shapecharge/E+ via Getty Images

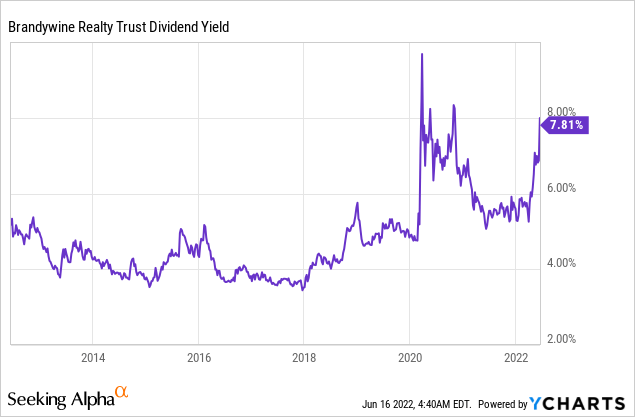

The stock market has entered into bear market territory this year due to the surge of inflation to a 40-year high and fears that the resultant interest rate hikes of the Fed may cause a recession. During bear markets, investors should try to identify severely beaten down stocks, which will endure a potential recession and thus they will greatly reward investors whenever the economy recovers. Brandywine Realty Trust (NYSE:BDN) certainly fits this description. The stock has plunged 31% this year and thus it is now trading at a 10-year low valuation level with a 10-year high dividend yield of 7.8%.

Business overview

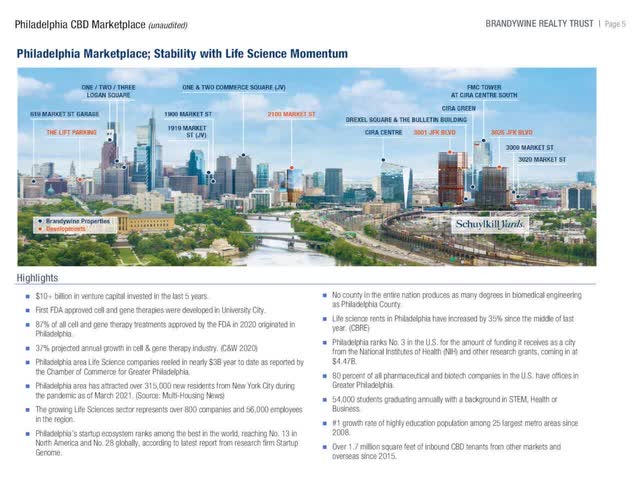

Brandywine Realty Trust is a REIT that owns, develops and leases an urban, town center and transit-oriented portfolio, which includes 168 properties in Philadelphia, Austin and Washington, D.C. The trust generates approximately three-quarters of its operating income in Philadelphia and 22% of its operating income in Austin.

As Brandywine generates nearly all its operating income in Philadelphia and Austin, it greatly benefits from some key advantages of these two markets. Philadelphia has attracted more than $10 billion of venture capital in the last five years. It also has the highest growth rate of highly educated citizens and the third-highest number of doctoral degrees in medicine and pharmacy.

Brandywine Realty Trust Competitive Advantages (Investor Presentation)

In addition, 87% of all the gene and cell therapy treatments approved by the FDA in 2020 originated in Philadelphia while about 80% of all the U.S. pharmaceutical and biotechnology companies have offices in Greater Philadelphia.

Moreover, Austin is the fastest-growing metropolitan area, with the highest population growth in the last nine years. It is also the best place to start business, the second most attractive city for commercial real estate and the second-best jobs market. Overall, Brandywine operates in two of the most promising real estate markets in the U.S.

Thanks to its strong business model, Brandywine has proved resilient throughout the coronavirus crisis. While most REITs have been significantly affected by the pandemic, Brandywine posted just a 4% decrease in its funds from operations [FFO] per unit, from $1.43 in 2019 to $1.37 in 2021. Given the severity of the downturn caused by the pandemic, the performance of Brandywine is a testament to the strength of its business model.

Moreover, Brandywine has begun to recover from the pandemic. In the first quarter, the REIT reported flat FFO per unit of $0.35 but exceeded the analysts’ consensus by $0.01. Furthermore, the trust is expected by analysts to begin to recover this year and grow its FFO per unit 2%, from $1.37 to $1.40. These expectations are in line with the guidance of management for FFO per unit of $1.37-$1.45 this year.

Valuation

The surge of inflation to a 40-year high has caused panic to investors because inflation has a double effect on many stocks. It exerts pressure on their margins via increased costs and also exerts pressure on their valuation, as it greatly reduces the present value of future cash flows.

Fortunately for the unitholders of Brandywine, the business model of the REIT is resilient to inflation, as Brandywine can pass its increased costs to its tenants via rent hikes. Indeed, in the first quarter, Brandywine raised its rents by 12.9% over last year’s quarter. It is also important to note that the entire sector of REITs is resilient to inflation thanks to the ability of most REITs to raise their rents significantly. To cut a long story short, while inflation is a headwind for the earnings of many companies, the business model of Brandywine is certainly defensive in an inflationary environment.

On the other hand, it is only natural that high inflation reduces the fair valuation level of most stocks, as it reduces the present value of future cash flows. However, this effect is much more pronounced in high-growth stocks, in which future cash flows are much higher than present cash flows. This is why the technology sector has been by far the most severely beaten sector in the ongoing bear market. On the contrary, Brandywine is a slow-growth REIT and hence the effect of inflation on its valuation should be limited.

Nevertheless, the stock of Brandywine has shed 31% this year and thus it has plunged to a nearly 10-year low. The stock traded lower than its current price only in early 2020, when the broad stock market temporarily collapsed due to the onset of the coronavirus crisis. Due to its recent decline, Brandywine is currently trading at a price-to-FFO ratio of only 7.0, which is much lower than the 10-year average of 10.9 of the stock.

It is also worth noting that the current valuation of Brandywine is a 10-year low level. As soon as inflation begins to subside, one can reasonably expect the stock to begin to revert towards its historical valuation level. Whenever the stock reaches its average price-to-FFO ratio of 10.9, it will offer a 56% (=10.9/7.0 – 1) capital gain to investors.

Investors should also note that analysts expect Brandywine to grow its FFO per unit by 3% in 2023 and by another 5% in 2024. If the REIT meets the analysts’ estimates, it will reward investors even more, as it will offer them a double gift; higher FFO per unit and a higher price-to-FFO ratio. Notably, analysts have predicted the results of Brandywine correctly (with a maximum deviation of $0.01 per share) for 18 consecutive quarters. This is a testament to the reliable and predictable business performance of Brandywine.

Dividend

Due to its sharp correction this year, Brandywine is currently offering a 7.8% dividend yield. This is a nearly 10-year high dividend yield for the stock.

The stock has a payout ratio of 55%, which is undoubtedly healthy for a REIT. Given also the resilience of Brandywine to downturns, the dividend has a meaningful margin of safety.

On the other hand, it is important to note that Brandywine has a material debt load. Its interest coverage ratio is 1.1 while its net debt (as per Buffett, net debt = total liabilities – cash – receivables) stands at $2.0 billion. This amount is 118% of the market capitalization of the stock and about 9 times the FFO of the last 12 months and hence it is somewhat high. The weak balance sheet of Brandywine is the main reason behind the freeze of its dividend for 15 consecutive quarters.

On the bright side, Brandywine is recovering from the pandemic and is expected to grow its bottom line in the next two years. Given also the healthy payout ratio and the defensive business model of the REIT, the 7.8% dividend seems to have a wide margin of safety for the foreseeable future.

Final Thoughts

During bear markets, investors should do their best to identify high-beta stocks that will recover strongly from the downturn. High-beta stocks incur sharp declines during bear markets but they offer great returns in the subsequent recovery. The key is to identify resilient companies, which will recover from the downturn. Brandywine is offering a nearly 10-year high dividend yield of 7.8% and is trading at a 10-year low valuation level. Thanks to its defensive business model, it can endure a potential recession and is likely to offer great total returns whenever the economy recovers.

Be the first to comment