shironosov

Published on the Value Lab 25/7/22

Herc Holdings (NYSE:HRI) is a rather nice company. Operating at a national level and able to occupy large customer wallet shares, it can deliver on more complex projects and can connect itself more to infrastructure related revenues coming from government wallets rather than smaller contractor wallets. It’s having no issue growing its fleet, primarily through acquiring regional competitors however, and its fleet orders are coming in from OEMs without much trouble. While the company has some attractive elements to it and is rather cheap on an EV/EBITDA basis, we are concerned with the macro picture and how that could impact some key markets.

Quick Q2 Update

About 50% of the growth was inorganic through acquisitions of companies and their fleets, but the rest was organic.

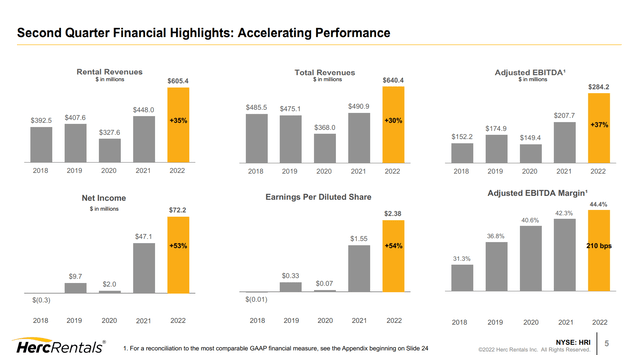

Financial Highlights (Q2 2022 Pres)

Naturally some of the organic growth is also through fleet expenditures, but a good deal was from pricing (5.5% growth) which alone offset some of the G&A growth we’d seen in the quarter. The rest of the benefits to profits has been coming from operating leverage offsetting the rest of the fixed cost expansion that was more discretionary. Adjusted EBITDA and sales both grew around 35%.

Operating Leverage

The environment is currently very good, and the economics of a business like this settle nicely when investments stop as the company simply reaps the rental revenue from the equipment. With the easy financing environment engagements have been numerous, and a situation where governments have been moving forward with major infrastructure has also benefited the company. However, the economics feature a lot of operating leverage and with a good amount of exposure to contractors, which could be subject to contraction if the housing market takes a dip as unemployment risks spiraling and rates continue to put direct pressure on housing. HRI was able to bring down expenses substantially during COVID which gives us some data to work with. They brought expenses down by about 22% as an emergency measure, which happened to preserve margins in Q2 of 2020, but beyond that G&A couldn’t fall further even if revenues declined more harshly without taking anti-economical action. We think 22% represents the margin for sales decline before operating leverage starts taking effect and really tanking profits. Given 32% of the end-markets are contractors and 25% are ‘other’, we get a total of around 55% of revenue exposed to potentially more vulnerable markets. 22% of a decline in margin before operating leverage hits is actually a great defense against a more vulnerable 50% of the business, especially as engagements are on a contracted basis and do provide some recurring revenue even as rollovers slow down. Nonetheless, operating leverage is a feature of the business, and the 22% G&A declines came during COVID-19 where there was more scope for aggressive cuts than there might be now.

Still Some Major Positives

While operating leverage risks the company’s health on the macro downside, there are still some impressive elements that could make HRI compelling. The low valuation around 4.6x EV/EBITDA is the first, and also their ability to consolidate with regional players at the same multiple, essentially paying no premium for fleets that would be rather difficult to greenfield from vendors given supply chain issues. The corporate strategy will accrete value in our opinion. Moreover, there are resilient markets in government and industrial, with the industrial segment necessarily needing to increase capacity in the current environment. While these things put HRI on our buy radar, we will wait because we are nervous about them trading together with housing which is an area that could see sentiment hits as unemployment risks spiraling.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment