Paul Butterfield

Running a concentrated portfolio can be something of a double-edged sword. When things go right with even one holding, the upside can be remarkable. But when things don’t go right, a significant amount of pain can be the result. At this moment, I only have eight particular holdings in my portfolio and, thanks to a change in circumstances regarding one particular holding, I have gone from being up materially over the past several months to beating the market only marginally. The specific culprit, in this case, is lifestyle and toy company Funko (NASDAQ:FNKO). After management revised down guidance for the current fiscal year and pointed to inventory concerns, shares of the company plummeted after having previously been up nicely year over year. Although this may turn some investors away, I have decided to increase my exposure to the business further, believing that shares are cheap enough right now to warrant significant upside once inflationary pressures ease.

Not toying around

Much of the time that I have owned shares of Funko, the picture for the company was looking rather positive. Management continued to increase guidance for the company and shares were on the rise. This all changed, unfortunately, after management announced financial results covering the third quarter of the company’s 2022 fiscal year. In response to reduced guidance, shares of the enterprise plunged and are now down 57.6% since I last wrote about the enterprise in August of this year.

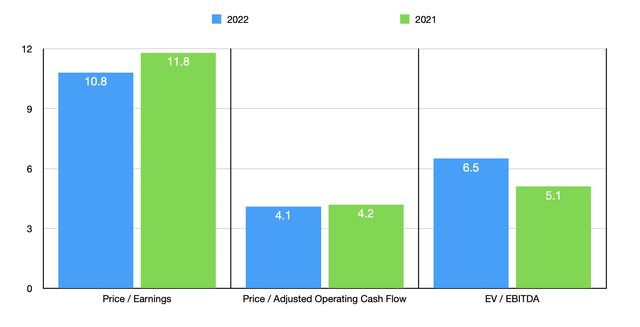

Normally, such a significant decline would require a meaningful decrease in guidance. But what is meaningful is most certainly subjective. For instance, previously, management forecasted revenue for 2022 as a whole of between $1.30 billion and $1.35 billion. That range has now been pushed down to between $1.29 billion and $1.33 billion. In terms of profitability, the picture was a bit more complicated. The prior expected range for adjusted net income for 2022 was $101.8 million to $107.3 million. That number has now been cut by more than half, with the expectation of between $47 million and $49 million for the year. Although not nearly as bad, there was a reduction in expectations when it comes to EBITDA. In guidance that management provided for the second quarter of this year, management had forecasted EBITDA of $193.5 million at the midpoint. Now, the company is forecasting an EBITDA margin in the high single-digit range. If we take this to mean a margin of 9%, then it would translate to profitability for shareholders of $117.9 million.

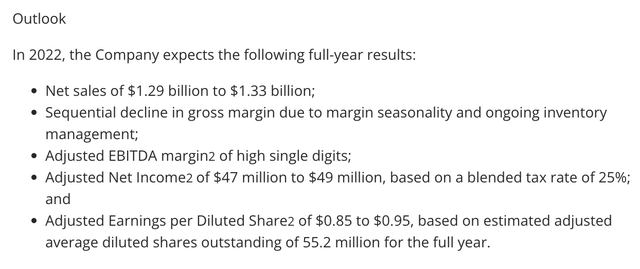

This downward revision came at a time when overall financial results for the company became a bit mixed. For the third quarter of its 2022 fiscal year, for instance, the company reported revenue of $365.6 million. That’s 36.6% higher than the $267.7 million reported the same time last year. Although revenue rose nicely in response to strong demand across most of the company’s product categories, profit figures came in a bit lower. Net income fell from $11.9 million last year to $9.6 million this year. Some of this pain was in response to the company’s gross margin falling from 36% to 35%, driven by an increase in product costs outpacing the price increases management had put in place. Even more painful, though, was the 63.5% increase in selling, general, and administrative expenses that the company experienced. The largest portion of this involved higher personnel and related costs. Increased advertising and marketing expenses, increased facilities costs, a rise in administrative expenses, and other factors, all negatively affected the enterprise. Naturally, other profitability metrics for the company suffered as a result. Operating cash flow went from $7.4 million to negative $34.6 million. But if we adjust for changes in working capital, it would have inched up from $33.1 million to $33.9 million. Unfortunately, though, this was the only positive for the company from a profitability perspective. Even EBITDA for the company worsened year over year, dropping from $40.2 million to $35.7 million.

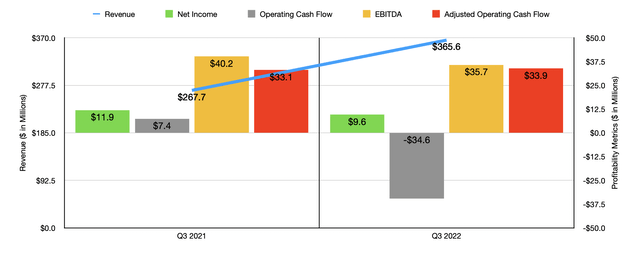

For context, you can also see, in the chart above, the financial data for the first nine months of the company’s 2022 fiscal year relative to the same time last year. These results closely mirror what we experienced in the third quarter alone. During its investor presentation, management stressed the need to manage inventory better. This seems to be something of a painful point for the enterprise. As of the end of the latest quarter, inventories totaled $265.8 million. That’s up from the $140.8 million reported the same time last year. Sales for the final quarter of this year should be around $320.3 million. That’s down from the $336.3 million reported for the final quarter of 2021. What this means is that increased inventories were not in response to the expectation of higher sales.

In response to revising lower the guidance for the current fiscal year, the management team at the company also announced, on December 5th, that they were making some changes to leadership. The CEO of the company Has been replaced by the Chief Creative Officer of the enterprise, and relegated to the role of President. The CFO, meanwhile, resigned immediately and the company is on the lookout for a solid replacement. In addition to engaging a consultant, the company also said that it would create a COO role, with the leader of that yet to be solidified and with said leader having the task of overseeing operational improvements for the firm. No doubt some of this will involve focusing on the excess inventory in the company’s books.

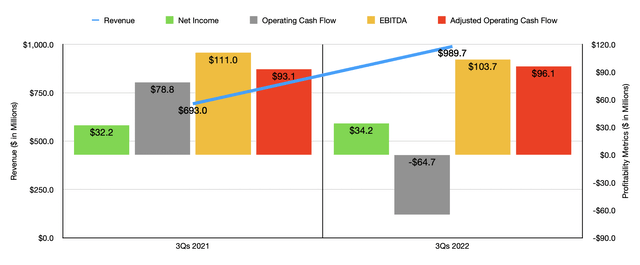

Using estimates regarding the rest of the 2022 fiscal year and assuming that adjusted operating cash flow should total $127.7 million for the year, we can see that shares of the business look rather cheap. On a forward price-to-earnings basis, the company is trading at a multiple of 10.8. That’s down from the 11.8 reading that we get using data from the 2021 fiscal year. The forward price to adjusted operating cash flow multiple should fall from 4.2 to 4.1, while the EV to EBITDA multiple with the company should increase modestly from 5.1 to 6.5. As part of my analysis, I also compared the company to three similar businesses. On a price-to-earnings basis, these companies ranged from a low of 3.6 to a high of 19.4. In this case, two of the three companies were cheaper than Funko. Using the price to operating cash flow approach, the range was from 1.7 to 20.4. And when it comes to the EV to EBITDA approach, the range was from 1.9 to 7.9. In both of these cases, one of the three prospects was cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Funko | 10.8 | 4.1 | 6.5 |

| Mattel (MAT) | 10.0 | 13.0 | 7.9 |

| Hasbro (HAS) | 19.4 | 20.4 | 7.5 |

| JAKKS Pacific (JAKK) | 3.6 | 1.7 | 1.9 |

Takeaway

I have no doubt that the data recently announced by management will cause a bit of pain for the company from a fundamental perspective. In a sense, the firm deserved some sort of pullback in response to the developments. It is also true, however, that shares of the company look incredibly cheap and that growth should continue for the company in the long run. Add these factors together, and I still feel comfortable with the ‘strong buy’ rating I had on its stock.

Be the first to comment