eyjafjallajokull

It’s been a rough year thus far for the Gold Juniors Index (GDXJ), with many developers sliding as much as 60% from their highs attributed to worries about increases to upfront capex, weaker IRR figures (lower metals prices), and a higher cost of capital. Skeena Resources (NYSE:SKE) has not been immune to this selling pressure, also sliding over 60% from its highs. However, I see this as a case of the baby being thrown out with the bathwater. The reason? Eskay Creek is a brownfields project with infrastructure, and its operating costs mean it is a project worth developing even at $1,200/oz gold. Hence, I see the stock as a steal below US$5.30 after a more than 60% share price decline.

Eskay Creek Exploration (Company Website)

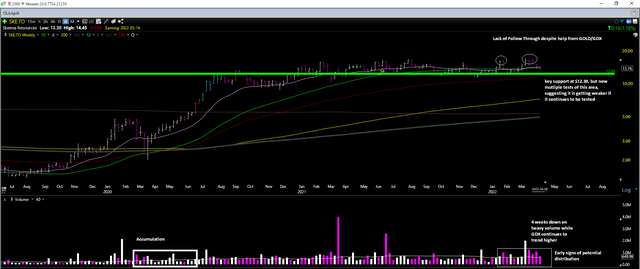

Roughly four months ago, I sent out a note that I would be exiting most of my position in Skeena Resources and sold the last 1/4 of my position in early May. This was because the stock was negatively changing its character, unable to see any follow-through to its breakout despite help from the sector-wide rally. In addition, the volume profile had turned decisively negative. When I bought the stock in May 2020, it was under heavy accumulation, which prompted me to start a new position given its strong fundamentals. As of early April, we had seen four weeks of above-average selling pressure in a row, suggesting early signs of distribution. These points are highlighted in the below chart I shared on April 10th.

Skeena Resources Chart – April 8th, 2022 (TC2000.com)

In total, I exited my position with a more than 90% gain at an average price of US$10.90 after trimming my position earlier at US$12.25, choosing to move onto the sidelines even though I still liked the story. The reason for selling is that the junior miners are very volatile, and there were zero reasons to be long the stock from a technical standpoint if it couldn’t hold this major support level at US$9.50. Since my sale on April 11th, the stock has declined more than 55% in just four months, proof that using stop loss orders and paying attention to technical changes is imperative when trading junior miners.

Some investors might argue that there was zero change in the fundamentals, which is absolutely true. However, when it comes to exploration and development stocks that are very volatile, it’s a major red flag when they stop going up on good news. The reason is that an inability to rally on positive news often suggests that the stock has become crowded, increasing the likelihood that an intermediate-term peak in the share price has been reached. So, while investors must pay attention to new fundamental developments closely, the reaction to the news is typically more important than the news itself.

The good news is that after a 60% decline from its highs, Skeena is trading at its most attractive valuation since Q2 2020. Let’s take a closer look below:

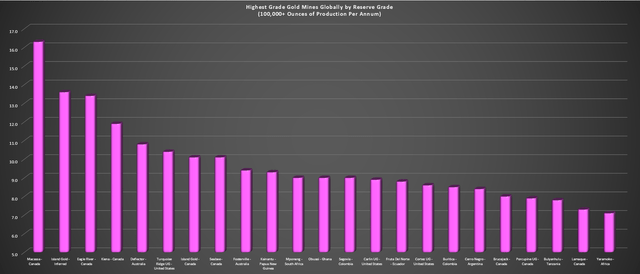

Eskay Creek Project

Skeena is the proud 100% owner of the Eskay Creek Project in British Columbia after acquiring the project from Barrick (GOLD). Notably, this was a past-producing mine with historic production of 3.3 million ounces of gold and 160 million ounces of silver at incredible grades (45 grams per tonne gold, 74 ounces per tonne silver). Unfortunately, the mine was closed in 2008 after a 14-year mine life, and due to the low gold prices, Barrick used extremely high cut-off grades (12-15 grams per tonne gold-equivalent for mill ore), meaning considerable resources were left behind. To put this in perspective, these cut-off grades are in line with some of the highest-grade gold mines as of 2022.

Highest Grade Gold Mines by Reserve Grade (Company Filings, Author’s Chart)

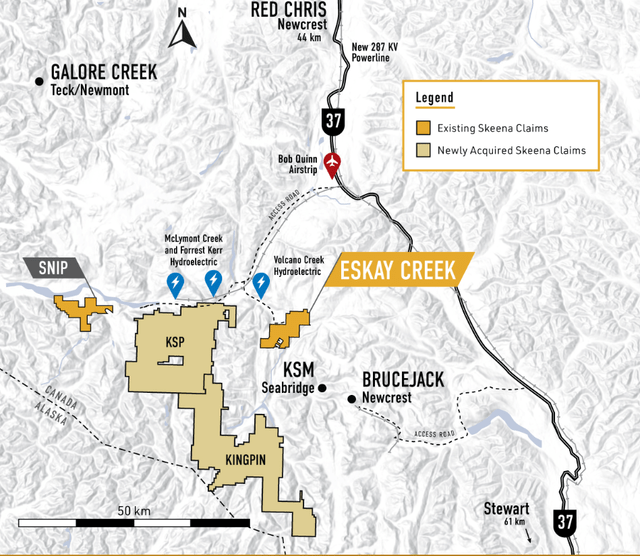

At the time of the acquisition, Skeena’s CEO Walter Coles Jr. was optimistic about the option deal to acquire up to 100% interest in Eskay Creek in the Golden Triangle, noting that multiple properties could generate upwards of 100,000 ounces per year. One major reason for his optimism was that since Barrick closed the site, infrastructure in the region had improved considerably (287-kV Northwest Transmission Line, Volcano Creek Hydroelectric Power Station 7 kilometers from site), and the gold price was much higher. This meant Skeena didn’t need to bank on 15 gram per tonne material to restart Eskay Creek and identify a mineable deposit. Instead, 2.50+ grams per tonne material (gold-equivalent) was likely to suffice.

Due to the high cut-off grades, we know that anything below 12 grams per tonne was left over and, in some cases, it likely was not followed up on through additional exploration.

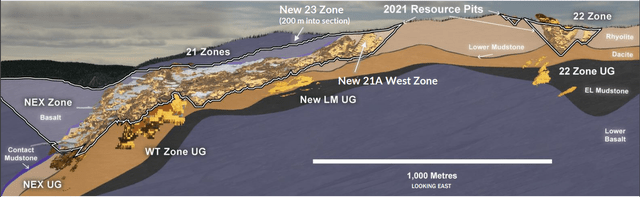

Eskay Creek Project (Company Website)

While Skeena’s CEO was undoubtedly right in his assessment that properties acquired could produce upwards of 100,000 ounces per annum, it would be an understatement to say that exploration success has exceeded expectations. This is because Skeena has identified a resource base of ~5.6 million gold-equivalent ounces, which is entirely separate from Albino Lake (estimated 400,000+ GEOs but under dispute), and its recent 23 Zone discovery. Within this resource base, Skeena has a reserve base of ~3.88 million GEOs at an average grade of 4.57 grams per tonne gold equivalent, which would give Skeena one of the highest-grade open-pit mines globally if this asset were to go into production.

Eskay Creek Resources (Company Presentation)

Given the high-grade nature of this project, the Pre-Feasibility Study for Eskay Creek identified a project capable of producing over 300,000 GEOs per annum at all-in sustaining costs below $550/oz. These costs would be more than 55% below the estimated industry average of $1,230/oz in FY2022, allowing Skeena to command a premium multiple (Tier-1 jurisdiction project, industry-leading margins) if it were to head into production. However, some negative developments have occurred since the Q3 2021 Pre-Feasibility Study [PFS], which are worth discussing.

Recent Developments

For starters, gold and silver prices have slid from their highs, currently sitting at $1,770/oz and $20.00/oz, respectively. At the same time, we’ve seen significant inflationary pressure sector-wide, and multiple capex blowouts have occurred in the construction phase in Canada. Two examples are Argonaut’s (OTCPK:ARNGF) Magino Project and Iamgold’s (IAG) Cote Project, which have seen upfront capex increase more than 70% from initial estimates. Finally, labor costs are up sector-wide, suggesting that operating cost assumptions in studies completed pre-2022 are likely too conservative.

The result of these inflationary pressures and the lower metals prices is that any companies with marginal projects would be better off saving their money and not bothering to update/release Preliminary Economic Assessments and Pre-Feasibility/Feasibility studies. The reason is that they’ll likely have to use lower or flat metal prices than they had hoped to use to showcase project economics, and they’ll have to incorporate higher operating costs and capital expenditures. The result is higher cut-off grades, potentially resulting in a smaller mineable resource, a lower internal rate of return [IRR], and much higher operating costs than previously envisioned.

With higher capex comes higher share dilution to finance these projects, a major negative for companies that have spent the past year diluting shareholders at successively lower levels in many cases. In addition, with a higher cost of capital comes a more difficult time financing these projects. Finally, with higher specialized labor costs (drilling, contractors) comes higher costs for completing these studies or grade-control/exploratory/infill drilling to advance projects. Due to these negative developments, the list of juniors worth owning has shrunk from 30 to 10, and I am shocked that some of them are still above $100 million market caps, given that, in some cases, their resources will never be developed without at least a $2,500/oz gold price.

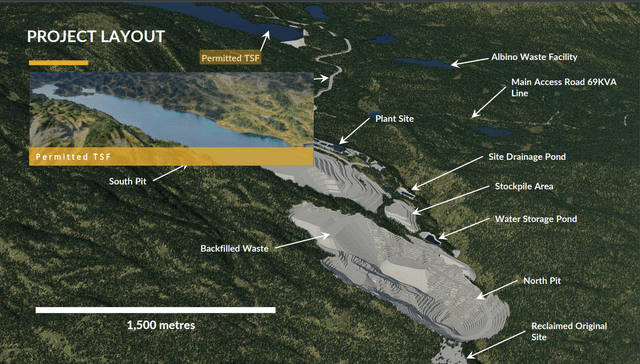

Fortunately, while this impacts most juniors, and it will also impact Skeena, its impact on Skeena is much smaller. For starters, Skeena has a permitted tailings facility (areas where capex blowouts have occurred), and this is a brownfields project, suggesting a low likelihood of a capex blowout. So, while upfront capex might increase from ~$380 million to $470 million, this would still be one of the cheapest projects globally on an annual production profile vs. upfront capex adjusted basis. For comparison, Argonaut’s Magino is going to cost $700+ million to build and will produce less than 160,000 ounces per annum.

Eskay Creek Proposed Project Layout (Company Presentation)

Secondly, while many projects can’t stomach sub $1,500/oz gold prices, Eskay Creek is still wildly profitable at $1,400/oz gold and $20.00/oz silver, suggesting that this isn’t a project that gets mothballed if precious metals prices continue their decline. Finally, while inflationary pressures are a curse to most juniors and several producers are also seeing significant increases in their cost profiles, this is actually a benefit to Skeena indirectly. The reason is that although many majors have strong projects in their pipeline, few have a project that stands up to Eskay Creek from a capex, production, and operating cost standpoint, and certainly not in Tier-1 jurisdictions.

Eskay Creek Mineralization (Company Presentation)

For example, one of Newmont’s (NEM) better projects it’s pursuing is Ahafo North, a ~300,000-ounce producer in Ghana capable of producing at $750/oz costs over the mine life with an upfront capex of $850+ million. Barrick may have a strong development pipeline (Fourmile, Goldrush) and two massive projects in the wings (Reko Diq, Donlin). Still, regarding Tier-1 relatively low-capex projects, each company’s pipeline isn’t as impressive, and Barrick would benefit from tax pools with a Canadian acquisition.

It’s important to note that both companies and several majors are busy leveraging off existing infrastructure in many cases at operating sites to benefit from lower-capex growth (Yanacocha, Pamour, Robertson, Pueblo Viejo). That said, one way for a major to improve margins considerably would be to look at high-margin projects like Eskay Creek with a quick payback.

At a share price of US$12.00 and given the discipline of most majors, there was a low likelihood of companies offering a premium to acquire Skeena and its Eskay Creek Project (plus ownership in Snip). However, after a 55% share price decline, Skeena’s price tag is much more palatable, and this is a deal (if it were to occur) where investors would not hiss at the acquirer for repeating the mistakes of the past cycle (big projects with big premiums at cycle highs – Red Back, Andean, Richfield, Trelawney, Probe, etc.).

To summarize, I am not saying this will occur. One reason is that Newmont, Barrick, and several others are busy with their development projects. That said, Skeena is differentiated from the majority of its peers. This is because while marginal projects have shed their takeover target status and become un-investable on a stand-alone basis, Skeena has become much more attractive. This is due to its brownfields status/extensive infrastructure, and grades that allow it to weather even the ugliest downdrafts in precious metals prices. Let’s take a look at the valuation below:

Valuation

Based on an estimated ~80 million shares on a fully-diluted basis (2023) and a share price of $5.60, Skeena trades at a market cap of ~$448 million. This leaves the stock trading at less than $100/oz of reserves despite an estimated all-in cost to retrieve these ounces of less than $800/oz. Meanwhile, from a P/NAV standpoint, Skeena trades at a valuation of 0.40x even using conservative metals prices of $1,550/oz and $22.00/oz silver. At a $1,700/oz gold price and $24.00/oz silver price, Skeena’s P/NAV multiple comes in at 0.34x.

While a $22.00/oz silver price (10% above spot) might not appear conservative, I believe it to be for when Skeena expects to head into production (post-2024), given that the all-in cost for most silver producers is near $20.00/oz. This means we will see a serious supply problem post-2025 if silver stays at these prices ($18.00/oz to $20.00/oz). Not only will we see some producers stop producing at their less robust assets, but we’ll also see reduced investment as some producers look to cut costs, like what we saw from the sector in 2014/2015. Hence, I have no issue using a long-term silver price of $22.00/oz for assumptions, even if it’s above spot levels.

The issue with using the above P/NAV multiples, though, is that we have to incorporate some inflationary pressures into upfront capex and operating costs. After including cost escalations for upfront capex and operating costs and using more conservative metals price assumptions of $1,625/oz gold and $22.00/oz silver, I believe a more conservative figure for the After-Tax NPV (5%) is $970 million. If we compare this to Skeena’s fully-diluted market cap of ~$448 million, this translates to a P/NAV multiple of 0.46.

At first glance, Skeena might not look cheap when some producers are trading at less than 1.0x P/NAV. However, there are several important points worth noting:

- zero value is ascribed to Albino Lake (under dispute), with the potential to extract 300,000+ GEOs at the cost of less than $200/oz (no mining costs)

- zero value is ascribed to exploration upside on a property that continues to yield phenomenal results

- zero value is ascribed to the new 23 Zone Discovery, which could increase the mine life at Eskay Creek or fill in gaps in the latter years

- zero value is ascribed to its Snip Project (high-grade ounces in British Columbia), where it has a free-carried interest if Hochschild (OTCQX:HCHDF) wants to earn 60% of the project

- zero value is ascribed to any upside in metals prices, and a $1,625/oz gold price assumption is brutally conservative for a mine set to operate between 2025-2035

- zero value is ascribed to new properties acquired recently

Even if we are brutally conservative and assume the Albino Lake dispute isn’t solved (where I’m cautiously optimistic) and the 23 Zone, Snip, and exploration upside are worth a combined $300 million, we arrive at a fair value for Skeena of $1.27 billion. In my view, Skeena should trade at a minimum of 0.65x P/NAV at a bare minimum in the development phase and 1.00x in the construction/fully financed phase, translating to a fair value of US$10.32 (0.65x). Longer-term, assuming a share count of ~110 million shares (equity dilution to build project), Skeena’s fair value jumps to US$11.55. I have assigned $50 million in value to the 23 Zone, $150 million to Snip, and $100 million to exploration upside.

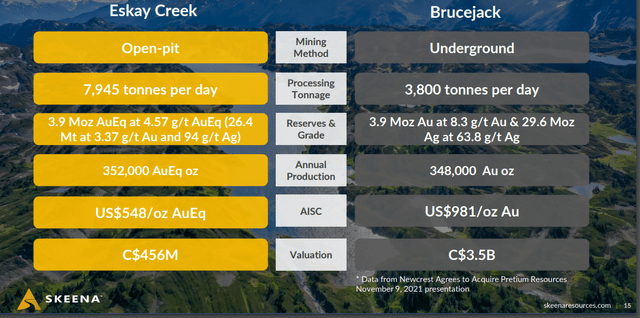

Eskay Creek vs. Brucejack (Newcrest Acquisition) (Company Presentation)

It’s important to note that these are conservative assumptions. However, I prefer to use brutally conservative figures to assess fair value, and if a stock is still cheap after stripping out the upside, I can be comfortable that I’m likely getting an attractive price. However, if we look at real-world examples of value, which Skeena points out, majors are willing to pay much more for producing assets in British Columbia. In fact, Newcrest (OTCPK:NCMGF) just paid ~$2.8 billion to acquire Brucejack, a mine with a similar production profile and resource base but with much higher operating costs.

Under the Newcrest umbrella, the company has big plans for Brucejack (higher throughput, more efficient mining methods/improved productivity), and this resource does not include the new major discovery at Golden Marmot and near-mine upside. Hence, I do not think these are apples-to-apples comparisons. Still, even if Brucejack turns into a 420,000-ounce per annum producer at $775/oz costs and Skeena’s costs increase to $700/oz, these two assets would have a similar AISC margin. Hence, the only major difference is that Brucejack is permitted and in production, and Eskay Creek is not.

Newcrest – Brucejack Mine (Newcrest Presentation)

Based on these differences, I think it’s fair to discount Eskay Creek by 55% vs. Brucejack, given that this asset is not yet fully permitted, not in construction and financed, and is still at least three years from production. However, applying a 55% discount gives us a fair value for Eskay Creek (ex-Snip) of $1.26 billion. After adding $150 million attributable to Snip, this gives us a fair value of $1.41 billion [US$17.60 per share].

Obviously, this is the fair value in a transaction scenario and after a premium. No major in its right mind will offer Skeena a 300% premium, let alone 100%. That said, the Newcrest transaction highlights the value of high-grade Tier-1 jurisdiction assets that can weather downturns in the gold cycle. So, for investors that want to look at the blue sky potential, I wouldn’t rule out an acquisition if Skeena stays at these depressed prices. However, even under my conservative assumptions and after baking in inflationary pressures, I see a fair value of US$10.32, or 84% upside from current levels.

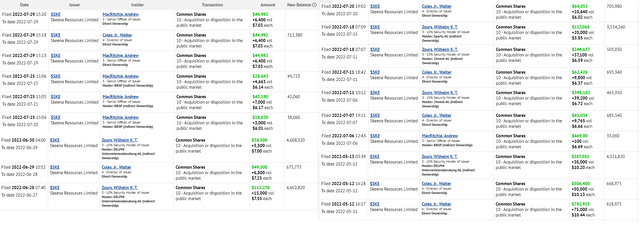

The good news is that insiders are aligned and seem to agree with CEO Walter Coles Jr. and others buying in large blocks over the past few months. This included 125,000 shares purchased by the CEO in the second week of May alone at an average price of US$8.00 per share, with additional follow-on buying of 40,000 shares in July (total value of more than $1.25 million).

Skeena Insider Buying (SEDI Insider Filings)

Summary

Given the inflationary pressures sector-wide increased cost of capital, many juniors have been pummeled, with several down more than 70% from their all-time highs. However, I see Skeena Resources as a case of the baby being thrown out with the bathwater. This is because its grades and brownfield status insulates it somewhat from significant capex increases and metals price declines. So, with the stock trading at barely 0.45x P/NAV despite conservative metals price assumptions and no upside regionally or for Snip, I see the stock as a steal below US$5.30 per share.

Be the first to comment