SpVVK

Investment Thesis

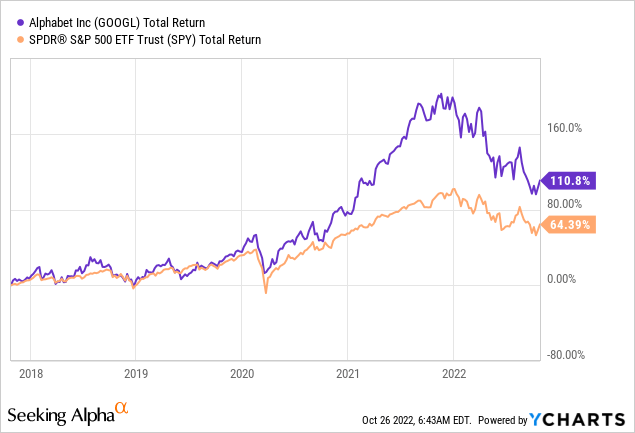

Alphabet (GOOG)(NASDAQ:GOOGL), the parent company of Google, has been a stellar investment over the past five years. Shares have returned 110%, and they have been a part of the big tech FAANG names that have driven the S&P 500 to recent highs.

The company divides itself up into two core Google-related segments: Google Services and Google Cloud, with a further segment for Other Bets. Google Services includes pretty much everything you’ve heard of with Google in the name, plus Android and YouTube; the company also offers hardware products such as the Pixel smartphones, Fitbit, Chromecast, and the Google Nest Cams and Doorbell.

Google Cloud is the company’s cloud platform and a challenger to the likes of Amazon’s (AMZN) AWS and Microsoft’s (MSFT) Azure. It also offers Google Workspace, which generates revenues from cloud-based collaboration tools for enterprises such as Gmail, Docs, Drive, Calendar, and Meet.

Despite being a fairly well diversified business in terms of its offerings, Alphabet still makes most of its money in one industry: advertising. Google Search is still the biggest contributor to Alphabet’s business by far, and unfortunately, when the economy slows down and a recession looms, advertising is one of the first costs to get cut.

This was known heading into Alphabet’s Q3 earnings, which is why I wrote a preview article entitled Google: Q3 Earnings Can’t Be Worse Than Expected, Right?

So, did I jinx it? Well, shares are down more than 6% in pre-market as I write this… but you can be the judge.

Google Q3 Earnings Overview

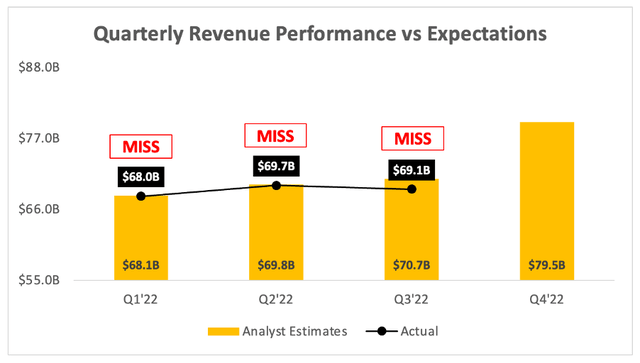

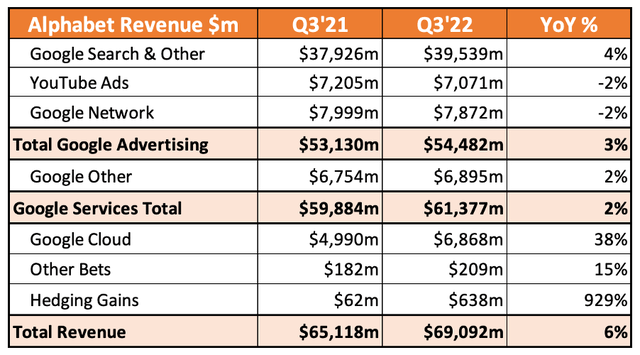

Starting from the top, and Alphabet grew its revenue by just 6% YoY to $69.1B. falling short of analysts’ $70.7B estimates.

Seeking Alpha / Alphabet / Author’s Work

Looking at the segments, it’s clear to see the advertising slowdown has hit Google pretty hard. That said, the optimist in me wants to point out that advertising still grew 3% YoY in a tough environment against difficult Q3’21 comps – the biggest disappointment continues to be YouTube’s YoY decline.

Another fairly bright spot is Google Cloud, which grew 38% YoY to reach just under $6.9 billion, representing sequential (quarter-on-quarter) growth of just under 10%. It’s worth noting that, right now, Google Cloud is having a negative impact on margins (operating loss for the segment in Q3 was -$699m); eventually that trend will reverse, as Google ploughs less into R&D and cloud infrastructure as a portion of revenue, thereby benefitting from scale that the likes of AWS already have, and this could be a substantial future catalyst for earnings growth.

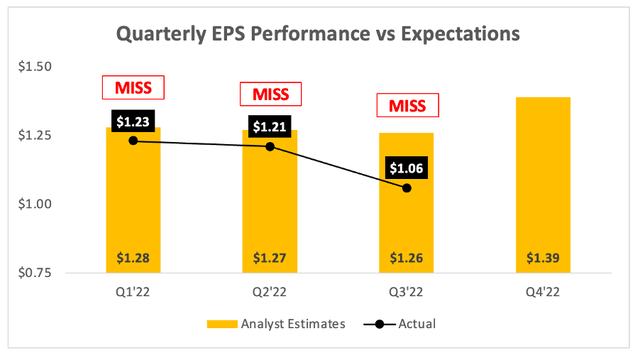

Speaking of the bottom line, it was yet another miss for Alphabet when it came to EPS. The company posted EPS of $1.06, missing analysts’ estimates of $1.26 once again.

Seeking Alpha / Alphabet / Author’s Work

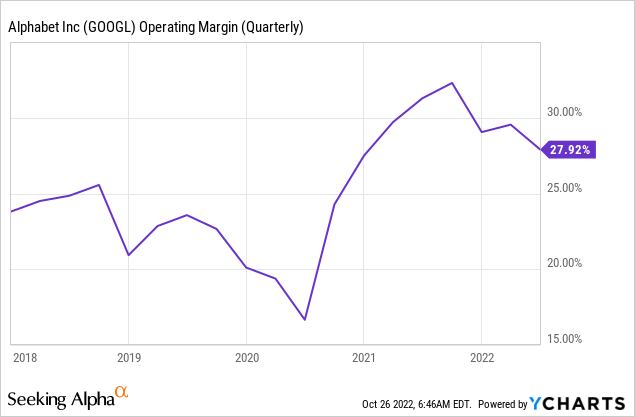

One of the more disappointing items on Alphabet’s earnings was the substantial drop off in operating margins YoY, falling from 32% in Q3’21 to 25% in this latest quarter – the reasons for which I’ll get into later on. Yet investors should not be surprised, as Alphabet’s margins have been on a decline since Q3’21, driven by several factors including the difficult macroeconomic environment.

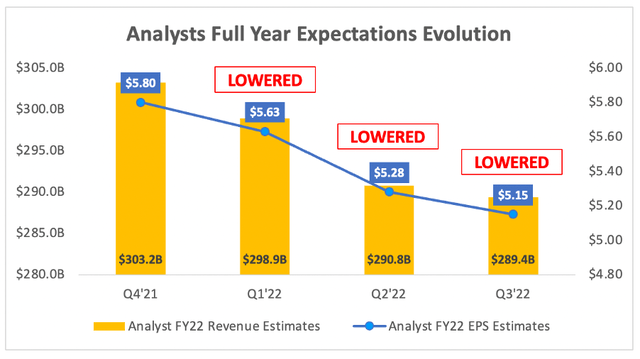

As per the below graph, Alphabet has had a disappointing year so far, with analysts consistently lowering their full year outlooks for the company – and I expect these to fall even lower once the latest results are taken into account.

All in all, another disappointing quarter in 2022 for Alphabet; but, I don’t think that long-term investors should be overly concerned. The numbers are bad, yes, but my view is that a lot of these issues are caused by temporary macroeconomic headwinds that are outside of Alphabet’s control.

A Whole Host of Headwinds

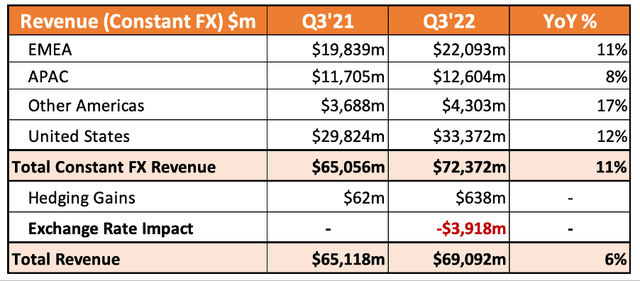

The macroeconomic environment is clearly putting a lot of pressure on Alphabet right now, and one of the biggest drivers is the current strength of the US Dollar. If we take a look at Alphabet’s revenue on a constant FX basis (i.e., assuming that there were no currency fluctuations between Q3’21 and Q3’22), then it paints a better story.

The strengthening US Dollar resulted in an eye-watering negative impact of ~$3.3 billion on Alphabet’s Q3 revenue, and growth would have been a respectable 11% YoY on a constant FX basis. It’s also worth highlighting that Alphabet is seeing solid growth in regions such as ‘Other Americas’, which bodes well for the company’s future potential.

Yet this was only the first headwind. It’s a very difficult macroeconomic environment at the minute, and more so for advertising businesses, so 11% constant revenue growth, coming up against difficult YoY comparisons from a strong 2021, shows strong business performance in my view. This is perhaps more impressive when you consider some of the other headwinds that CFO Ruth Porat highlighted in the earnings call:

The largest driver of the deceleration in year-on-year growth of Search compared with 3Q ‘21 was lapping the outsized growth in 2021. The sequential deceleration in the year-on-year growth of Search in the third quarter versus the second quarter was also driven by lapping with an additional headwind from pullback in advertiser spend in some areas.

In YouTube and Network, the sequential deceleration of year-on-year growth in the third quarter versus the second quarter primarily reflects further pullbacks in advertiser spend.

Within other revenues, we expect an ongoing headwind from the slowdown in buyer spend on Google Play due to a number of factors, including lower levels of user engagement in gaming that impacted results in the second and third quarters. As Philipp mentioned, among other factors, this shift in user behavior was also a headwind to advertising revenues, with lower revenues from app promo spend on YouTube, Network and Play ads in Search and other.

When Snap (SNAP) reported its Q3 earnings last week and advertising stocks temporarily tanked, I was not that concerned; Snap isn’t that great a business in my opinion. Yet when Ruth Porat starts highlighting the scale of the decline in advertising from Q2 to Q3, I start to get a bit more concerned about some of the other advertising businesses within my portfolio. It also gets worse in terms of the outlook, as Porat also expects an even larger exchange rate headwind in Q4.

In my view, I think this quarter from Alphabet reflects a difficult macroeconomic environment much more than a struggling business – but there is one bone investors may have to pick…

Cost Control? No? OK…

In Alphabet’s Q2 earnings call, CEO Sundar Pichai said the following:

Earlier this month, I announced that we’ll be slowing our hiring and sharpening our focus as a company.

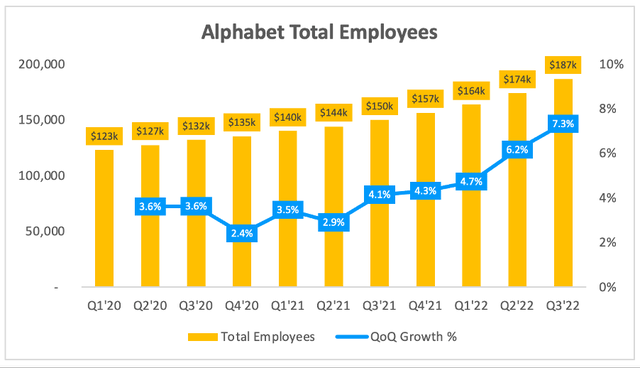

Well, on the face of it, that didn’t work out too well this quarter, as Alphabet saw one the largest sequential increases in employee numbers over (at least) the past few years. Total headcount grew by a whopping 12,765 people from Q2 to Q3, and investors are questioning this headcount growth, particularly since operating costs grew ~26% this quarter when revenues only grew 6%.

But, there are reasons; over 2,600 of these employees were driven by the recent Google Cloud acquisition of Mandiant, and CFO Porat did warn on the Q2 earnings call that Q3 figures wouldn’t reflect their decision to slow down hiring:

Given the uncertain global economic outlook and the hiring progress achieved to date, as Sundar previously announced, we intend to slow the pace of hiring. We expect our actions on hiring to become more apparent in 2023. Our headcount additions in the third quarter will reflect we already have a strong number of commitments, including new graduate hires.

As a reminder, we also expect the acquisition of Mandiant to close by the end of the year, which will further increase headcount on top of hiring.

So, investors can expect to see this level of hiring certainly ease up over the coming quarters.

Operating expenses were also negatively impacted by the strengthening US Dollar. Porat highlighted that the impact of FX is greater on operating income than it is on revenues, given that Alphabet’s expense base is weighted more toward the US, which is where most R&D efforts are located.

All in all, I think the headline hiring figures may be surprising to investors, but that’s probably because everyone forgot the details laid out in Alphabet’s Q2 earnings call. It feels to me like this quarter should truly be the peak in hiring acceleration, but with the US Dollar continuing to strengthen, cost control will remain a challenge for Alphabet.

GOOGL Stock Valuation Remains Attractive

As with all growing, innovating companies, valuation is tough. I believe that my approach will give me an idea about whether Alphabet is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

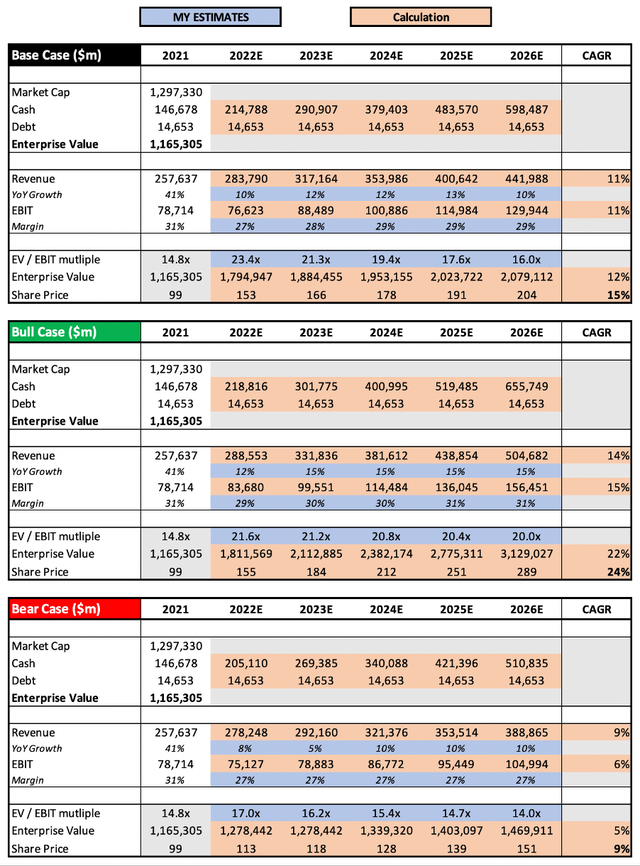

My model inputs and assumptions are the same as they were in my previous article, apart from a slight reduction in 2022 revenue growth and EBIT margin estimates due to the impact of FX headwinds.

Put all that together, and I still see Alphabet shares achieving a CAGR through to 2026 of 9%, 15%, and 24% in my respective bear, base, and bull case scenarios.

Bottom Line

This was undoubtedly a quarter full of macroeconomic pain for Alphabet, but here’s the funny thing – I didn’t really see any issues with the business itself, and I thought the FX neutral growth of 11% YoY was pretty darn resilient given all the broader issues. If it makes Alphabet investors feel better, I don’t hold Alphabet shares myself, so I have no reason to try and find the positives and perhaps downplay the negatives.

There could undoubtedly be tough times ahead for this company, but it’s such a strong business that I think this macro-induced weakness has resulted in an attractive share price for long-term investors. Given this, I’ll reiterate my previous ‘Buy’ rating on Alphabet.

Be the first to comment