igoriss/iStock via Getty Images

Overview

I believe Krispy Kreme (NASDAQ:DNUT) is undervalued by 33%. I expect DNUT to be successful in implementing its new business model, which involves setting up mini-factories in high-volume locations that supply donuts to smaller locations – which would enable it to increase its market presence in underdeveloped markets.

Kreme also owns Insomnia Cookies, a cookie delivery service that operates primarily on or near college campuses in the United States and is popular among young people. Insomnia Cookies has high EBITDA margins and good unit economics, and it is well-positioned to continue expanding its online presence and reach beyond the collegiate market.

Business description

Having started out as a small donut shop in North Carolina in 1937, Krispy Kreme has expanded to become a global phenomenon with locations all across the United States, Canada, and other countries.

New growth strategy should profit margins as DNUT grows in underdeveloped markets

Using the Hub and Spoke [H&S] strategy, DNUT can expand into new areas while maintaining a presence in existing ones thanks to the company’s well-known brand. While DNUT enjoys widespread name recognition, the company has a weak foothold in several major American cities like New York and Chicago and has failed to establish a big presence in other major cities like Boston and Minneapolis due to ineffective management (I believe). This, in my opinion, provides DNUT with a great deal of room for growth within existing markets.

To give a brief context on the new business model: The majority of their existing Hot Light Theatre [HLT] facilities in the United States and Canada have been reacquired and are still being operated by the company as part of their transition to a new H&S business model. In this setup, DNUT’s HLT would employ their high-volume doughnut machines to effectively run mini-factories, cranking out doughnuts that would then be distributed daily to DFD (Delivered Fresh Daily) Cabinets and FSD (Fresh Shop) locations.

- DNUT Freestanding DFD Cabinets are owned by DNUT, while the merchandise is paid for by the grocery shops and other end-channel retailers. Because the merchant takes on the risk of stock-outs, this tactic is both savvy and economical.

- To a certain extent, Fresh shops are like Dunkin’ Donuts in that they receive a morning delivery of baked goods, but they also have specialized equipment.

In the United States and Canada markets, I expect DNUT will enhance the number of points of access [POA] by favoring the DFD cabinet format over that of Fresh Shops. In my opinion, this H&S approach will allow DNUT outlets to make more doughnuts for the same amount of money as they would if they used a smaller donut machine. At full scale, I expect each US/CAN DNUT hub with spokes to support in the high-double digits of these DFD Cabinets, making them competitive with their equivalents in the EMEA region.

Importantly, the expense of this technique is likely the reason why its profit economics are so much better than those of the traditional franchise model. The company claims that the initial investment for each cabinet is only $5,000 (3Q21 earnings call), and that’s before considering things like trucks and people for daily delivery. As a whole, this tactic is most easily interpreted as a means of increasing revenue from already-in-place legacy systems.

Growth of Insomnia Cookies

Many people, in my opinion, fail to see the true worth of Insomnia Cookies or, worse, entirely ignore them.

I believe that DNUT will keep expanding the platform by capitalizing on its popularity among young people and into new areas. In addition, I believe Insomnia could leverage its own supply chain to continue expanding its omnichannel network, taking the brand beyond the collegiate market and into other big urban communities. Since e-commerce already makes up a sizable chunk of Insomnia’s sales, I believe this is feasible, as it indicates that Insomnia is doing something well that is gaining traction.

To put it plainly, Insomnia Cookies is a cookie delivery service that predominantly operates on or around college campuses in the United States, delivering freshly-baked cookies for low order values ($2–$3). There are just one or two people working in each shop, and usually just a few ovens. Since this is the case, the price tag for such spots is really reasonable (helps with ROI and profit margins). The product is widely sought after by college students and is commonly ordered online for delivery (as mentioned earlier, most volumes are through digital orders).

With its high EBITDA margins and good unit economics, I view Insomnia Cookies to be a very high-quality asset for DNUT. While there are over 5,000 universities in the United States, there are only 227 Insomnia Cookies stores as of 3Q22. Additionally, the majority of the 227 outlets are located in just a few educational institutions. Therefore, I think there’s a lot of room for development still to come.

In addition, DNUT’s brand is crucial to the company’s success. As of LTM3Q22, the brand contributed 12% of the company’s sales. Given its size and recent success, this segment of DNUT’s business deserves far more attention than what it is receiving today.

Tapping on the e-commerce trend

As a result of rising customer demand for digitally-enabled conveniences and the proliferation of digitally-enabled value propositions, I expect that e-commerce will emerge as a key factor in DNUT expansion. The major reason I say this is because DNUT can create a more personal connection with its customers through a branded e-commerce engagement and offer them a seamless and convenient shopping and delivery experience, whether they choose to “click and collect” from a store or have their purchases shipped directly to their homes.

Convenience is becoming increasingly important to consumers, and DNUT must adapt by providing a highly tailored digital platform. In addition, e-commerce paves the way for and facilitates numerous events, which expands opportunities to interact with customers and broadens their base. Services such as catering, gift-giving, and workplace delivery are available. The company could also leverage pre-existing distribution networks, such as those of DoorDash (DASH) and Uber Eats (UBER), to expand its customer base.

The overarching objective of both e-commerce and the delivery channels is to maximize the effectiveness of the current doughnut shop network. I believe DNUT will be able to use this expanded channel to boost the lifetime value of its consumers and attract new ones by capitalizing on the wealth of information collected from its current patrons.

Forecast

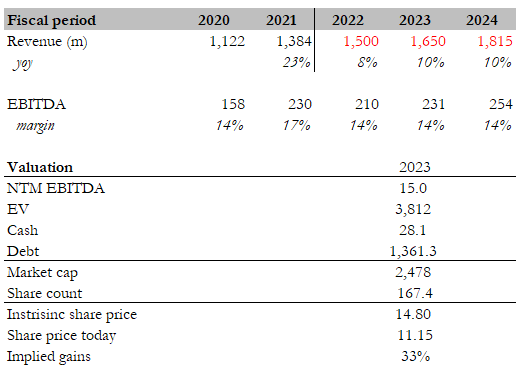

According to my investment thesis, DNUT should be able to continue growing as they develop new locations in underpenetrated or underrepresented markets. However, I anticipate a slowdown in growth in 2023 as a result of the recession. DNUT should return to historical margins (pre-covid), but I wouldn’t be surprised if margins expanded further due to a greater mix of higher margin business.

DNUT is currently trading at 13x forward EBITDA, which is near the lowest it has ever traded. There is a chance that we could see a mean reversion when DNUT continues to grow as planned and investors are not worried about near-term growth anymore. I believe DNUT will trade at 15x forward EBITDA (its average).

Author’s estimates

Key risks

Health-conscious trend

There are more health-conscious consumers today than ever before, and I believe this trend will continue in the future. This would mean lesser intake of sugar, and indirectly donuts – which is a key offering of DNUT. If this health-conscious trend becomes a larger-than-expected problem, DNUT will undoubtedly be impacted.

Building a new presence in under-penetrated markets may not be successful.

A core part of my thesis is that DNUT can develop a presence in key US cities. This may not be as simple as it appears because there are already incumbents in the market that consumers are aware of.

Conclusion

I believe DNUT is undervalued by 33%. I think DNUT will be able to expand into less established countries by adopting its new business strategy, which entails establishing mini-factories in high-volume sites that provide donuts to smaller shops.

Kreme also owns the wildly renowned cookie delivery service Insomnia Cookies, which focuses its operations mostly on or around college campuses in the United States. Insomnia Cookies is in a strong position to continue growing its online presence and expanding beyond the collegiate market thanks to its high EBITDA margins and favorable unit economics.

Be the first to comment