maikid/E+ via Getty Images

One of the world’s largest publicly traded property and casualty insurer, Chubb Limited (NYSE:CB) operates in a market that provides significant downside protection for its members. The company enjoys industry leading profitability, and has, in the year-to-date, been able to outperform the broad market thanks to its excellent fundamentals. The company will likely continue to beat the market, because of its strong fundamentals.

Tepid Stock Market Performance

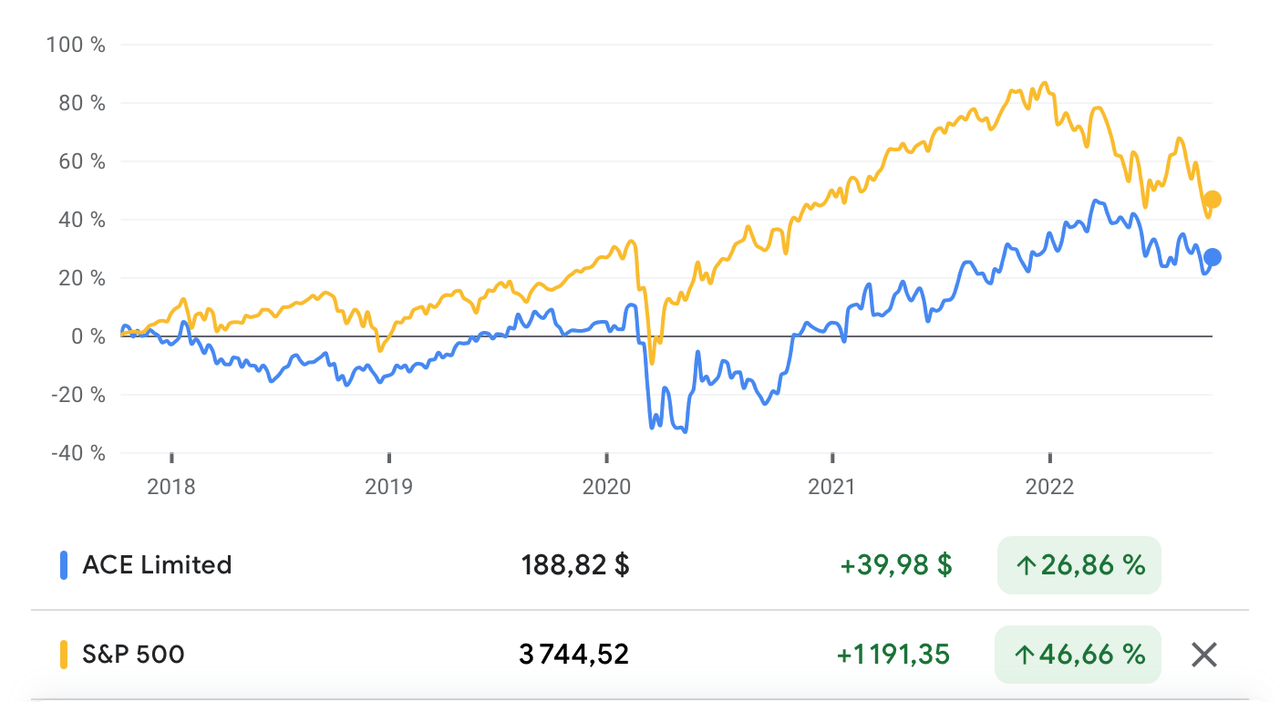

In the last five years, Chubb has greatly underperformed the S&P 500, gaining 26.86% in the market, compared to 46.66% for the S&P 500.

Source: Google Finance

In the year-to-date, Chubb’s share price has declined by 1.37%, which is not a great result, but is vastly superior to the 21.93% decline of the S&P 500. The company’s stock market performance reflects the company’s solid, but unspectacular results in the last five years, at a time when growth firms were leading the market.

Strong Financial Performance

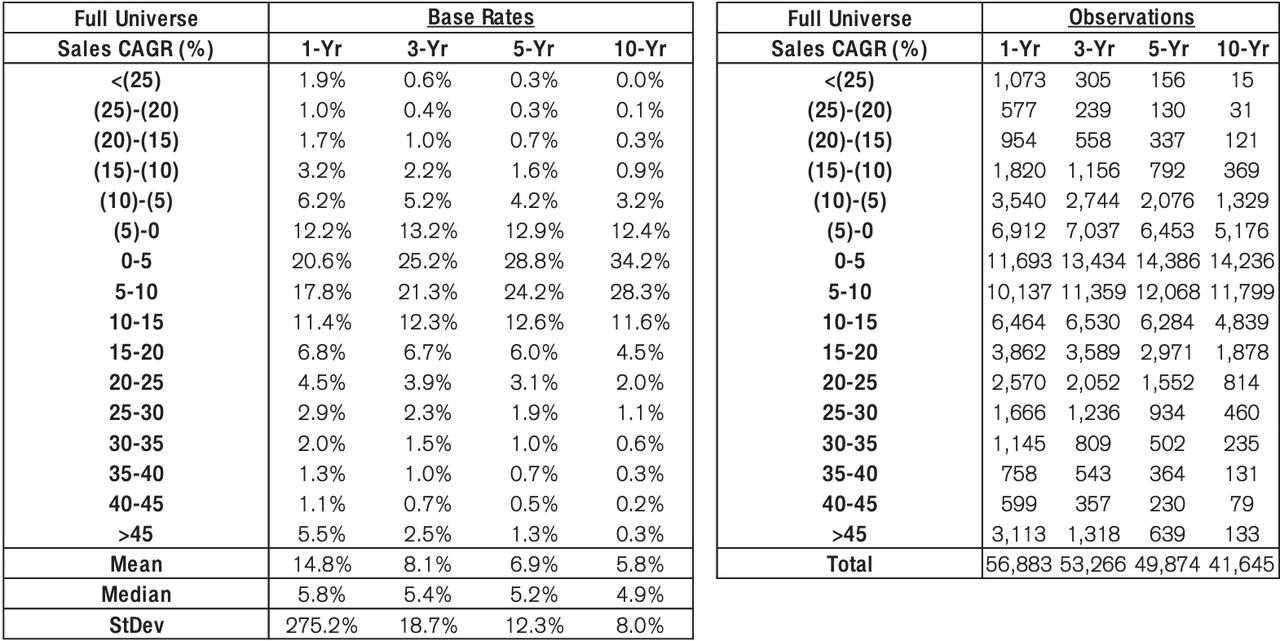

Chubb has grown revenue from $32.243 billion in 2017, to $40.963 billion in 2021, for a 5-year revenue compound annual growth rate (CAGR) of 4.9%. According to Credit Suisse’s The Base Rate Book, 28.8% of firms between 1950 and 2015 achieved similar growth rates. That suggests a “normalcy” to the company’s growth, which is sustainable over time.

Source: Credit Suisse

In the trailing twelve months (TTM), Chubb has earned $40.938 billion in revenue, with a strong chance that the company could beat 2022’s historic results.

Chubb’s gross profitability rose from nearly 0.079 in 2017 to just over 0.09 in 2021. This is far from the 0.33 threshold that Robert Novy-Marx’s research says marks an attractive company. However, it does show a pattern of improving profitability in the last half-decade. In the year to date, gross profitability has risen to nearly 0.93.

Chubb’s operating profit margin has risen sharply, from 13.4% in 2017, to 25.2% in 2021, again highlighting the improving profitability of the company. In the year-to-date, operating profit margin declined somewhat, to 21.9%.

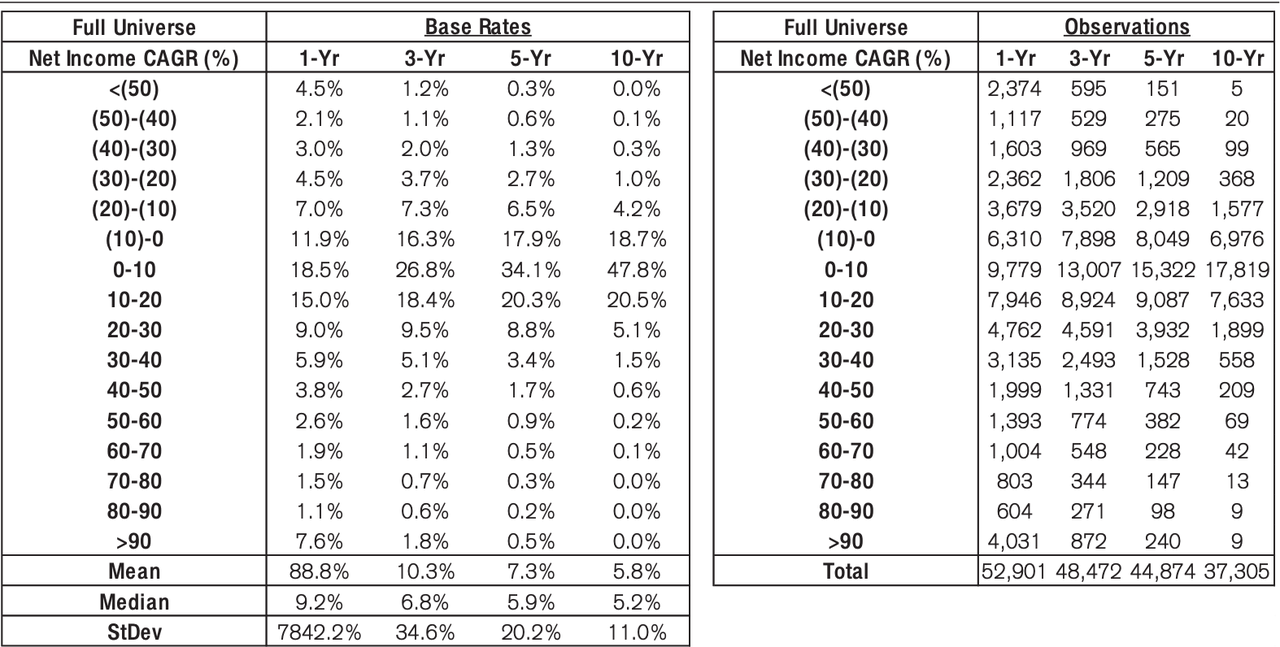

Net income rose from more than $3.86 billion in 2017, to nearly $8.54 billion in 2021, for a 5-year net income CAGR of 17.2%, achieved by 20.8% of firms in the 1950-2015 period.

Source: Credit Suisse

In the year-to-date, net income declined sharply, to over $7.16 billion, which is still the second highest net income ever achieved by the firm.

Total assets grew from more than $167 billion in 2017 to more than $200 billion in 2021, for a 5-year total assets CAGR of 3.68%. There is an inverse relationship between asset growth and future returns, so, in the presence of asset growth, we have to ask if a business has the competitive advantages to defy the asset growth effect. In the TTM period, total assets declined to nearly $196 billion. In addition, the company’s total capital as of the 30th of June 2022, was $67.8 billion. Chubb has net loss reserves of $56.3 billion.

The company’s growing profitability is reflected in its return on invested capital (ROIC), which has risen from 2.8% in 2017, to 5.4% in 2021. In the TTM period, ROIC declined to 4.7%.

In addition, Chubb’s free cash flow (FCF) rose from $4.5 billion in 2017, to nearly $11.15 billion in 2021, for a 5-year FCF CAGR of 19.88%. In the TTM period, Chubb earned FCF of more than $11 billion.

Chubb’s Business

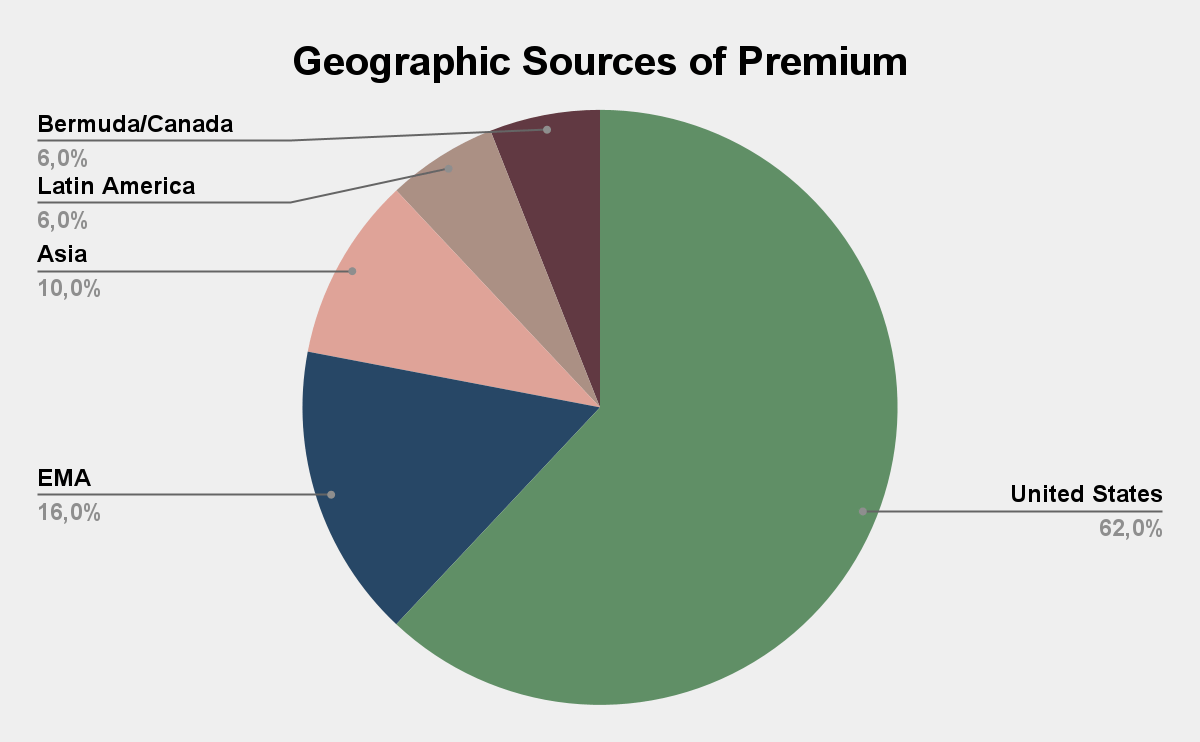

Chubb is the largest writer of commercial lines insurance, in terms of direct premiums in the United States, and one of the largest financial lines writers in the world. The insurer operates in 54 other countries and territories, with 62% of the firm’s premiums derived from outside the United States.

Source: Second Quarter 2022 Investor Presentation

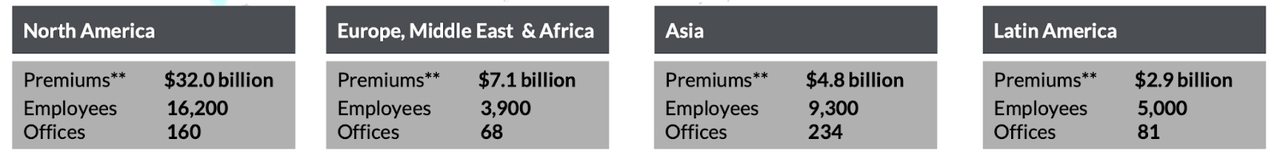

North America earned the company $32 billion in premiums, as of the second quarter, compared to $7.1 billion for the Europe, Middle East and Africa (EMA) region, $4.8 billion for Asia, and $2.9 billion for Latin America.

Source: Second Quarter 2022 Investor Presentation

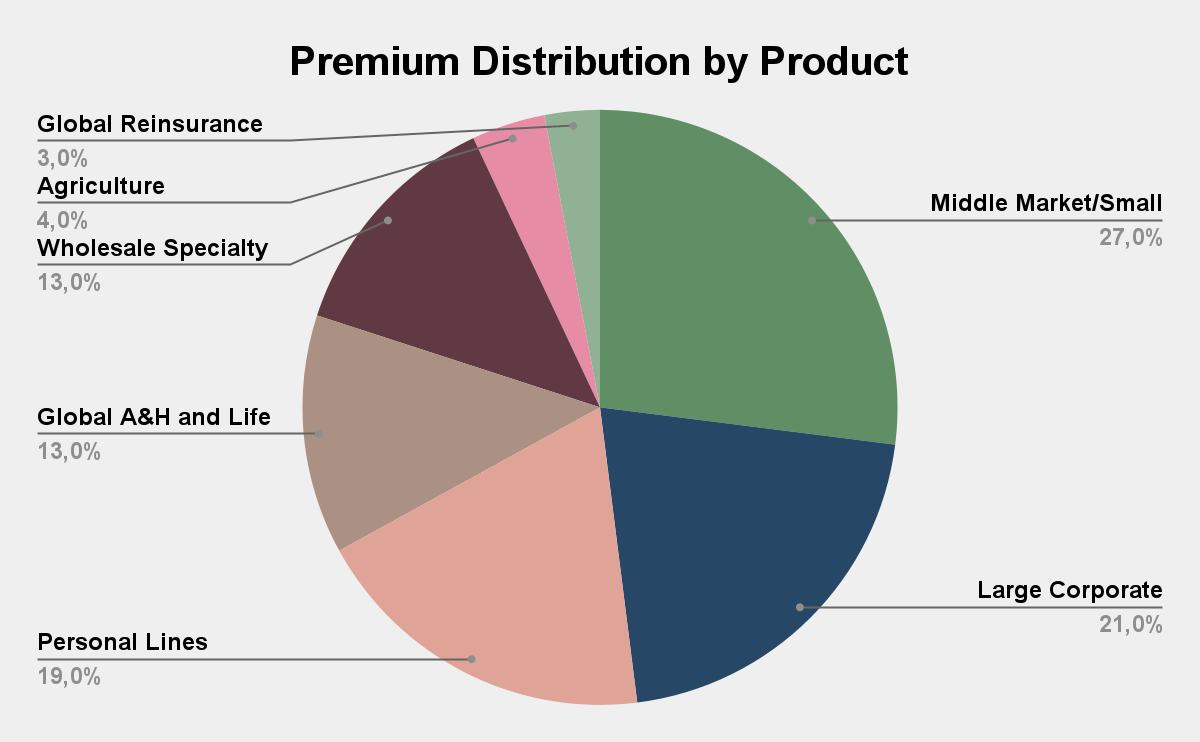

Property & casualty is the most significant source of premiums for the firm, with 61% of premiums emanating from the property & casualty segments, middle market/small commercial (27%); large corporate commercial (21%); and wholesale specialty commercial (13%).

Source: Second Quarter 2022 Investor Presentation

Insurers Have Downside Protection

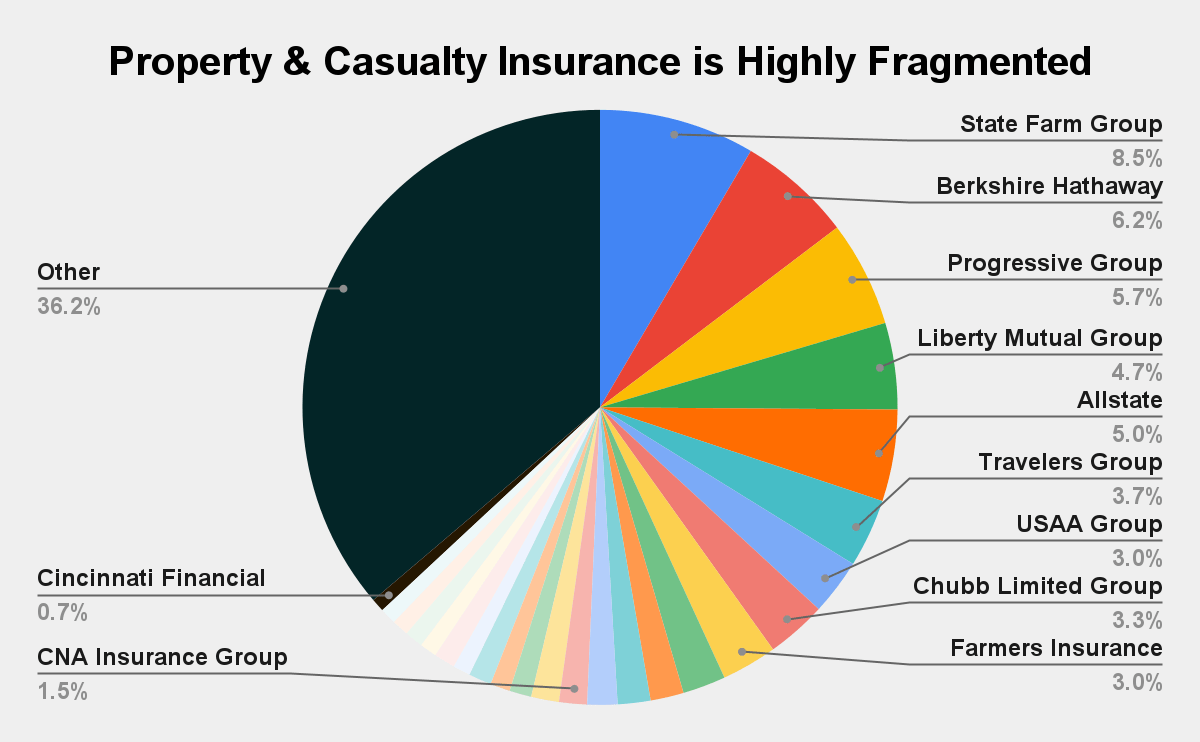

The insurance industry is a highly fragmented market. Consider data for direct premiums written for “States, U.S. Territories, Canada, Aggregate Other Lien”, from the National Association of Insurance Carriers (NAIC). It shows the degree of fragmentation of the market, where no firm has more than 10% of the market.

Source: NAIC

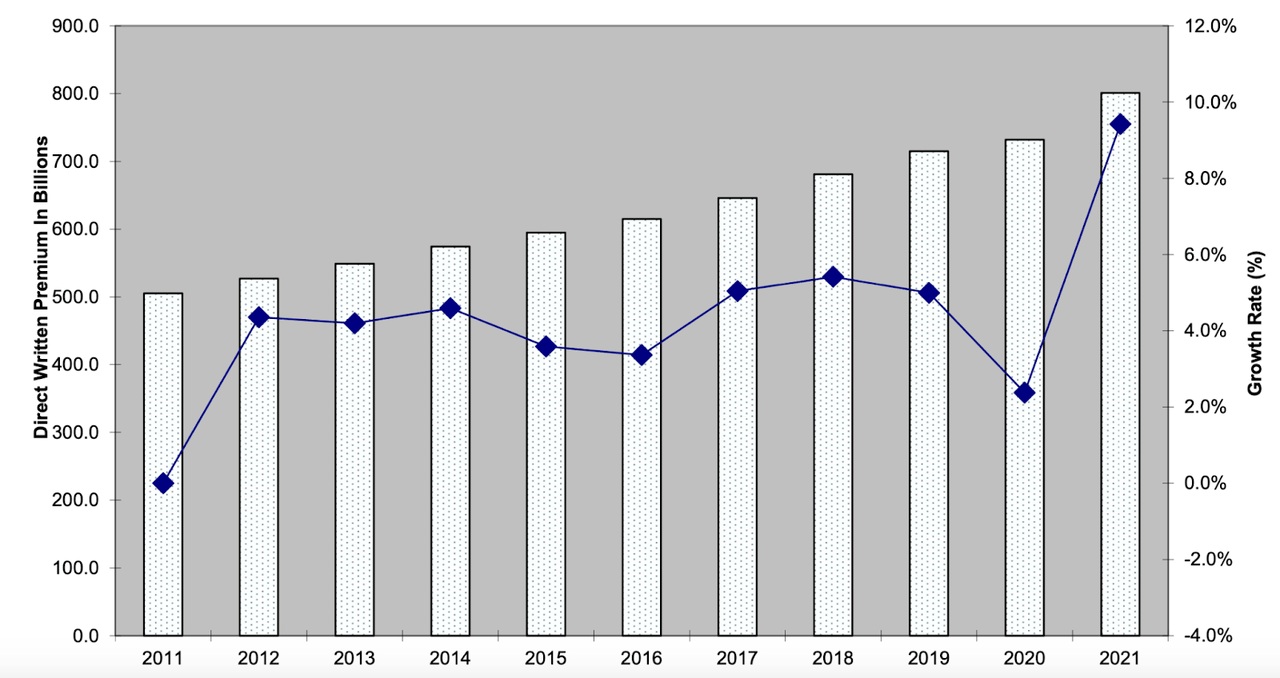

Given the asset growth that Chubb has displayed, this kind of chart should normally be concerning for investors, because it suggests a market where profitability is hard to attain. When you factor in the commodity-like nature of insurance, it becomes clear that fragmentation is unlikely to ever change. However, insurers have traditionally been profitable, despite selling largely non-differentiable products. This is because property & casualty is either required by law, or, is seen as so essential by consumers that they get it anyway, and that creates a perpetual market for insurers. This prevents the kinds of boom-and-bust cycles you see in commodity businesses. The direct premiums trend for the industry, as shown in the chart below, shows the degree of downside protection that the industry has. While growth rates may go up and down, the value of direct written premiums has steadily risen over the last decade. People simply do not terminate insurance programs en masse.

Source: NAIC

Chubb, because of its scale, can compete on price, brand awareness, and will always be one of the leading insurers recommended by agents. These are the three most important things for an insurer’s success.

Chubb Continues to be an Excellent Underwriter

Over the last decade, Chubb has earned an average annual underwriting margin of 9.3%. Over the last year, the company earned an underwriting margin of 10.9%. Chubb’s combined ratio (loss ratio + expense ratio), and hence underwriting profitability, compares favorably with that of peers such as American International Group Inc (AIG), Allianz, AXA, CNA Financial (CNA), Hartford Financial Services Group (HIG), QBE Insurance Group Limited, The Travelers Companies Inc (TRV) and Zurich Insurance Group.

|

1-Year |

3-Year |

5-Year |

10-Year |

|

|

Peers |

94.6% |

97.2% |

98.3% |

98.1% |

|

Chubb |

89.1% |

91.9% |

92.2% |

90.7% |

(Source: Second Quarter 2022 Investor Presentation)

In the second quarter of 2022, the combined ratio was 84%.

The absence of a peer with a combined ratio greater than 100 is another indicator of the downside protection given to insurers, because it shows an insurer’s ability to both cover their clients and be profitable.

Costs Remain Low

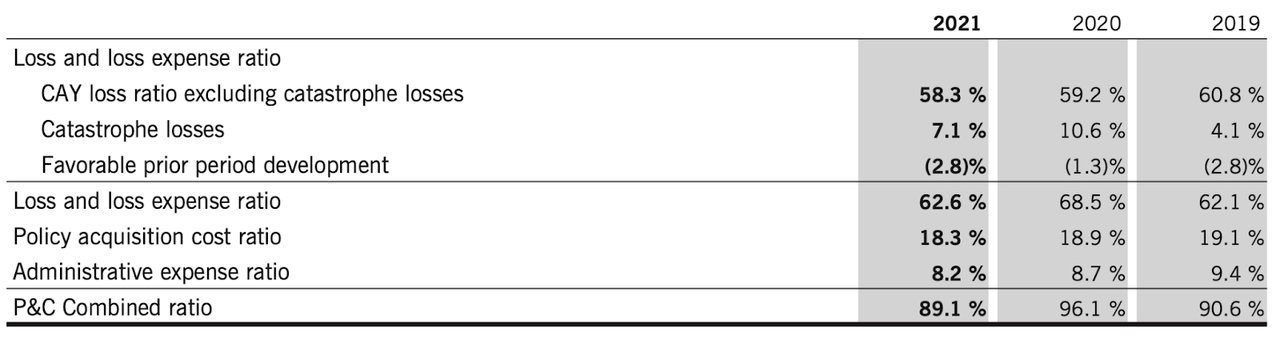

According to the company’s 2021 Annual Report, costs remain admirably low. The company has been able to acquire new policies at steadily lower costs, while also reducing its administrative costs. This shows the impact of scale economies on the company’s costs.

Source: 2021 Annual Report

Valuation

Chubb has an unadjusted FCF yield (FCF/enterprise value) of 12.15%. This is a very attractive yield, especially when compared to the FCF yield of the 2,000 largest companies listed in the United States, who have an average FCF yield of just 1.5%, as measured by New Constructs.

Conclusion

Chubb is a large insurer that enjoys scale economies, low costs, great brand awareness, and an ability to earn industry leading profits. The insurance industry as a whole gives its members significant downside protection, which is very important in the kind of volatile period we are in now. With the economy struggling, Chubb is likely to continue to outperform the market.

Be the first to comment