PixelsEffect/E+ via Getty Images

Shares of Selecta Biosciences (NASDAQ:SELB) are trading 85% below 2019 IPO price point of $14. Shares have lost a third of their value so far in 2022.

The stock reappeared on my radar in June after the small company received a $10M milestone payment from partner Sobi as well as extension of license agreement with gene therapy pioneer Sarepta Therapeutics (SRPT) followed by $6M milestone payment.

At $330M market capitalization, current valuation seems cheap as contrasted to the vast potential of the ImmTOR platform and the benefits it could bring to the emerging yet risky field of gene therapy (restore self-tolerance in autoimmune disease and overcome immunogenicity challenges).

With multiple strategic collaborations ongoing and internal gene therapy programs entering the clinic, I think the present is an ideal time to revisit this small company and potential near-term prospects for upside.

Chart

Figure 1: SELB weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see share price top out multiple times at the $5 level and crash to a bottom below $1 earlier this year. From there, shares have rebounded back above $2 and appear to be consolidating at the 50-day moving average. My initial take is that readers with multi-year timeframe would do well to snag a pilot position in the near term and then adopt a “buy the dips” approach during the second half of this year.

Overview

Management’s presentation at Canaccord Genuity Growth Conference was quite helpful in being brought up to speed on this unique small cap platform technology story in the gene therapy space:

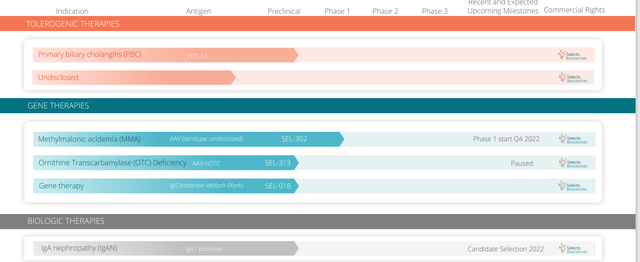

CEO Carsten Brunn describes Selecta as a precision immune tolerance platform company focused on the technology called ImmTOR (nanoparticle encapsulates the immune modulator rapamycin and utilizes antigen specific immune tolerance). It’s agnostic to the antigen and they are focusing on three pillars.

The first is redosing of therapeutic biologics or enzymes with lead program of chronic refractory gout currently in phase 3 study (partnered with Sobi). Study will be done by the end of the year with readout in Q1 2023. 2nd program is an IgA protease, another therapeutic enzyme that is highly immunogenic for the treatment of IgA nephropathy

Figure 2: Pipeline (Source: corporate presentation)

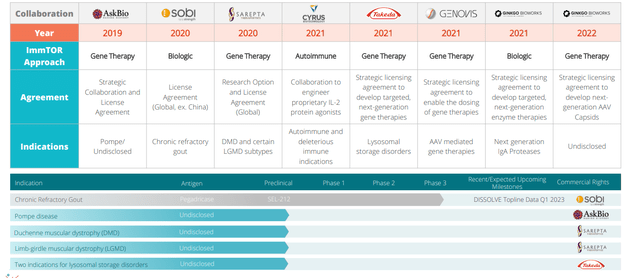

2nd pillar is AAV gene therapy with the idea of enabling redosing but they also have other modalities such as an IgG protease which addresses another key challenge in gene therapy (30%+ of all patients have natural AAV infection and thus are not currently eligible for gene therapy).

Figure 3: Key collaborators (Source: corporate presentation)

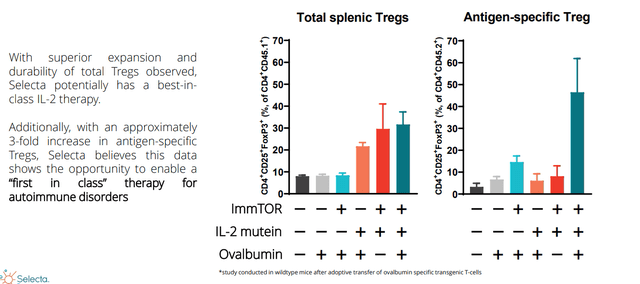

3rd pillar is the one CEO is most excited about and that’s brand new data released at JPMorgan in January this year. They combined their ImmTOR technology with an antigen-specific Treg IL-2 molecule. This represents an evolution of the platform and opens up autoimmune diseases where they have to restore self-tolerance (high hurdle). While the IL-2 field is crowded, they are actually aiming for first-in-class as CEO stresses they are pursuing applications in autoimmune disease and not in cancer as many companies are. It’s all big players in the clinic, such as Merck via Pandion acquisition, Sanofi, Eli Lilly, Roche, Amgen and BMS to name a few. The premise is to expand all pre-existing Tregs that are there in anticipation of a bystander effect. CEO opines that most IL-2 molecules are not that differentiated and all expand pre-existing Tregs. Their approach with ImmTOR induces antigen-specific Tregs but does NOT expand them in order to get the best of both worlds.

Figure 4: Significant expansion of antigen-specific Tregs with a single dose of ImmTOR combined with IL-2 mutein + antigen (Source: corporate presentation)

Thus, they have a better chance of addressing the underlying disease because they induce Tregs specific to the auto-antigen that actually causes the disease (much more targeted approach). Good news is there is encouraging data with just IL-2s alone such as Lilly’s data in atopic dermatitis. However, the limitation is they expand all pre-existing Tregs including the ones you don’t want versus just the antigen-specific ones. Combination could be safer than each of the two molecules alone (ImmTOR + IL-2) as they can use a lower dose of ImmTOR (active ingredient in ImmTOR, rapamycin, inhibits T-effector cells). If they dose too high, they make autoimmune diseases worse so again the combination might be safer as data indicates so far in preclinical.

As for the potential impact for ImmTOR on the field of gene therapy, at the moment it is effectively not possible to redose AAV-based gene therapy and there are safety effects that also arise (and many patients already have existing antibodies to AAV). AAV vectors are non-self replicating (“once and done” is not a reality and efficacy wanes over time). The other challenge is that AAV vectors are highly immunogenic so once a single dose is given, they get very high titers of neutralizing antibodies so a second dose cannot be given. There have been a few unfortunate patient deaths at higher doses in the past few years as well, so much room to improve on safety. They started with hypothesis that they can prevent the formation of neutralizing antibodies by combining ImmTOR with the first dose of gene therapy and they were able to demonstrate this last year. While it is true they don’t know when they will need to redose, the idea here is to give multiple lower dose and titrate up to the right transgene level (versus giving higher dose where safety issues arise). They have shown this is possible in animal models along with synergistic effect, thus making this a very attractive strategy for high dose gene therapy. Endpoints to demonstrate that ImmTOR can prevent formation of neutralizing antibodies that can mitigate effect of the gene therapy and perhaps cause safety issues is very straightforward, namely measuring the NAbs.

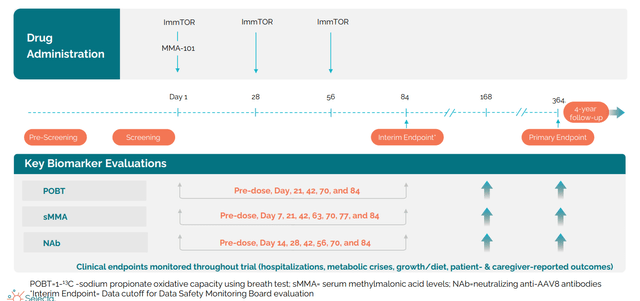

Inclusion criteria for gene therapy studies are titer 1-5 or lower (non-detectable). Zolgensma label has titer of 1-50 or lower eligible to receive a dose. Anywhere 50 to 5 is the zone you want to get to. In the human proof of concept study, they saw that even the empty capsid is very immunogenic and get titers in the thousands (those patients will never be able to be redosed). Titer in the 100s won’t be redosed immediately, but there is a chance those NAb titers go down. They have demonstrated they can event NAbs in the human proof of concept study run at the height of Covid (single dose of AAV8 vector without a payload and looked at two ascending single doses). Endpoint was are they able to prevent formation of neutralizing antibodies. At day 30 at the high dose they had 100% with titer of 1 to 25 or lower and 60% at 1-5 or lower (undetectable). At day 90 titers went up again (not surprising as NHP study shows you have to give monthly doses for 3 months as long as vector is around, after 90 days it is cleared). They are taking this into the clinic in first indication of MMA and are going with 3 monthly doses of ImmTOR.

Figure 5: MMA clinical trial design (Source: corporate presentation)

Planned gene therapy MMA study will start in Q4 and is phase 1/2 at the NIH (total of 6 patients, first cohort adolescents and second cohort in children). This is primarily a safety study but they are looking at biomarkers of the disease (MMA acid). They will measure NAb titers at various points and follow patients at least to 1 year (endpoint at Year 1).

30% to 70% already had a natural AAV infection and are not eligible to be treated with gene therapy and thus have no options at times (limits commercial potential of gene therapy companies). They have an IgG protease from a non-human pathogen that cleaves IgG and creates a window of a couple days where you can give gene therapy. This increases the number of patients eligible for gene therapy and essentially doubles commercial potential.

As for partnerships in gene therapy, they are working with Takeda, Sarepta Therapeutics, AskBio and others. CEO Doug Ingram of Sarepta was the first CEO of a gene therapy company that openly said or admitted that “once and done” doesn’t work (treating DMD kids but likely have to give a second dose). They are all doing work getting ImmTOR into the clinic, partnerships are at various stages. Sarepta has just extended their option period in June, triggered a $2M milestone and a $4M milestone to follow. The FDA agreed for MMA program that 3 monthly doses is the way to go, so regulatory precedent is important. Gene therapy field has had rough going due to patient deaths and safety concerns, many companies are trading below cash.

Finding from NHP study showed that ImmTOR at first dose gets 60% higher expression of the transgene. If this translates into humans, it means you can use safer, lower doses which are also cheaper (one of the bottlenecks in gene therapy being cost of manufacturing, time to get slots, etc).

Gout program partnered with Sobi is their lead asset, phase 3 is technically derisked and is placebo controlled (in chronic refractory gout there is no placebo effect). They are looking serum uric acid (SUA) control at Month 6 which is the regulatory endpoint. They ran two phase 2 studies already so they are not expecting much in the way of surprises. It’s a major financial derisking event for them (paid taxes upfront, so all revenues and royalties are tax-free for them). In summer 2020 they received $100M upfront for the asset and are eligible to receive $630M in milestones (received $15M so far). Double digit mid to high teen royalties or more likely they will monetize this royalty stream to finance other assets including development of IL-2.

Gingko partnership in IgAN is planning candidate selection near term and builds on learnings of the gout program. In IgAN they are trying to debulk of patients of Iga1 immune complex deposits in the kidney (similar mechanistic approach). Attractive commercial opportunity in the US and ex US, high unmet patient need (3 to 4 times higher incidence of the disease in Japan). They have over 400 patients dosed in chronic refractory gout out to 12 months now, so they are building on the learnings there.

CEO is not aware of other companies allowing for redosing of gene therapies. Competitors are focusing on different approaches, such as trying to modify capsids to make them less immunogenic or avoid pre-existing immunity. Selecta is the only such company with human data.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $143M as contrasted to positive net income of $8.6M. Research and development expenses rose to $19.2M, while G&A rose to $6.2M. Collaboration and license revenue nearly doubled to $39.3M driven by reimbursement of costs incurred for the Phase 3 DISSOLVE clinical program under Sobi license and the shipment of manufactured supply under the Sarepta Agreement. Management is guiding for operational runway into mid-2024.

As for institutional investors of note, Biotechnology Value Fund appears to have jettisoned the majority of its position with just 1.5% stake retained. EcoR1 Capital on the other hand, recently acquired a 3.5 million share pilot position the previous quarter.

As for insiders, board member Tim Springer owns nearly 30 million shares. CEO owns over 500,000 shares and several members of management team appear to own 200,000 shares or more.

As for executive lineup and previous experience, it does appear on the light side though CEO Brunn served prior at Bayer as President of Pharmaceuticals for the Americas region. Chief Operating Officer Lloyd Johnson served prior as VP Operations at Alkermes.

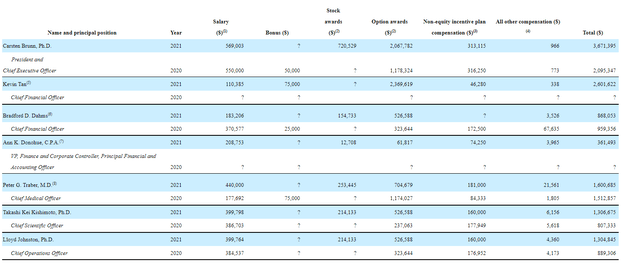

As for executive compensation, cash component for majority of salaries seems more than reasonable (around $500k or significantly less in some cases). Similarly, stock options and awards are on the very light side as well (perhaps a sign management is focused on running the company instead of excessively enriching themselves).

Figure 6: Proxy filing (Source: Proxy filing)

The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

As for strength of IP, patents related to ImmTOR co-administered with pegadricase expire between 2032 and 2041. Similarly, coverage for ImmTOR co-administered with viral vector expires between 2032 and 2042. SEL-212 has a US patent that expired in 2021.

Final Thoughts

To conclude, it would appear there is outsized long term potential here coupled with significant risk given early stage nature of the story. The most attractive element of investment thesis here to my eyes is the potential for ImmTOR platform to open up market opportunities for gene therapy players as a “picks and shovels” play, while also allowing for redosing and utilizing lower dose levels to avoid serious adverse events that have been plaguing the industry of late. On the other hand, I disagree with analysts on the platform being de-risked by SEL-212 data as the prior phase 2b results were far from conclusive (in fact, many considered it to be a failed study). So, I admit there is significant validation via big name partnerships inked such as with Takeda and Sarepta Therapeutics. However, burden of proof is on human data to really bridge the divide and achieve a higher valuation.

For readers who are interested in the story and have done their due diligence, I do not feel comfortable recommending SELB at current valuation. I would like to revisit AFTER the pivotal gout data so that the somewhat binary catalyst is out of the way.

As for risks, I think we could see more partnership discontinuations or at least setbacks (AskBio returned its first drug candidate, I believe). Disappointing pivotal data would weigh on shares, as would additional dilution in 2023 needed to extend operational runway. Competition in spaces being targeted is something to be considered as well, such as gout indication already being sufficiently addressed by Horizon Therapeutics (HZNP) Krystexxa along with other shots on goal in its pipeline to address the more than 9 million sufferers across indications and settings.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. I look forward to your thoughts in the Comments section below. Lastly, be aware that most of my articles appear first to members of the ROTY community.

Be the first to comment