travelpixpro

I can resist anything except temptation.“― Oscar Wilde

We put out of first article around COMPASS Pathways (NASDAQ:CMPS) in early March of this year. We concluded that piece around this small developmental company from across the pond with no investment recommendation but note that “it might be advisable to revisit this name in the future as the company moves development forward and the market stabilizes overall.”

It has been seven and a half months since our initial take on COMPASS and the stock saw a flurry of buy reiterations from analyst firms last week. Therefore, even as the overall market continues to be volatile, we circle back on COMPASS below.

Company Overview:

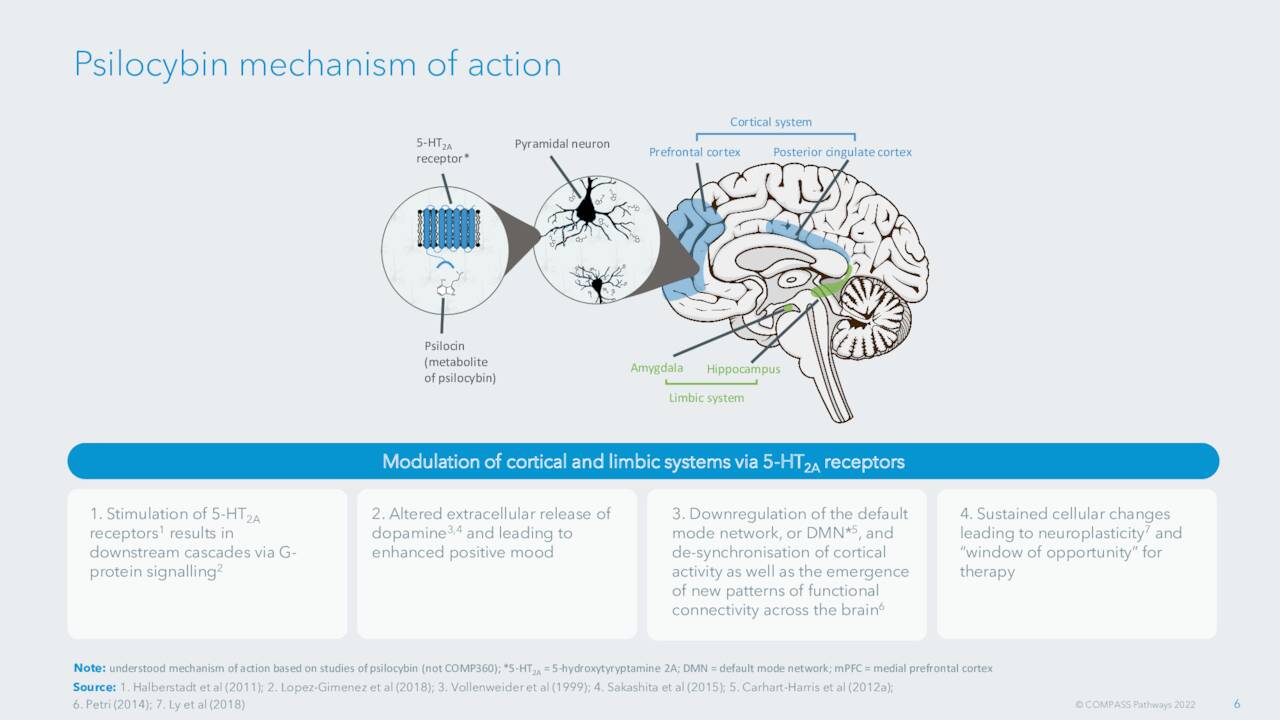

London based COMPASS Pathways is a small cap developmental firm whose key asset is a compound named COMP360. This is psilocybin therapy that has is about to move into Phase III development after successfully completing Phase IIb clinical trials for the treatment of treatment-resistant depression or TRD. COMP360 has Breakthrough Therapy designation for this indication. The stock currently trades around nine bucks a share and sports an approximate market capitalization of $400 million.

September Company Presentation

The company’s developmental approach is somewhat unique in this space as it is using psilocybin which is found in psychedelic mushrooms to develop treatments not only for TRD but also for treatment of post-traumatic stress disorder or PTSD. The company recently added a second site for the PTSD study, Mt. Sinai Hospital in New York City. The other site at King’s College is already actively recruiting individuals for is mid-stage trial for PTSD.

In September, the company announced a new Phase II program in anorexia for COMP360 to add to the primary TRD and PTSD programs currently underway. This is no current FDA approved pharmacological treatment for anorexia.

September Company Presentation

The company has myriad investigator initiated studies for multiple potential indications for COMP360. These efforts are too early stage to be germane to this analysis, however.

September Company Presentation

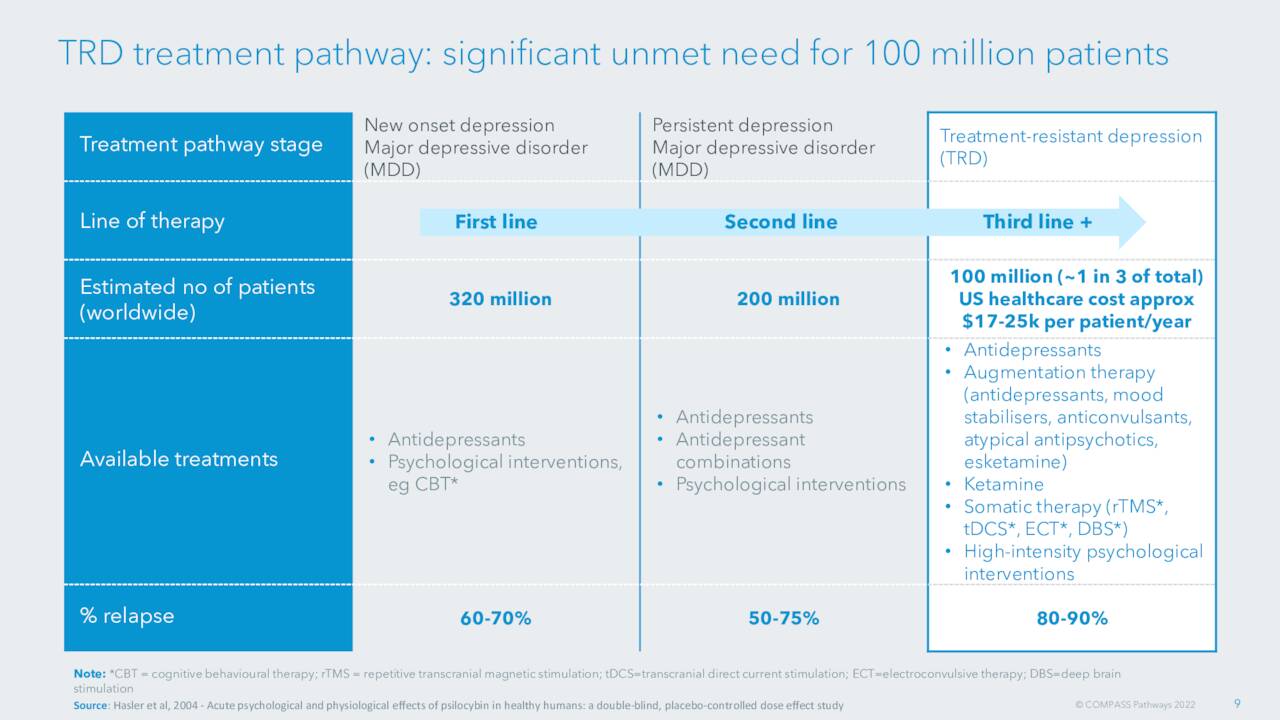

Treatment-resistant depression is a worldwide scourge that affects hundreds of millions of individuals globally. They are multiple approved treatments. However, many individuals don’t respond to current treatments. In addition, there are no pharmacological therapies available for many mental illnesses.

September Company Presentation

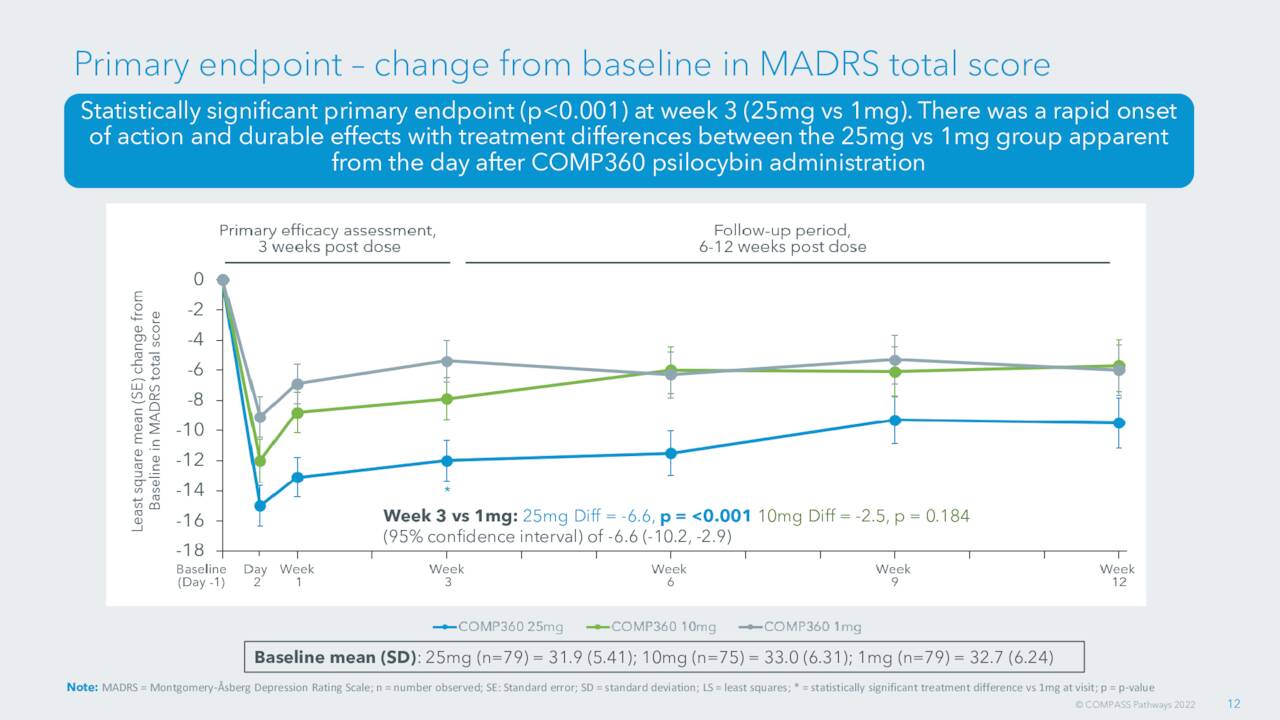

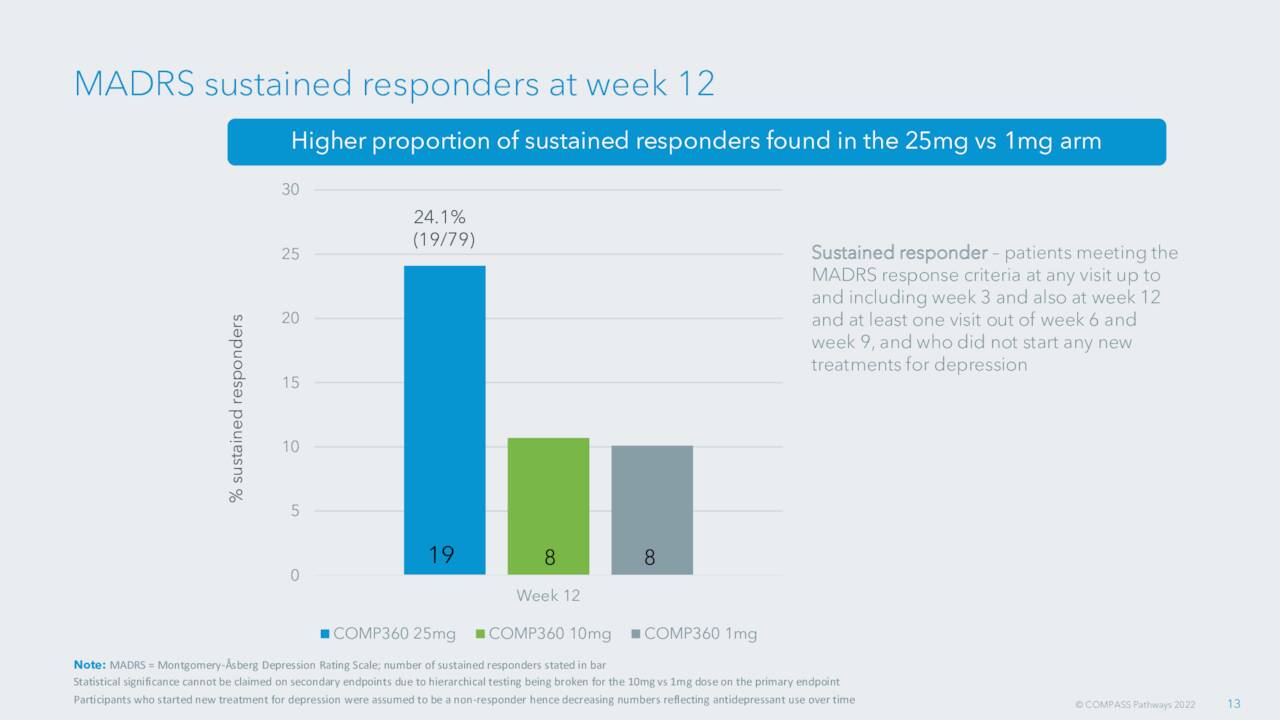

As mentioned, the company’s Phase IIb study was successful and the company has settled on a 25mg dosage for both the Phase 3 trial as well as commercialization.

September Company Presentation

When we last left COMPASS, the company had not had a follow up meeting with the FDA to determine the way forward and design of the pivotal Phase study that hopefully leads to FDA approval and product launch.

September Company Presentation

That meeting has now taken place. These Phase 3 studies will consist of two control pivotal trials and they will incorporate a number of the important lessons from COMPASS Pathways’ Phase II program. These studies for COMP360 to treat TRD should commence by the end of this year. A recent article around COMPASS here on Seeking Alpha projected the likely timeline for FDA approval if all goes well in these trials at approximately two years.

Analyst Commentary and Balance Sheet:

Over the past week or so, four analyst firms including BTIG and Canaccord Genuity have reissued Buy ratings on COMPASS Pathways. Price targets proffered range from $30 to $120 a share.

Four insiders sold approximately $400,000 worth of stock in aggregate in March of this year. That has been the only insider activity in the shares so far in 2022. Bears seem to be targeting this stock as over 20% of the outstanding float is currently held short. As of the end of the second quarter, COMPASS had just over $205 million in cash and marketable securities on its balance sheet against no long-term debt. The company posted a net loss of $21 million in the second quarter. Management expects to be able to fund their operations into 2024 with the current funding in place.

Verdict:

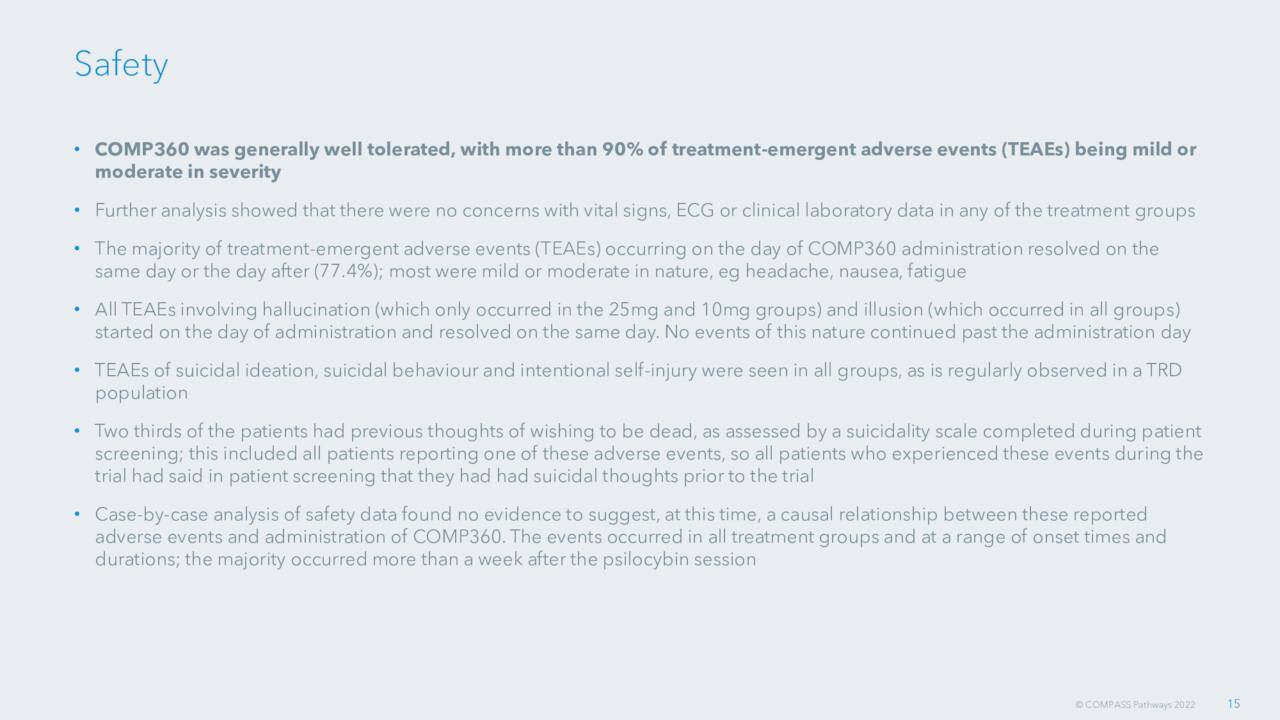

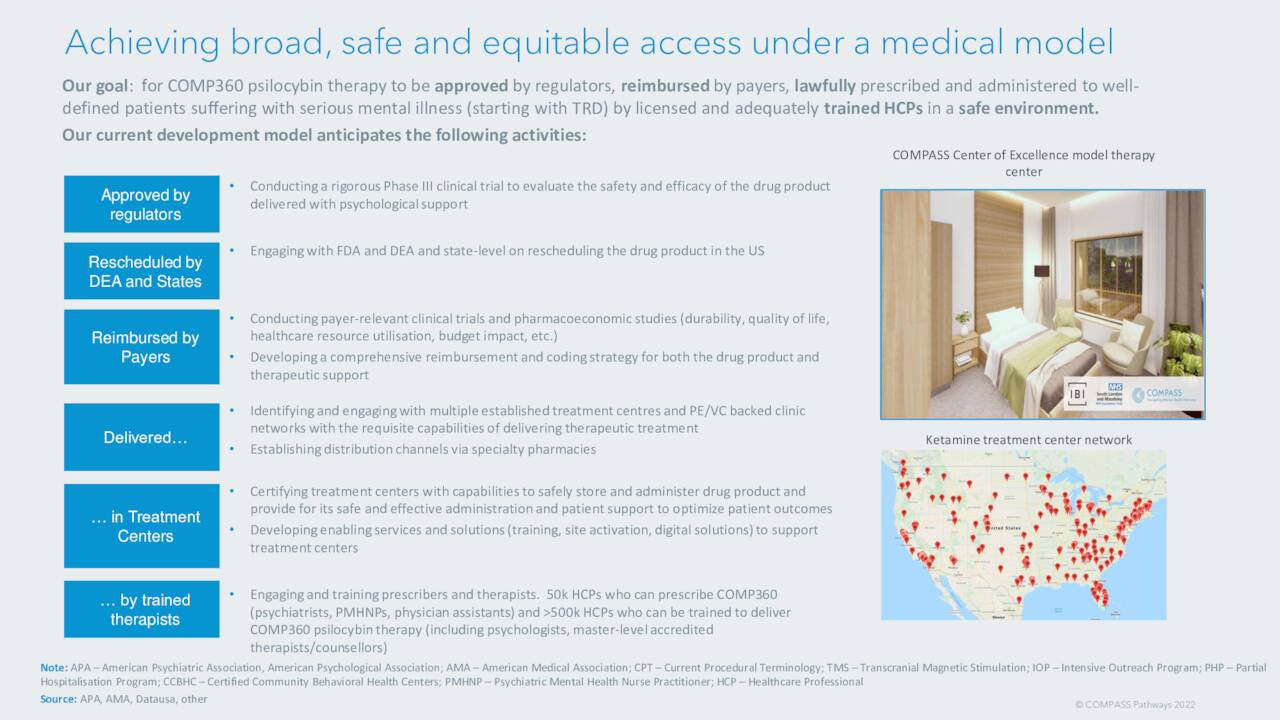

COMP360 seems to be advancing at a decent clip in development. The company is well-funded at the moment and is targeting some significant potential markets. However, there are already a variety of treatments for TRD so this isn’t “green space.” In addition, psilocybin is categorized as a Schedule 1 drug by the DEA. An article in June went into detail on what challenges that designation presents in getting COMP360 to approval status.

In addition, COMPASS is not alone trying to develop new treatments using psilocybin. Cybin (CYBN) is developing CYB003, a deuterated psilocybin analog, under investigation for alcohol use disorder and major depressive disorder. MindMed (MNMD) also has a study examining the acute effects of psilocybin.

September Company Presentation

The company is getting ready to embark on Phase 3 development and is laying the groundwork for commercialization. During the summer it brought in a seasoned executive to take over CEO duties from the co-founder of the company, who is now Executive Chairman.

Ordinarily, I would say COMPASS has advanced to the point where the stock merits a small “watch item” position given it is about to kick off late stage development. A few things keep me from that recommendation at the moment, however.

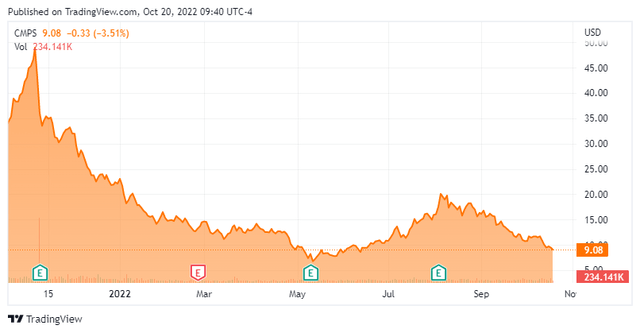

First, the overall market continues to volatile and a global recession seems approaching. High beta parts of the market tend not to do well in that environment. Second, the stock has lost nearly 75% of its value over the past year and hasn’t found a confirmable floor. Finally, the short position in this equity has more than doubled since we last visited the name even as the shares have continued to decline.

While the company is aiming at very large potential markets, COMP360 has some significant challenges to overcome before this compound can be greenlighted by the FDA. Therefore, while the story around COMPASS has gotten more interesting since we last peaked in on it, I am not quite ready to pull the trigger and establish an initial stake in the shares quite yet.

There is a charm about the forbidden that makes it unspeakably desirable.”― Mark Twain

Be the first to comment