selensergen/iStock via Getty Images

The currency market proved its extreme sensitivity to rate movements when it swiftly bought Japanese yen in response to a surprise widening of the Bank of Japan’s carefully curated interest rate band. In its December statement on monetary policy, the Bank of Japan (BoJ) widened this band ever so slightly “to improve market functioning” while at the same time emphasizing that it remains fully committed to continuing accommodative monetary policies. While the change from “between around +/- 0.25 percentage points to between around +/- 0.5 percentage points” is microscopic, current private sector holders of Japanese bonds understandably want to exit as soon as possible. Rates now should only go up from here. Traders still shorting the yen to do carry trades also need to close up shop. Looming over this flurry of activity is the memory of the Fed starting its historic rate hike cycle with a mere 0.25 percentage point increase. While the markets brace for monetary tightening, the Bank of Japan is not projecting more tightening to come. Indeed, Japan’s central bank is saying quite the opposite as its words read as dovish as ever.

For example, the Bank of Japan “will support financing, mainly of firms, and maintain stability in financial markets, and will not hesitate to take additional easing measures if necessary” (emphasis mine). The BoJ “will continue with Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control, aiming to achieve the price stability target of 2 percent, as long as it is necessary for maintaining that target in a stable manner. It will continue expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds 2 percent and stays above the target in a stable manner” (emphasis mine). Perhaps most importantly, the BoJ “also expects short- and long-term policy interest rates to remain at their present or lower levels” (emphasis mine). In other words, the BoJ is not fighting inflation and is not signaling the launch of a cycle of monetary tightening or even normalization.

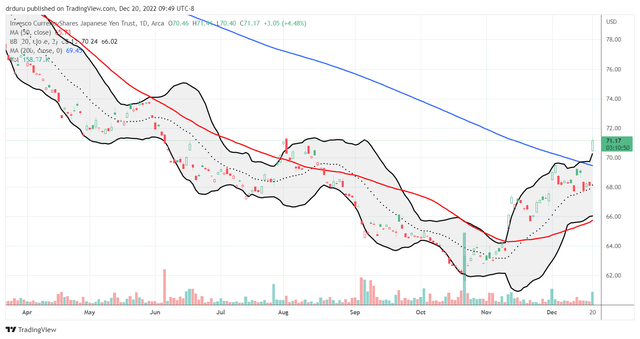

Likely anticipating the pressure to come on interest rates from market reactions, the BoJ plans another increase in its purchases of Japanese government bonds from 7.3 trillion yen per month to 9 trillion yen per month. As of the time of writing, the market is entirely focused on the hawkish actions instead of the dovish words. Accordingly, the Invesco CurrencyShares Japanese Yen Trust (FXY) broke out above its 200-day moving average (DMA) and gained 4.5%. This breakout above an important long-term trend line is bullish for the yen.

The Invesco CurrencyShares Japanese Yen Trust (FXY) printed a bullish 200DMA breakout in response to the BoJ’s policy change. (TradingView.com)

The Trade

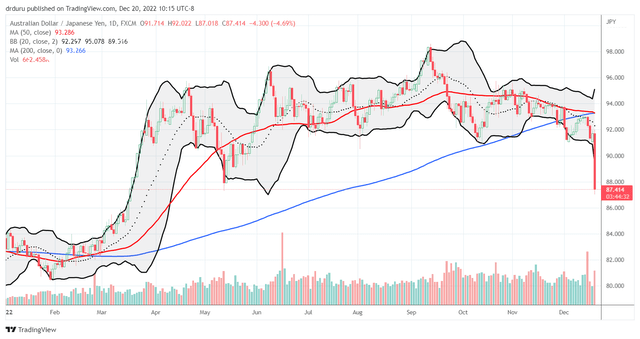

Early last month, I worried that the BoJ was wasting money intervening in the currency market to prop up the value of the yen. Now, that move looks brilliant. The bottom for the Japanese yen looks confirmed just below the yen’s bottom in 1998 in the wake of the Asian economic crisis at the time and the collapse of Long-Term Capital Management. However, while the market’s response is bullish for the yen, it is likely bearish for stock markets. To the extent the yen was used as a funding currency for speculative trades, those trades will get closed down by buying yen and selling stocks. I like to follow the Australian dollar versus the Japanese yen (AUD/JPY) as an indicator of risk sentiment. AUD/JPY signaled fresh trouble last week. Now, the currency pair is flashing a 4-alarm fire.

AUD/JPY plunged 4.6% and now trades at a 9-month low. The March breakout is almost over. (TradingView.com)

These currency moves are extreme, so I assume the odds are high for some sort of clawback in the coming days or even weeks. Yet, the yen bullish catalysts that began for me in late September remain in place, so I am in buy the dip mode on the yen. I took profits on my FXY position after it failed to break through 200DMA resistance earlier this month, so I need some FXY relief to reload. The extreme nature of the yen’s move motivated me to take profits on other yen currency pair longs. I even flipped contrarian for a short-term long in AUD/JPY.

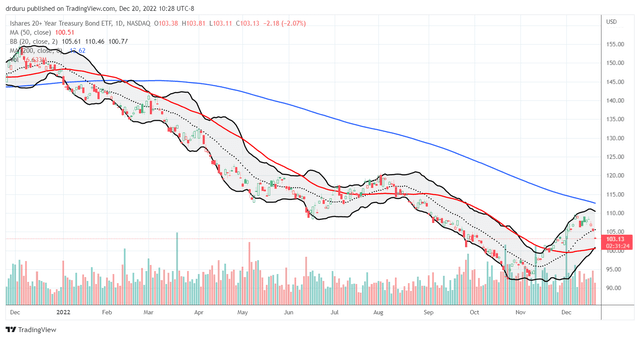

Finally, the Bank of Japan’s move created collateral carnage in the U.S. bond market. The whiff of tightening from the BoJ caused the U.S. bond market to continue taking the Fed’s hawkishness more seriously, at least for the day. The 12 basis point jump in the 10-year U.S. Treasury caused all the expected selling in rate-sensitive stocks. The iShares 20+ Year Treasury Bond ETF (TLT) dropped an outsized 2.1% and left the 200DMA downtrend well intact.

The rally in long-term bonds looks like it is over for now. (TradingView.com)

Be careful out there!

Be the first to comment