onurdongel

Introduction

Linde (NYSE:LIN) is the largest supplier of industrial gases with annual sales of approximately $31 billion. Linde has its origins since 1879 and was founded by Carl Von Linde and partners. In 2018, Linde acquired the American company Praxair, which first belonged to Linde but was confiscated in 1917 during the First World War.

Other companies supplying industrial gases included L’Air Liquide (OTCPK:AIQUF) (2021 sales: $27 billion) and Air Products and Chemicals (APD) (2021 sales: $11 billion). Linde and L’Air Liquide together provide approximately 50% of the industrial gases market. L’Air Liquide realizes more sales from the EMEA region than Linde in percentage terms.

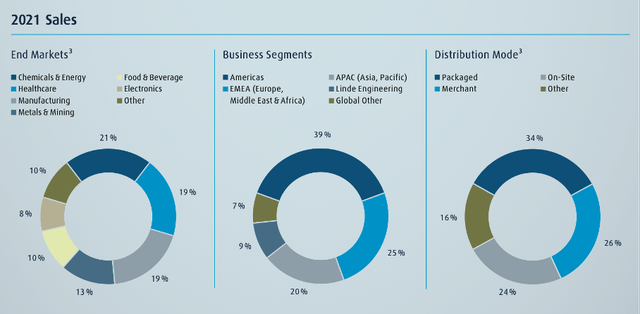

Linde serves various end markets such as Healthcare, Food & Beverage, Electronics, Manufacturing, Chemicals & Energy, and Metals & Mining. Linde supplies industrial gases, but it also designs and develops plants. Both internally and for external customers.

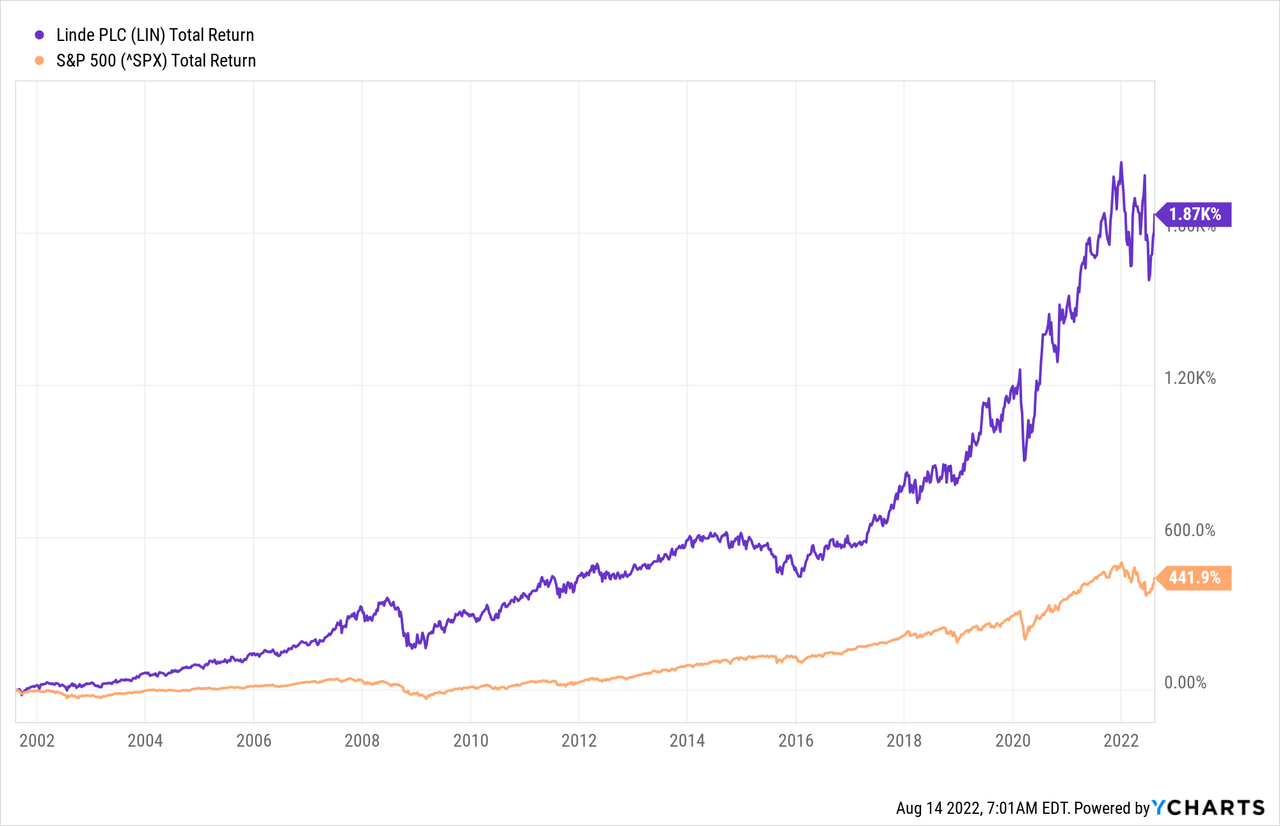

Supplying industrial gases appears to be a solid business, Linde is growing strongly in both revenue and profit. The industrial gases market is expected to grow with a CAGR of 6.1% by 2031 and Linde is benefiting strongly from this secular trend. The strong growth is reflected in the share price. Including the payment of dividends, the total return is 1870% over the past 20 years (16.1% YoY). The total return of the S&P500 is ‘only’ 442% (8.8% YoY) over the same period.

The outlook is promising, management recently raised its full-year guidance to adjusted earnings per share in the range of $11.73 to $11.93, up from +10% to +12%.

Earnings growth is driven by strong prospects in the semiconductor market where demand for industrial gases is increasing. The expansion of blue hydrogen production on the US Gulf Coast should also contribute strongly to profit growth in the coming years.

There are 4 catalysts that drive the stock price up:

- Expanding hydrogen production on the US Gulf Coast will yield twice as much hydrogen.

- The CHIPS for America Act & FABS Act drive massive expansion in semiconductor manufacturing. Linde will benefit greatly as it supplies industrial gases to reputable customers in this industry.

- Long-term on-site contracts consist of inflation-adjusted price escalations and minimum volume agreements.

- Share repurchases and dividend increases push the share price up.

However, the stock’s valuation is slightly higher than its 10-year average, but in line with competitors. Because the stock has 4 strong growth catalysts and the stock’s valuation is in line with competitors, I’m giving the stock a “strong buy” rating.

Linde Overview

Linde Plc is a fast-growing company that has seen strong growth in sales and profits in recent years, both organically and through acquisitions. Linde offers industrial gases such as atmospheric gases (oxygen, nitrogen, argon, noble gases) and process gases (carbon dioxide, helium, hydrogen, electronic gases, specialty gases, acetylene).

Sales of industrial gases are divided into packaged gases (cylinder gases), merchant gases (bulk gases) and on-site gases. Linde also designs and develops technical equipment for air separation and other industrial gas applications manufactured specifically for end customers (approximately 9% of sales in 2Q 2022). Linde supplies industrial gases to various end markets, such as the chemical and energy industry, healthcare, and manufacturing. The various end markets ensure a good spread and little turnover volatility during recessions.

Linde’s Sales: End Markets, Business Segments, Distribution Mode (2021 Annual Report)

Small volumes of gases are supplied as packaged gases (cylinder gases). Merchant gases (bulk gases) are transported from the production locations to their own cylinder filling locations. These locations fill the cylinders with the necessary gases. Cylinder gases are transported to customers or customers pick them up at a packaging facility or retail store.

Medium volumes of gases are delivered from tank trucks to storage containers at the customer’s site. The duration of the contract is usually 3 to 7 years and based on customer requirements. No agreements are made about minimum volume agreements.

Customers requiring a large volume of gases are supplied with gas on-site. Air separation installations are being developed near the customer that supply the gas directly to the customer by pipeline.

The on-site supply contracts are requirement contracts with a duration of 10-20 years. These contracts contain minimum volume agreements and price escalation provisions. Linde is responsible for the design, construction, operation, and maintenance of the plants. The long-term contracts in combination with price escalations and minimum volume agreements give Linde a predictable view of future sales.

Revenue And Earnings Per Share Up During 2Q 2022

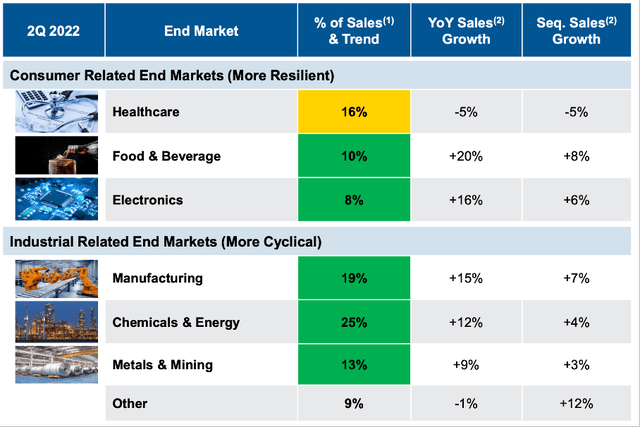

The recent figures for the second quarter of 2022 are neat. High inflation is priced in, and costs are well contained, driving both consolidated revenues and profits up 11.6% and 7.3% year-over-year in the second quarter of 2022. The strong growth in the second quarter of 2022 was mainly due to price escalations and volume growth.

The largest part of the revenue consists of the end market Chemicals & Energy (mostly defensive) and is followed by Manufacturing (usually cyclical) and Healthcare (defensive). More than 67% of revenue comes from contractual fixed payments, such as facility fees and rent, and sales to resilient end markets such as food and beverage, healthcare, and electronics. This provides tremendous downside protection in difficult times, in the event of gas outages or energy volatility.

Linde’s End Markets And Their Resilience (2Q 2022 Investor Presentation)

Organic sales from all end markets increased strongly with the exception of Healthcare. This is due to the decline in COVID-related oxygen volumes after the pandemic. Linde provides essential medical oxygen to COVID-19 patients and has already helped more than 100,000 patients in the US by 2021.

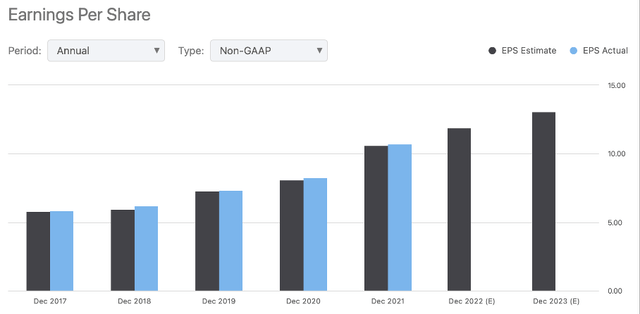

The division into different end markets ensures a stable and predictable flow of revenue and profit. From 2017 to 2021, earnings per share grew at an average annual rate of 16.3%, outperforming analysts’ forecasts.

Linde’s Earnings Per Share (Seeking Alpha)

Linde weathered the pandemic well, earnings per share grew by 12% in 2020. Linde also weathered the 2008 financial crisis well, the financial crisis resulted in a small 5% drop in earnings per share. Through strong contractual agreements and diversification in various end markets, and through good price agreements and cost control, Linde knows how to maintain profits well.

Great Prospects In The Energy And Electronics End Markets

Despite the economic uncertainties, management is raising the outlook. Management raises full-year outlook to adjusted EPS in the range of $11.73 to $11.93, which is an increase of +10% to +12% from 2021. This figure includes an exchange rate effect of -5% YoY, and assumes no economic growth. The Russian EPS contribution will be removed as of July 1.

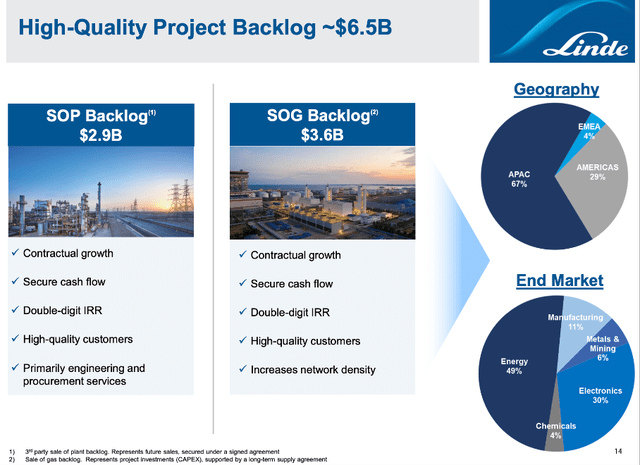

The outlook is good, sale of gases (SOG) backlog is $3.6 billion and sale of projects (SOP) is $2.9 billion. The internal rate of return is double digits, and the backlog of end markets is mainly in 1) Energy (49%) and 2) Electronics (30%).

Linde’s High-Quality Project Backlog (2Q 2022 Investor Relations)

1) The outlook for energy end markets is bright. Linde started a new blue hydrogen production site on the US Gulf Coast in 2021. The expansion of this hydrogen production site is expected to produce 3 billion cubic feet per day from natural gas, double the original amount.

Applications of hydrogen are found mainly in the refining sector, but hydrogen is also needed to produce ammonia. Hydrogen is also used in mobility, such as hydrogen filling stations or small electrolysers. Norled had put into service the first hydrogen-powered ferry in 2021. Linde has been selected to supply Norled hydrogen using a new 24MW electrolyser. The ferry carries both cars and passengers. Clean energy plays a key role in the energy transition. Linde sees opportunities in new environmentally friendly end markets and contributes to a better world.

2) Linde also sees strong growth opportunities in the electronics end markets. About 30% of the backlog consists of gases for the electronics market. Semiconductors are in high demand as more and more cars and trucks are becoming electric and autonomous. The semiconductor market is very attractive due to the large investments made to expand the business. The CHIPS for America Act & FABS Act as well as in Europe increase investment in semiconductor plants to expand beyond Taiwan and China. Linde has a wide range of high-value clients such as Samsung (OTCPK:SSNLF), TSMC (TSM), Intel (INTC), GlobalFoundries (GFS), Micron (MU) et cetera that provide good diversification to reduce risk exposure and drive growth.

Rising Dividends, Share Repurchases, But A Slightly Expensive Valuation

In addition to strong earnings and stable growing underlying end markets, stock valuation is important, especially during rising interest rates.

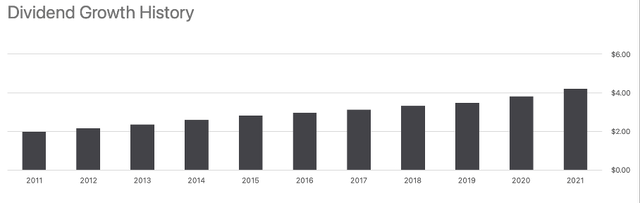

Management is shareholder friendly by repurchasing shares and increasing the dividend annually. Management has increased the dividend by an average of 7.8% per year over the past 10 years. In the second quarter, it repurchased $1.6 billion worth of shares. In total, $2.2 billion was returned to the shareholder by paying dividends and repurchasing shares during this period.

Linde’s Dividend Growth History (Seeking Alpha)

From 2022 to 2024, Linde will execute the share repurchase program with additional authorization up to $10.0 billion. As of June 30, 2022, $7.2 billion will remain authorized under the current program. The buyback yield is then 4.7%.

Linde could continue to repurchase its own shares for years to come, as it creates huge cash flow every year. In 2021, free cash flow was $6.6 billion, of which $2.2 billion was paid for dividends. Share buybacks reduce the share amount and increase earnings per share and dividend per share. It also creates additional demand that could cause the share price to rise.

Let’s talk about the PE ratio. Linde appears to be overvalued with its PE ratio of over 45. Earnings include non-cash charges due to its business in Russia that Linde plans to divest. Without these costs, the figure looks bright. Linde expects earnings per share of $11.73 to $11.93 in 2022, averaging $11.83, making the PE ratio for December 2022 at 26.

Linde’s 10-year average PE ratio is 22, so the stock seems slightly overvalued. But the company is growing steadily and analysts expect earnings per share to grow in the coming years. At the end of 2023, the stock is valued equally as the 10-year average at the current price.

Competitors L’Air Liquide and Air Products and Chemicals are valued equally as Linde, both have a PE ratio of 26. Gross margin is highest for L’Air Liquide and lowest for Air Products and Chemicals, so there should be opportunities for Linde to be more cost-effective and increase earnings.

Risks

Linde sounds like a rosy company to have in your stock portfolio. However, there are some risks that could indicate a decline in company value and stock price, these are:

- Strong growth in Linde’s non-capital intensive activities could increase turnover volatility during economic uncertainty.

- The sale of Russian activities may be disappointing, and more write-offs will follow.

1) Linde’s activities are divided into non-capital-intensive activities and capital-intensive activities. Non-capital-intensive activities such as packaged gases, merchant gases and Linde Engineering are currently growing very strongly, while capital-intensive on-site activities are growing more slowly. This outlook looks positive as it will lead to a sharp increase in return on capital (2Q 2022 is ROC 20%). However, delivering on-site gases provides a basis for a stable revenue stream because long-term contracts are provided with minimal volume agreements and price escalations. Strong growth in non-capital intensive activities means Linde can expect more volatility in turnover in times of economic uncertainty.

2) Political tensions affected the second quarter 2022 result. Earlier this year, Linde announced it would abandon Russia’s LNG ambitions. The current situation in Russia is untenable given the sanctions and capital restrictions.

In the second quarter of 2022, Linde takes a Russian hit of $993 million because of the write-off of its Russian activities. This impairment is a non-cash charge and the amount depends on the valuation of the Russian ruble. The value of the Russian ruble has increased in recent months, increasing the value of these assets by 25%. Due to political tensions, Linde sells its Russian activities, with the aim of creating economic value in countries with stable politics. The strong volatility of the Russian ruble could lower the valuation of Linde’s Russian business, leading to more write-downs.

Conclusion

Linde is a company I would like to see in my portfolio. It has beaten the S&P 500 with ease. The share’s strong price appreciation is the result of strong management, which has enabled strong growth in revenue and profit, both organically and through acquisitions. Linde has the pricing power to pass on inflation to customers. Its long-term on-site industrial gases contracts run for 10 to 20 years, ensuring stable and predictable sales. The outlook is favorable, strong growth is expected in the semiconductor industry and energy markets. In summary, I have listed the following pros and cons:

Pros:

- Strong growth prospects due to major investments by the CHIPS for America Act & FABS Act and Linde’s high-value customers in the semiconductor market.

- The expansion of the blue hydrogen production site on the US Gulf Coast should contribute strongly to profit growth in the coming years.

- Strong growth in non-capital intensive activities ensures high ROC (2Q 2022 ROC = 20%).

- Inflation protection: price increases and minimum volume agreements for industrial gases on-site.

- Management is shareholder friendly by increasing the dividend annually and executing a generous share buyback program.

- The stock valuation is in line with competitors.

Cons:

- The strong growth of non-capital intensive activities can lead to more volatility in turnover because there are no minimum volume agreements.

- The proceeds from the sale of its Russian activities may be disappointing.

Linde is a company with a good mix of risks and rewards. Linde is able to drive price escalations during highly inflationary environments and see robust volume growth thanks to investments in the semiconductor and energy markets. The stock’s valuation is in line with its competitors, but slightly overvalued compared to the 10-year average. Since the stock has 4 strong growth catalysts, the slightly higher premium is worth owning the stock for the long term.

Be the first to comment