knape/E+ via Getty Images

A swift and decisive change in monetary policy across the globe entailed by inflation almost spiraling out of control is still reverberating through various corners of the market, international equity ETFs being no exception.

Higher interest rates in the U.S. designed to suppress persistent inflation percolated into FX rates, pushing developed world currencies to record lows against the powerful USD. Growth concerns meanwhile provoked compression of multiples and pushed equity valuations meaningfully lower. In the case of Europe, the energy crisis amid geopolitical headwinds also grossly contributed, resulting in the euro trading at parity with the dollar, a level not seen since the early aughts.

In my May article on the iShares MSCI Sweden ETF (NYSEARCA:EWD), an index-tracking ETF with a portfolio of 46 equities in the current iteration, I warned that hotter forecast inflation and softer economic growth amid a U-turn in monetary policy were a bearish mix capable of sending already struggling Swedish stocks and the krona even lower.

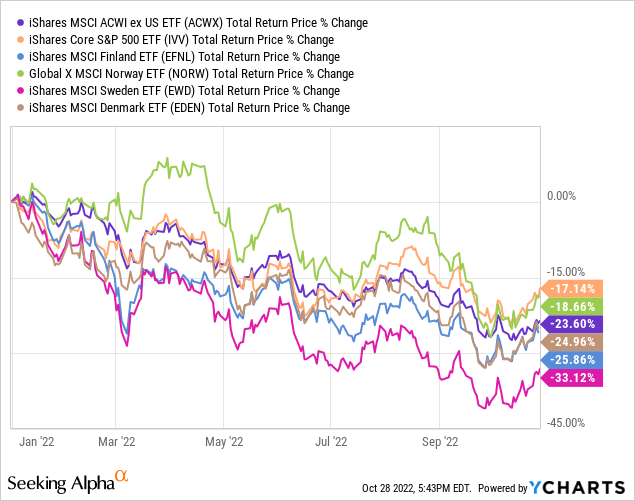

It appeared that I identified the risks correctly as, since then, EWD’s price has declined by almost 14%, while the S&P 500 is down by just 71 bps. Overall, since the beginning of calamitous 2022, EWD has fallen by 20% delivering the worst result in the Nordic peer group encompassing the iShares MSCI Denmark ETF (EDEN), Global X MSCI Norway ETF (NORW), iShares MSCI Finland ETF (EFNL), and also trailing the U.S. market represented by the iShares Core S&P 500 ETF (IVV), as well as non-U.S. global equities from the iShares MSCI ACWI ex U.S. ETF (ACWX).

A contrarian would justifiably point out here that the time for Stockholm-quoted stocks has come, as the decline is simply horrible and thus is looking overdone. However, I am not that certain as there are still risks both from the SEK and Swedish companies in the near term, so I will not upgrade EWD to a Buy today.

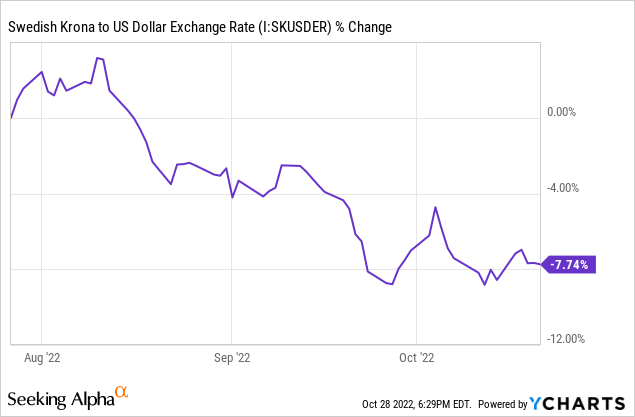

Bulls might point out here that the decidedly hawkish Riksbank is a strong supportive factor. Certainly, the central bank did what it is necessary to quell inflation. In September, explaining that “inflation is too hot,” it decided to increase the policy rate massively, by 100 bps, with the rate now standing at 1.75%. However, the super-sized hike was not enough to send the SEK/USD rate meaningfully higher. In fact, the slump continued well into October.

What are other factors that weighed on the krona and Swedish equities? European energy crisis, among other things. This is somewhat counterintuitive as the country has rich hydro resources in the northern part, with the populous south part (Stockholm included) having nuclear power plants meeting a great deal of electricity demand. For example, as of the BP Statistical Review of World Energy 2022, over 29% of Sweden’s primary energy consumption in 2021 was met by hydro, while nuclear was responsible for 21% of the total of 2.28 exajoules. Compare this to Germany’s 12.64 exajoules, of which a measly 1.4% were from hydro and 4.9% from nuclear. Yet this is far from the whole story. The issue is that the electricity grid in the south of the country partly relies on imported power, so elevated natural gas prices could easily percolate into bills, thus denting activity and contributing to a prospect of a recession. Which is certainly a bearish factor for the krona and EWD holdings as well.

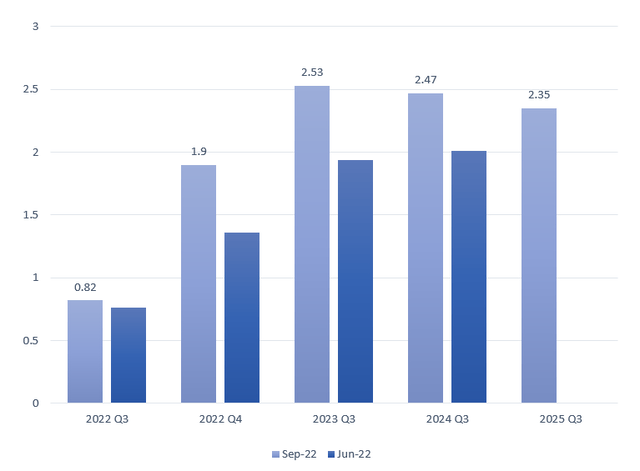

Speaking of a recession, the central bank has already meaningfully trimmed its GDP growth outlook for next year, which went from 0.7% expected in June to a 0.7% contraction mentioned in its September press release. This is a direct consequence both of elevated prices as well as higher interest rates. With the policy rate medium-term outlook also updated, the regulator made it clear suppressing inflation would require more decisive actions.

Policy rate in percent, quarterly mean values. Created by the author using data from the Riksbank

There are other factors to consider. For example, the National Institute of Economic Research has recently released an Economic Tendency Survey for October 2022 titled “Very weak sentiment in the economy.” The major takeaway is that the ET indicator declined steeply, by 6.2 points to 84.6, the change akin to the one reported in September when it slid by 6.4. This is a vivid encapsulation of gradually deteriorating economic prospects, with retail and services being especially sluggish, more likely owing to the painful combination of inflation and higher interest rates.

Among the key losers is the construction market, as builders’ expectations for the next twelve months are at a thirty-year low. And with close to half of Swedish mortgages having a floating rate, this is anything but a surprise.

However, this is yet to be fully reflected in financial results. For example, Skanska AB, a construction and development company accounting for ~1.1% of the EWD portfolio, has recently presented its Q3 report, with almost every metric being fairly strong, especially considering its “historically high order backlog.”

However, the fact is that Skanska operates in the Nordics, Europe, and the U.S., with the latter accounting for over 46% of the Construction segment operating income in 9M 2022, so its results are not that impacted by the property market softness in Sweden. Also, on page 4 of the 9M report, the company mentioned that the next twelve months’ outlook for residential development in Sweden, Norway, and Finland remains weak.

Anyway, the stock is down by more than 26% YTD in Stockholm as of writing this article as the market has been pricing in an economic slowdown.

Importantly, even though EWD has a comparatively small exposure to homebuilders that will feel the ripple effects of the Riksbank’s fight against inflation, financials like Nordea Bank (~7.1% weight) account for around 29%, and for them, higher rates are not necessarily a net positive despite anecdotal evidence suggesting overwise. In fact, this is a double-edged sword, as they can suppress loan growth despite contributing to increases in net interest income.

The silver lining is that the October confidence indicator for the manufacturing industry dipped 4.5 points, touching 105.1, yet it is still “stronger than normal.” For industrials-heavy EWD which has ~37.7% of the net asset deployed to the sector, this is a positive.

Final thoughts

It is hardly surprising investors in Swedish stocks are feeling glum. Sky-high inflation and the Riksbank’s efforts to tame it did little to support the bruised krona, yet contributed to the economic slowdown manifested in a meaningful deterioration of sentiment as discussed above, with a recession risk not to ignore amid the ripple effects of the European energy crisis. I am not a SEK bull at this point.

That said, I see little reason to steer clear of the SEK and Swedish equities completely, considering their historic weaknesses offer an opportunity for patient investors.

EWD’s 9.9x Price/Earnings ratio might be one of the reasons. Amid the economic woes, the ratio has contracted phenomenally this year; as of January 12, it stood at 21.75x, thus pointing to the fact a value opportunity probably emerged. However, I would reiterate a point I made in the previous article. Earnings compression amid a recession could result in a decline in share prices, even in case P/E remains ultra-low.

Overall, dollar-cost averaging might be considered by investors who have a two-year plus horizon and who are ready to tolerate losses should Fed hawkishness continue roiling developed world currencies and should Sweden enter a recession.

In sum, I maintain a neutral rating on the Swedish equities in the EWD portfolio despite the existing positives owing to the decidedly hawkish Fed, a factor that bodes ill for the krona in the first place.

Be the first to comment