Hispanolistic

Don’t you love how the smartphone wars have shifted to privacy instead of innovation?

It’s no longer about the coolest gadgets or new tools that roll out, but largely becoming a battle about who keeps your data the most secure, and of course, battery life.

These two things, security and battery life, are always going to be at the forefront of updates and new models. Just improvements with one of the two are enough to get you to upgrade your smartphone.

Well, major corporations are in the same boat, specifically on the cybersecurity side. The need to feel secure when using the internet is not going away.

Our company today, A10 Networks, Inc. (NYSE:ATEN), is a leader in cybersecurity technology.

This is a technology that is constantly advancing, requiring updates every few months to maintain an adequate level of security when operating on the internet.

Today, we’ll break down the company’s fundamentals, sentiment and technicals to see if A10 is a buy or sell.

About A10 Networks

The San Jose, California-based company is a leading provider of cybersecurity and infrastructure networking solutions in the Americas, Asia Pacific and EMEA countries. A10 Networks was founded in 2004 and now has wholly owned subsidiaries throughout the world.

Its networking solutions enable next-generation networks focused on reliability, availability, scalability and cybersecurity. They support each of the main types of work environments, cloud, hybrid and in the office.

The company’s customers include leading service providers (cloud, telecommunications, multiple system operators, cable), government organizations and enterprises. A10 Networks generates revenues primarily by sales of hardware appliances with perpetual licenses to their embedded software solutions, as well as licenses to, or subscription services for, software-only versions for their customers.

A10’s customer base has grown to include more than 7,850 customers worldwide.

They use a high-touch sales organization as well as distribution channel partners and fulfill nearly all orders globally through these partners. They believe this gives them the best benefit of channel distribution, while still maintaining face-to-face relationships with end customers.

As of June 30, 2022, 57% of sales were from the Americas, 32% from the Asia Pacific region and 11% from the EMEA region. Their sales are generally confided to a limited number of large customers, including service providers and enterprise customers, in any period. For the three months ending June 30, 2022, their ten largest customers accounted for 49% of total revenues.

Let’s take a look at the fundamentals to see how well that has been doing for the company.

Fundamental Analysis

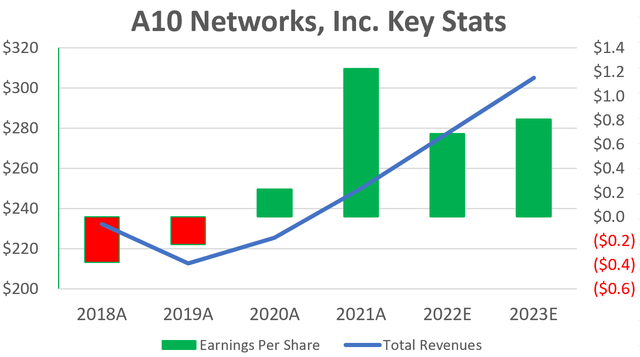

For the fundamental take, we’ll look at two main metrics – top-of-the-line numbers with revenues and bottom-of-the-line numbers with earnings per share.

These two numbers tell us the most about the company without getting into the weeds of their accounting processes.

Below, you can see the revenues represented as the blue line on the chart (prices on the left in millions) and earnings per share as the green and red bars on the chart (prices on the right).

The major trend here sticks out right away – both revenues and earnings per share are improving. The expectations for earnings per share are expected to cool off from a big jump in 2021, but nonetheless, they are following a nice uptrend. Everyone working remotely in 2020 helped lead to a surge in earnings in 2021.

Both segments of sales, the product and services lines, saw increasing revenues for the most recent quarter, but product revenue is a larger portion of sales and growing at a faster pace, rising 20% YoY compared to 6.8% for services.

Next up, we’ll look at a few sentiment indicators to see how investors feel about the stock.

Sentiment Readings

Short interest is a key sentiment reading because it tells us how much leverage investors are willing to take to bet on the stock to decline. Typically, anything under 5% is not meaningful, while more than 20% is a reason to be cautious. A10 is at 5.89%, so this is still not meaningful yet. All companies usually carry some short interest exposure, it’s a trading strategy and a possible hedging position. So isn’t a meaningful level to be worried about.

Three analysts are covering the company on Yahoo Finance. They have the stock rated as a strong buy with an average price target of $20.67. The stock closed on September 6, 2022, at $13.05. That’s 58% in upside potential based on these analysts’ coverage.

The company has beat analyst expectations in each of the last four quarters.

The sentiment for A10 Networks is overwhelmingly bullish, as the analysts covering the stock rate it a buy, and the company continues to outperform against expectations.

Now let’s see how the price action looks for the stock.

Price Patterns

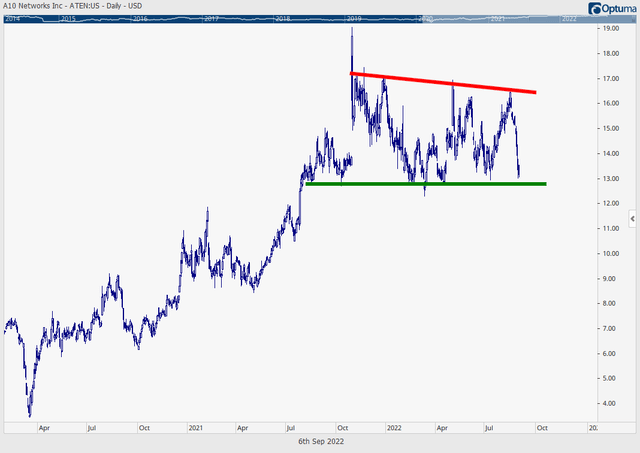

A10 Networks is stuck in a sideways pattern at the moment, with a key resistance in red and major support in green.

The price channel is pretty wide, with the resistance hovering around $16 per share and the support just under $13 per share. With the stock trading near the bottom of this channel, it looks like a great opportunity to add some long exposure, simply based on this price chart. If it closes below that green support line, you will want to exit to avoid any further declines that may be imminent.

Conclusion

The stock has shown a strong recovery in earnings per share, consistency with earnings and has an overwhelmingly bullish sentiment reading. The price chart gave us nothing to be worried about at the moment, with a major support just under where the stock is trading.

Due to these factors, I am putting A10 Networks on my Bank It list today.

I think the stock easily has room to run back up to $16 a share, and if the fundamentals continue to improve like we say in the key stats chart, then this stock could easily climb well past that level.

Be the first to comment