JHVEPhoto

By all accounts, Exxon Mobil (NYSE:XOM) reported a blowout quarter, yet the stock price isn’t rallying much. Investors must take note of how a stock trades in relation to the news flow, especially around an earnings report. My investment thesis is only slightly Bullish as Exxon Mobil trades at all-time highs while the profits are at peak levels.

Tricky Quarter

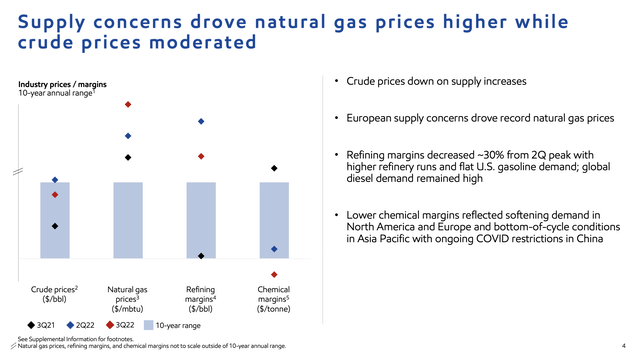

Energy prices around the world have collapsed since earlier this year where Exxon Mobil produced a Q2’22 profit of $4.14 per share. The energy giant earned $17.6 billion in Q2 and had presented to the market that Q3 profits would actually dip from those levels due to lower margins in energy products.

The company actually reported a Q3’22 EPS of $4.45 per share with profits of $18.5 billion. Exxon Mobil saw liquid prices hit profits by $1.6 billion in the quarter while gas prices boosted profits by $2.0 billion. Ultimately though, the energy products division delivered over $0.5 billion in higher profits in Q3 after the early guidance suggested the division would see profits fall sequentially from Q2’22.

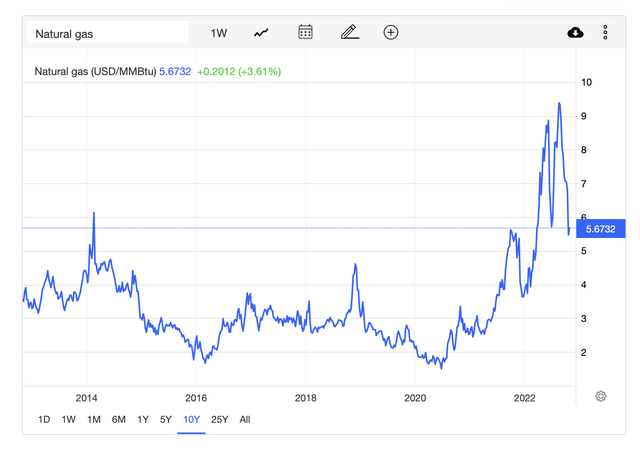

The stock isn’t rallying much due to the high natural gas prices not being sustainable, at least in the long term. Europe has already seen natural gas prices fall and Exxon Mobil won’t repeat a period where natural gas price realizations soar 172% YoY off a period that was already far above the 10-year range.

Source: Exxon Mobil Q3’22 presentation

Reuters had reported Q3 natural gas price averages were $8.47/MMBtu and current U.S. prices are down substantially to $5.68/MMBtu. A lot of the outsized gains in natural gas are likely to disappear in the next year and return to price levels from the last decade.

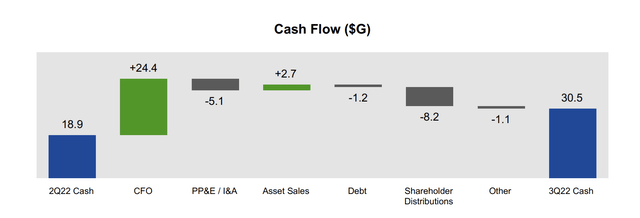

The energy giant produced a massive quarterly cash flow of $24.4 billion. Free cash flows were $19.3 billion due to the surging oil prices allowing Exxon Mobil to distribute $8.2 billion to shareholders via a larger dividend and minimal share buybacks of $4.5 billion. The company was still able to repay debt during Q3 due to the outsized cash flows generated on the elevated energy prices.

Source: Exxon Mobil Q3’22 earnings release

Tricky Stock

The stock has only rallied a few percentage points to $110 despite the impressive quarterly results. Investors are clearly fearful normalized profits will return either when Russia fully exits Ukraine or Europe is able to establish reliable energy sources without needing Russian supplies.

Exxon Mobil only earned $5.38 per share back in 2021 when energy prices and industry margins were more normal. Analysts have earnings dipping back below $10 in the long term questioning how the stock will rally much beyond the current price of $110. Even these analyst estimates appear very high compared to more normalized energy prices.

The stock has a market cap of $450 billion, but the energy giant is only spending ~$15 billion on share buybacks annually. Exxon Mobil doesn’t appear so cheap considering the limited ability or interest in repurchasing shares despite what some would consider a cheap stock price.

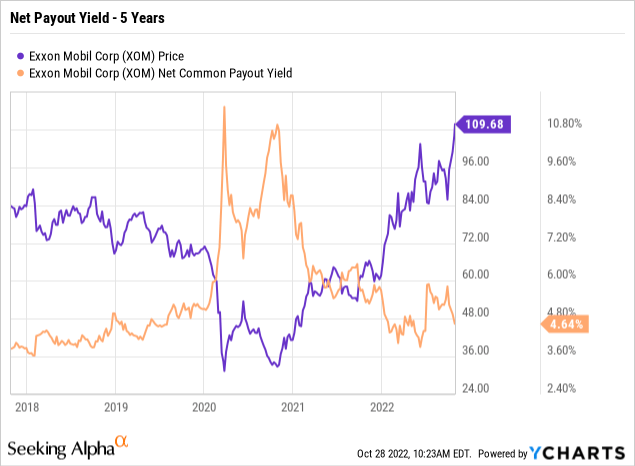

The company hiked the quarterly dividend by 3.4% to $0.91 pushing the dividend yield up to 3.3% now. The net payout yield (combines dividend yield with net buyback yield) was only 4.6% entering the quarter and will peak around 6.6% with the new dividend and expected higher buyback.

The net payout yield provides a good indication of how the business has transformed in the last couple of years. The stock at $110 appears far more fairly valued here. In the past, Exxon Mobil was expensive in the $80s when my view was more negative on the stock.

The company is more refrained with capital spending eliminating the past downside risks of over spending cratering energy prices. The big question is the valuation knowing that earnings will fall over the next couple of years and stock prices don’t hod up well in such an environment. The stock probably has about $10 of upside from here where the stock would trade at 12x analyst EPS expectations for 2023 and 2024.

Takeaway

The key investor takeaway is that Exxon Mobil had a blowout quarter despite providing preliminary numbers pointing to lower sequential profits. The stock probably has another $10 upside where investors must exit positions and look to repurchase at lower levels after energy prices normalize in the next couple of years.

Be the first to comment