REITs That Can Fight Inflation

ekapol

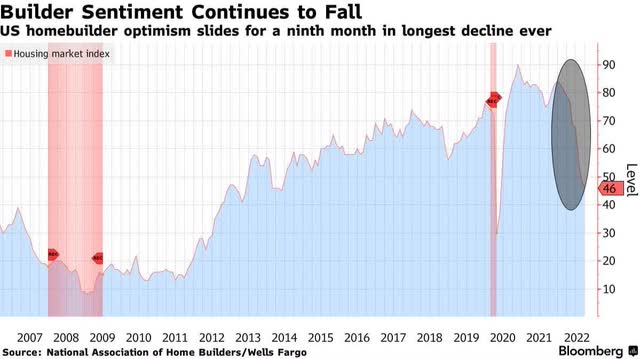

Home prices continue to fall as interest rates reached a 6% peak this month. The housing market, developers, and homebuilding is experiencing a slide, with homebuilder sentiment falling, as showcased in the Bloomberg chart below.

Homebuilder Sentiment Fall

Homebuilder Sentiment Chart (National Association of Home Builders via Bloomberg)

Year-to-date, the Real Estate Select Sector (XLRE) is -25%, and (XHB), the SPDR Homebuilders ETF is -32%. Inflated costs for raw materials, transportation, and fuel are headwinds for the industry. The National Association of Home Builders Index fell from a level of 49 in July to 46, and as fellow Seeking Alpha author Leo Nelissen writes,

“This is now the longest decline ever, although that doesn’t mean as much as sentiment in 2008 was much lower. Yet, there’s no denying that these numbers are bad. The sentiment is now well-below any levels seen during the years after 2013 when the demand side came back, prices rose, and the Fed wasn’t as aggressive.”

This results in a decline in building permits and commercial real estate deals. With rising costs for building materials and decades-high inflation creating economic slowdowns, investors want to hedge their bets on the right investments, even amid a housing downturn.

Certain real estate stocks, including REITs, are excellent diversifiers to portfolios. Finding undervalued companies that are high quality and deliver attractive returns and the prospect of future earnings offer benefits sought by investors. And while it may seem counterintuitive, with mortgage rates reaching 13-year highs of 6%, many real estate stocks continue to outperform most industries and offer portfolio diversification. While purchasing physical properties is nice, it’s becoming more difficult for the average buyer. Why not consider stocks that can provide a diversified blend of real estate assets and long-term total returns?

A Solid Hedge Against The Fed

The Fed’s third consecutive 75-basis point hike this week and updated dot-plot signal more ‘pain’ to close out the year, increasing housing recession fears. The new dot plot, with a median forecast of 4.4% for fed funds by the end of 2022, puts an additional 75 basis points in November firmly on the table. But the real estate sector offers some safe haven attributes. Like value stocks, real estate can provide competitive returns and has historically been a solid hedge against inflation and an indicator for predicting recessions and economic rallies. The good news with the REITs I am recommending is they possess yields above the Fed Fund’s forecasted rate of 4.4%. While there is some risk involved, I agree with Goldman economist Jan Hatzius who says, “While outright declines in national home prices are possible and appear quite likely for some regions, large declines seem unlikely.” As a result, I have provided 3 top quant-rated real estate stocks to consider.

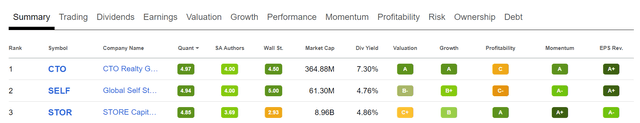

Top 3 Quant-Rated REITs

Top 3 Quant-Rated REITs (Seeking Alpha Premium)

1. CTO Realty Growth, Inc. (CTO)

-

Market Capitalization: $374.59M

-

P/FFO (FWD): 11.92

-

Dividend Yield (FWD): 7.63%

-

Quant Sector Ranking (As of 9/21): 1 out of 179

-

Quant Industry Ranking (As of 9/21): 1 out of 17

-

Quant Rating: Strong Buy

While I typically steer clear of small-cap companies, CTO Realty Growth, Inc. is a unique diversified REIT offering single and multi-tenant properties expanding across the U.S. for a solid income stream and portfolio. Nine years of consecutive dividend payments and growth coupled with a 7.63% forward dividend yield make this stock very attractive.

CTO Stock Consistency Grade (Seeking Alpha Premium)

CTO’s properties are located along the Sunbelt and focus on high-quality retail-based businesses in high-growth markets. Ranking #1 in its sector and industry, this stock offers great long-term prospects. CTO has a solid valuation and growth, and CTO owns a 15% stake in Alpine Income Property Trust, Inc. (PINE), which I ranked as a one of my Top 5 REITs for 2022. Announcing a three-for-one stock split earlier this year, the stock has gained momentum since the late June announcement.

“We believe this stock split will improve the tradability and accessibility of our common stock for investors, is a strong indication of our attractive historical performance, and reflects our confidence in our ability to deliver sustainable, long-term growth for our stockholders,” said John P. Albright, President and Chief Executive Officer of CTO Realty Growth.

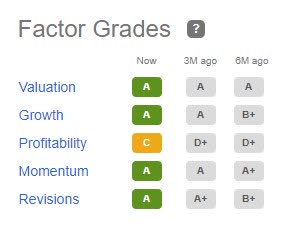

CTO Stock Factor Grades (Seeking Alpha Premium)

Given the attractive forward yield of over 7% and the stock presently trading at a post-split price of $19.82/share, which represents a forward P/AFFO of 11.04x versus the sector median 15.56x, I believe there’s upside room with this pick, whose factor grades above rate investment characteristics on a sector relative, are tremendous.

CTO Has A Great Valuation Framework

CTO Valuation Framework (Seeking Alpha Premium)

Where many stocks are selling off, CTO’s Q2 AFFO of $1.48 beat by $1.10, and revenue of $19.46M beat by nearly 40%, showcasing why our quant ratings give it a Strong Buy rating, along with our next stock pick, SELF.

2. Global Self Storage (SELF)

-

Market Capitalization: $61.96M

-

P/FFO (FWD): 15.11

-

Dividend Yield (FWD): 5.19%

-

Quant Sector Ranking (As of 9/21): 2 out of 179

-

Quant Industry Ranking (As of 9/21): 1 out of 25

-

Quant Rating: Strong Buy

I am a big fan of warehouses and self-storage, which have grown in popularity over the last few years. With little overhead and high-income potential – given their size – self-storage units offer affordable and easily accessible property for residential and commercial customers.

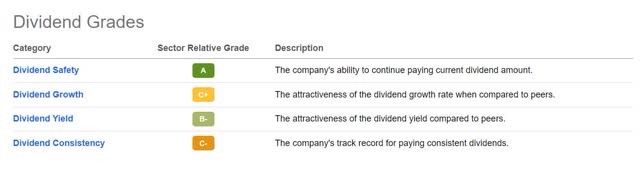

SELF Stock Dividend Grades (Seeking Alpha Premium)

An excellent investment for the tech sector, which uses warehouses for shipping and receiving, storing data centers, and high-tech logistics, SELF’s storage facilities have experienced a growing revenue stream and consecutive earnings beats.

SELF not only comes at an attractive price and valuation (forward P/AFFO of 15.11x), but its bullish momentum, growth, and profitability are showcasing why shareholders love this dividend-paying stock. SELF offers a 5.19% forward dividend yield, an ‘A’ Dividend Safety rating, and solid overall dividend grades. SELF raised its dividend by 11.5% following Q2 earnings that included an FFO of $0.11 that beat by $0.02 and revenue of $2.98M which beat by $0.02M. Given its solid balance sheet and record same-store revenues, SELF plans to pursue more properties and potential acquisitions as either wholly-owned or joint ventures, given the high demand for storage units, mainly serving the tech sector.

“Our strong pricing power, operational excellence, and revenue rate management program has driven strong cash flow, and this has allowed us to increase our dividend for common stockholders by 11.5%…”We also continued to benefit from our revenue rate management program, which dynamically manages move-in rates and existing tenant rent increases. It has enabled us to maintain a hedge against inflation due to our ability to quickly adapt our pricing to market conditions on our month-to-month rentals, said Global Self President & CEO Mark C. Winmill.

With operating income that increased 41.6% in Q2, analyst upward revisions leading to an A+ grade, and metrics that showcase an attractive stock, SELF may be in a cooling real estate market. Still, this stock is part of a red-hot warehouse market that’s driving record development.

3. STORE Capital Corporation (STOR)

-

Market Capitalization: $9.02B

-

P/FFO (FWD): 14.35

-

Quant Sector Ranking (As of 9/21): 5 out of 179

-

Quant Industry Ranking (As of 9/21): 2 out of 17

-

Quant Rating: Strong Buy

I wrote about STORE Capital Corporation a few months ago as a High-Yield Dividend Monster, given its solid dividend scorecard and 5.19% forward dividend yield. As one of the biggest and fastest triple net lease REITs possessing more than 2,500 properties, STORE offers a diversified Single Tenant Operation Real Estate.

Strongly bullish, STOR is actively trading, with analysts calling the stock overbought, despite the stock being down 8.38% YTD. With an overall C+ valuation grade, STOR’s forward P/AFFO is 13.86x compared to the sector median of 15.56x, a -10.98% difference to the sector, while offering investors a forward dividend yield of 5.16%.

STORE Dividend Grades (Seeking Alpha Premium)

Not only is the stock a strong buy, but its overall dividend grades are also attractive, offering six years of consecutive dividend growth and payments, something investors want in the current environment that’s eating away at returns. With the Fed’s third 75-basis point hike to counter inflation, STOR’s triple net lease REITs possess strong balance sheets and diversification to weather drawdowns, which we’re currently seeing in the overall markets and real estate sectors.

STOR Factor Grades (Seeking Alpha Premium)

STORE Capital’s overall factor grades are positive, including great momentum and revisions to support the stellar Q2 earnings results that led to a 7% dividend increase. Q2 FFO of $0.58 beat by $0.04, and revenue of $223.8M beat by $4.72M, resulting in a raise in guidance. “Based on our year-to-date results, we are raising our AFFO per share guidance to a range of $2.25 to $2.27, up from a range of $2.20 to $2.23. At the midpoint, this updated guidance represents greater than 10% growth over 2021,” said Mary Fedewa, STORE Capital, President & CEO.

I believe housing and real estate stocks are an excellent hedge despite expected moderation due to affordability and inflationary pressures. With the current inflationary environment and discounted price, our stock picks’ strong financials, recession-resilient characteristics, and solid fundamentals make them three solid picks to consider for portfolios. Consider these three strong buys amid rising mortgage rates based on solid fundamentals.

REIT All About Them – Top Yielding Real Estate Stocks

Despite the economic outlook and falling home and commercial real estate prices, the real estate market can still offer solid returns and hedge against rising interest rates. Although the real estate sector is experiencing a slowdown which includes a seventh consecutive decline in home sales, according to the National Association of Realtors (NAR), to reiterate Goldman strategist Hatzius’ comments, the housing market is unlikely to experience a substantial decline, which is why I’ve selected three top real estate stocks.

With increasing rates and rental income streams that are passing costs onto consumers, companies within the real estate sector are proving resilient and as income-producing inflationary hedges. The three stock picks, CTO, SELF, and STOR, come at a discount and stand to benefit from pricing competition and diversified income streams. Consider these stocks which come at reasonable price points and possess excellent fundamentals, growth, and profitability prospects. We have many Top Real Estate Stocks for you to choose from to help inflation-proof your portfolio. Our investment research tools help to ensure you are furnished with the best resources to make informed investment decisions.

Be the first to comment