andresr/E+ via Getty Images

Elevance Health (NYSE:ELV) released its third-quarter earnings report on Wednesday and strolled past expectations, beating its earnings estimate by 38 cents per share. However, Elevance Health’s stellar third-quarter performance comes as no surprise to us.

A little over a year ago, we assigned a buy rating to the stock based on its robust earnings trajectory and lucrative dividend profile. After careful consideration, we’ve decided to upgrade Elevance Health stock to a strong buy; here’s why.

Operational Outlook

Robust Organic Growth

Elevance showcases exponential organic growth. The company’s long and short-term growth rates exceed the broader healthcare insurance’s (5.5%) by a vast amount, primarily due to the company’s horizontally-integrated business model.

| 3-Y CAGR | 15.52% |

| 5-Y CAGR | 11.12% |

| 10-Y CAGR | 9.26% |

Source: Seeking Alpha

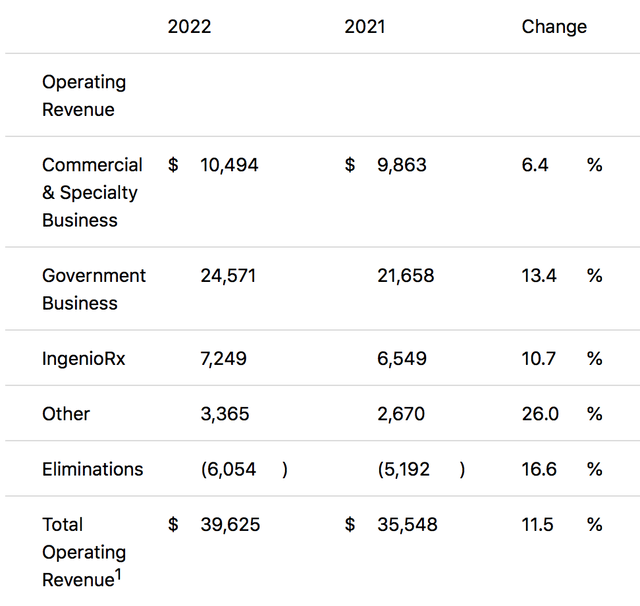

The company’s membership growth rates are progressing at a solid pace. According to its latest financial report, Elevance’s total memberships increased by 4.9% year-over-year, leading to higher income from premiums. In addition, the company’s pharmacy income is skyrocketing, with IngenioRx being fundamental to the company’s broader revenue mix.

Seeking Alpha

Although the company’s organic growth is something to admire, Elevance has a pivotal risk to look out for. The company’s investment portfolio has a substantial amount ($2.8 billion) of unrealized losses. These include various fixed-maturity securities, which could add a negative draw to the company’s future earnings report/s.

Amplified Shareholder Value

Intrinsic Value

Elevance Health’s share buybacks have added tremendous value to its stock’s intrinsic value. The company repurchased 3.7 million shares in its third quarter for approximately $1.7 billion. Elevance’s share buyback program has $2.4 billion left in the tank, which could proliferate its stock’s future fair value.

In isolation, stock buybacks increase a share’s absolute value. Thus, theoretically speaking, Elevance’s investors will likely experience value additivity as time progresses.

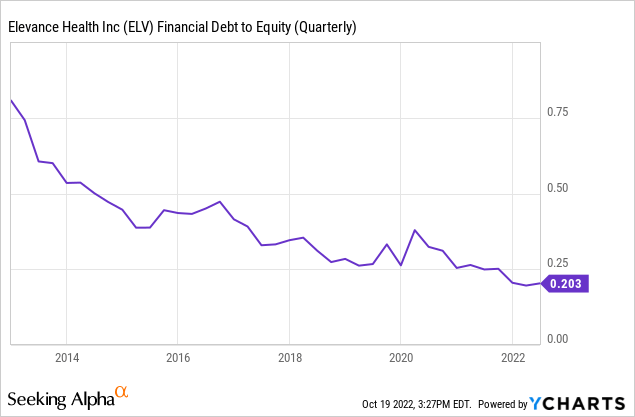

Furthermore, due to paying down debt, Elevance has been able to increase shareholder value by a tremendous amount. The company’s debt-to-equity ratio has decreased linearly in the past ten years, indicating that investors’ residual value is steepening.

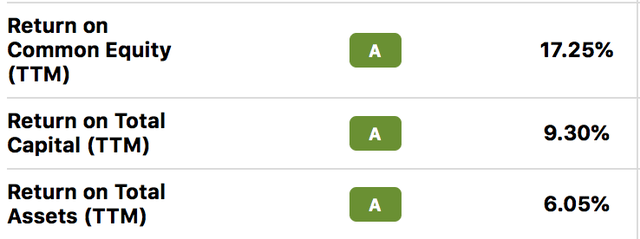

Lastly, Elevance presents solid return metrics. Stocks that possess robust return ratios are often referred to as “quality stocks”. Quality stocks pass plenty of value down to their shareholders, and Elevance is no exception.

Seeking Alpha

Dividends

After beating its third-quarter earnings target, Elevance announced a dividend of $1.28 per share at a forward yield of 1.07%. A yield of 1.07% is low, granted; however, based on the company’s low payout ratio, its sound dividend coverage ratio, and its recent debt reduction, it’s likely that Elevance shareholders could experience elevated compensation in the future.

| Dividend Yield | 1.07% (fwd) |

| Dividend Coverage Ratio | 5.63x |

| Dividend Payout Ratio | 17.08% |

Source: Seeking Alpha

Price Action – Factor Analysis

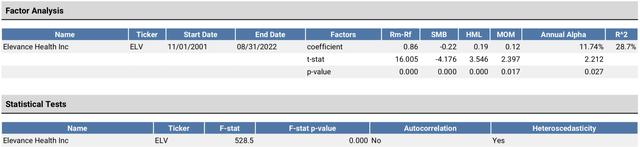

A price action analysis employing a factor regression suggests that Elevance stock is ideally positioned to garner investor interest. The regression below tests the stock’s historical returns relative to various market environments. The tested environments include small-cap conducive, value-seeking, and momentum investing.

According to the regression’s results, Elevance performs best whenever large-cap and value stocks are in favor among investors. Moreover, the stock exhibits a positive correlation to momentum.

PortfolioVisualizer

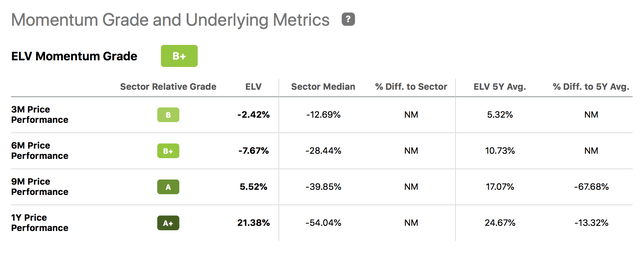

As previously mentioned, Elevance correlates to momentum, meaning the stock tends to rise in value whenever it garnered positive gains in the previous twelve months. The diagram below corroborates the claim as time series data shows that Elevance exhibits a phenomenal momentum grade.

Seeking Alpha

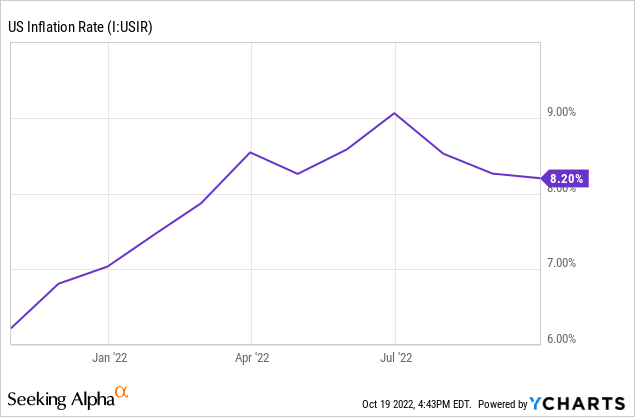

Furthermore, Elevance’s tendency to outperform whenever investors prefer large-cap and value stocks is a significant bonus, as large-cap and value assets tend to outperform the broader market whenever inflation runs ragged. Thus, the stock is suitable to the current market environment.

Potential Risks

Despite already covering a few of Elevance’s risks throughout the article, it’s necessary to outline additional headwinds to juxtapose the central argument.

Firstly, Elevance is exposed to the financial services sector, which is highly sensitive to recessions. The rhetoric is that the U.S. economy might soon be in a deep recession. Thus, exposure to insurance stocks exposes investors to a potential capitulation.

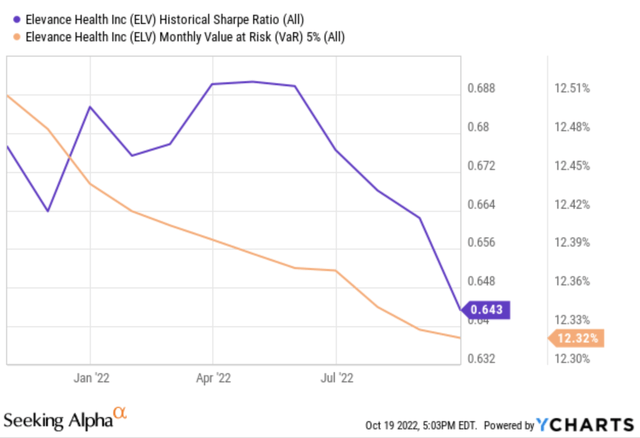

Furthermore, Elevance exhibits unfavorable risk/return metrics. The stock’s Sharpe ratio is below an efficient threshold (1.00), implying its excess return and volatility don’t align. Moreover, the stock’s monthly value at risk metric reveals that Elevance stock loses more than 12.32% of its market value in 5% of its traded months, posing a threat to sustainable gains.

Seeking Alpha; YCharts

Final Word On Elevance Stock

Elevance’s third-quarter earnings beat is a sign of the times. The company exhibits phenomenal operating progress, with membership accumulation and pharmacy traction taking center stage. Moreover, the business provides good value to its shareholders with constant debt reduction and a viable dividend profile.

Be the first to comment