Emirhan Karamuk/iStock Editorial via Getty Images

Introduction

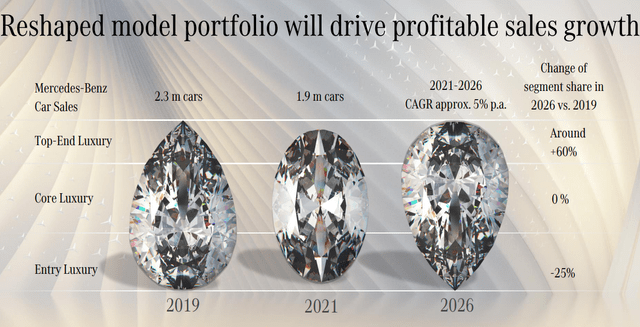

When we look at Mercedes-Benz (OTCPK:MBGAF, OTCPK:MBGYY), we have to start from one important fact. The company chose before the pandemic to switch its business model from being volume oriented to becoming margin focused. This is why in my previous articles on the company, I always started by showing this slide that explains how Mercedes-Benz is reshaping its portfolio, expecting decreasing overall volumes, but increasing core luxury and top-end luxury sales.

Mercedes-Benz 2022 The Economics of Desire Presentation

Why is Mercedes-Benz undertaking this strategy? The answer is easy to understand: the company aims at a return on sales and at higher margins that are more suitable for a luxury car manufacturer.

In my previous articles, I shared why this strategy caught my attention as it is more resilient to inflationary pressure, and can make the company face the current economic environment where volumes are decreasing with a strength that will lead to countertrend results compared to some of its peers.

Q3 Results

I must say that, even though I expected a good quarter, the results Mercedes-Benz released exceeded my expectations.

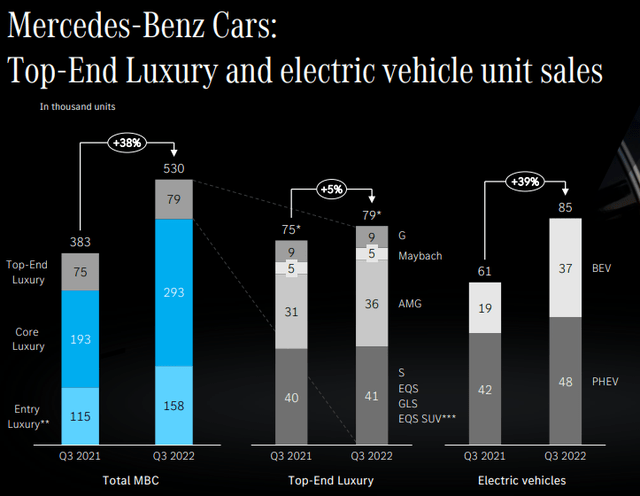

Car sales

In fact, unit sales of Mercedes-Benz cars reached 530,400 vehicles, 38% above Q3 of the prior year. This means that it is the strongest quarter in 2022, even though, as the company pointed out, production and sales continue to be affected by semiconductor bottlenecks and interrupted supply chains. The main market is still China, where unit sales rose to 222,600 (vs. 132,600 in Q3 2021). This means that China accounts for almost 42% of total sales. Germany was strong, too, with 48,400 vehicles sold (vs. 45,100 in Q3 2021). In Europe, the total number of vehicles sold was 146,100, which is a 21.6% increase vs. Q3 2021 when the company sold 120,100 cars.

A very strong result was achieved on the United States, where unit sales of Mercedes-Benz cars rose by 62% to 74,900 vehicles (vs. 46,200 in Q3 2021).

Van sales

Mercedes-Benz Vans performed much above the prior-year level in third quarter of 2022. In fact, in this quarter it sold of 104,000 vehicles, an 18% increase compared to the 88,000 vans sold in Q3 2021.

If we breakdown the results by geography we see that 63,500 units were sold in Europe (vs. 51,700 in Q3 2021). In Germany, 28,300 vehicles were sold, 28% more compared to the prior-year quarter.

In the U.S., however, there was a slight volume decrease from 16,100 last year to 15,500 units sold in the past quarter. It is not a major downturn and the company explains it as a consequence of some of the supply chain constraints that are still happening.

Interestingly, China performed well despite Covid-related lockdowns. In fact, unit sales reached 11,700 vehicles (vs. 7,500 in Q3 2021).

Financials

Let’s translate these volumes into financial results.

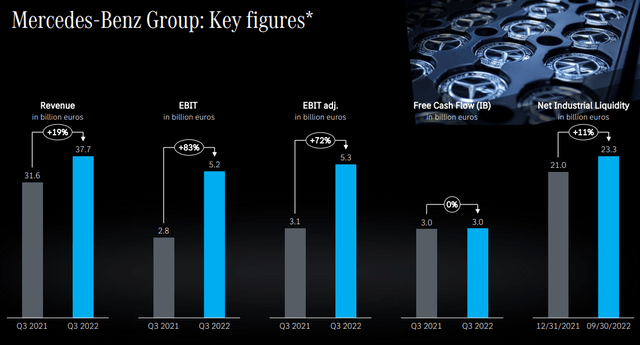

Mercedes reported a total revenue of €37.7 billion for the quarter, a 19.3% increase versus Q3 2021’s revenue of €31.6 billion.

EBIT was impressive. While last year it amounted to €2.8 billion, this year it reached €5.2 billion, an 85.7% increase. Accordingly, net profit was quite high at €4.0 billion in third quarter 35% above Q3 2021.

Mercedes-Benz Equity Roadshow Presentation Q3 2022

We see everything said above in the EPS which went up from €2.31 to €3.66 (+58% YoY).

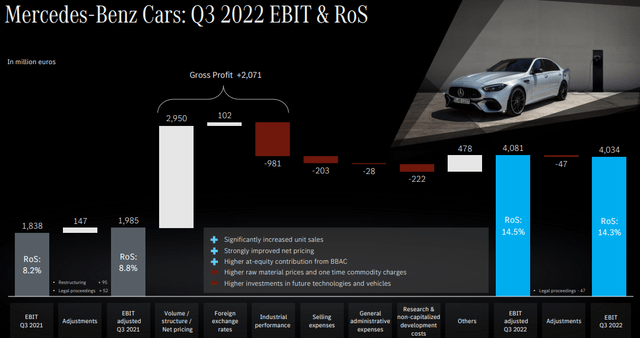

The key to understand these results is to be found in the new business model Mercedes is adopting. While it is slowly exiting lower margin segments, it is focusing on increasing volumes in the top-end category, addressing wealthier customers and benefitting from better pricing power. The result is that the return on sales is increasing at a fast pace, as shown in the waterfall-chart shown below.

Mercedes-Benz Equity Roadshow Presentation Q3 2022

We see that RoS spiked up from 8.8% to 14.3% thanks to one main factor: volume mix and pricing. It means that Mercedes was able swing its volume mix from entry luxury to the upper segments. This is confirmed by this other graph that reported Mercedes’ sales, where we see that core luxury grew by 51.8%, becoming a real driver of better profits.

Mercedes-Benz Equity Roadshow Presentation Q3 2022

Valuation

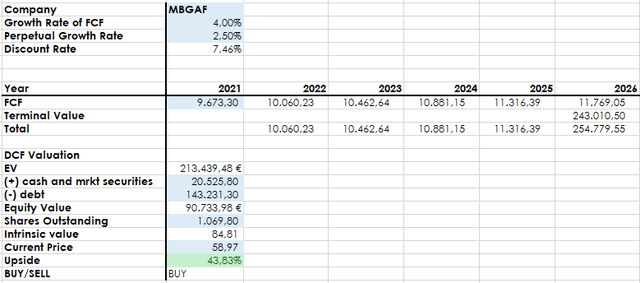

Looking at these results, I decided to reduce my discount rate by 50bps compared to the last discounted cash flow model I shared in my previous article. This is because, even though interest rates are rising, I believe Mercedes Benz is proving more and more that it is executing well its business plan and it is managing to really shift its sales by addressing wealthier customers. This will make the company stand out in the automaker industry and, especially, it should lead the company to better results compared to some of its peers.

The result is that the upside is better now than three months ago, with a target price revised upwards to $85 which is equal to a 44% upside. I rate the stock as a buy and I will initiate my position in the next few days.

True, the economic environment doesn’t seem promising for 2023, but I think that the more Mercedes-Benz presents itself as addressing high-net-worth individuals, the more it will be insulated from a recession. Of course, the Van division may suffer since it is more linked to the productive cycle, but luxurious items (and cars) always have demand for them.

Be the first to comment