Kevin Frayer/Getty Images News

Baidu (NASDAQ:BIDU), along with other prominent Chinese tech stocks such as Alibaba (BABA), has been under severe scrutiny over the past decade. However, even in these challenging times, the company has proven to be highly resilient; not only has it weathered the storm, it is in a terrific position to thrive. Specifically, Baidu has demonstrated tremendous strength on two important metrics, namely 1) underlying operating cash flow generation and 2) balance sheet strength (more on this below).

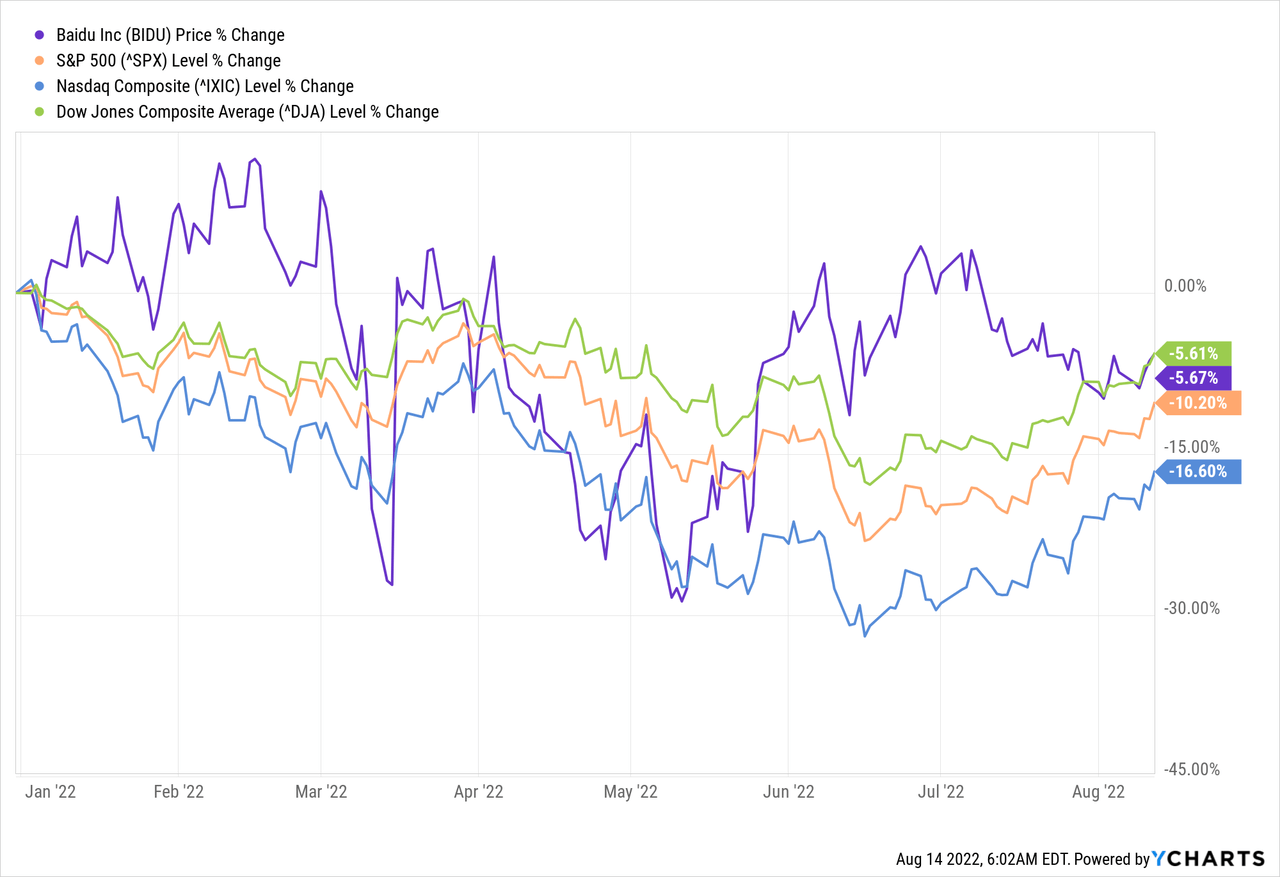

So far this year, the markets are going through a manic-depressive phase. Market sentiment is fragile and the general market indices have come under substantial pressure, as the headlines are flooded with negative news. In addition to high inflation, interest rate hikes, supply chain disruptions, ongoing COVID-19 issues, a potential 2022 monkeypox outbreak, and the war in Ukraine, we now also have concerns about Taiwan, exacerbated by Nancy Pelosi’s visit to the island. As a result, in June, the S&P 500 entered bear market territory, dropping more than 20% from its highs. This is the worst performance since the early days of COVID-19 (March 2020). The good news is that, as of July, sentiment has improved materially. In fact, July was the best month since 2020. So, in just a couple of months, we went from experiencing the worst performance since March 2020 to also experiencing the best performance since 2020. Moreover, positive momentum is continuing to build in August, as U.S. inflation eased in July and wholesale inflation actually fell (due to a slide in energy prices), another sign that prices increases are slowing. Improving inflation data has sparked a stock market rally.

Earlier this year, mostly in Q1 and in June/July, Baidu was actually faring much better relative to the major U.S. indices, in part due to the gradual easing of the Chinese tech crackdown.

However, the sentiment in China is starting to look gloomy again, especially after Pelosi’s visit to Taiwan, which adds even more pressure to the already strained US-Chinese relations. Even so, and despite the recent rally in the U.S. markets, on a year-to-date basis, Baidu is still outperforming the tech-heavy Nasdaq and S&P 500, which are down 16.6% and 10.2%, respectively, and has delivered similar performance to the Dow Jones, which is down 5.61%.

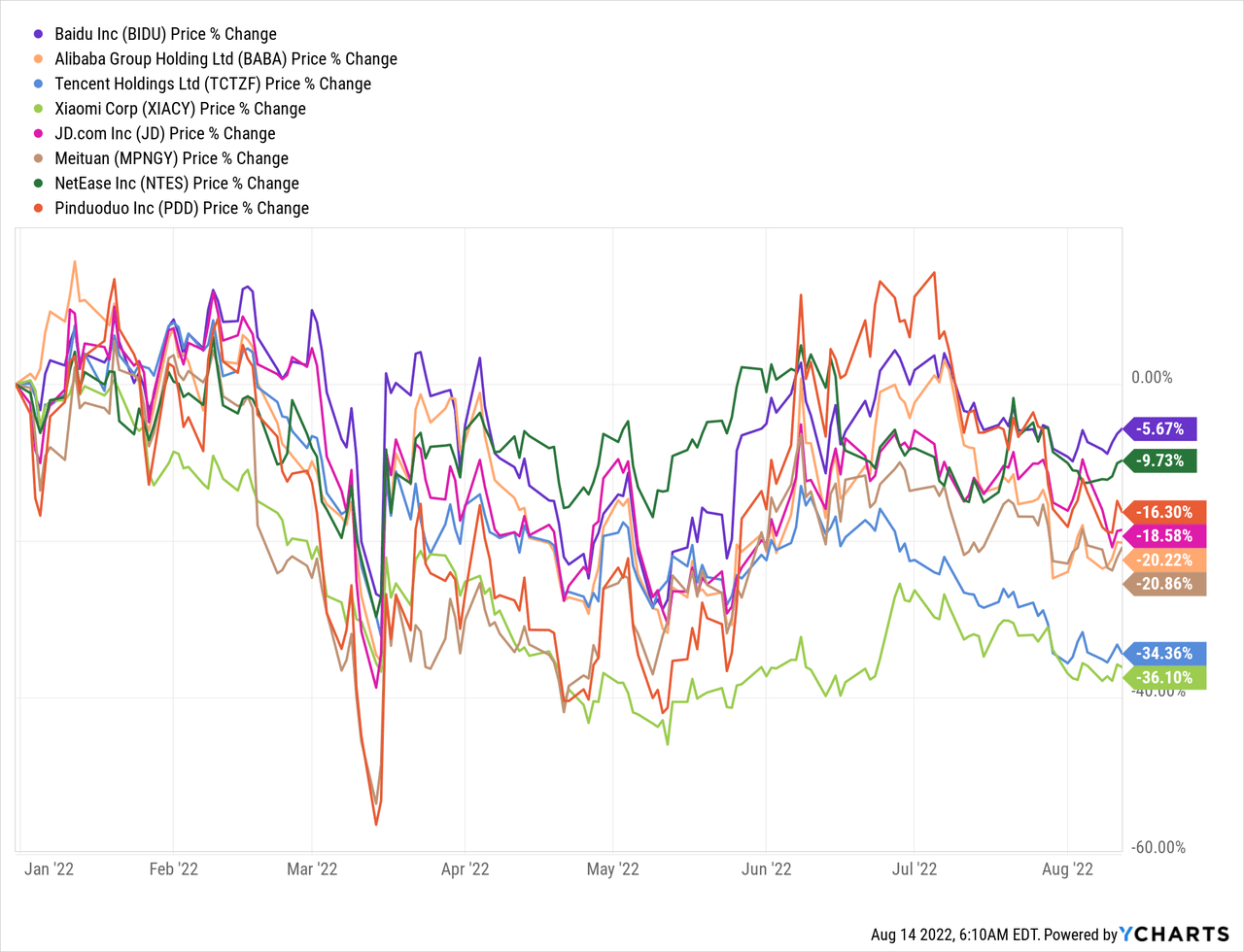

Not only has Baidu outperformed most major U.S. indices, it has also outperformed all of its Chinese tech peers, by a wide margin:

Baidu reported solid Q1 2022 results, despite challenges posed by the COVID-19 resurgence in China. Results topped expectations, thanks to continued strength in its core business, particularly non-online marketing revenue and cloud services, with non-ad revenues increasing by 35% year over year, driven by Baidu AI Cloud, which grew 45% year over year. All in all, Baidu remains extremely profitable, delivering an adjusted EPS of $1.77 on $4.48 billion in revenue (compared to estimates of 83 cents per share and $4.16 billion in revenue), underlying operating cash flow generation remains stable, and the balance sheet is flooded with cash.

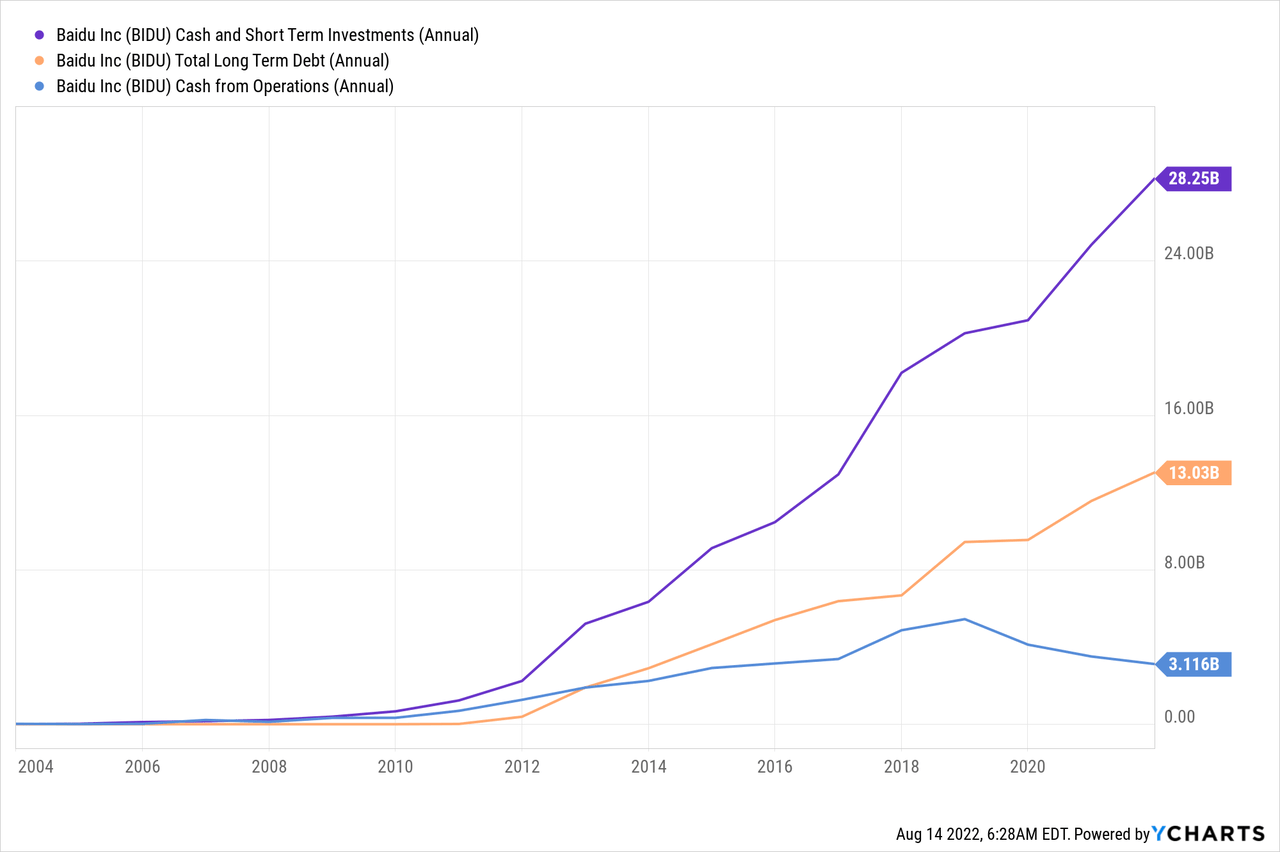

It is important to emphasise that the resilience in Baidu’s operating cash flow, and ability to hoard cash, is not a recent phenomenon. In fact, this has been the case for more way more than a decade.

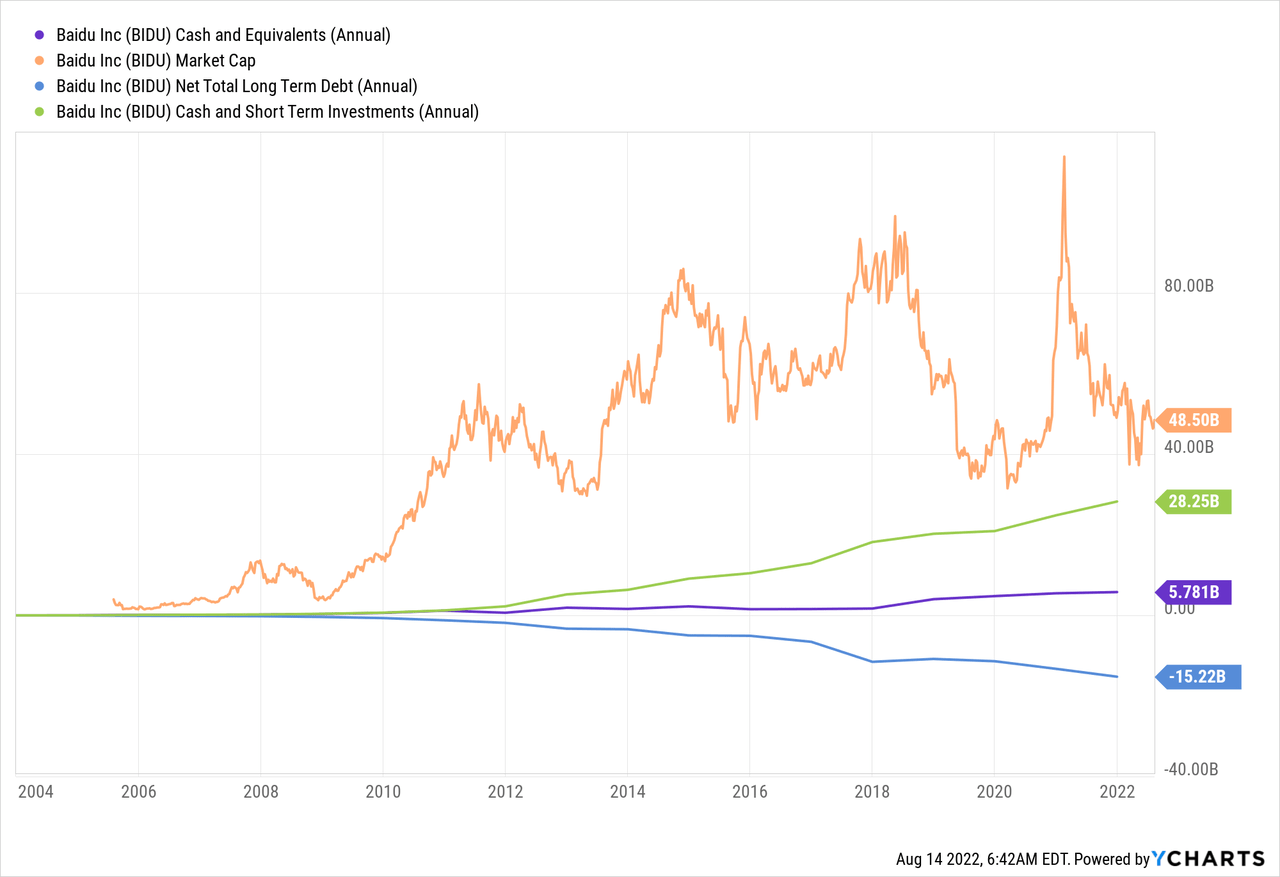

The cash balance has skyrocketed at a very rapid pace, to almost $30 billion, largely due to strong and consistent operating cash flows. Of importance, the cash balance has increased at a much faster rate versus long term debt. However, despite the massive cash balance and ability to generate substantial operating cash flows, Baidu’s market cap remains depressed, below $50 billion. To put things into context:

- cash & short term investments represent almost 60% of Baidu’s current market cap

- net debt is negative, as the company has more cash than long term debt

- net cash represents more than 30% of the current market cap

Based on the aforementioned, Baidu is dirt cheap. In fact, even though global markets have performed exceptionally well over the past decade or so, Baidu has been dead money, with the share price hovering around 2011 levels. This doesn’t make sense, especially since Baidu’s cash position is near record levels and will continue to grow due to strong operating cash flows, all else constant. To be fair, Baidu is not the only cheap Chinese tech name out there. For instance, I recently covered Alibaba and reached similar conclusions. However, for a company to suffer indiscriminately just because it happens to be of Chinese origin is inappropriate. In fact, Baidu is one of the world’s leading brands, making it on the world’s 100 most valuable brands, ranking ahead of powerhouses like Uber (UBER). What’s more, even though Baidu is often referred to as the “Google of China”, as it dominates more than 70% of China’s market share, it is so much more than just a prominent search engine. For example:

-

- Baidu has made substantial progress on cloud computing and chips (Kunlun was recently spun off)

- Baidu owns a majority stake in iQIYI (IQ), often referred to as the “Netflix of China” (note: Baidu plans to sell all its holdings in iQIYI at about $7 billion)

- Baidu has established a global leadership position in AI, including self-driving technology through Apollo, which includes robotaxis and robobuses, and recently unveiled its next-generation fully autonomous vehicle Apollo RT6, an all-electric, production-ready model with a detachable steering wheel. It is anticipated that Baidu’s robotaxi will be half the cost of taking a taxi today

- Baidu’s electric car startup Jidu Auto, a joint venture between Baidu and Geely Automobile (OTCPK:GELYF), is said to be valued around $3.5 billion, based on a new $300M-$400M funding round, as it seeks to launch its first commercial vehicle in 2023.

Therefore, in addition to its legacy search business, all stars are aligned for Baidu to also become a global force in AI, electric vehicles, smart transportation, and much more. Yet, despite the remarkable progress, Baidu’s share price remains stagnant, as outlined above. This situation cannot last forever. Not only Baidu is making meaningful progress on so many exciting strategic initiatives, its cash-rich balance sheet continues to strengthen. Why? Because, Baidu is already generating substantial and consistent amounts of operating cashflows, which enables it to invest in its future as well as hoard cash. Once these initiatives pay off, it will be generating even more substantial amounts of operating cashflows. Not many companies are in such as fortunate position. Therefore, I can only conclude that the market is either in hibernation mode or assumes that Baidu will struggle to grow. But there are no credible signs that Baidu will struggle to grow, in part due to the reasons discussed above. Baidu is not a company that is complacent. In fact, it has heavily invested billions of dollars in R&D throughout the years (this year R&D spend has increased 10% year over year). But let’s entertain the pessimistic scenario that Baidu will struggle to grow. To this end, I assume the following scenario:

- 10-year investment horizon

- $3 billion annual run rate in operating cash flow (this is below 2015 levels, which is quite pessimistic)

- Static world i.e. annual operating cash flow will remain constant at $3 billion, and this cash flow will not be reinvested, i.e., it will simply accumulate on the balance sheet (i.e., zero investments besides maintenance CAPEX, zero innovation, zero M&A activity, zero dividends, zero share buybacks, etc.)

In this pessimistic, static-world scenario, over a 10-year period, Baidu will accumulate more than $20 billion in cash, which is approximately 50% of its current market cap. This, combined with the existing cash balance of ~$30 billion, means that in 10 years from now, more than 100% of the current market cap will consist of cash. This provides a tremendous margin of safety, but it is also extremely pessimistic of a scenario. In reality, Baidu will innovate, grow originally, acquire other companies, and buy back shares. Eventually, the swelling cash position, growing cash flows and growing EPS will “force” the market to rerate Baidu at much higher levels. As such, patient investors stand to benefit. Unless Baidu’s products become obsolete. The odds of this happening are extremely low, in my opinion.

Be the first to comment