adventtr

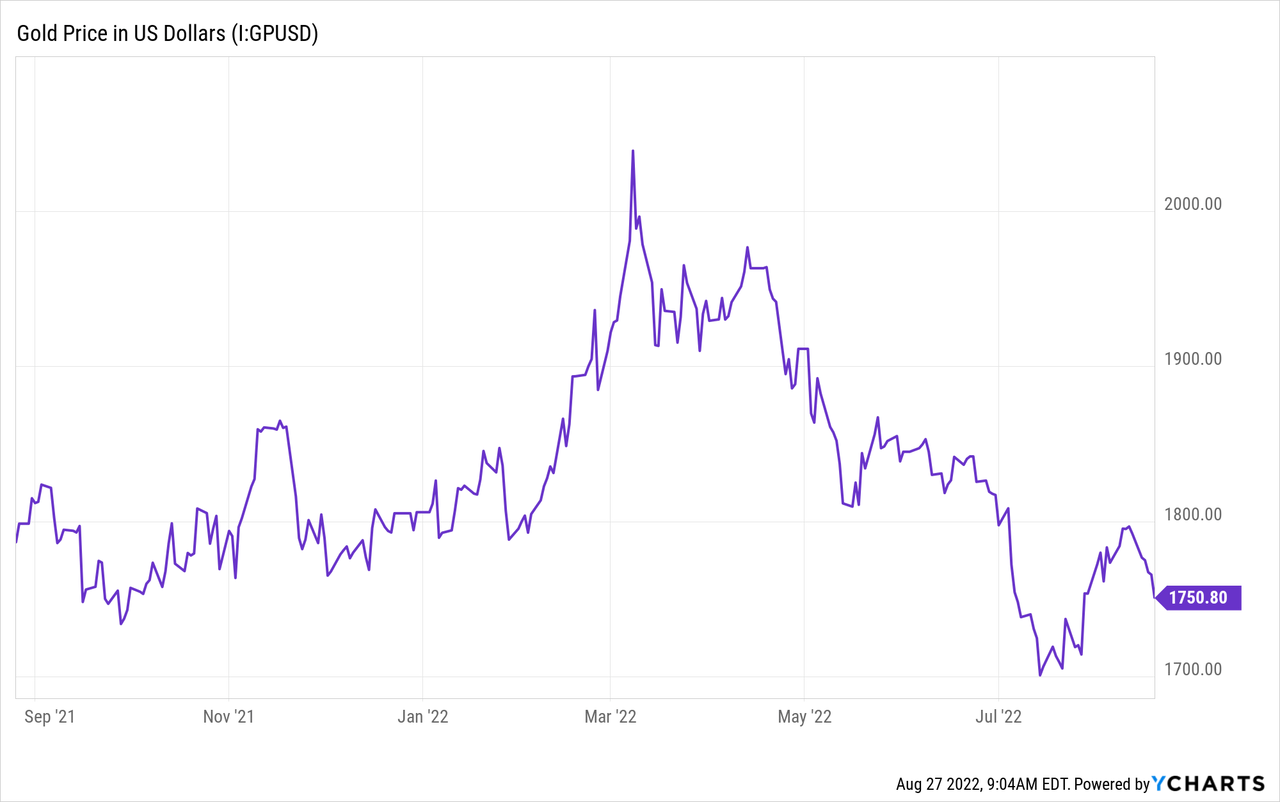

The gold prices are down since their peak in 2020. A few weeks ago, the gold prices corrected immediately after the US published a strong jobs report. Everyone expects the Fed to take more serious measures against inflation. But no one understands how overvalued the US dollar is and how undervalued the yellow metal is. There is obvious undersupply of gold right now, the world’s indebtedness is near all-time highs, the geopolitical uncertainty is substantial and Russia started returning to a form of a gold standard. I cannot say exactly how much gold will be by a certain time period. Right now, it looks obvious the Fed is very hawkish and will tighten further due to high inflation readings. In the short to medium term, it is bearish for gold. But some fundamental factors are in favor of patient long-term investors. Let me explain this in some more detail.

Strong jobs and falling GDP

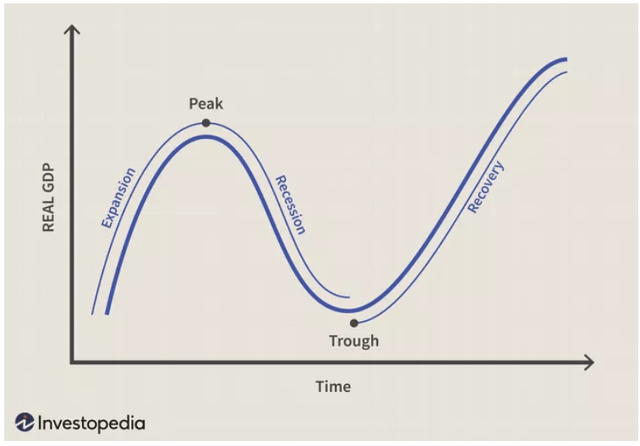

A lot was recently said about the Fed. It is forced to act because of unbelievably high inflation numbers. It also has the opportunity to do so because the unemployment level is near all-time lows seen in 2019, before the pandemic. That is why it is hard to understand what stage of an economic cycle we are at. Some analysts argue we entered a technical recession. It happens when the national Gross Domestic Product (GDP) decreases for two consecutive quarters.

But let us try to understand what constitutes a recession.

According to the NBER’s Business Cycle Dating Committee, a recession is “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators. A recession begins when the economy reaches a peak of activity and ends when the economy reaches its trough.“

Economic cycle

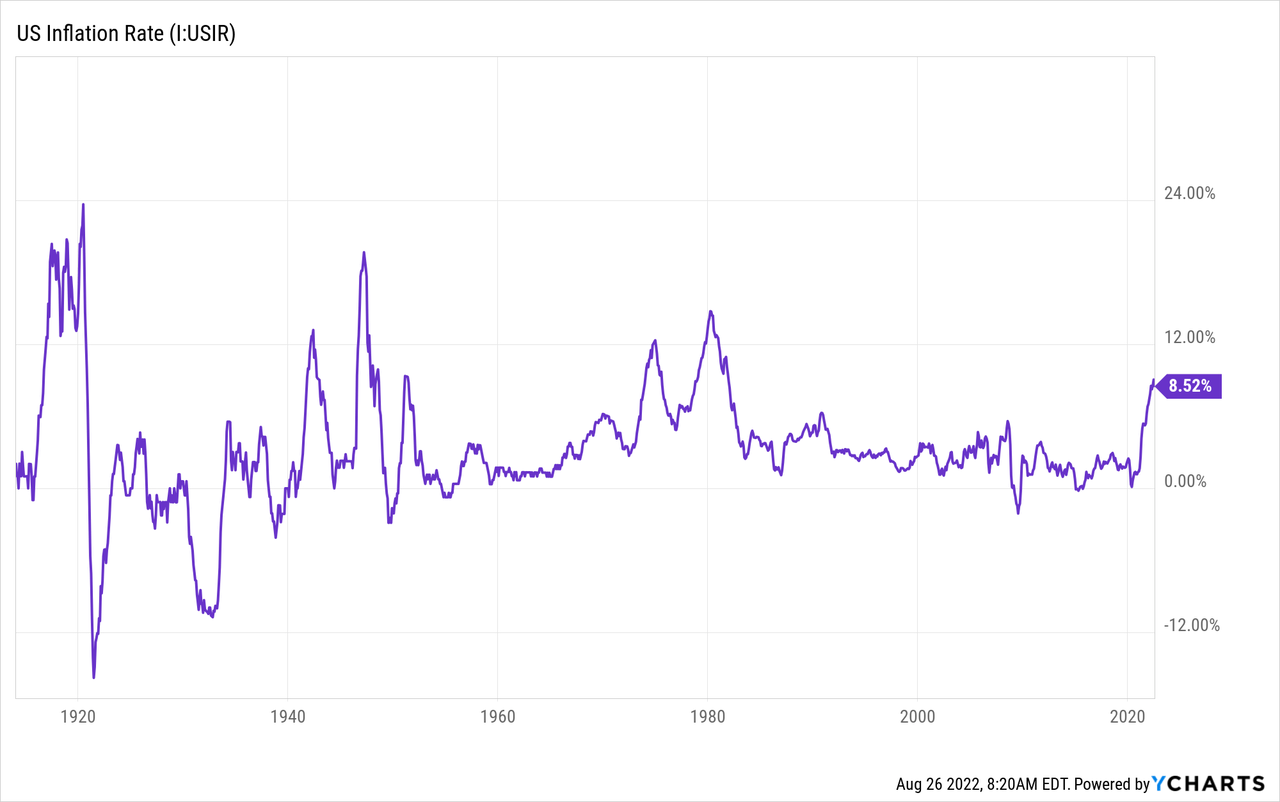

That is why the US economy is in a technical, but not a full-scale recession. Right now, the US lacks high unemployment numbers. At the same time, the inflation rate is nearing all-time highs.

The Fed’s actions and the bearish case for gold

Due to high inflation, the Federal Reserve is forced to take action. It can do so by quantitative tightening and raising the interest rates.

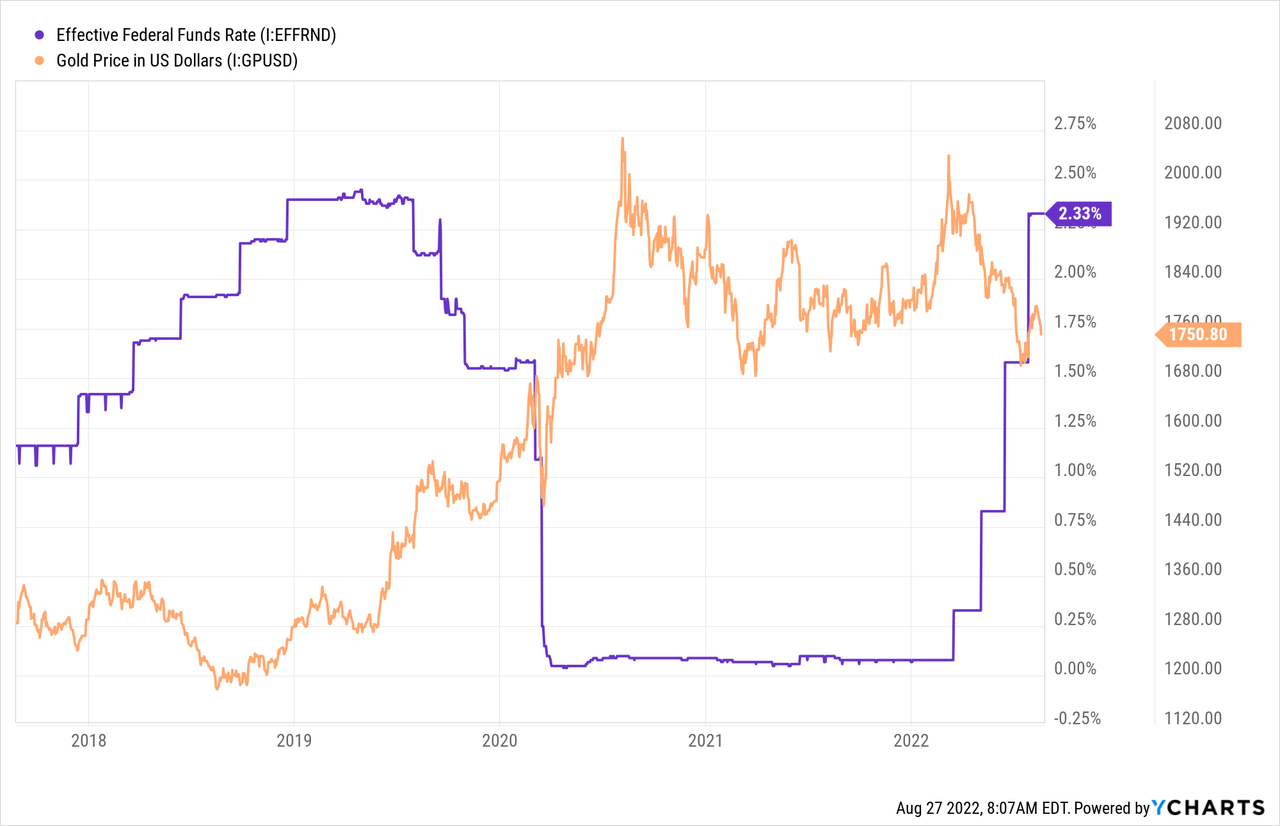

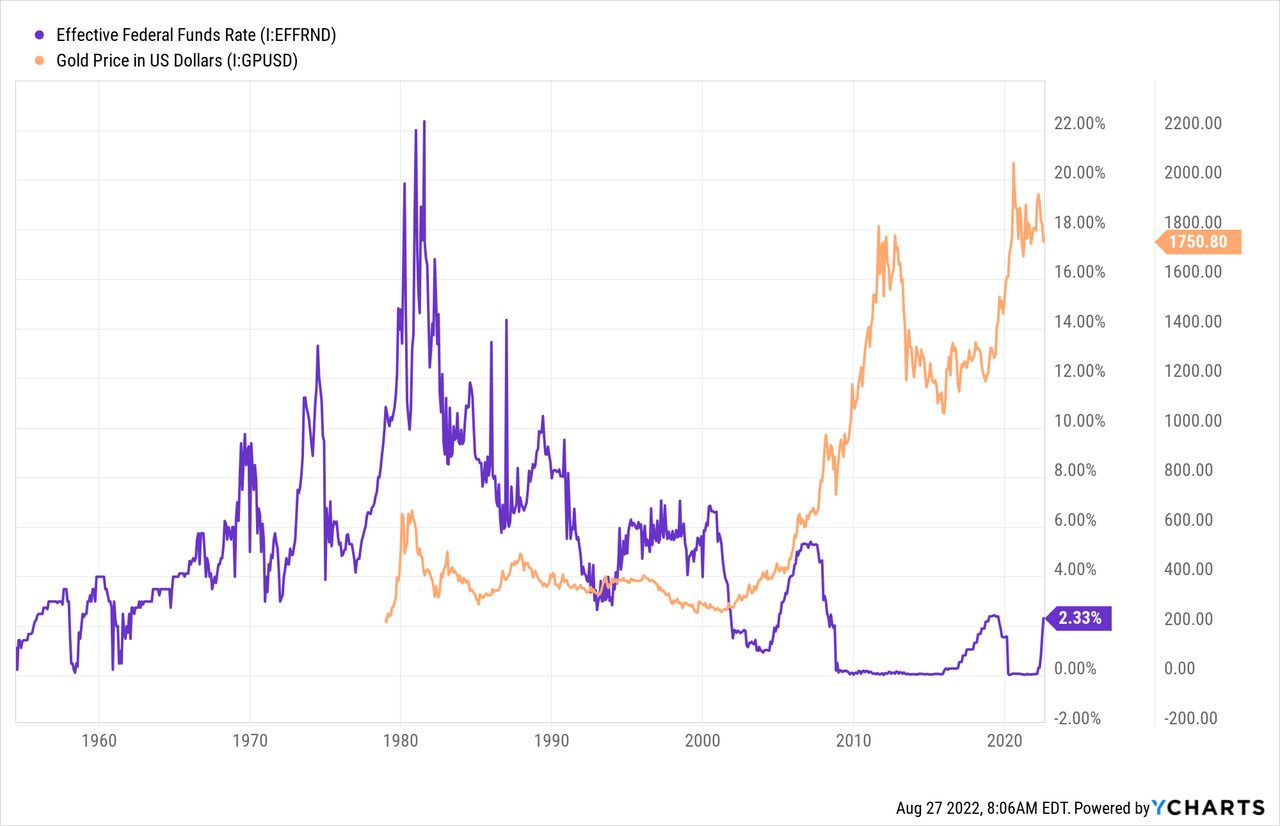

In the short term, it could be bearish for gold. For example, in 2018, the interest rates were rising. This prevented the gold prices from rising. However, when the Fed stopped tightening the monetary policies, the gold prices started surging.

At the same time, in previous periods, aggressive actions taken by the Fed did not always make the gold prices plunge. The most obvious example was the Great Stagflation period in the 1970s. The gold prices hovered at all-time highs and so did the federal funds rate. But it was long time ago. Many more people remember the 2000 – 2008 period when the rates kept rising, which did not prevent the yellow metal prices from increasing as well.

But let us assume that this time, the further tightening by the Fed will make the gold prices plunge in the short to medium term.

After all, when the Fed became more hawkish due to higher inflation readings this year, the yellow metal got cheaper.

But we also have to bear in mind the Fed’s rate hikes will make the economic situation worse. By this, I mean the GDP would contract further, whilst the unemployment rate would rise substantially. This means the US economy would enter a full-scale recession. Soon after the situation gets critical, the Fed would have to ease the monetary policies, e.g. print more money. This will make the demand for gold rise.

De-dollarization and geopolitical uncertainty

Tensions are escalating around Taiwan and the situation in Ukraine has not ended yet. These events are highly bullish for gold since investors prefer to hedge uncertainty with safe buys like the yellow metal. At the same time, sanctions force countries to change their trading, financial and investing patterns. In other words, numerous sanctions imposed against Russia and growing tensions around Taiwan severely threaten the global logistics chains. But they also make countries, most obviously Russia and China, decrease their reliance on the US dollar. That is because the USD is controlled by the Fed and any payment made in dollars is monitored by the US authorities. Countries that have very complicated relations with the US cannot afford to invest in USDs or assets denominated in dollars. It is highly likely Russia and China will move further away both from USD investments and dollar-denominated transactions.

Since the Bretton-Woods agreement came into force, the USD became the world’s leading currency. This does not just make it a medium of exchange when it comes to international transactions, but also a store of value and an attractive investment currency. But the situation is radically different now, given the geopolitical tensions and sanctions. Many countries might move further away from the dollar and switch to their national currencies so that the US authorities would have no opportunity to control their transactions and assets. But governments cannot store their reserves solely in their national currencies. After all, some national currencies substantially fall in value due to high inflation.

So, nowadays gold is still important for many countries’ reserves, most notably China’s. But right now, its proportion is still limited. Many nations also hold euros and the Chinese yuan but most importantly the US dollar. In order to decrease their reliance on other countries, some governments and central banks could buy even more gold, the world’s oldest currency.

Gold standard

Earlier on, I wrote about Nixon’s gold reform when the USD was untied from gold. This allowed the Fed to print more money to support the economy that entered into recession at the time. Before that many countries also had gold standards, a measure to keep national currencies strong and to keep inflation under control. After all, physical gold is limited, whilst central banks can print as much money as they see appropriate.

This situation changed somewhat in spring 2022 when the central bank of Russia announced it was willing to purchase gold at a fixed price of 5000 rubles (about USD 85) per gram. The decision does not show Russia established a classical gold standard, but there is now a clear linkage of the ruble, the country’s national currency, to the yellow metal. This measure among others helped the government strengthen the ruble, something which many countries need, given the record high inflation readings in many countries. That might mean other nations would follow the example of Russia.

Global indebtedness

As I mentioned earlier on, the world is struggling with inflation. It is partly due to poor logistics after the coronavirus pandemic and also the situation around Ukraine. However, it is also due to infinite money printing by many central banks resulting from very high indebtedness. That is because many governments nowadays spend much more than they earn. Consumers and businesses in developed countries do exactly the same.

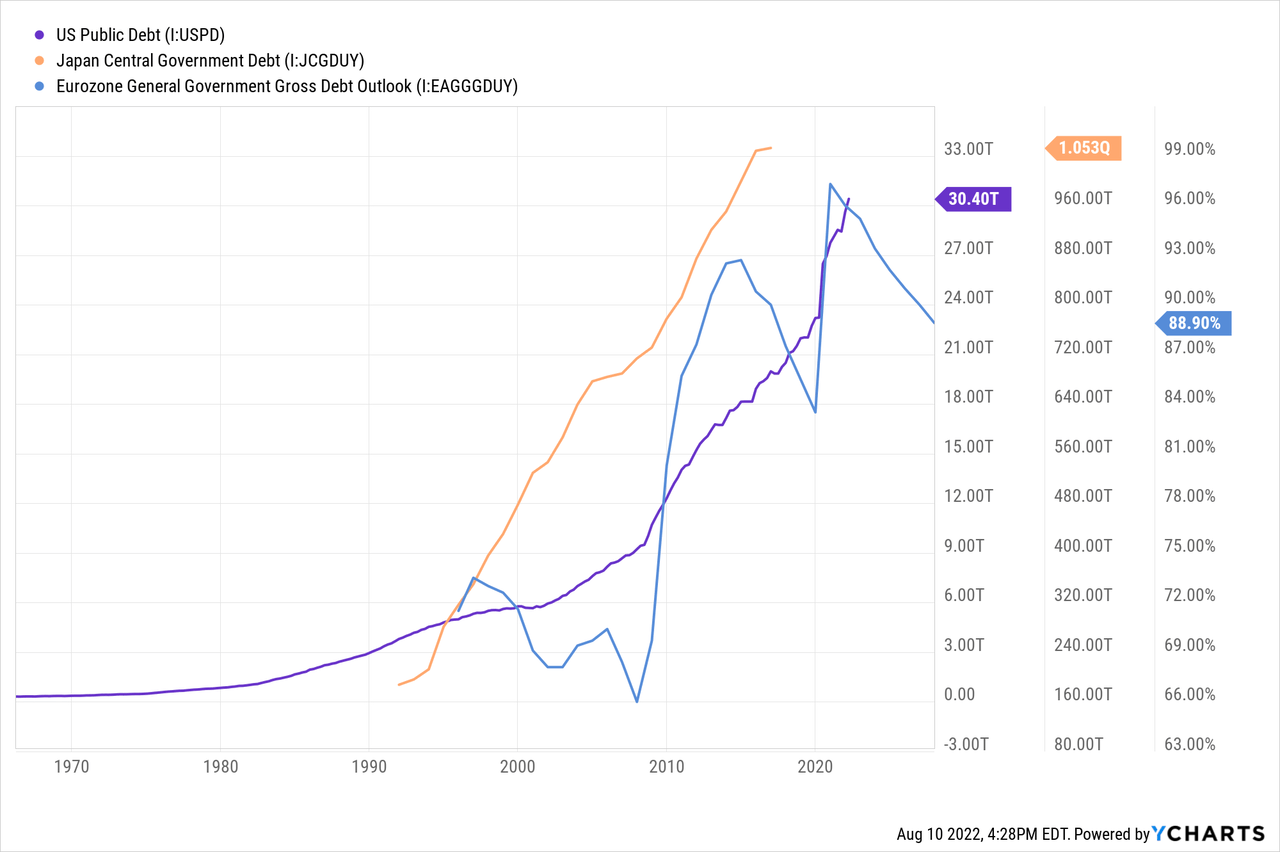

That is why the global debt is rising at a very fast pace. This is particularly true of the US, the Eurozone and Japan. You could see this from the diagram below.

The global debt and the current money supply make the real value of money extremely low. That is particularly true of the USD, the world’s most popular currency. But many investors have not realized this just yet.

Asset allocation is not in favor of gold

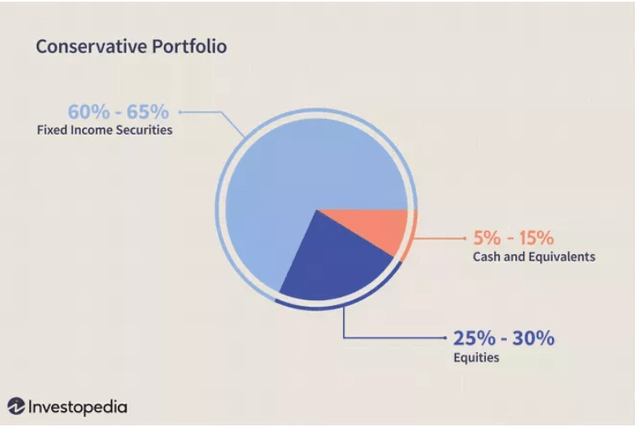

Some research was done by me. As a result, I noticed that it is very rare for various financial institutions, even conservative pension funds, to invest in gold. Portfolio exposure to gold amounts to 2% or even less.

Below is a pie chart representing recommended portfolio allocation of a conservative investor.

It mostly consists of bonds (60%-65%) and also equities (25%-30%). But there is absolutely no place for gold, which is the only currency that survived all the money reforms, all the wars and crises this world experienced.

Undersupply of physical gold

There is a clear undersupply of physical gold too. Just 244000 metric tons of gold have been discovered so far. At the same time, the total amount of paper gold (Exchange Traded Funds (ETF’s), gold contracts, futures, options, etc.) is worth about USD 200-300 trillion, whilst physical gold is worth just USD 11 trillion. In other words, there is much more paper gold than there is physical gold.

Right now, the situation in the markets is under control since many investors are not worried their money is invested in paper, not real metal. But potentially, there could be chaos should investors ask the sellers to supply the real metal. Futures and options foresee such an opportunity, but the buyers usually do not claim any physical delivery. That is, in my opinion, really good for investors who bought physical gold bars or coins.

Conclusion

Gold is highly undervalued, given its lack of popularity among investors, a very modest supply of it and the very fact it has a long track record of being used as a medium of exchange. It serves as a hedge against currency devaluation and geopolitical tensions. There is also a risk that nations might move to one of the forms of gold standards to put money devaluation on pause. The USD would not save countries from inflation and money devaluation. It is clear to me that the market does not see the many bullish factors on the gold market that are clearly present right now.

Be the first to comment