Vladimir Zapletin/iStock via Getty Images

LyondellBasell Industries (NYSE:LYB) is a uniquely positioned business within the current high inflationary environment where recession is also looming on the horizon.

On one hand, it is a relatively cyclical business that is sensitive to changes in the business cycle, and on the other, it is a beneficiary of the higher commodity prices that we witnessed during 2022.

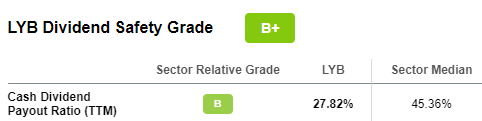

In addition, LYB has a forward dividend yield of nearly 6% and an excellent dividend safety score with cash dividend payout ratio of less than 30%.

Seeking Alpha

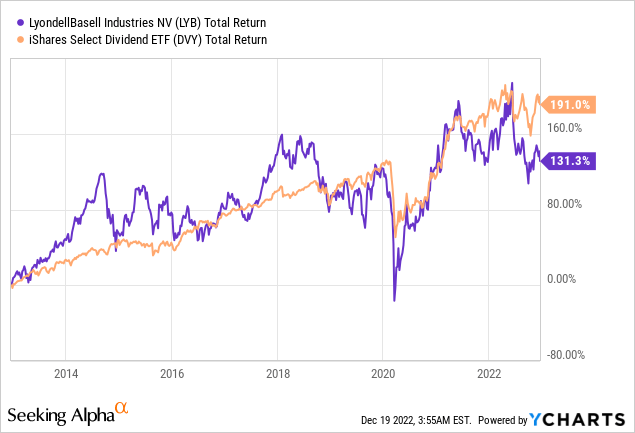

That is why LyondellBasell is one of the major holdings of the high dividend iShares Select Dividend ETF (DVY). In terms of performance, LYB has largely trailed the ETF over the past 10 years, with wide gaps opening between the two in 2014 and 2017-18 periods.

As of the time of this writing, however, the gap has reversed and LYB has now significantly underperformed the high dividend ETF. Although there are very specific reasons for this underperformance, LyondellBasell’s dividend yield relative to that of the ETF could be used as an early signal.

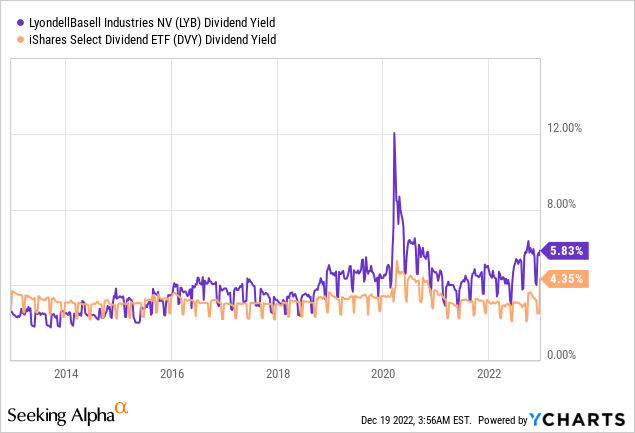

For example, during the two periods mentioned above, when the price of LYB was well ahead of its fundamentals, its dividend yield was consistently lower than that of the DVY.

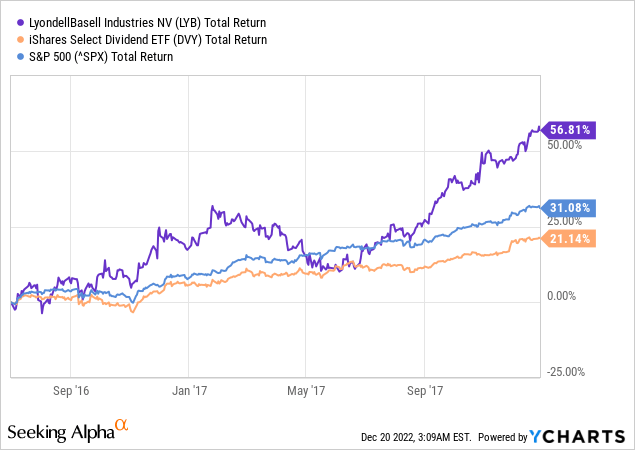

The opposite was true during the lows of mid-2016, when LYB’s dividend yield was much higher. This led to LYB significantly outperforming both the DVY and the S&P 500 in the following year.

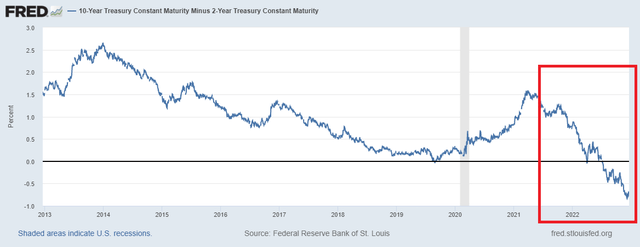

Keeping The Business Cycle In Mind

Having said all that, it seems reasonable that as long as LYB’s dividend is relatively safe, its current yield of almost 6% makes the company an attractive investment opportunity for next 12-18 months. However, this time around the outside macroeconomic environment poses significant challenges with many signs leading to an upcoming recession in 2023.

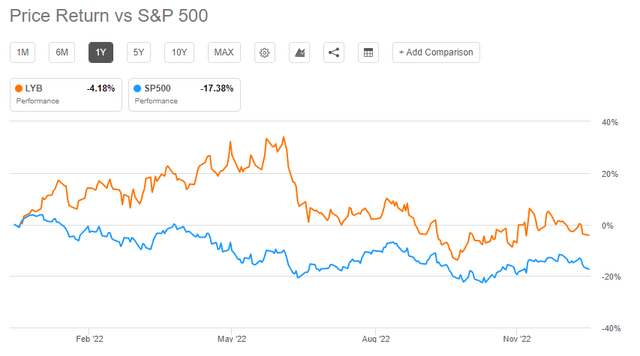

As a result, most cyclical and high momentum names were decimated during 2022 as expectations of economic slowdown and lower liquidity get priced in. In the case of LYB, however, the share price fell by only 4% during the past 1 year, compared to more than 17% decrease for the S&P 500.

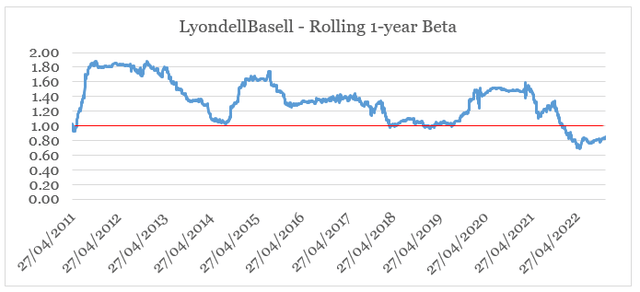

The company’s 1-year rolling beta also fell from around 1.6 in early 2021 to roughly 0.8 as of today.

prepared by the author, using data from Seeking Alpha

This clearly illustrates that LYB has become far less exposed to cyclical swings in the S&P 500 and is better positioned to endure further declines in the broader equity market.

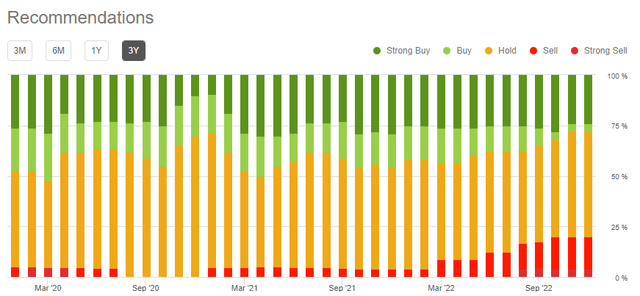

At the same time, Wall Street analysts have turned more bearish on LYB during 2022 after a number of downgrades in recent months (see below). As a result, the share price now seems to reflect the higher probability of a recession in the coming year.

Lower Margins Are Priced-In

Before we can conclude that LYB represents an attractive investment opportunity for 2023, we should first take a closer look at business fundamentals and their drivers. From thereon, we should also evaluate the safety of its dividend, before we can draw any conclusions.

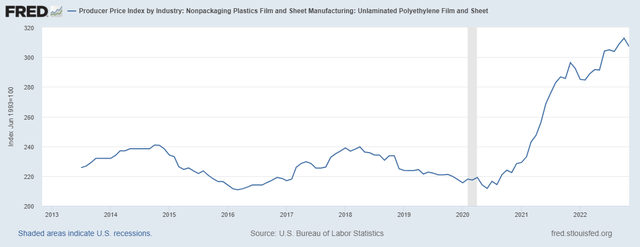

As a starting point, LYB has been a significant beneficiary of recent supply chain issues, which resulted in higher prices for many of the company’s end-products.

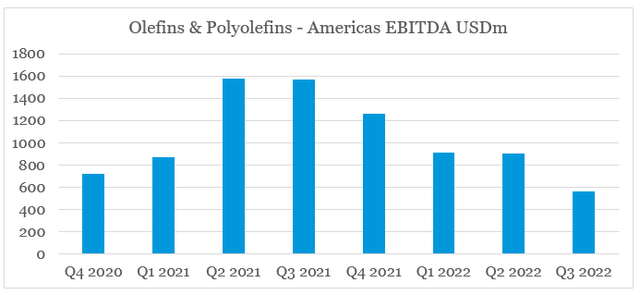

As prices of petrochemicals products, such as polyethylene and polypropylene, skyrocketed in 2021, so did LyondellBasell profits. As things normalize, however, it appears that LYB profits are also rolling over from their 2021 highs. In the graph below, we could see the quarterly EBITDA for the company’s largest segment in terms of revenue – Olefins & Polyolefins – Americas.

prepared by the author, using data from Investor Presentations

The management has also recently warned that the company is facing headwinds from both weaker demand and higher costs.

LyondellBasell’s business portfolio faced headwinds from rising costs and weaker demand at the same time.

Source: LyondellBasell Earnings Transcript Q3 2022

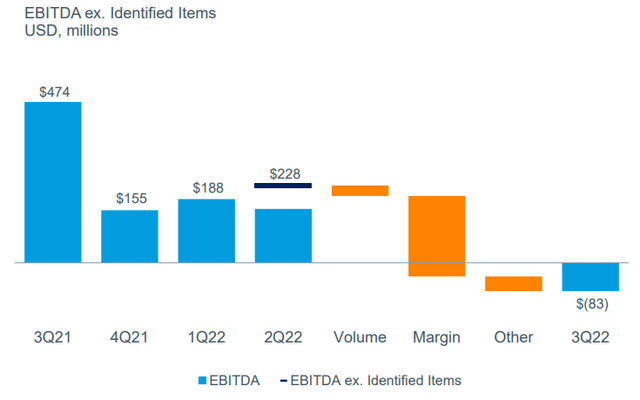

The overseas Olefins & Polyolefins business segment, which accounts for roughly a fourth of the company’s revenue, has been hit hard by higher energy costs in Europe and weaker demand.

LyondellBasell Investor Presentation

By reducing capacity, LYB management has been taking steps to prepare the business for the challenging macroeconomic environment in Europe.

Also, in response to lower demand and margins, we plan to operate our European assets at approximately 60% of capacity during the fourth quarter. As previously announced, we have postponed the restart of our integrated O&P site in France until early 2023.

Source: LyondellBasell Earnings Transcript Q3 2022

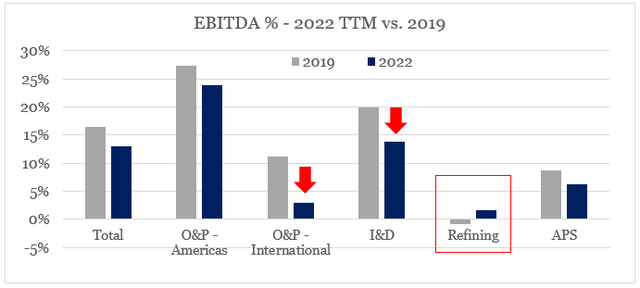

The International Olefins & Polyolefins segment is already significantly below its pre-pandemic levels in terms of margins, while Intermediates & Derivatives is also under pressure as a result of lower demand for durable goods combined with strong supply.

prepared by the author, using data from SEC Filings

As the Energy Crisis in Europe continues weigh on demand and margins, the full reopening of the Chinese economy remains the big question mark for the overall health of the sector.

Very important just to look at China. What will happen in China, how will demand be encouraged in China? That’s a big question mark. I mean you know that China normally imported about 40% of their needs in polyethylene. So at this point in time, not a lot of growth in China, and therefore, the material is not flowing into China either.

Source: LyondellBasell Earnings Transcript Q3 2022

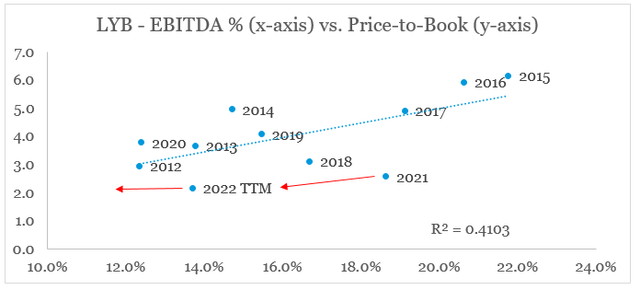

While speculations are still running high, LYB’s multiples are already pricing in a significant decline in margins going forward. Based on the historical relationship between the EBITDA margin and price-to-book ratio, the former is expected to decline from almost 14% during the past 12 months to around 10%.

prepared by the author, using data from Seeking Alpha

Of course, there’s always a possibility that lower than expected demand in 2023 could ultimately result in even lower profit margins. However, LyondellBasell business is well-positioned to meet short-term turbulences due to its ability to generate high free cash flow and the well-covered dividend.

The Dividend As An Anchor

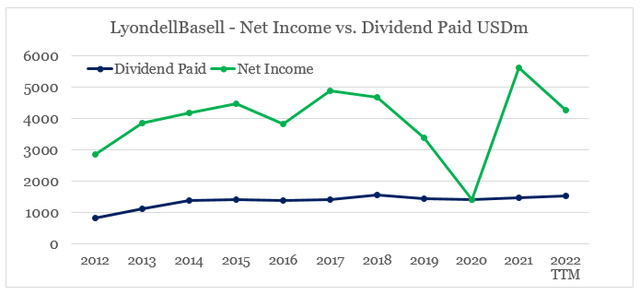

On a net income basis, LYB’s dividend yield of almost 6% appears relatively safe. Even after the sharp declines in profitability earlier this year, the dividend payout ratio stands at only 36%.

prepared by the author, using data from Seeking Alpha

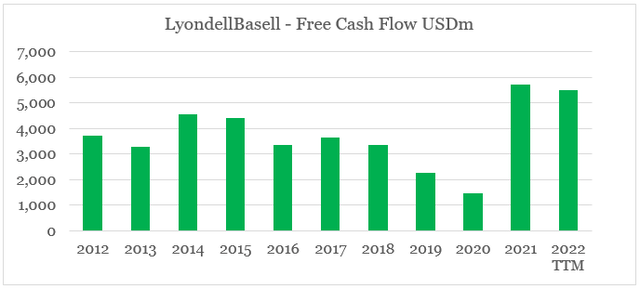

More importantly, the company has generated significant amounts of free cash flow over the past two years (see below).

prepared by the author, using data from Seeking Alpha

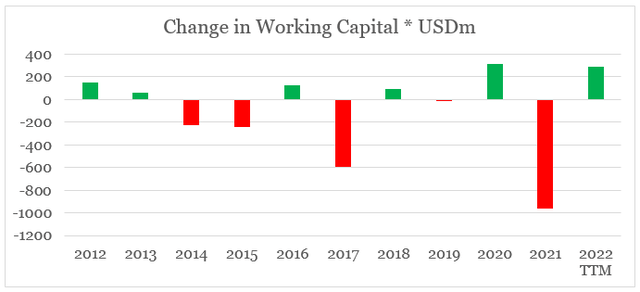

While profitability is expected to contract, working capital requirements are also normalizing, which provides a tailwind for cash flow.

prepared by the author, using data from Seeking Alpha

* based on changes in accounts receivable, inventories and accounts payable

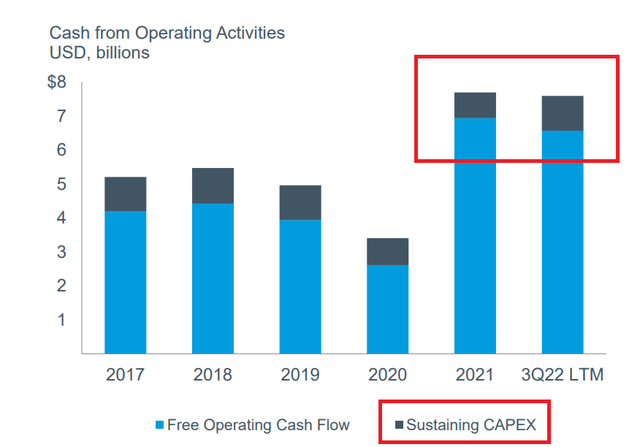

Sustaining capital expenditure also remains very low when compared to the overall free operating cash flow over the past 12 months, which would allow the management to scale back roughly $1bn worth of growth Capex.

LyondellBasell Investor Presentation

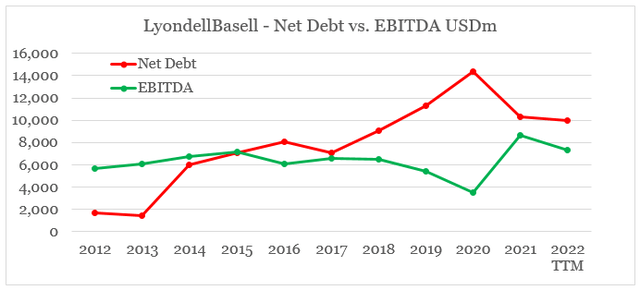

The management has also capitalized on this opportunity to deleverage the business over the past two years. Thus, the interest coverage ratio now stands at roughly 17, while the gap between Net Debt and EBITDA has narrowed down.

Seeking Alpha prepared by the author, using data from Seeking Alpha

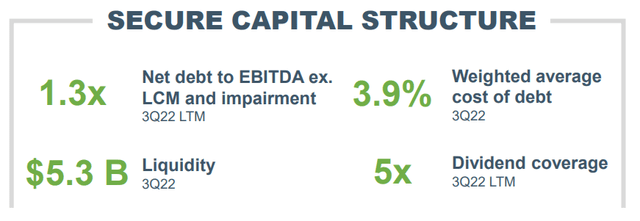

Overall liquidity is also exceptionally strong, with cash and cash equivalents at roughly $1.5bn during the end of Q3 2022.

LyondellBasell Investor Presentation

Conclusion

LyondellBasell has become an increasingly attractive addition for equity portfolios aimed at capital preservation and high dividend yield. As profitability is coming under pressure, the company’s ability to generate cash flow remains strong. Moreover, valuation multiples already reflect much lower profitability going forward. In the meantime, the nearly 6% dividend yield appears relatively safe given the low debt payout ratio, strong liquidity position and the recent deleveraging.

Be the first to comment