation

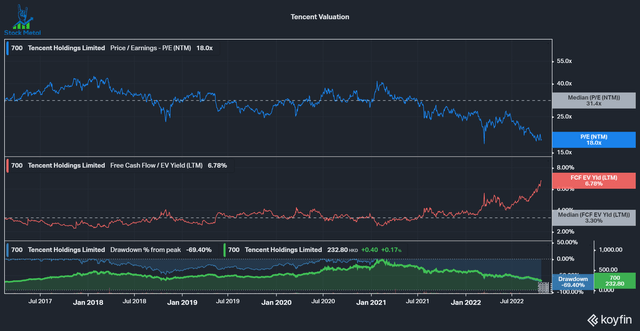

Tencent currently trades at historically low multiples, around half of its 10-year median. From a valuation standpoint, the company is cheap, but we can’t forget that they changed their capital allocation strategy, a large part of why I used to be invested in Tencent back in 2020/2021.

Tencent historical multiples (Koyfin)

Prosus currently has a Net asset value of $111.6 billion, according to its investor relations (as of 21st October 2022). This amounts to €84.1 per share, compared to a share price of €48.53, a discount of 43% to its NAV.

Conclusion

The situation around Tencent and Prosus is still attractive after shares in both companies took a big fall. The discount to NAV is still significant and I believe that Prosus will be able to narrow it down over time towards 30% or lower, but I am not sure if Tencent can keep its value. Due to a worsening macro environment globally and inside China, I believe that the risk/reward ratio is not favorable anymore, at least in my case, as a trade. If Tencent can turn things around and continue to grow its cash flows again, then there is a good upside. Especially the dramatic restrictions on the Chinese chip industry are not instilling confidence in me, though. I keep both stocks at their respective ratings: Tencent is a hold, and Prosus is a buy, with significant risks to be considered.

Be the first to comment