Elena Bionysheva-Abramova/iStock via Getty Images

The Q2 Earnings Season for the Gold Miners Index (GDX) left much to be desired. Worse, anxiety continues to build regarding Q3, with producers continuing to deal with inflationary pressures but now selling at a lower realized gold price. While the royalty/streaming companies have been immune from this margin pressure, an unfortunate development forced Maverix Metals (NYSE:MMX) to cut its guidance, leading to significant underperformance in the stock over the past month. However, I believe the Omlon worries are overblown, and I see this dip as providing a low-risk entry point for a starter position in the stock.

Hope Bay Project – Maverix 1% NSR Royalty (Agnico Eagle Mines Presentation)

Q2 Sales

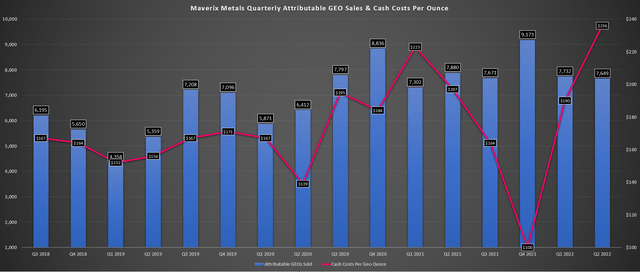

Maverix released its Q2 results earlier this month, reporting a quarterly volume of ~7,6000 GEOs, a 3% decline from the year-ago period. This was not the results investors were looking for, especially with the company up against easy year-over-year comps after a soft H1 2022 for La Colorada, an increased royalty at Omolon, and the benefit of its Auramet stream, which didn’t benefit the Q2 2021 results. The main culprit for the weaker quarter was the company’s Omolon royalty asset operated by Polymetal (OTCPK:AUCOY), which contributed just 20 GEOs in the quarter, down from 343 GEOs at a lower royalty rate in Q2 2021. Let’s take a closer look below:

Maverix Metals – Quarterly Attributable GEO Sales & Cash Costs (Company Filings, Author’s Chart)

While Maverix has had a solid growth profile, the one clear risk in the portfolio as of Q1 2022 was Omolon Hub northeast of the Magadan region of Russia, with multiple mines feeding the Kubaka plant. Maverix initially picked up a 2.0% NSR royalty on Omolon from a royalty portfolio acquired in 2019 and chose to increase this to 2.50% last year, which turned out to be unfavorable timing given the start of the Russia-Ukraine War.

The good news was that as of its Q1 results, Polymetal continued to operate uninterrupted, suggesting there’d be little impact on Maverix royalty. However, the risk of disruption to sales and worries about this asset did not appear priced into the stock, with Maverix trading at a premium to its mid-tier royalty peers. For this reason, I preferred to remain on the sidelines this year, not wanting to sit through a sharp drawdown in case we were to see negative news arise out of Omolon.

This is, unfortunately, what we saw in the Q2 results – guidance was cut to 29,500 GEOs (mid-point) from 33,500 GEOs (previous mid-point) to bake in conservatism at Omolon (no contribution in H2). As discussed by the company, restrictions in Q2 forced Polymetal to reduce gold shipments which led to a shortfall in gold sales vs. ounces produced. The result was that only 20 of the 1,100 GEOs were recognized in Q2, significantly impacting Maverix’s revenue. According to Maverix, Polymetal has reiterated its production guidance for the year but did warn that there was a risk of underperformance given persistent lockdowns in Asia.

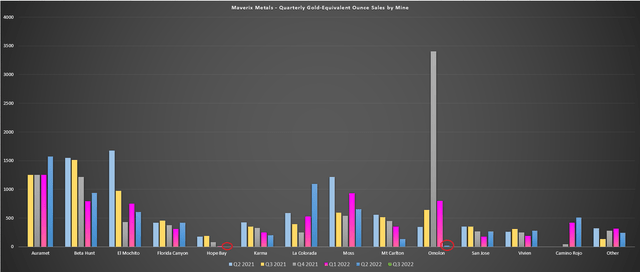

Maverix Metals – Quarterly GEO Sales by Mine (Company Filings, Author’s Chart)

While this is certainly a negative development, and the effects of limited production at Omolon and no production at Hope Bay hurt the Q2 results, it’s crucial to put Omolon Hub in context. From an attributable GEO standpoint, this is a significant asset, and a halt in production or inability to realize revenue here would lead to a 10% decline in GEO sales. However, from a NAV standpoint, Omolon represents less than 8% of Maverix’s NAV (~$40 million vs. $530 million).

If we completely remove it from Maverix’s portfolio and take a worst-case approach which I don’t see as necessary with a single delay in gold shipments, this is a $0.25 impact on MMX’s share price. If we increase the discount rate to 10% from 5%, it’s just a $0.06 impact. So, with MMX tumbling by $0.60 per share since its Q2 results, one could argue that any net asset value attributed to Omolon has been deleted from the portfolio 1.5x already. Obviously, this is not how the market works, and several factors are at play. Still, the point is that however one chooses to discount Omolon, the negativity is priced into the stock at US$3.50. Let’s look at the financial results:

Financial Results & Recent Developments

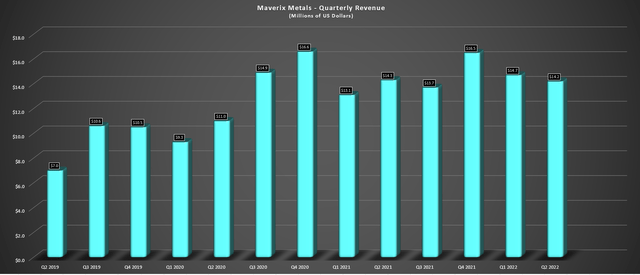

Looking at Maverix’s revenue below, the company reported Q2 revenue of $14.2 million, a 1% decline from the year-ago period. This decline in revenue was despite an increase in its average realized gold price to $1,856/oz (Q2 2021: $1816/oz), which likely disappointed investors even further. However, it’s important to note that this was an unusual quarter, with Maverix not benefiting from Hope Bay (Q2 2021: 177 GEOs) and seeing a massive decline in contribution from Omolon. If we adjust for Hope Bay’s true potential (300,000+ ounces per year or 750 GEOs attributable to Maverix per quarter), revenue and gold sales would have increased.

Maverix – Quarterly Revenue (Company Filings, Author’s Chart)

From a margin standpoint, Maverix’s results were solid, with the company reporting cash cost margins of $1,620/oz, up slightly from $1,619/oz in the year-ago period. This continues to give Maverix some of the most attractive margins sector-wide (87.3%), benefiting from its low-risk royalty/streaming model. Meanwhile, from an operational standpoint, Maverix’s newest contributor, Camino Rojo, continues to fire on all cylinders. To date, Orla Mining (ORLA) has done an excellent job operating its low-cost Mexican asset, reaching commercial production in April and maintaining its guidance for the year. On the topic of Orla, another of its assets could also contribute by H2 2025 for Maverix – a very positive development.

Recent Developments

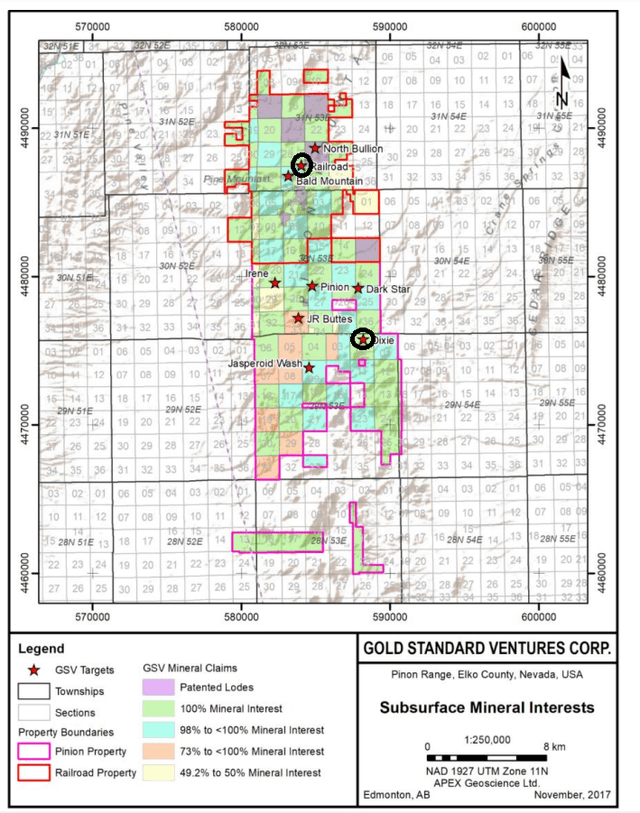

While it’s easy to focus on the negative, which is that Agnico Eagle (AEM) temporarily suspended production at Hope Bay and some uncertainty related to Omolon Hub in Russia, the positive developments cannot be overstated. Beginning with Orla, the company has acquired Gold Standard’s Railroad South Project and the surrounding land package, which is great news for Maverix’s 2.0% NSR royalty on the project. This is also a bonus for Maverix’s recent acquisition of a 4.0% NSR royalty on Dixie Creek and two claims near the Railroad prospect area. These landholdings were unlikely to receive much attention under the weaker balance sheet of Gold Standard Ventures. However, they could see lots of attention from cash-flow-positive Orla, which will likely want to see what its regional upside looks like while it builds Railroad South.

Recent Nevada Royalty Acquisitions (Gold Standard Technical Report)

Previously, I chose to model this asset very conservatively, given that Gold Standard had a low market cap to initial capex ratio, creating uncertainty about its ability to fund the Nevada project. However, it’s now looking like this could contribute 1,000+ GEOs per annum from 2025 through 2030 for Maverix. If any large discoveries are made at Railroad (north of Pinion) or Dixie (2 kilometers south of the high-grade Dark Star deposit), we could see increased contribution later this decade. This is because these landholdings have higher royalty rates (4.0% NSR royalty vs. 2.0% NSR royalty previous on planned mining areas).

Moving north to Nunavut, Agnico Eagle (AEM) appears quite excited with what it’s seeing at its newly acquired Hope Bay Project (Q1 2021), evidenced by the company increasing its exploration budget for 2022, with 80% of those incremental dollars going to Hope Bay ($24 million of $30 million). Agnico noted that it would be allocating this capital to drilling and developing exploration drifts at Doris to accelerate exploration from underground in high potential areas. The goal is to allow for easier resource conversion and mine development for future production resumption.

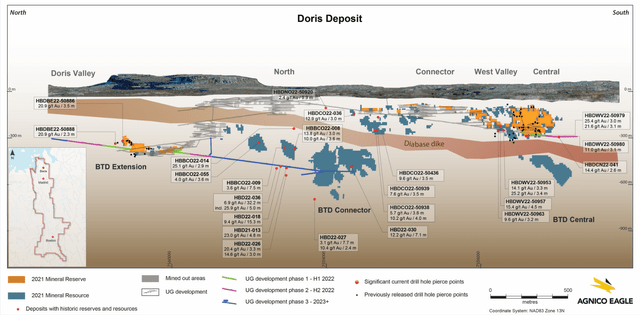

Hope Bay – Doris Deposit – Maverix 1% NSR Royalty (Agnico Eagle Mines Presentation)

For those unfamiliar, Maverix received negative news when Agnico decided to suspend production at Hope Bay, focusing on improving its understanding of Doris and Madrid’s true potential before ramping up production at the asset later (assuming exploration delivers desired results). To date, the results are exceeding expectations, with drill results confirming the potential to grow Doris at depth below the dike (brown shaded area) in the BTD Extension and BTD Connector Zones, where there are limited mineral reserves in place currently. The company also noted that it’s confident in growing the size of the deposit above the dike in the West Valley Zone.

As the above map shows, highlight intercepts included 32.2 meters at 6.9 grams per tonne of gold north of the BTD Connector Zone and 15.3 meters at 9.4 grams per tonne of gold. Agnico also intersected 7.1 meters at 12.2 grams per tonne gold in a current mineral resource block in the BTD Connector Zone and several high-grade intercepts above the dike in the West Valley Zone. Finally, Agnico intersected 3.5 meters at 20.9 grams per tonne of gold and 2.3 meters at 20.9 grams per tonne of gold in the vicinity of current mineral reserves and just north of mineral reserves in the BTD Extension Zone.

These results are highly encouraging, they are at just one deposit at Hope Bay (completely separate from Boston and Madrid), and while not representative of average grades, they appear to be better than what Agnico was looking for when it acquired TMAC. So, while Hope Bay may not be contributing for Maverix currently and may not until 2024, I am quite confident that this asset will return to production post-2024 and could contribute as much as 2,000 GEOs in 2025/2026 and 3,000 GEOs per annum from 2027-2035, providing a nice boost to Maverix’s annual production. Besides, this could be the tip of the iceberg for this massive land package (1,100 square kilometers), with the possibility of a larger production scenario explored long term.

Finally, Coeur Mining (CDE) continues to remain bullish on Silvertip and is looking at a much larger production scenario, given its exploration success. Based on comments in the Q2 Conference Call, Coeur appears to be looking at a 3,000+ tonne per day scenario, which would be triple the company’s previous 1,000 tonnes per day throughput target before Coeur placed the asset on care and maintenance in 2020.

Given Coeur’s weak balance sheet and inability to fund this restart near-term, I have no clue how one analyst came up with a 2023 restart, and investors should take any discussion of a near-term restart with a grain of salt. That said, once the Rochester Expansion is complete next year and Couer’s balance sheet improves, I wouldn’t rule out a 2027 start. Given that Maverix holds a large 2.5% NSR royalty on the British Columbia Project, a restart at more than triple the achieved throughput rate would be a big deal for Maverix (2,000+ GEOs per annum).

Valuation

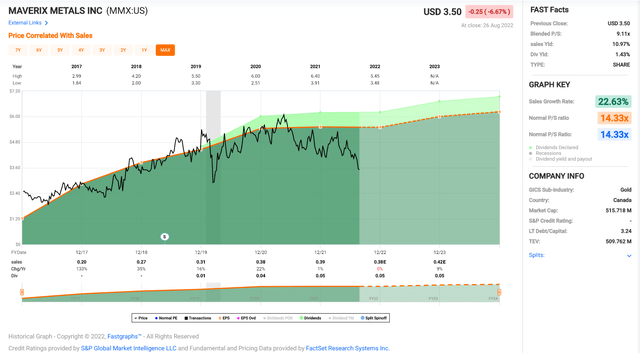

Based on ~157 million fully diluted shares and a share price of US$3.50, Maverix trades at a market cap of ~$550 million, which might appear steep at first glance for a company with trailing-twelve-month revenue of $59.1 million (9.3x sales). However, as we can see below, the stock has historically traded at more than 14x sales, which makes sense given that it has software-like margins (three-year average: 80% gross margins), has responsibly grown its portfolio without overpaying, and is immune from inflationary pressures, unlike many producers which are finding it difficult to control costs in the current environment.

Maverix Metals – Price/Sales Ratio (FASTGraphs.com)

Based on what I believe to be a conservative multiple of 13x sales and FY2023 revenue estimates of $61 million, Maverix could easily command a fair value of US$5.05 per share (fully-diluted basis). However, using price-to-sales for royalty/streaming companies is not that useful, given that it doesn’t capture the value in the portfolio at assets that are not yet in production or at an inflection point from a growth standpoint. In Maverix’s case, there are several. In fact, the company’s North American royalty portfolio alone could benefit from additional attributable sales of ~16,000 GEOs by FY2027 and 19,000+ GEOs by FY2029. Even at a $1,800/oz gold price, this would increase revenue by ~$27 million per annum in FY2027.

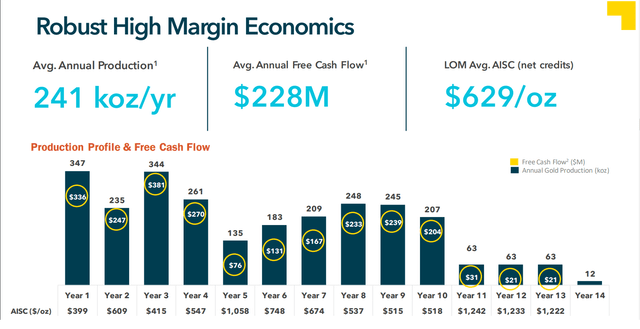

Outside of North America, a significant amount of upside is bought and paid for already. For starters, Karora (OTCQX:KRRGF) is working to push Beta Hunt production to 145,000+ ounces per annum by 2024 while also increasing nickel production (Maverix 1.5% NSR on nickel). Meanwhile, Montage (OTCPK:MAUTF) could bring Kone into production by 2026, with this Cote d’Ivoire asset averaging ~270,000 ounces for its first five years (~5,000 GEOs per annum attributable to Maverix). Finally, Bluestone’s (OTCQB:BBSRF) Cerro Blanco could add ~2,500 GEOs to Maverix’s portfolio from 2025-2029 if successfully permitted.

Bluestone – Cerro Blanco Economics – Maverix 1.0% NSR Royalty (Bluestone Resources)

So, while Maverix might be a ~30,000 GEO per annum royalty/streaming company, there’s a path to 45,000 GEOs per annum by FY2026 and 60,000+ GEOs per annum by FY2028 just within the portfolio at its more advanced assets. Therefore, I believe it’s more appropriate to value the company on a P/NAV basis, and with an estimated net asset value of $620 million, Maverix trades at just 0.88x P/NAV. Based on what I believe to be a fair multiple of 1.40x P/NAV, I see over 57% upside to a fair value of US$5.50. Therefore, with Maverix’s recent decline, investors are finally getting a margin of safety for this low-risk organic growth story.

Summary

Maverix has been on my radar for a while, but given the Russia-Ukraine War, I was worried that this might lead to share price weakness if there were any disruptions at Omolon. While this has led to a guidance cut and some uncertainty around the asset, Omolon is just one tiny piece of the Maverix story (less than 8% of net asset value) and even less significant given the recent positive developments across the portfolio. Hence, I think this sell-off is overdone, and this is a rare opportunity to buy Maverix at a deep discount to net asset value.

Be the first to comment