gorodenkoff

Computer Services, Inc. (OTCQX:CSVI) just recently joined the dividend kings, a group of companies having 50 or more years of consecutive dividend increases.

At first glance, Computer Services seems to be an unlikely candidate to be a king of anything. It is a small cap that trades over the counter. It is not a member of the S&P 500, so it is not a Dividend Aristocrat. Yet it has increased dividends through eight recessions. In addition, the company recently reported:

- 22 consecutive years of revenue growth

- 25 years of net income growth

- 50 years of dividend growth

Business

CSVI has offered computer services to customers from the beginning of its history. The company opened its doors in 1965 with six employees, three customers, and a $321,400 Burroughs B300 computer. The computer sorted checks and deposit slips printed with MICR characters at a rate of 1,500 pieces per minute.

The company reorganized into two operating segments in 2020.

The core banking services are in the Enterprise Banking Group. This includes payment solutions as well as mobile and internet banking.

The Business Solutions Group covers a myriad of services including:

- Document solutions: check imaging, branch and merchant capture, various document delivery services

- Managed services: cyber security, network management, cloud-based management services, corporate intranets, telecommunication, remote banking connectivity, web hosting, board portals, software licensing and installation, and professional services

- Regulatory Compliance: compliance software, homeland security, anti-money laundering, anti-terrorism financing, and fraud prevention

A detailed list of the company’s extensive services can be found in the company’s supplemental disclosures to the annual report.

The financial services industry is subject to extensive government regulations. This provides a moat for the company rather than a risk. The company becomes the expert in meeting regulations and codes the knowledge into its software for all its clients. Other companies would need to do significant work to match this knowledge and incorporate it into the software.

Software must be accurate, but it also must be usable. Computer Services was recognized by Aite Group as providing the “best user experience” in its 2019 AIM Evaluation. One report wrote,

it’s no surprise they got the award. CSI’s efficient and transparent management team, in conjunction with their high retention rates are the leading reasons for this achievement.

Tim Viere, CEO of EntreBank said of selecting Computer Services,

In every measure, CSI rose to the top as the best banking services provider that could deliver the innovative technology advancements and customer service we needed to deliver that value for our customers.

In 2019, the company has been recognized as one of Best Places to Work for seven consecutive years by the Kentucky Chamber of Commerce and the Kentucky Society for Human Resource Management. The company was again named one of the Best Places to Work in Kentucky in 2022, making the list for ten consecutive years. The company was also recognized to be a best place to work in Illinois. The company has a fair ranking of 3.7 at Glassdoor.

The directors and executive officers together own 2.22% of shares.

As of this writing, the dividend sits at a shade above 3%.

Valuation

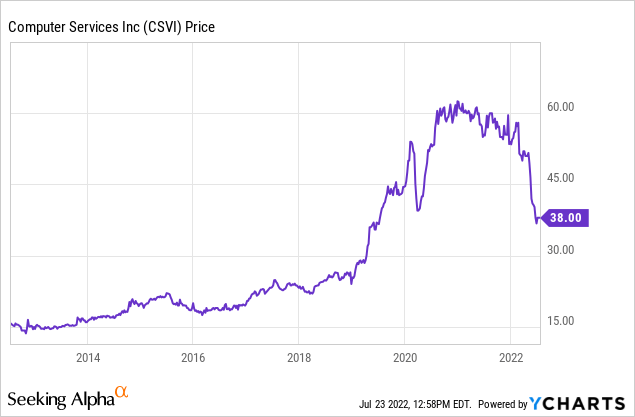

The company’s stock price more than doubled in 2019, plummeted during the pandemic in 2020, than rose still more in a V-shaped recovery. Since mid 2020, however, the stock price has drifted downwards. In the last six months it repeated the swan dive that it did during the pandemic. The stock price is currently at pandemic lows:

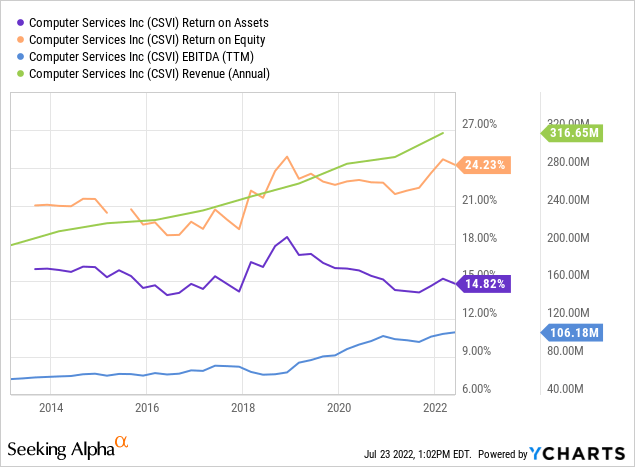

This is the same company that has been growing revenue, earnings, and ROA steadily for years:

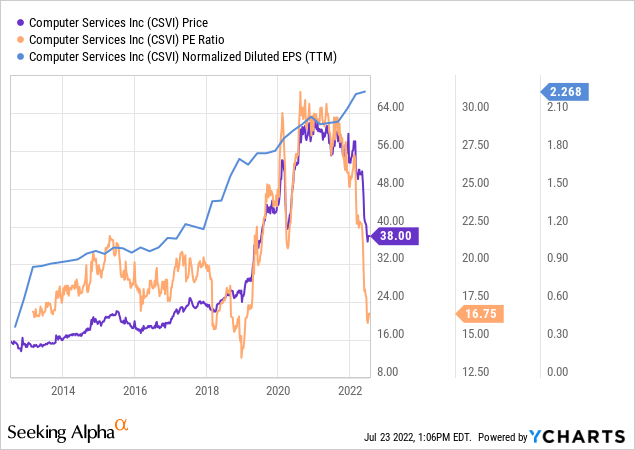

It should not be surprising that the P/E for the company is now at a low not seen since 2019, a low seen only three times in the last decade:

Possible Risks

The biggest risk at present is that the stock price will continue to plummet. It is almost a quintessential example of a falling knife. It is usually not a good idea to try to catch one.

In addition, the stock is small and does not trade on major exchanges. Such stocks are typically more volatile and risky than other stocks.

Keep in mind, though, that this is not a typical small cap company. Its stability is plain to see. The company is not in jeopardy in any way.

Nor is the dividend at risk. The company sports a Current Ratio of 2.48 and a Quick Ratio of 1.88. These numbers have not changed much over the years. It is hard to imagine a dividend king discontinue dividend increases after 50 years.

The biggest issue might be simply be that its total return over the long term is lower than growth investors typically like to see. The recent drop in stock price might well compensate handsomely for that. I myself made a good bit of money from the stock’s recovery from pandemic lows. I expect I will again see a nice return from this low, even if the rise in stock price is not as dramatic as it was two years ago.

Conclusions

Computer Services is as solid a company that can be found anywhere, having increased its revenue, net income, and dividends in good times and bad. It has survived quite well in past recessions, and it should do just fine in the next one. Its software has won at least one award, and the company has gained notice as a good place to work in both Kentucky and Illinois.

The revenue growth should continue, slowly and steadily. The stock price should resume its upward climb sooner or later. The lower it drops, the more dramatic the recovery should be.

I have recently bought shares at $38.27 for my portfolios, to replace the ones I sold off some months ago. I intend to dollar average additional positions in coming months.

Be the first to comment