SimonSkafar

CMS Energy Corporation (NYSE:CMS) is one of the largest regulated electric and natural gas companies in the highly-populated state of Michigan. The utility sector as a whole has long been very popular with conservative investors in search of income, such as many retirees. Admittedly though, electric ones have been more popular and have generally had higher valuations than natural gas ones due to interest in electrification. However, neither electric nor natural gas utilities are likely to go anywhere in the near future, which works out quite well for CMS Energy.

The company appears to have benefited from some of the beliefs about natural gas becoming obsolete, though, as its valuation is incredibly attractive at the current level. This could provide an opportunity for any investor looking for a company with stable and secure cash flows along with a very appetizing 3.45% dividend yield. In fact, the company looks much more attractive as an investment today than it did the last time that I discussed it despite the overall thesis not changing. Thus, there certainly looks to be a lot to like here.

About CMS Energy

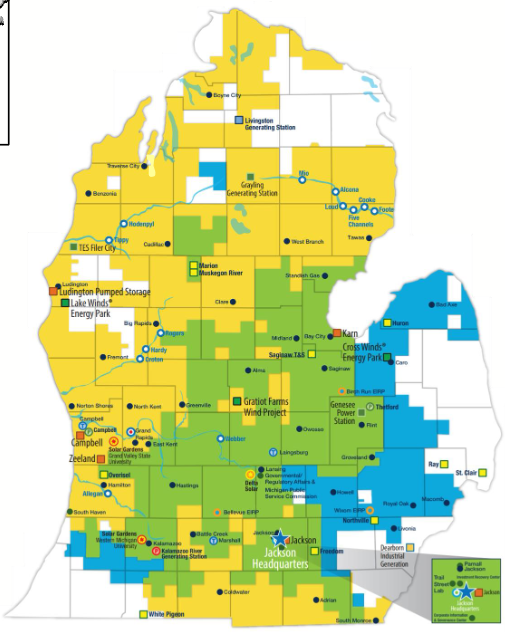

As stated in the introduction, CMS Energy is one of the largest electric and natural gas utilities in the state of Michigan. Indeed, the company’s service area includes most of the state except for the city of Detroit and the Upper Peninsula:

CMS Energy

The state is highly populated and, as might be expected, CMS Energy has a very large customer base. The company serves approximately 6.8 million residents, which includes 1.9 million electric and 1.8 million natural gas customers. This relatively even mix between electric and natural gas customers is quite nice to see because of the characteristics of each of these fuels.

In short, both electricity and natural gas have a certain seasonal element to them. During the winter months, natural gas sees considerably higher consumption, as people are using it to provide space heating to their homes and businesses. Electricity, on the other hand, tends to be utilized year-round, but it does still see by far its highest usage during the summer months as people use it to power air conditioners, fans, and other things that they are not using during the colder months of the year.

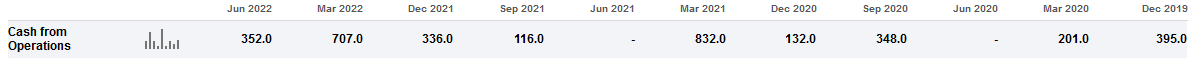

The fact that the company has a relatively balanced mix of both customer types thus helps to balance out its cash flows from quarter to quarter and reduce the seasonal fluctuations that we might otherwise see. It is not completely successful at this, though. As we can see here, CMS Energy typically has substantially higher operating cash flow during the first quarter of the year than it does at other times:

Seeking Alpha

At first glance, this may appear to counter the statement that I made in the introduction about utilities like CMS Energy enjoying remarkably stable cash flow. However, it is important to keep in mind that Michigan is the ninth-coldest state in the United States. We can, therefore, expect that heating is going to be utilized much more than air conditioning in most residences, so the increased demand for electricity during the summer months cannot completely offset the demand for heating during the colder months. If we look at the company’s trailing twelve-month operating cash flow, we do see a great deal of stability:

Seeking Alpha

The reason for this stability is that most people consider electric and natural gas services to be necessities for our modern way of life. This is reinforced by the fact that the government and various charities provide assistance for people that need assistance paying their utility bills. As such, we can assume that people will prioritize paying their utility bills ahead of more discretionary expenses during times when money gets tight.

This is something that might be very important now as there are very real signs that the United States is either in or very soon will be in a recession. The nation has now seen two consecutive quarters of negative gross domestic product growth, which is the classic definition of a recession. As I pointed out in a recent article, it is very likely that the third quarter of 2022 also experienced negative gross domestic product growth. Recessions tend to hurt the budgets of the poorest members of society the hardest, which is especially true when we combine one with the inflation that we have been seeing in both food and fuel. Thus, it may be a good idea to be invested in a company that exhibits very stable finances like CMS Energy as opposed to one that is more reliant on discretionary spending.

Naturally, as investors, we are not satisfied with mere stability. We want to see the companies that we are invested in deliver growth. CMS Energy is quite well-positioned to do this by two methods. The first is customer growth. Admittedly, Michigan is not one of the more rapidly-growing states, but it is projected that the number of households and businesses in CMS Energy’s service territory will grow at a 1% compound annual growth rate over the next few years. It should be fairly obvious how this will result in growth. After all, if the company has more customers paying their electric and gas bills then its revenues should increase all else being equal. This should result in more money making its way down to the company’s bottom-line profits and cash flow. Naturally, though, a 1% growth rate is not nearly enough to satisfy most investors.

The primary method that CMS Energy will use to generate earnings growth is to increase the size of its rate base. The rate base is the value of the company’s assets upon which regulators allow it to earn a specified rate of return. As this rate of return is a percentage, any increase to the firm’s rate base allows it to increase the prices that it charges its customers in order to earn that rate of return. The usual way that a company increases its rate base is by investing money into upgrading, modernizing, and possibly even expanding its utility-grade infrastructure. CMS Energy is planning to do exactly this by spending approximately $14.3 billion over the 2022 to 2026 period on this task.

This should have the effect of increasing the company’s rate base by $5.5 billion (26.19%) over the period. At this point, there will undoubtedly be some investors that point out that this rate base increase is far less than the amount that the company is spending. There are two reasons for this. The first is depreciation, which is constantly reducing the value of the company’s capital assets. Thus, something that the company purchases this year will have a lower value to contribute to the company’s rate base in 2026. As such, the company’s spending needs to overcome the depreciation and still increase the overall value of its assets in service.

The second reason why the rate base will not grow as much as the amount that the company is spending is that some portions of the new assets are intended to replace assets that the company intends to retire and take out of service. Obviously, these retired assets will no longer be able to contribute their value to the rate base and thus offset some of the spending. Overall, though, CMS Energy should still be able to grow its earnings per share at a 6% to 8% rate over the period. When we combine this with the 3.45% dividend yield, investors should be looking at a 9.5% to 11.5% total return over the 2022 to 2026 period, which is certainly very reasonable for a low-growth utility stock.

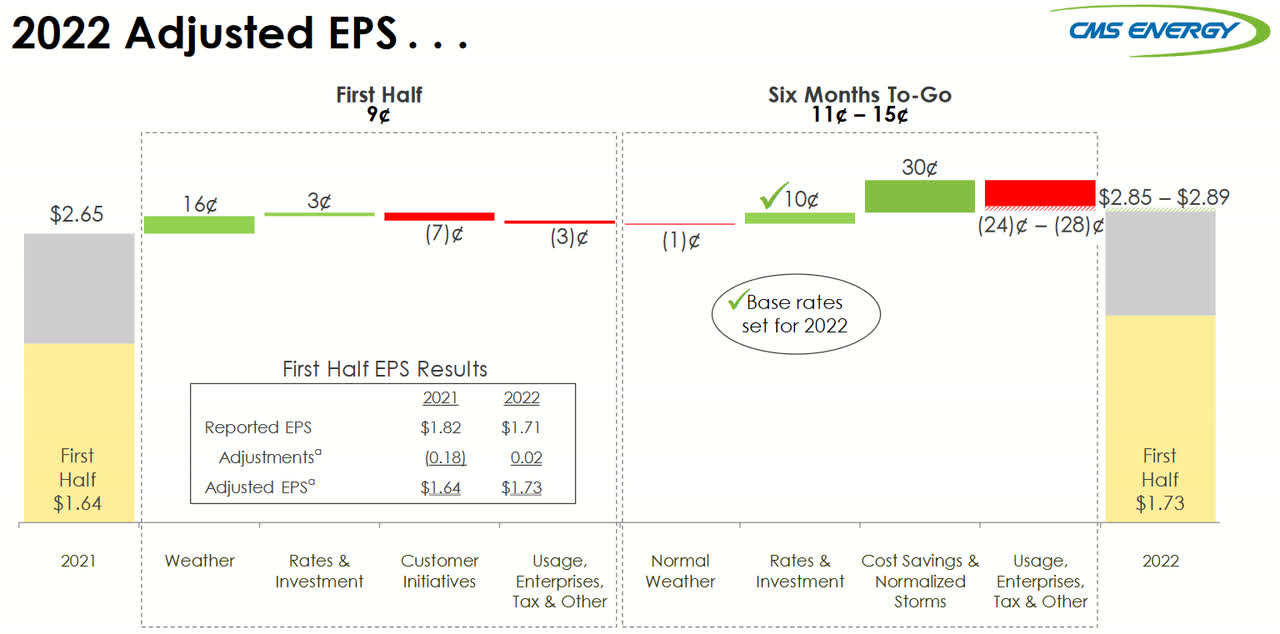

Unfortunately, we did not see this growth play out in the company’s second-quarter 2022 earnings report. During that quarter, CMS Energy reported earnings per share of $1.71 compared to $1.82 in the prior-year quarter. However, the company did see its revenue increase significantly, going from $1.558 billion a year ago to $1.920 billion in the most recent quarter. This is not necessarily a problem, however, since the decrease in earnings was driven by employees accepting the company’s voluntary separation program. Basically, the company has to pay its union employees a great deal of money upfront in exchange for them choosing to retire early.

This should not be a repeating cost, so we can ignore it in order to see how the company’s regular operations actually performed. If we do this, CMS Energy would have reported earnings per share of $1.73 per share compared to $1.64 per share a year ago. The company expects to be able to keep up this growth over the second half of the year, with adjusted earnings per share coming in at $2.85 to $2.89 for the full-year 2022 compared to $2.65 in 2021:

Interestingly, CMS Energy has not so far been suffering from the increased fuel costs that many other electric utilities have seen, or perhaps management has simply not revealed that. The company generates 31% of its electricity from natural gas, and as everyone reading this is no doubt well aware, natural gas prices have risen by 16.88% over the past year. This has proven to be a drag on the earnings of most utilities since they purchase a large amount of natural gas to fuel their plants. CMS Energy does as well, but so far, these higher fuel costs have apparently not hurt the company significantly. It is certainly possible that this could change if natural gas prices rise, however. Thus, it is certainly possible that the company will fail to meet its earnings per share guidance. When we consider the overall weakness in the economy, though, it is somewhat more likely that natural gas prices will moderate in the short term, resulting in management’s guidance proving to be fairly accurate.

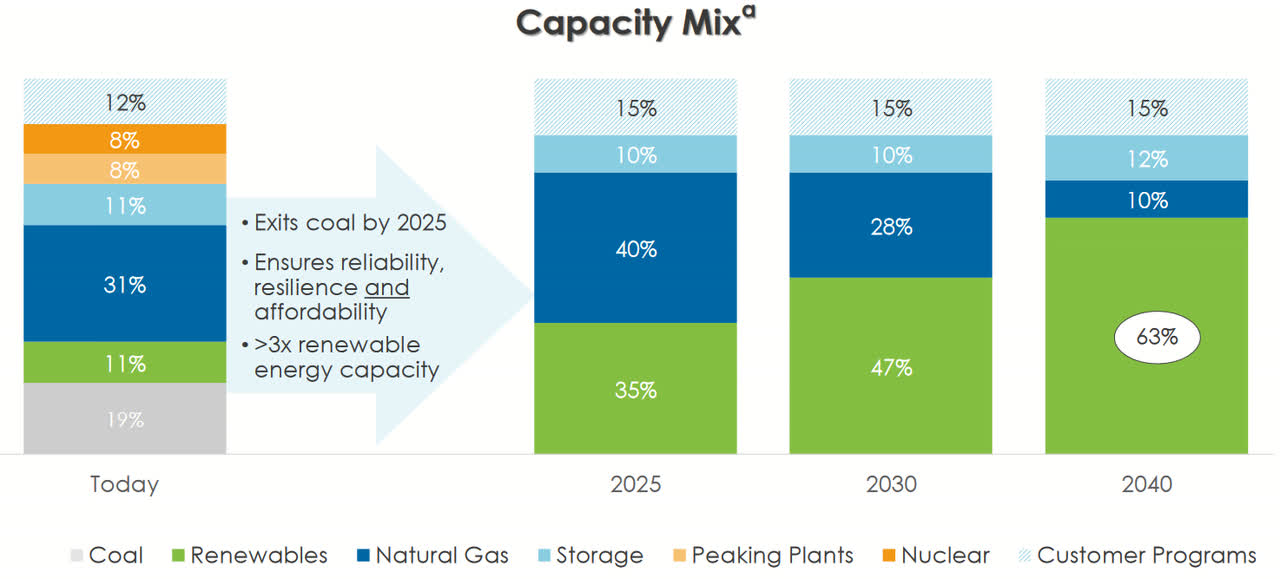

As stated earlier, one of the reasons why the rate base growth will not equal the amount of money spent is because the company is planning a few asset retirements. The most significant of these is that it will be retiring all of its existing coal-fired power plants. This is a part of the company’s goal to achieve net-zero carbon emissions by 2040. As coal is by far the largest emitter of carbon of any fuel currently in use, this makes a great deal of sense. However, it is a fairly expensive and ambitious plan since the company actually wants to retire all of its coal capacity by 2025. This is because 19% of its current electricity generation capacity consists of coal-fired power plants. CMS Energy will need to construct a great deal of new capacity in order to accomplish this, which will primarily be renewables supported by natural gas:

CMS Energy

As we can see, the company plans to have 35% of its electricity generated by renewables by 2025, a massive increase from 11% today. However, we also see the percentage of natural gas in its energy mix increasing over the same period. This is not exactly unusual due to the biggest problem with renewable power today. Despite what many proponents of the “green” economy proclaim, renewable power is not particularly reliable. After all, solar energy does not work at night and it is much less effective on cloudy, rainy, or snowy days, which are quite common in Michigan. In addition, wind power does not work when the air is still, or ironically when the wind is blowing too quickly. Thus, something reliable needs to be used to support the renewables when they are unable to produce sufficient electricity to maintain the grid. That something, by and large, is natural gas. This is because natural gas burns much cleaner than any other fossil fuel and it can produce electricity reliably. This is why natural gas is called a “transitional fuel,” as it provides a means to support the needs of a modern electric grid while still serving to reduce greenhouse gas emissions.

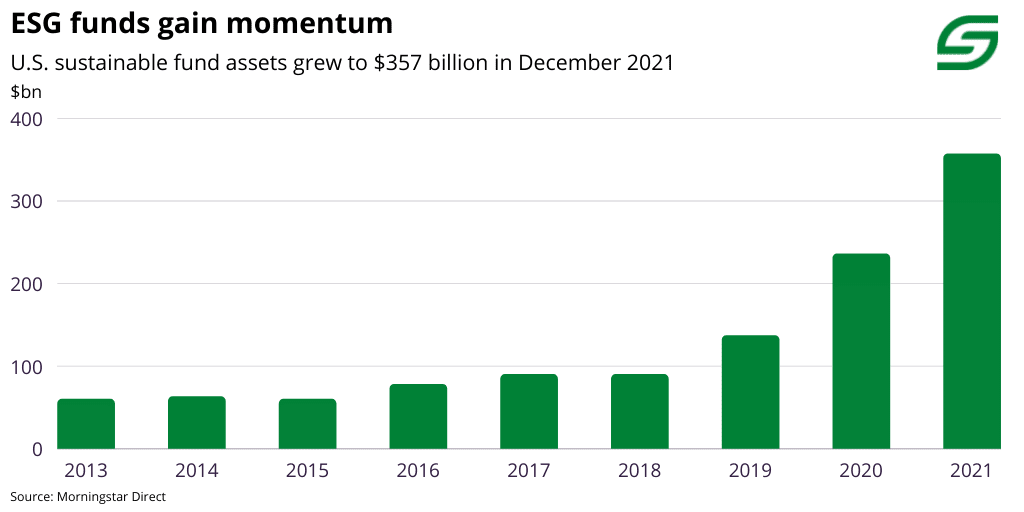

Another thing that we notice is that CMS Energy intends to be deriving fully 63% of its electric generation capacity from renewables by 2040. This is something that might begin to endear it to the managers of the various environmental, social, and governance funds that have emerged over the past several years. If this happens, it could prove to be a benefit to investors due to the sheer quantity of assets controlled by these funds. As of December 31, 2021 (the most recent date for which data is currently available), American environmental, social, and governance funds had approximately $357 billion under management, a tremendous increase over previous years:

Sustainfi.com/Data from Morningstar Direct

This admittedly may be due to idealistic young investors putting the money that they received from their COVID-19 stimulus checks into these funds. The cause of the increase is somewhat irrelevant for our purposes, however. Despite the large number of assets controlled by these funds, American funds are well beyond their European counterparts. According to Morningstar Direct, European environmental, social, and governance funds controlled $2.231 trillion worth of assets as of December 31, 2021. These are the kind of numbers that can have a very significant impact on a company like CMS Energy, which only has a market capitalization of $16.08 billion. If the management of these funds becomes interested in the company due to its improving renewable credentials, they may begin to purchase the stock, which will certainly drive up the price because of the amount of money that would be deployed on the buy side. In addition, this same effect could prevent the stock from falling too far in the event of a market correction. Overall, any investor should be able to appreciate this, regardless of one’s individual stance on renewable sources of power.

Natural Gas Utility Fundamentals

Earlier in this article, I stated that some market participants apparently believe that natural gas utilities will soon become obsolete and thus may not like that CMS Energy has relatively balanced exposure to both electricity and natural gas. This is a viewpoint that has been promoted by the proponents of electrification, which includes politicians, environmental activists, and various members of the media. At its core, electrification refers to the conversion of things that are traditionally powered by fossil fuels to the use of electricity instead. One of the most commonly cited targets for conversion is space heating, which is the most common use of natural gas supplied by utilities.

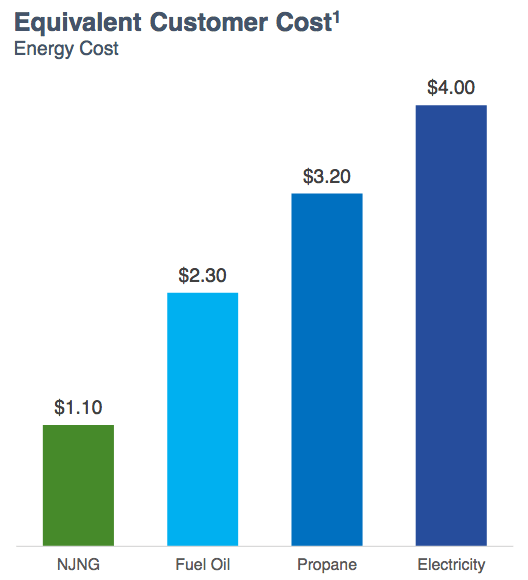

However, it seems incredibly unlikely that this will happen to any great degree in the near future, particularly in colder states like Michigan. One of the biggest reasons for this is that electricity is much less efficient at producing heat than natural gas. As a result, it is considerably more expensive to heat a home with electricity instead of natural gas:

New Jersey Resources/Data from US EIA

As we can see, it can be nearly four times as expensive to heat a home with electricity as opposed to natural gas. This is despite the significant increase in natural gas prices that we have seen over the past eighteen months. It seems rather unlikely that very many people will be willing to replace their current natural gas heating system with an electric one and have their bills go up to that degree. This is especially true for people of limited means or that live in states with cold climates like Michigan.

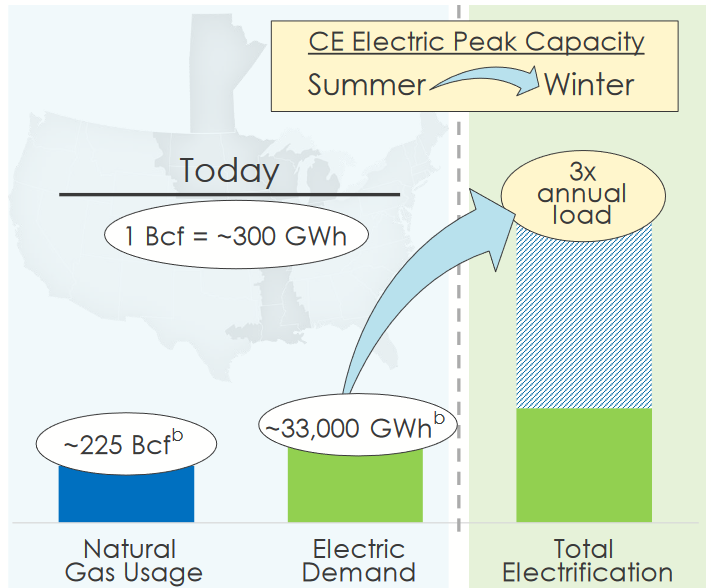

Another reason why the replacement of natural gas with electricity for space heating purposes is rather unlikely is that the electrical grid cannot handle it. Today, CMS Energy’s customers use approximately 225 billion cubic feet of natural gas annually to heat their homes. It would require approximately 33,000 gigawatt-hours of electricity to produce the same quantity of energy. That would require tripling the peak capacity of the electrical grid:

CMS Energy

This does not even include the impact of electric cars, which I discussed in an earlier article. It seems highly unlikely that the electric grid will be able to be built out to this degree without enormous investments to expand the grid as well as advances in technology that can bring down the price of electricity to eliminate the cost disadvantage. These things are not expected to happen until 2050 or later according to the United States Energy Information Administration, which I pointed out in my previous article on CMS Energy (linked above). Overall, investors should have no particular concerns about the company’s sizable natural gas utility business suddenly becoming obsolete.

Financial Considerations

It is always critical that we analyze the way that a company is financing itself before making an investment in it. This is because debt is a riskier way to finance a company because debt must be repaid at maturity. As few companies have the ability to accomplish this using their cash on hand, the debt is usually paid off by issuing new debt and using the proceeds to pay off the existing debt. This can, of course, cause a company’s interest costs to increase following the rollover depending on the market conditions. In addition, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes a decline in cash flows could push a company into insolvency if it has too much debt. Although utilities such as CMS Energy tend to have remarkably stable cash flows, bankruptcies are not unheard of in the sector so this is still a risk that we should consider.

One method that we can use to analyze a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well the company’s equity will cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important.

As of June 30, 2022, CMS Energy had a net debt of $12.353 billion compared to $7.471 billion of shareholders’ equity. This gives the company a net debt-to-equity ratio of 1.65. Here is how that compares to some of its peers:

|

Company |

Net Debt-to-Equity Ratio |

|

CMS Energy |

1.65 |

|

DTE Energy (DTE) |

2.23 |

|

Avista Corporation (AVA) |

1.17 |

|

Eversource Energy (ES) |

1.41 |

|

Entergy Corporation (ETR) |

2.18 |

As we can see here, CMS Energy does appear to be more highly levered than some, but not all, of its peers. This might mean that the company is using more debt than it should to finance itself but considering that it is still roughly in the middle of the group, it is probably not too bad. Overall, investors do not appear to have too much to worry about here but I would certainly prefer if the company were to get this down a bit, especially considering that it will be spending a great deal of money in the near future to fund its renewable ambitions.

Dividend Analysis

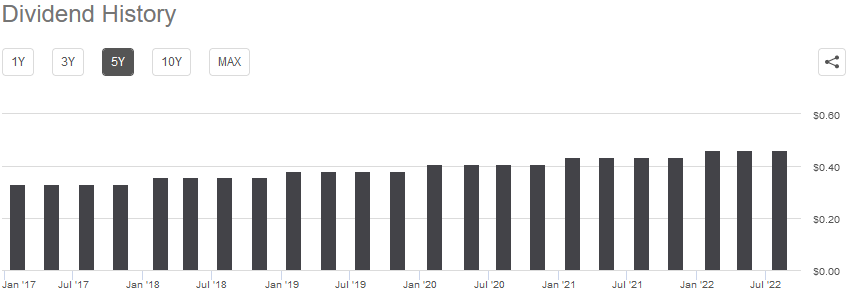

One of the primary reasons why investors purchase shares of utility companies is because of the very high yields that they tend to pay out. CMS Energy is certainly no exception to this as the stock’s 3.45% current yield is significantly higher than the 1.73% yield of the S&P 500 index (SPY). CMS Energy also has a history of increasing its dividend annually:

Seeking Alpha

This is something that is quite nice to see during inflationary times like the one that we are experiencing right now. This is because inflation is steadily reducing the number of goods and services that a person can purchase with the dividend that they receive from the company. This can make it seem like one is getting steadily poorer and poorer, which is a particularly big problem for retirees or others that are depending on the dividend to pay their bills and finance their lifestyles. The fact that CMS Energy gives its investors more money each year helps to offset this effect and ensures that the dividend can maintain its purchasing power over time.

As is always the case though, it is critical that we ensure that the company can actually afford the dividend that it pays out. After all, we do not want to find ourselves in a situation where the company is forced to cut the dividend since that will both reduce our incomes and almost certainly cause the stock price to decline. The usual way that we determine a company’s ability to pay its dividend is by looking at its free cash flow. Free cash flow is the amount of money that is generated by a company’s ordinary operations and is left over after it pays all its bills and makes all necessary capital expenses. This is therefore the money that is available to do things such as reduce debt, buy back stock, or pay a dividend. In the twelve-month period that ended June 30, 2022, CMS Energy reported a negative levered free cash flow of $1.6245 billion. This is obviously not enough to pay any dividend, yet the company still paid out $529 million during the period. At first glance, it certainly appears that the company cannot afford this dividend, which is certain to discourage some investors.

However, it is not uncommon for a utility to finance its capital expenditures through the issuance of equity and especially debt. The company will then pay its dividend out of operating cash flow. This is due to the very high costs involved in constructing and maintaining utility-grade infrastructure over a wide geographic area. In the twelve-month period that ended on June 30, 2022, CMS Energy reported an operating cash flow of $1.511 billion but only paid out $529 million in dividends. This allowed the company to cover its dividend and still have a great deal of money left over that can be used for other purposes. Overall, it does appear that CMS Energy can afford its dividend and investors probably do not need to worry about a cut here.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a utility like CMS Energy, one way that we can value it is by looking at the price-to-earnings growth ratio. This is a modified form of the well-known price-to-earnings ratio that takes a company’s earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued based on the company’s forward earnings per share growth and vice versa. However, very few companies have a ratio that low in today’s still relatively hot market, which is especially true in the low-growth utility sector. Thus, the best way to use this ratio is to compare CMS Energy with some of its peers in order to determine what company is offering the most attractive relative valuation.

According to Zacks Investment Research, CMS Energy will grow its earnings per share at an 8.26% rate over the next three to five years. This gives the company a price-to-earnings growth ratio of 2.23 today. Here is how that compares to some of the company’s peers:

|

Company |

PEG Ratio |

|

CMS Energy |

2.23 |

|

DTE Energy |

2.85 |

|

Avista Corporation |

3.56 |

|

Eversource Energy |

2.75 |

|

Entergy |

2.22 |

As we can clearly see, CMS Energy appears to be offering its investors a very attractive value proposition here. The company is one of the cheapest in the industry based on its current share price and forward earnings per share growth. It is also worth noting that this is a much more attractive ratio than the 2.84 that the company had the last time that we looked at it, which is likely due to the steep stock price decline that the company experienced over the past month. This is promising as it could provide us with a respectable entry price.

Conclusion

In conclusion, CMS Energy may have a lot to offer someone today. The company is quite well balanced between its natural gas and electric utility businesses, both of which have a respectable future. The company has certainly not lost sight of the fact that many people want it to focus on sustainability practices either, as it is spending a great deal of money to accomplish that. The valuation is also very attractive today. The biggest concern here is that the company’s debt is a bit higher than I really like to see but it is also not completely out of line with the rest of the sector so it is probably not too bad. Overall, we could have an attractive opportunity here.

Be the first to comment