AvigatorPhotographer/iStock via Getty Images

Thesis

The BMO MicroSectors U.S. Big Oil Index 3X Leveraged ETN (NRGU) is an exchange traded note that has an objective of giving an investor three times the daily performance of the Solactive MicroSectors U.S. Big Oil Index. The return is based on changes in the level of the Index on a daily compounded basis, before fees are taken into account. The Index has only ten companies composing it, as we detail in the Holdings section below. Inflation accelerating corroborated with continued flare-ups in Covid variants set the stage for an ever increasing volatile price action in the energy space, but within a well-defined uptrend. NRGU is a good vehicle to take advantage of temporary dips in the energy markets for outsized returns. Already up 63% year-to-date NRGU has a lot more space to run, in what some market participants are characterizing as a structural bull market in commodities. We are Bullish NRGU for 2022 with well-chosen entry points on the back of risk-off scenarios where we have seen the energy markets take a beating, with the most recent event in December 2021.

Performance

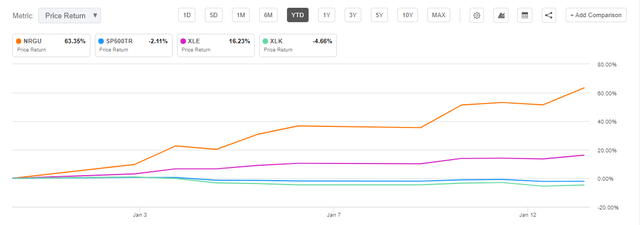

The fund is up substantially in 2022 as more market participants flee Tech stocks and rotate into value and specifically Energy:

YTD Price Return Seeking Alpha

As we can see from the year to date performance graph NRGU trounced both the Energy Select Sector SPDR Fund (XLE) and the S&P 500 Index (SPY), with NRGU up over 63% while XLE is up “only” 16% and the S&P 500 is in the red for the year.

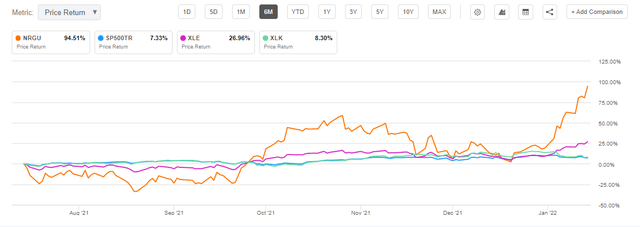

The vehicle is not a buy-and-hold vehicle as it experiences massive volatility due to its leveraged nature:

6-Months Performance Seeking Alpha

When we look at a 6-month graph we can see that NRGU was up substantially before the December sell-off driven by the omicron variant emergence. In December NRGU retraced all of its gains. The vehicle is volatile and the best trading strategy here is to pick a good entry point driven by an energy market sell-off and have a 30-50% profit target in mind when one can exit. This strategy would have made you a 50% profit from September to late October and a savvy investor could have re-entered the same trade during the December Covid flare-up to net another 50% in the subsequent 4-weeks. NRGU is best traded for short periods of time and on the back of volatile days in the energy market. I am firmly in the camp that Energy will outperform this year and the years of underinvestment in a “dirty” sector such as Oil&Gas will take their toll on higher prices in the future. A lack of Capex in a sector that needs continuous investment in order to pump out the same amount of oil each year will result in tighter production down the line coupled with a delayed and expensive transition to clean energy.

NRGU is not a vehicle to be used by any investor since it represents a very volatile and risky instrument, but thoughtfully utilized by a sophisticated investor it can generate outsized results in a very short amount of time.

NRGU Metrics on a 3-year look-back period:

- Standard Deviation: 141%

- Max Drawdown: -97%

- Sharpe Ratio: 0.28

Holdings

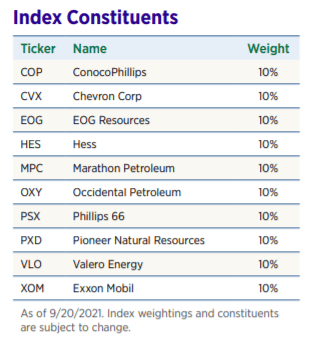

As discussed above the fund replicates the performance of the MicroSectors U.S. Big Oil Index which has only ten components:

Index Components

The ten components are generally large cap energy companies that have experienced significant analysts upgrades in the past few months:

Valero Energy (VLO):

* Barclays raised their price target for VLO

* Cowen increased their price target for the company

Chevron Corp (CVX):

* Wells increased their price target for CVX

Conclusion

NRGU is a leveraged ETN that offers exposure to ten large North American Oil & Gas companies. The vehicle has 3x leverage which makes it a very volatile instrument. However the structural leverage coupled with the structural bull market in energy stocks provides for very attractive returns if entry points are chosen carefully. We are Bullish NRGU for 2022 with well-chosen entry points on the back of risk-off scenarios where we have seen the energy markets take a beating, with the most recent event in December 2021.

Be the first to comment