gkrphoto/iStock via Getty Images

Koppers Holdings (NYSE:KOP) is a manufacturer of wood treatment chemicals and wood treated products for the railway, utility and construction industries.

The company is in a mature, commoditized, cyclical, not very attractive industry. In addition, the capital allocation shown by its management has been less than stellar.

Today, Koppers trades at a PE of 6, from what it seems to be a cyclical top in earnings. Several contingencies in the future could put more pressure on the company.

Unless there are significant changes in capital allocation, it is better to stay away from Koppers, unless the reader wants to speculate on the cyclical nature of its stock.

Note: Unless otherwise stated, all information has been obtained from KOP’s filings with the SEC.

Unattractive mature markets

KOP is a manufacturer of chemical products for wood protection. The company divides itself into three segments.

First, the Carbon and Chemicals segment manufactures carbon and oil based preservatives for wood that are also used in other industries like aluminium. Its main products are coal tar pitch and creosote. The segment is in a very mature or even declining industry that is being attacked on environmental grounds, with commoditized products and low margins. Production is moving out from the US, where KOP’s facilities are located.

Carbon and Chemicals sells to the second segment, Railroad and Utilities, that mostly buys wood preservatives made by CMC, and treats wood using pressure to insert the chemicals in the wood. These treated pieces are then sold as crossties for railroads or poles for utilities. KOP is one of the leaders if not the leader in the US and has a presence in Europe and Australia as well. Again, the industry is very mature or declining, with an undifferentiated product that is sold based on price and closeness.

Finally Performance Products manufactures copper based protective chemicals for wood, and also pressure treated wood with those chemicals. These are utilized in construction for the most part. The segment is also mature, with some more leeway for differentiation and the creation of a brand, given that they are sold a little bit farther along the production chain. According to KOP, it is the market share leader in this segment.

The three segments are in mature industries, although they have been listed in a somewhat descending order of commoditization. The company does not provide gross margins so we can compare operating margins based on the 10-K reports for FY21 and FY18. Worse in order comes Railroads and Utilities with operating margins below 6% for the past 6 years. Then Carbon and Chemicals, with margins ranging from 0% to 12%, depending on the cyclical nature of the business. Finally Performance Chemicals, with margins ranging from 12% to 20%.

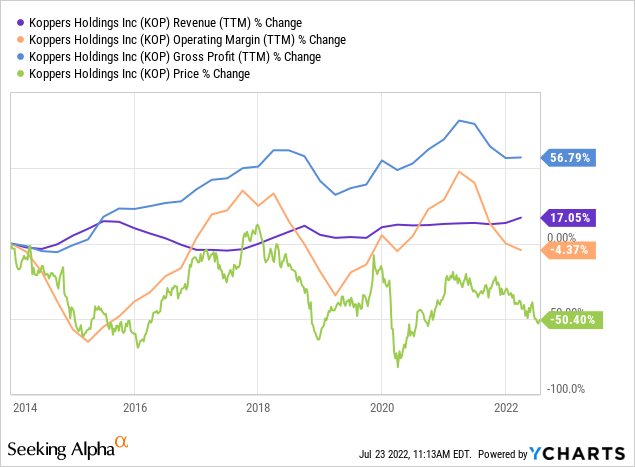

All of the segments suffer from cyclicality, CMC ranging from lows of $20 million in operating losses to $60 million in operating profits, RU from $6 to $60 million and PC from $30 to $80 million. The cyclicality is compounded by significant operating leverage, that can be seen in the low margins described above and also in the chart below, where small movements in revenue generate enormous movements in operating profits. It seems that the stock movement has in part followed and in part predicted similar movements in operating profits.

Capital allocation is the problem

Being in less than desirable industries is not a problem per se for the investor. A company in an undesirable industry can slowly move towards a better niche, improve efficiencies and milk the market while it can, or return capital to stockholders.

Unfortunately, KOP did not follow these paths in the past, quite the contrary, it has engaged in questionable capital allocation decisions.

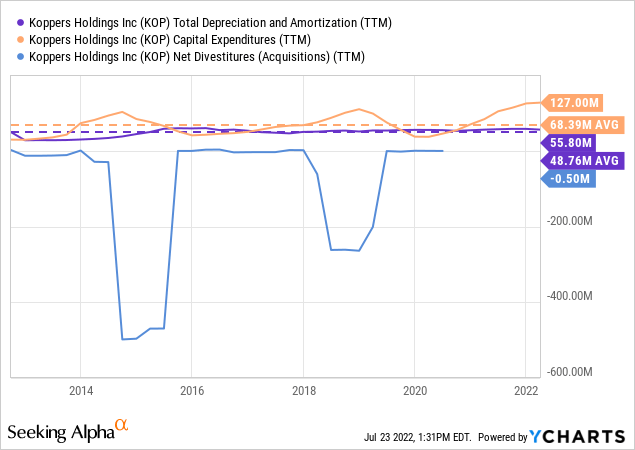

One example is CAPEX, one would expect the company to slowly divest or at least stop maintaining its assets, as they do not provide significant returns. However, as the chart below shows, not only has KOP kept capital expenditures above depreciation on average (meaning net investments in capital), but also done substantial acquisitions, which we will comment on later.

Have these investments been done at least in the more profitable segment of PC instead of the rest? Not so much. In the past six years, the CMC segment received $243 million in capital investments, the RU segment received $150 million, plus acquisitions for $270 million, and the PC segment received only $78 million.

Acquisitions have been mixed.

The big acquisition shown in 2014 was the PC segment, previously inexistent, acquired from a company called Osmose. The segment was nonexistent in the FY13 10-K report. According to the company’s FY15 10-K report, Osmose was paid $500 million, mostly debt financed. At the time it was a substantial price, considering Osmose had generated $150 million in revenues and $5 million in operating profits in 2013. However it turned out relatively fine, because this segment became the only one that is consistently profitable and that has a higher operating margin.

Then in 2018, the company acquired the utilities business of a competitor, for $260 million, again financed with debt. The acquired business had generated $150 million in revenues and $4 million in operating losses in 2017. After 2018, the RU segment did increase its operating profits, but not above what had been common in previous upturns of the cycle. For example it generated $50 million in 2019, but it had generated the same in 2016. Also when the cycle turned downwards, like in 2021, it generated the same as in 2017, around $25 million.

KOP also started a process of closing facilities in 2014, particularly in the CMC segment. The company claims that it has closed 11 facilities in that segment alone, including the sale of their Chinese subsidiary for a $40 million gain.

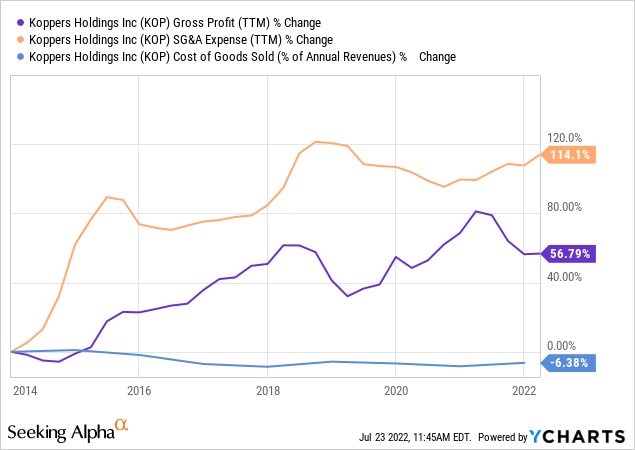

And indeed this policy did generate an increase in gross profits above the increase in revenue, as can been seen in the chart in the previous section. However, as can be seen below, SG&A expenses raised even more than gross profits, generating no movement in operating profits.

Finally, a company in this situation could buy back stock to increase EPS on the same business, or pay substantial dividends. However, KOP has not paid dividends since 2014, only recently announcing $0.05 quarterly dividends, yielding 1%. Outstanding stock remains at 21 million shares as it did in 2012.

Going ahead

The cycle seems to be on the downward portion again, at least for the Railroad and Utilities since 2021 on a YoY basis and for Performance Chemicals according to the latest quarterly data.

Some investors may want to speculate on the cycle going up again, and selling high. However, other risks besides the cycle may hurt a cyclical strategy.

First, the company is environmentally liable. Up to this point, it did not have to pay much for environmental remediation, with charges ranging from $5 to $10 million depending on the site. However, that may be different if one factory is found polluted as the divestment plan advances.

KOP is also exposed to environmental risks because CMC and RU products are very polluting and toxic. Creosote, for example, can only be handled by trained employees and should not be placed close to humans. Some of these products may be forbidden in the EU or in North America in the future.

Financially, the company is not in big trouble. It has $500 million in notes maturing in 2025, paying 6%. It also has an $800 million credit facility signed in June that carries variable interest at 1.5 to 2.5 + SOFR, depending on the credit stance of the company. At current SOFR rates, it could represent between 3% and 5.5%. The facility matures in 2027, but it can accelerate if KOP does not refinance or pays back the $500 million in notes 90 days before their maturity.

In accounting terms, the company may need to register some goodwill impairment on its RU segment, according to their FY21 goodwill impairment report included in their 10-K. The segment currently holds $120 million in goodwill and is going through a downward part of its cycle. Goodwill impairments are non cash based losses, but they can generate stock price movements.

On the positive side, it would be good to see the company slowly reduce its capital expenses in the less profitable business and trying to increase investments for its PC segment. The company expects $95 million in capital expenses this year, above depreciation again, but it has not provided any guidance on the segments where it will invest.

Also, it would be interesting for KOP to start tackling the environmental challenges and provide the railroad and utilities industry with products that can actively replace creosote and other pollutant products. In this way it could gain a substantial competitive advantage, turning upside down a risk. The company does have some environmental certifications for its Performance Chemicals segment.

Conclusions

With operations as they are, KOP is exposed to significant risks besides its cyclicality, and it constitutes a value trap and also a speculator’s trap.

It could do better as an investment if it significantly improved capital allocation, by reducing overall CAPEX, redirecting it towards the most profitable PC segment, trying to transform its environmental risks into competitive advantages and returning more capital to stockholders.

In the meantime, it is an interesting business to follow but not to invest in.

Be the first to comment