Gold Price (XAU/USD), Chart, and Analysis

- 10-year US Treasury yields nudge higher.

- Jackson Hole Symposium is the next source of volatility.

Gold is trading sideways to start the week with little in the way of market-moving data or events to trigger volatility in the precious metal this week. It may be that the market is already setting its sights on next week’s Jackson Hole Symposium for the next directional driver. This year’s event, ‘Reassessing Constraints on the Economy and Policy’ will be held on August 25-27 and will feature a raft of global central bankers. With no FOMC meeting this month – although the last minutes are due this Wednesday – the Fed may use next week’s meeting to give more details about the path of future rate hikes and bond sales.

Us Treasury yields are up a fraction as the session opens with the 10s back above 2.85%, while the 2s/10s spread remains around negative 40 basis points.

For all market-moving data releases and events, see the DailyFX Economic Calendar.

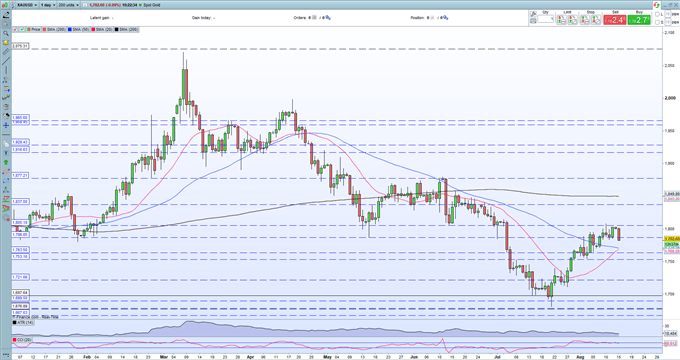

The daily gold chart remains mixed with spot gold fading the recent attempt to break through $1,800/oz. with any conviction. The chart shows a series of lower highs that remain in place off the March high, while gold is stuck between the simple moving averages. Support at $1,783/oz is being tested and a break here would leave $1,770/oz. exposed. To the upside, $1,800/oz. ahead of $1,807/oz. With the 14-day ATR at a multi-month low of just over $18/oz. it looks likely that gold will tread water ahead in the early part of the week.

Gold Daily Price Chart – August 15, 2022

Retail trader data show 75.01% of traders are net-long with the ratio of traders long to short at 3.00 to 1. The number of traders net-long is 0.40% higher than yesterday and 8.77% lower from last week, while the number of traders net-short is 0.88% higher than yesterday and 29.73% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Gold price trend may soon reverse higher despite the fact traders remain net-long.

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Be the first to comment