THEPALMER/E+ via Getty Images

Vehicles are a significant part of the modern world. Whether it be for commercial, personal, or defense purposes, vehicles help to get us and the things we are transporting from point A to point B. One company dedicated to producing vehicle propulsion solutions for the commercial and defense space, with a particular focus on heavy-duty fully automatic transmissions and commercial duty electrified propulsion systems is Allison Transmission Holdings (NYSE:ALSN). Despite pain in the broader economy and concerns of a potential slowdown, this particular enterprise has been doing remarkably well. Revenue continues to climb and profitability has largely followed along. Add on top of this the fact that shares of the company look quite cheap at this time, both on an absolute basis and relative to similar players, and I cannot help but to keep my ‘buy’ rating on the company right now.

Checking in with Allison Transmission

The last time I wrote an article about Allison Transmission was in November of 2021. In that article, I relayed to my readers that the company did have a rather bumpy time during the 2020 timeframe because of the COVID-19 pandemic. But absent that, the company had demonstrated an attractive operating history. I was expecting overall performance in 2021 to look better than it was in 2020 and shares were trading cheap enough that I could not help but to rate the business a ‘buy’ at that time, reflecting my opinion that it would likely outperform the broader market for the foreseeable future. Since then, things have gone even better than I anticipated. While the S&P 500 has decreased by 16.5%, shares of Allison Transmission have generated a return for investors of 0.2%. Comparatively speaking, this was a significant outperformance greater than anything I thought would have occurred.

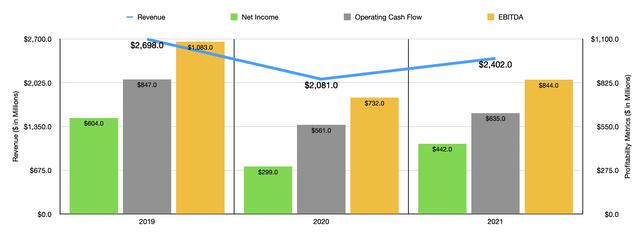

To see why the company has fared so well, we need only look at recent financial performance. Consider how the company ended its 2021 fiscal year. For that year, sales came in at $2.40 billion. Although this was still lower than the $2.71 billion in revenue the company peaked at in 2018, it did represent an increase of 15.4% over the $2.08 billion in sales generated in 2020. Growth in the 2021 fiscal year was driven by strength across the board. Although defense revenue inched up by just 2%, on-highway and off-highway revenue associated with operations outside of North America grew by 36%. Service parts, support equipment, and other related offerings grew by 11%, while the North America on highway category jumped by 9%. On a percentage basis, the greatest strength for the company came from the off-highway operations for North America. Sales there skyrocketed by 346%. This was driven by higher demand for hydraulic fracturing applications as well as by price increases on some of the company’s products. However, the overall sales increase was not all that high, with revenue growing from just $13 million in 2020 to $58 million in 2021.

When it comes to bottom line results, the company posted strong performance as well. Net income jumped from $299 million in 2020 to $442 million last year. Of course, we should also pay attention to other profitability metrics. Operating cash flow, for instance, also fared well, climbing from $561 million to $635 million. Meanwhile, EBITDA for the company also improved, rising from $732 million to $844 million over the same one-year timeframe. It is true that the company’s bottom line results are still lower than what was seen in 2019 before the pandemic struck. But the fact that the company was posting evidence of a solid recovery is great in and of itself.

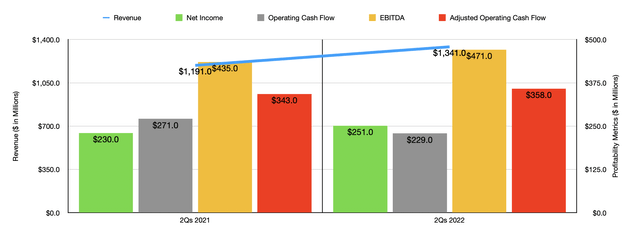

So far, the 2022 fiscal year has looked even better. Driven by strong demand and price increases, the company has seen its revenue climb to $1.34 billion in the first half of 2022. This compares to the $1.19 billion in revenue the company reported for the first two quarters of the 2021 fiscal year. Although the company has continued to invest in innovative new products, it’s difficult to peg any of its revenue increase to any one of these or even a group of them. In addition, the company did not really benefit materially from any acquisitions recently. The most recent acquisition was completed in March of this year and involved the purchase of India-based AVTEC Ltd.’s off-highway Transmission business and its Madras Export Processing Zone off-highway component machining business. But this was done for cash consideration of just $23 million.

With this rise in revenue, the company also saw its profits rise. Net income of $251 million in the first half of 2022 beat out the $230 million reported one year earlier. Operating cash flow did decline year over year, dropping from $271 million to $229 million. But if we were to adjust for changes in working capital, the metric would have risen from $343 million to $358 million. We also saw an increase when it came to EBITDA, with the metric climbing from $435 million in the first half of 2021 to $471 million the same time this year. Even though the company was able to benefit from keeping its selling, general, and administrative costs flat year over year, it did suffer as a result of other factors from a margin perspective, such as inflationary pressures pushing its gross profit margin down by roughly 1.5%. Though this may not seem like much, a 1.5% change in revenue from 2021 would translate to $36 million in lost profits for the company.

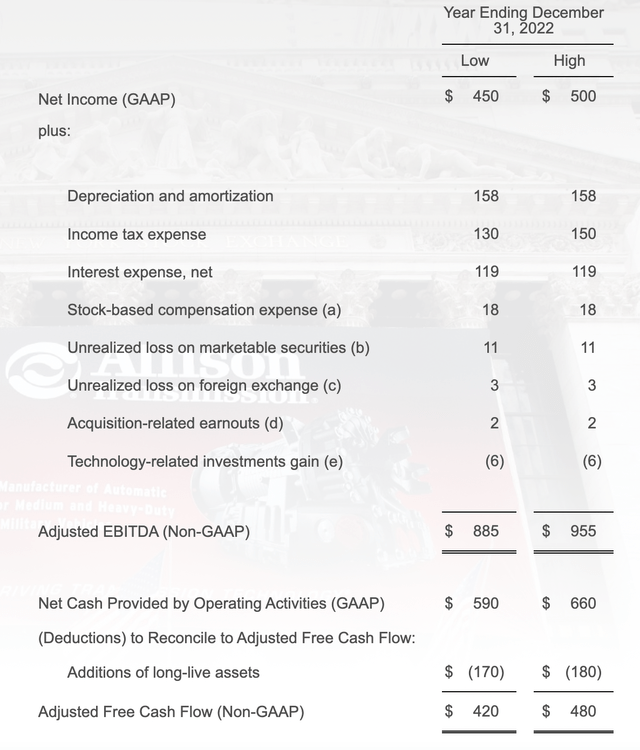

For the 2022 fiscal year as a whole, management expects revenue to come in fairly strong. Sales should be between $2.65 billion and $2.75 billion. At the midpoint, that would translate to a year-over-year increase of 12.4%. That’s roughly in line with the 12.6% increase the company saw in the first half of the year. The company has also been very detailed about what to expect from a profitability perspective. Net income, for instance, should come in between $450 million and $500 million. Operating cash flow should be between $590 million and $660 million, while EBITDA should be between $885 million and $955 million.

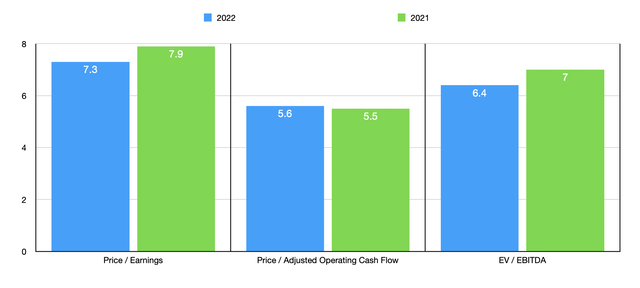

Using the midpoint figures for the guidance that management provided, we can easily price the company. On a forward basis, the price-to-earnings multiple of the firm is 7.3. This stacks up against the 7.9 reading that we get using results from 2021. The price to operating cash flow multiple, meanwhile, should be 5.6. That’s only slightly lower than the 5.5 reading that we get if we were to use data from last year. The EV to EBITDA multiple, meanwhile, should decline from 7 using data from 2021 to 6.4 using projected results for this year. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies range from a low of 8.2 to a high of 24.3. Using the price to operating cash flow approach, the range for the four companies with positive results should be between 5.8 and 28.2. In both scenarios, Allison Transmission was the cheapest of the group. And finally, using the EV to EBITDA approach, the range should be between 6.3 and 12.5. In this case, only one of the companies was cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Allison Transmission Holdings | 7.3 | 5.6 | 6.4 |

| Terex Corp. (TEX) | 8.2 | 7.0 | 6.3 |

| Federal Signal Corp. (FSS) | 20.1 | 28.2 | 12.2 |

| Alamo Group (ALG) | 15.6 | N/A | 9.7 |

| Oshkosh (OSK) | 24.3 | 15.3 | 11.3 |

| Trinity Industries (TRN) | 22.2 | 5.8 | 12.5 |

Takeaway

All the data I’m looking at today suggests to me that Allison Transmission continues to perform well despite concerns about the broader economy. Management is forecasting performance to remain robust through at least the end of this year. Shares of the company are also looking remarkably cheap, both on an absolute basis and relative to similar players. Because of these reasons, I have decided to keep my ‘buy’ rating on the company for now.

Be the first to comment