Hemera Technologies

Thesis

We urged investors to be cautious about adding Lumen Technologies, Inc. (NYSE:LUMN) stock in June. We highlighted several red flags with its price action and valuations, which weren’t constructive in helping investors outperform the market.

Accordingly, LUMN has been battered over the past four months, down nearly 35% since our article was published, significantly underperforming the SPDR S&P 500 ETF’s (SPY) 1.9% gain.

Notwithstanding, we gleaned a capitulation move over the past four weeks that saw LUMN break below its March 2020 COVID lows and revisit levels not seen since 1991.

However, given LUMN’s long-term downtrend since 2016, investors who continued to add through the last six years shouldn’t be surprised (that’s why it’s a long-term downtrend, right?). As investors can glean from our chart, the right way to bet on long-term downtrends is setting up short positions at appropriate resistance levels, validated by bearish reversal price action.

As a result, we urge investors to consult the market’s long-term directional bias when deciding whether to buy dips. Not every dip should be bought, particularly for stocks in which the market isn’t confident, like LUMN.

Still, we believe the capitulation move in LUMN could have set up an interesting mean reversion opportunity for nimble investors/traders who has experience with robust risk management strategies to mitigate against unforeseen losses.

We discuss why we are ready to re-rate LUMN and revise our rating from Hold to Speculative Buy, with a price target (PT) of $9. It implies a potential upside of 30%.

Benefit From Downtrends By Selling The Rips, Not Buying The Dips

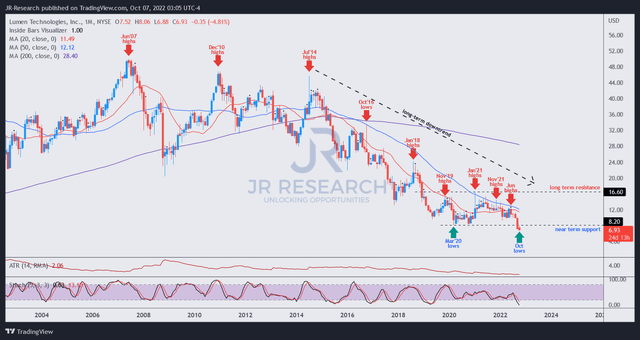

LUMN price chart (monthly) (TradingView)

Take a look at LUMN’s long-term price chart. What does it tell you? Quite simply, the market has “refused” to allow its long-term buying momentum to surge any higher beyond the highs last seen at the heights of the global financial crisis in June 2007.

As seen above, LUMN formed subsequent highs after sharp momentum surges in December 2010 and July 2014. However, both proved to be incredibly astute bull traps (indicating the market denied further buying upside decisively), forming consecutive lower highs.

Therefore, we aren’t surprised that LUMN’s long-term uptrend turned into a long-term downtrend after losing its 200-month moving average (we call it the last line of defense) resolutely in mid-2015.

A subsequent bull trap predicated on the momentum surge to form October 2016 highs confirmed the market’s intention on LUMN: a long-term downtrend.

Subsequently, every significant rip higher to form a bull trap has been an excellent opportunity to punish previous dip buyers with shorting opportunities and following the market’s long-term trend. This is a classic trend-following price action strategy that even novice price action investors/traders find relatively simple to execute.

Notwithstanding, we gleaned that LUMN has been in a consolidation zone since its lows in March 2020, with its “long-term resistance” in our chart forming the upper limit of the trading range.

Its “near-term support” represents the current lower limit of its trading range, which was breached recently by the remarkable waterfall decline over the past four weeks. Little wonder that the collapse sent investors who bought those dips at its near-term support bailing out in a hurry, triggering even more selling pressure, as traders also got stopped out at the worst possible moments. These investors/traders probably didn’t expect LUMN ever to revisit these lows again.

But, our word of caution is, don’t go against long-term trends. If you want to execute a mean reversion opportunity against a prevailing long-term trend, ensure you have a robust defined-risk management game plan knowing where to exit your profits/losses. Capital allocation is very critical here. Never hang on to losses on stocks in long-term downtrends if the market moves against your strategy. They could blow up in your face over time.

In contrast, we usually prefer to play alongside the long-term trend, not against it. It’s pretty simple to understand that your odds of winning improve markedly without going into the math, isn’t it?

But, A Mean Reversion Opportunity Awaits

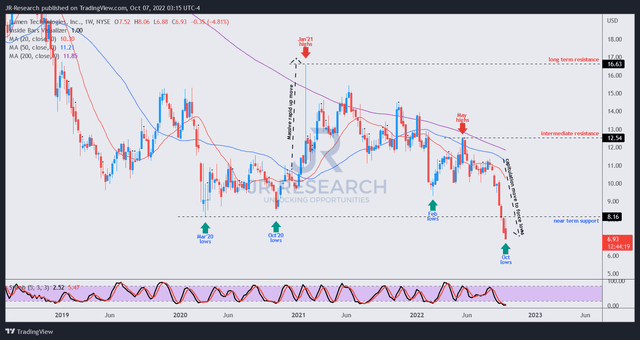

LUMN price chart (weekly) (TradingView)

By studying LUMN’s medium-term chart, investors could glean the mean-reversion opportunity clearly.

First, note that the massive bull trap in January 2021 ended hopes of reversing LUMN’s bearish bias. As seen above, the market drew in buyers rapidly to the top before digesting those gains astutely. Investors are reminded that the market is very smart. Analyzing the price action to discern the market’s forward intentions is critical.

The previous mean-reversion opportunity occurred in February lows, which led to the bull trap forming May highs. However, that was still a valid opportunity and would have yielded investors decent profits if they had appropriately set up their exit strategies.

Nothing much was interesting until the massive capitulation over the past four weeks, which took out all the significant lows through March 2020. So the rapid move is even more distinct than the mean reversion opportunity in February.

Therefore, we believe it sets up LUMN very nicely. The market’s astute move to force out holders rapidly should likely help it form a consolidation zone at the current levels, leading to a bullish reversal. Moreover, the extent of the decline had probably already taken out a lot of stop losses close to March 2020’s lows, which improves the reward-to-risk profile for our mean-reversion thesis.

We revise our rating on LUMN from Hold to Speculative Buy, with a PT of $9. However, investors are reminded to ensure they know how to allocate capital/position size appropriately, with robust defined stop-loss strategies to mitigate significant downside risks.

Be the first to comment