Mario Tama

Introduction

My thesis is that Netflix (NASDAQ:NFLX) has opportunities during these difficult times. They have options to bolster US film efforts with acquisitions seeing as bidding wars are less likely now that the market is not frothy. In addition, they can widen the audience with affordable ad plans and develop new revenue streams with paid sharing and gaming.

Film

Netflix has opportunities to do more with respect to US films but it is important to keep things in perspective and be mindful of the success they have experienced in other areas. In the 3Q22 call, Co-CEO Ted Sarandos reminded us that Netflix has made tremendous progress delighting viewers with shows and non-English films. 10 years ago they had no intellectual property (“IP”) and no library. Building out their own IP, the Netflix library now gets more viewing, revenue, and profit than competitors who have been around 100 years:

And you’ve got to remember as we go to do that it isn’t just making prestige shows in English. It’s also making a very kind of pop culture television across every genre, across every format imaginable. And in doing that, that’s the thing that I think we can bring scale and creativity and audience connectivity that others can’t compete with. So for me, that’s the biggest thing that when you say are we sharpening our tools, are we getting better, we’re definitely getting more mature about the process.

Of course Netflix has also had success with English films but they have opportunities to improve in this area. The 3Q22 letter explains that film is important to members and that there are advantages when Netflix produces their own movies:

Film is incredibly important to our members. We expanded into original film in 2016 because producing our own movies across all budgets and genres has advantages over the next best alternative: only licensing from other studios in the first pay TV window (the “pay-one” window). Those advantages include first window availability on Netflix (pay-one movies debut generally well after theatrical release), global rights (pay-one movies are licensed by country), the ability to carry the films on Netflix in perpetuity (typically only for 18-24 months for pay-one films) and copyright ownership, enabling us to create derivatives like sequels and to use the intellectual property (IP) in games and consumer products.

The Hollywood Reporter noted in April 2021 that Netflix made a $469 million deal for 2 sequels to Knives Out. It remarks that the Covid pandemic is one of the reasons why Netflix was able to make this deal:

Sources note that Lionsgate had what was considered a solid deal in which the company had first right of negotiation and last rights of refusal, all part of the negotiation safety net with which companies normally shield themselves from losing projects. (Lionsgate and CAA declined to comment.) And Johnson and Bergman were considered big backers of the theatrical experience. But that was before the pandemic hit, theatrical took a nosedive and backend became nonexistent.

One silver lining with this difficult time is that we’re less likely to see extreme bidding wars with respect to acquisitions. Given the price Netflix paid for a couple of sequels, I believe they should look into opportunities like buying all of Lions Gate (LGF.A) (LGF.B) in order to bolster their US film efforts. Seeking Alpha recently reported that the Glass Onion Knives Out sequel will be in theaters a month before it is available for streaming and I believe Netflix could do the same type of things with other films from Lions Gate.

The June 2022 10-Q from Lions Gate shows 83,312,392 class A shares plus 145,202,914 class B shares outstanding as of August 1st. Multiplying these by the October 18th share prices of $7.20 and $6.82, respectively, gives us a market cap of $1.59 billion or $600 million + $990 million. Of course Netflix would need to offer significantly more than the current market cap and they would also need to assume debt. We can think in terms of enterprise value (“EV”) for the debt considerations. Looking at the June 2022 10-Q, the EV for Lions Gate is $2,190.1 million more than the market cap due to $2,178.6 million long-term debt plus $53.4 million short-term debt plus $336.6 million noncontrolling interests less $378.5 million cash and equivalents. Note that gurufocus.com calculates EV by rolling the $1,008.6 million long-term film related and other obligations line into long-term debt and the $1,090.3 million short-term film related and other obligations line into short-term debt but this doesn’t make economic sense. This non-recourse debt is backed individually by each film and it isn’t part of the EV from a practical standpoint.

The Netflix 3Q22 letter said their gross debt was $14 billion which is in the $10-$15 billion target range. Acquiring a company like Lions Gate would likely take Netflix beyond this target range in 2022 but 2023 free cash flow (“FCF”) can be used to pay this down. The 3Q22 letter from Netflix said that 2022 FCF should be close to $1 billion and it is expected to grow substantially in 2023 assuming there isn’t a further material appreciation of the US dollar.

Other Opportunities

While not a panacea, the new advertising arm in 12 markets has tremendous potential per the 3Q22 letter. Plans will be in place in the 12 key markets by November 12th. Some viewers find ads to be odious but others don’t mind seeing 5 minutes of commercials every hour and the additional revenue can be very lucrative:

Cumulatively, these 12 markets account for ~$140 billion of brand advertising spend across TV and streaming, or over 75% of the global market.

Google (GOOG) (GOOGL) has regularly been saying that YouTube is the only way for advertisers to reach certain audiences right now. In the context of advertising, Netflix Co-CEO Reed Hastings repeated what former Disney (DIS) CEO, Bob Iger, said about linear TV falling off a cliff. Co-CEO Hastings spelled out the impact:

And what we under or what I underappreciated was just the impact on advertisers. They’re just being able to reach fewer people and then the 18 to 49 demographic is even faster than the decline in pay-TV. So this is what is really fueling the cycle is that really collapsed linear TV as an advertising vehicle outside of a few properties like sports.

Given these considerations, it was revealed in the 3Q22 call that Netflix is able to justify a high cost per thousand impressions (“CPM”).

Paid sharing gives Netflix a chance to better monetize engagement. Per the 3Q22 letter, Netflix accounts for 8.2% of video viewing in the UK which is 2.3x that of Amazon and 2.7x that of Disney+. The letter says that Netflix accounts for 7.6% of TV time in the US which is 2.6x that of Amazon (AMZN) and 1.4x that of Disney + Hulu + Hulu Live. Per the 3Q22 letter, Netflix can monetize engagement in a way that is fair to viewers:

We’ve landed on a thoughtful approach to monetize account sharing and we’ll begin rolling this out more broadly starting in early 2023. After listening to consumer feedback, we are going to offer the ability for borrowers to transfer their Netflix profile into their own account, and for sharers to manage their devices more easily and to create sub-accounts (“extra member”), if they want to pay for family or friends. In countries with our lower-priced ad-supported plan, we expect the profile transfer option for borrowers to be especially popular.

Finally, the possibilities for gaming expand each year as there is more to draw from with respect to Netflix’s growing content library.

Valuation

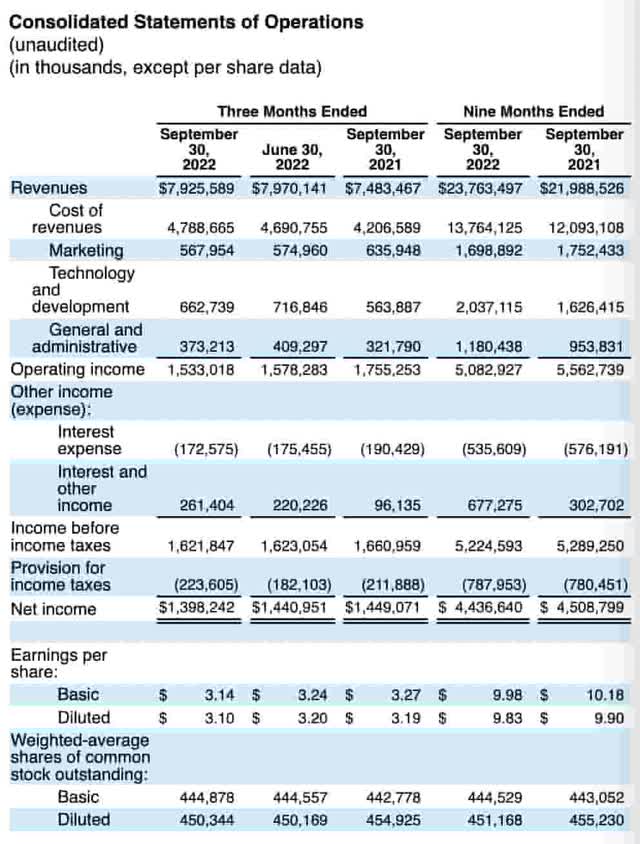

The financials on a reported basis are underwhelming right now. Quarterly revenue of $7,926 million for 3Q22 is up 5.9% from $7,483 million in 3Q21 and nine-month revenue for 2022 of $23,763 million is up 8.1% from nine-month revenue of $21,989 million in 2021. However, quarterly operating income of $1,533 million for 3Q22 is down 12.6% from $1,755 million for 3Q21. Nine-month operating income is down as well as the $5,083 million total for 2022 is 8.6% less than the $5,563 million total for 2021. It is important to remember the F/X considerations when analyzing these reported numbers:

Financials (3Q22 letter)

The reported numbers above aren’t very satisfying but we can be mollified knowing competitors went a bit crazy until the WBD (WBD) 2Q22 call when WBD CEO David Zaslav said they’ll be dialing back some streaming efforts. Listening to the 2Q22 WBD call, they will be a more rational competitor moving forward as they reduce streaming exuberance and put more energy back into other businesses. I’m optimistic that other competitors will see this logic and settle down with respect to overspending on streaming. Here is what the Netflix 3Q22 letter said about competitors:

We estimate they are all losing money, with combined 2022 operating losses well over $10 billion, vs. Netflix’s $5 to $6 billion annual operating profit.

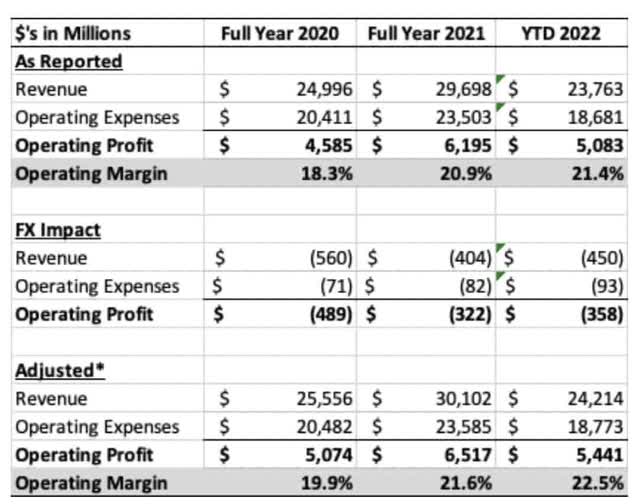

As we said above, F/X considerations for Netflix are important for the financials as they hit revenue harder than expenses. The YTD reported revenue of $23,763 million would be $450 million higher or 18.9% higher such that the adjusted revenue would be $24,214 million without the F/X hit. Were it not for F/X, the reported expenses of $18,681 million would be $93 million higher or less than 1% higher such that adjusted expenses would be $18,773 million. Obviously, operating income and net income are severely suppressed due to the fact that F/X headwinds hit revenue much harder than expenses. The 3Q22 letter has a table showing the ramifications of F/X:

Adjusted financials (3Q22 letter)

4Q22 revenue is expected to be about $7,776 million. Here is what the 3Q22 letter says about the 4Q22 operating margin:

We forecast Q4’22 operating margin of 4% vs. 8% in the year ago period. The fourth quarter is typically our lowest operating margin quarter of the year as it’s usually our largest quarter in terms of content and marketing spend. In addition, the aforementioned F/X impact has a high flow through to operating income (~75%-80% of the revenue impact) as most of our costs are in US dollars. Excluding the year-over-year impact of F/X, our Q4’22 operating margin forecast would be 10% vs. 8% in Q4’21.

Combining the revenue forecast of $7.8 billion and the adjusted operating margin forecast of 10%, I think we’ll see about $780 million in adjusted operating profit for 4Q22. Adding this to the 9-month figure of $5,441 million gives us a yearly adjusted operating profit of about $6.2 billion. Assuming that the content amortization accounting is sound then I think Netflix is worth 22 to 24x this or $136 to $149 billion.

The 3Q22 10-Q isn’t out yet but the 2Q22 10-Q says that through June 30th, there were 444,705,591 shares outstanding. The October 19th share price is $272.38 such that the market cap is $121 billion. Per the 3Q22 release, the EV is about $8 billion more than the market cap due to the net debt situation.

The EV is less than my valuation range and I think the stock is undervalued for long term investors intending to hold it for 3 years or more.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Be the first to comment