Jose Luis Pelaez Inc/DigitalVision via Getty Images

Co-produced with Treading Softly

To put it plainly, most workers are screwed.

It’s the truth. It’s also likely their own fault – regardless of whom you blame.

How do I know this?

Two studies have confirmed the same information. The same scary facts. Let’s consider them for a moment.

- 25% of workers have saved nothing for retirement.

- 51% of workers have less than $51,000 saved.

- 33% of respondents save less than 5% of their income

- 57% of respondents save less than 10%.

Before someone comes blustering in here and starts hating on young folks for skewing the results – this polling only evaluated 40 to 75-year-olds.

Interestingly, even with the terrible saving level and low account balances, 44% of respondents were confident in their retirement saving plan, expecting to only need about $55,000/year to survive comfortably in retirement. Yet, they don’t even have enough to reach that income level.

For many, using the 4% withdrawal will leave them doomed. Their failure will ripple through the economy and weigh it down heavily.

The Federal Reserve is Only Making it Worse

The Federal Reserve has a dual mandate. However, we recently covered how the Fed has largely abandoned this dual mandate, stubbornly ignoring inflation, allowing it to run to multi-decade highs. Now that the damage is done, the Fed is in a hurry to be aggressive, “fighting” inflation that was already slowing down.

It’d be like the fire department in Rome letting half of it burn down before deciding the solution is to erect a wall and let that half and its citizens go down in flame to protect the rest.

At least Nero would be proud.

Being lackadaisical at your job only to rush to finally do it and hurting others is no reason to get applause. Yet before you start throwing shade or fanning the flames of your anger at the government, remember that we alone are responsible for our retirement savings. If you didn’t do it, that’s on you. If you did, that’s also on you. Ultimately, we cannot rely on others for our own financial security.

It’s Time to Change the Script

We called 50% doomed if they followed the long-established retirement script of withdrawing 4% annually. With $50,000, that’s only $2,000 annually.

That’s nothing in the face of bills and the rising costs of living.

Considering that 25% of workers had nothing. Zip. Zero. What’s 4% of zero again?

For those facing retirement hopes with nothing saved, it’s time to wake up and get saving and investing. Anything is better than nothing at all. For the rest of us, the method we use to invest can largely change the outcome.

I have created our Income Method to allow retirees and investors to change how they approach the market and retirement. I want to help as many as possible for as long as possible to see outcomes beyond their initial projections.

Let’s consider investing for an average of 8% yield vs. investing with the plan to sell off 4% of your portfolio’s balance annually:

| Retirement Balance | 4% Withdrawal Rule | Income Method (Target 8% yield) |

| $50,000 | $2,000 | $4,000 |

| $100,000 | $4,000 | $8,000 |

| $1,000,000 | $40,000 | $80,000 |

Not only can your portfolio generate a lot more income with the Income Method, but you are also not eroding the principal value yearly.

Investing for dividends means creating a recurring and steady income stream that pours into your account month after month, year after year. Recessions? Strong economy? War? Famine? All are times when dividends continue to be paid to investors.

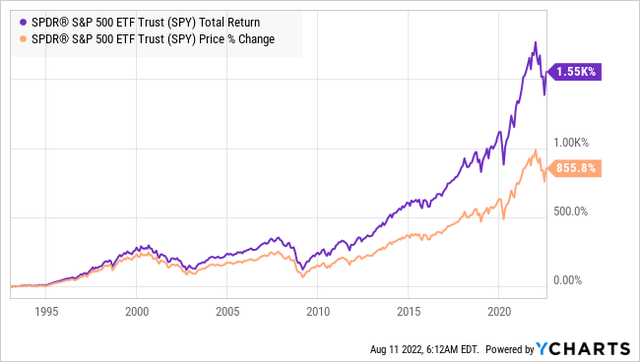

It’s interesting that dividend investing is often treated as a fringe of retirement planning. What else can turn 855% returns into 1550% returns? Dividends can.

Take a look:

A little change can go a long way. Dividends are a powerful force in the market that so many ignore to their own detriment. If you’ve failed to save for retirement or saved but ignored dividends, you’ve made a terrible mistake for your portfolio’s long-term performance.

Basic Tenets of Our Income Method

So you want to leave the doomed column and enter into a whole new outlook? Welcome to income investing! Let’s talk about some basic tenets of our unique Income Method.

Demand Income Today

The first requirement of following our Income Method is we require our investments to pay us for our ownership today. Not a promised payment in the distant future, and not hoping to sell our shares for more money to some fool in the future. We don’t want our retirement in the hands of some unknown person in the future! We want cash coming into our accounts today, as the company earns it, we want our cut. Is that unreasonable? During your working years, you likely were paid within weeks.

You did your job and were paid for those hours a week or two later. You’re providing capital to a business, so demand to be paid for it within a quarter. It’s your capital that you worked your tail off to earn and then made smart decisions to save for the future. A decision that about 50% of your peers failed to do.

You are the one who made sacrifices. Maybe living in a cheaper house, driving an older model car, and cutting back spending on your wants in order to save that money. You deserve to be paid for it and forget any company that refuses to do so.

We don’t invest in anything that doesn’t pay us for being owners. We also target an average yield between 7-9%. This means even if it pays a dividend, but it is a very small dividend, it doesn’t get our hard-earned dollars in it.

I wouldn’t keep an apple tree that never produces apples. Likewise, I don’t make an investment that doesn’t pay me back.

Keep a Steady Hand

When farmers plow a field, they can’t get distracted if they want to plow straight lines. Have you ever tried to walk a straight line while looking all around you? You’ll stray to the left or the right.

You cannot afford to get distracted from your goal and purpose when it comes to dividend investing. This is doubly important if you are playing catch up from past mistakes or inaction.

Prices will rise and fall. The market is similar to the ocean like that. From a distance, the ocean looks flat, calm, and beautiful but up come in the midst of the sea, it is temperamental, raging, and turbulent. Ocean waves rise, crest, and fall. The wind whips up storms or vanishes entirely without warning.

The history of the market is steadily climbing. Time smooths the ups and downs into a steady slope upwards. However, over shorter periods the turmoil of the markets can unnerve even experienced investors. How many people were saying in March 2020 that the market wouldn’t recover for “years”? And that it would get “much worse”? How many sold in the depths of March and bought back at higher prices later? A lot.

As an income investor, you need to steel your will and understand what you are buying and why. This way drops become opportunities to add to your positions and climbs become part of a longer-term trend upwards to new heights. Don’t panic over changing prices. Seize the opportunity to grow your income.

Diversify, Don’t Cross the Streams

We have a simple rule: The Rule of 42. We have dedicated entire articles discussing the depths of the reasons behind this rule, but it boils down to this: diversifying your income streams is essential to avoid any one source sinking your ship.

Many famed investors have become rich from a concentrated portfolio of only 10 picks or less. Of course, those investors also are in a position where they could lose billions and still have more money than their heirs could spend.

We’re not banking on massive share price climbs. We don’t have the benefit of still being insanely rich if our portfolio fails. We’re investing for income, and diversification is our friend. When we have income flowing into our account from 42 or more places, it means that any one investment which stops its dividend is not going to destroy our income stream.

Dividends are a defensive investment strategy as companies are much less likely to cut dividends than share prices are likely to decrease over any period of time. Companies cannot control their share price. They can readily control their dividend amount. As such, dividends are very sticky and are impacted by actual profits far more than the sentiments of a moody market.

So we keep a wide array of dividend-paying investments to keep our income flowing.

Reinvest 25% of Your Dividends

When you’re retired, it might be tempting to take all your dividend income and spend it. You have the right if you decide to do so!

Yet, I would encourage you to reinvest 25% of all your dividends at a minimum. This has many benefits. It keeps your income stream growing rapidly, allowing you to see a growing amount to spend freely. It also protects your budgeting from dividend cuts.

High Dividend Opportunities Model Portfolio from Q1 of 2021 to Q2 of 2022 saw its dividend income increase 7.6% on the whole. This includes any and all cuts and raises. So if you were reinvesting 25% plus your portfolio grew its dividends by 7.6%, you’ll have a rapidly growing stream of income.

Before retirement, reinvest every penny. This will allow the power of compounding dividends to rapidly grow your income. You’ll be astonished at how rapidly your income stream grows all on its own before the benefit of your continued retirement saving deposits.

After you are retired, don’t forget that you still have a future. Just like you saved for retirement in your working life, it is wise to continue allocating a portion of your income for your future.

Shutterstock

Conclusion

Don’t hesitate and let your retirement be a land of doom and gloom. Take action. Take charge of your retirement and start benefitting today from income investing.

Your retirement is in your hands. No one else will benefit from your success or be hurt by your struggles like you and your family.

The Federal Reserve is worried about its own issues. The government only cares when it is pandering for the next election. Your neighbor has their own issues to take care of.

Over half of American workers are looking at utter disaster as they march overly confident towards a disappointing future. One where they will see themselves in poverty, forced to work at advanced ages, and dependent upon others to live in comfort.

You don’t have to be one of them. I’m not saying it is easy. It likely won’t be. Saving requires sacrifice. You are giving up money you could spend today, and I assume you have a great many uses that you would love a little extra cash for. If it was easy, more people would do it.

I created my unique Income Method to revolutionize how we approach the markets and retirement planning. Take time to evaluate your plans and approach and see if our method would yield you more income and less stress. If it does, take these principles and start adjusting your portfolio today.

You will thank yourself in the future for your prudent action today.

Be the first to comment