Brandon Bell/Getty Images News

Amazon.com, Inc. (AMZN) recently announced its agreement to acquire a stake (2%) in Grubhub but with a warrant to further increase it by another 13% for a total stake of over 15%. Furthermore, Amazon is providing its U.S. Prime members with 1-year of free Grubhub+ subscription offering free delivery for a minimum order value of $12. Thus, we analyzed the potential opportunity for Grubhub with this partnership with Amazon in terms of users, transaction volume, and market share growth. Grubhub was acquired by Just Eat Takeaway.com N.V. (OTCPK:JTKWY) in 2021 for $7.3 bln and accounted for 18% of revenue in 2021.

Partnership with Amazon Provide User Growth of 62 Mln Users

Amazon partnered with Grubhub where Amazon Prime members can enjoy a free one-year Grubhub+ membership (normally $9.99/month) with their Prime membership. As mentioned by the company, “the agreement is expected to expand membership to Grubhub+.”

|

Grubhub |

2022F |

2023F |

2024F |

2025F |

2026F |

|

Users (‘mln’) |

38.94 |

44.08 |

49.22 |

54.36 |

59.50 |

|

Growth % |

15.21% |

13.20% |

11.66% |

10.44% |

9.46% |

|

Additional Users from Amazon Partnership (‘mln’) |

6.19 |

12.39 |

12.39 |

12.39 |

12.39 |

|

Total Users |

45.13 |

56.47 |

61.61 |

66.75 |

71.89 |

|

Total Growth % |

33.53% |

25.11% |

9.10% |

8.34% |

7.70% |

Source: Business of Apps, Khaveen Investments

In the table above, we projected Grubhub’s user growth based on its past 5-year average customer base increase of 5.14 mln users per year. On top of that, we expect the Amazon partnership to provide a boost to its user growth. With the assumption that Grubhub subsidizes the membership cost, we analyzed Amazon U.S. Prime users of 159.8 mln in 2021 in comparison to Grubhub users to determine the potential user growth opportunity for Grubhub.

|

Amazon Prime Members in the US (‘mln’) (‘a’) |

159.80 |

|

Penetration Rate of Food Delivery Services in the US (‘b’) |

48.10% |

|

Estimated Number of Prime Members Using Food Delivery (‘mln’) (‘c’) |

76.86 |

|

Grubhub Share of Total Food Delivery Users (‘d’) |

19.41% |

|

Estimated Number of Prime Members Using Grubhub (‘mln’) (‘e’) |

14.92 |

|

Total Additional User Opportunity from Prime Members for Grubhub (‘mln’) (‘f’) |

61.94 |

*c = a x b

e = c x d

f = c – e

Source: eMarketer, Statista, Khaveen Investments

To estimate the number of Amazon Prime U.S. users using food delivery apps (76.86 mln), we used the penetration rate of food delivery users (48.1%) and multiplied it by the number of Amazon Prime users (159.8 mln). From these 76.86 mln users, we estimated the number of Prime Members using Grubhub (14.92 mln) based on the company’s share of users in the food delivery market (19.4%) which we derived by dividing Grubhub’s users over the total users of food delivery platforms including UberEats (UBER), Postmates, Grubhub, DoorDash (DASH), Deliveroo (OTCPK:DROOF) and Delivery Hero (DHERO).

Additionally, we subtracted our estimated Amazon Prime users already Grubhub users (14.92 mln) from our estimated number of Amazon Prime users using food delivery services (76.86 mln) and prorate it across 5 years as a conservative assumption. Hence, we obtained the estimated yearly additional users from the Amazon Partnership of 61.94 mln over 5 years, which translates to 12.39 mln users per year. In 2022, we prorated this by 0.5 as the partnership was only announced in H2 2022. Overall, with the expected additional users, we believe that the partnership could provide Grubhub with user growth opportunities leveraging Amazon’s massive Prime user base.

Partnership Boost Total Platform Order Volume by $3.4 Bln

|

Grubhub |

2022F |

2023F |

2024F |

2025F |

2026F |

|

Users (‘mln’) |

38.94 |

44.08 |

49.22 |

54.36 |

59.50 |

|

Growth % |

15.21% |

13.20% |

11.66% |

10.44% |

9.46% |

|

Additional Users from Amazon Partnership (‘mln’) |

6.19 |

12.39 |

12.39 |

12.39 |

12.39 |

|

Total Users (‘mln’) |

45.13 |

56.47 |

61.61 |

66.75 |

71.89 |

|

Gross Transaction Volume ($ bln) (‘a’) |

10.71 |

12.12 |

13.54 |

14.95 |

16.37 |

|

Growth % |

10.42% |

13.20% |

11.66% |

10.44% |

9.46% |

|

Incremental Volume from Amazon partnership ($ bln) (‘b’) |

1.70 |

3.41 |

3.41 |

3.41 |

3.41 |

|

Total Transaction Volume with Amazon Partnership ($ bln) (‘c’) |

12.41 |

15.53 |

16.95 |

18.36 |

19.77 |

|

Growth % |

27.99% |

25.11% |

9.10% |

8.34% |

7.70% |

* c = a + b

Source: Business of Apps, Khaveen Investments

In terms of the impact on Grubhub’s gross transaction volume, we first projected Grubhub’s total transaction volume excluding the partnership based on our user base forecast in the previous point and the 5-year average Grubhub transaction volume per user of $275.06 by dividing its gross transaction volume by the number of users. Then, with the 5-year average transaction volume per user of $275.06 multiplied by our estimated additional users per year from the partnership (12.39 mln), we arrived at the estimated incremental volume from the Amazon partnership of $3.41 bln yearly until 2026. In 2022, our estimated incremental volume to Grubhub from the Amazon partnership is $1.7 bln based on the prorated additional users of 6.19 mln.

Then, we calculated the total estimated transaction volume as the sum of our estimated Grubhub’s gross transaction volume and incremental volume from the Amazon partnership. Hence, we believe that the partnership would boost the platform order volume with the contribution of an estimated incremental volume of $3.41 bln yearly.

Opportunity for Market Share to Increase to 8.74% with Partnership

|

Comparison |

Uber Eats |

Postmates |

Grubhub |

DoorDash |

Deliveroo |

Delivery Hero |

|

Users ($ mln) |

81.00 |

9.30 |

33.80 |

25.00 |

8.00 |

17.00 |

|

Average Order Value ($) |

40.00 |

40.00 |

31.27 |

37.28 |

26.42 |

12.69 |

|

Number of restaurants |

900,000 |

600,000 |

324,000 |

390,000 |

160,000 |

271,000 |

|

Reviews |

2.90 |

2.30 |

2.80 |

1.20 |

1.30 |

3.00 |

|

Average Delivery Time (mins) |

30.00 |

50.00 |

70.00 |

36.00 |

32.00 |

28.00 |

|

Average Delivery Fee ($) |

5.00 |

4.00 |

6.00 |

3.00 |

4.86 |

– |

|

Gross Booking ($ bln) |

51.60 |

2.57 |

9.70 |

10.40 |

6.60 |

2.86 |

|

2021 Revenue ($ mln) |

8,300.00 |

730.00 |

2,123.00 |

4,880.00 |

1,824.00 |

6,664.70 |

Source: Business of Apps, Khaveen Investments

We compared Grubhub with Uber Eats, Postmates, DoorDash, Deliveroo, and Delivery Hero based on different metrics to determine Grubhub’s competitiveness. Based on the table, we believe that Uber Eats is the leader in the food delivery market at the top in all metrics except for average delivery time and delivery fee. Moreover, we believe Postmates is on par with Uber Eats in terms of average order value. Whereas Grubhub has the highest average delivery fee of $6 followed by Uber Eats and Deliveroo. Additionally, DoorDash is the second in terms of gross booking whereas Delivery Hero is the leader with the lowest average delivery time and has the second highest revenue.

Hence, we believe that Grubhub is less competitive overall as compared to Uber Eats, Postmates, DoorDash and Deliveroo.

|

Revenue Comparison ($ mln) |

2022F |

2023F |

2024F |

|

Grubhub (without Amazon Partnership) |

2,511 |

2,868 |

3,176 |

|

Growth % |

18.29% |

14.19% |

10.75% |

|

Grubhub (with Amazon Partnership) |

2,691 |

3,367 |

3,709 |

|

Growth % |

26.76% |

25.11% |

10.16% |

Source: Khaveen Investments

We projected Grubhub’s forward 3-year revenue without the Amazon partnership based on analyst revenue growth consensus. Additionally, we then compared this with our forecasted Grubhub revenue growth with the Amazon partnership which is higher due to the integration with a forecasted 3-year average growth of 23.45% as compared to 14.41% excluding synergies from the partnership. Overall, we believe that the partnership would provide a higher revenue growth to Grubhub.

Whereas for Postmates, UberEats, Deliveroo, and Delivery, we forecasted their revenue based on Allied Market Research food delivery mobile application market CAGR of 25% by 2030. We then obtained the market share of each company by dividing their revenue by the total revenue of the 6 companies.

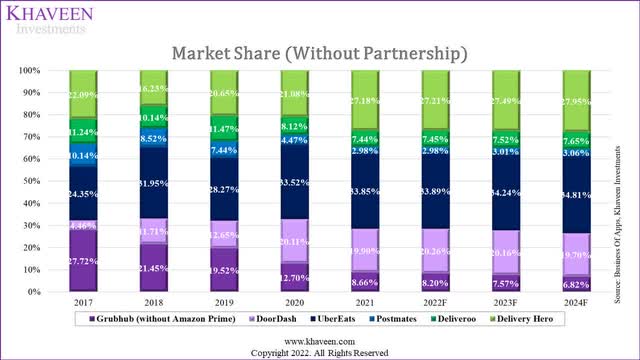

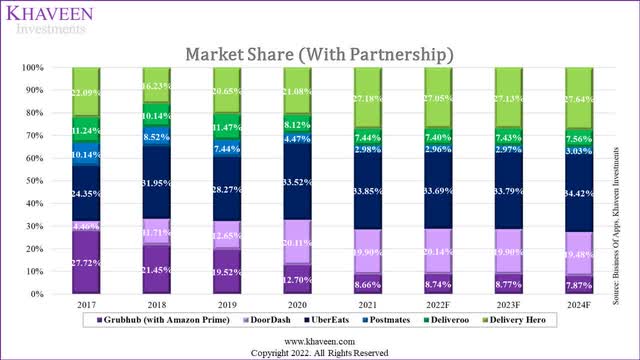

Business of Apps, Khaveen Investments Business of Apps, Khaveen Investments

As seen in the charts, we expect the partnership to result in a higher market share for Grubhub at a forecast of 8.74%, as compared to 8.2% without the partnership, in 2022. Grubhub’s market share had declined every year since 2017 when it had the largest market share of 27.72%. However, in 2018 it was overtaken by UberEats with a 31.95% market share, placing it in the 2nd position in 2018 and 2019. Then in 2020 and 2021, Grubhub further dropped to the 3rd position whereas Delivery Hero overtook it to the 2nd position. All in all, we still expect Uber Eats’ market share to remain the largest followed by DoorDash whereas we forecasted Grubhub to have the 4th largest market share with or without the partnership. Nonetheless, we believe that the partnership could increase Grubhub’s market share but remain smaller compared to Uber Eats, Door Dash, and Delivery Hero.

Risk: Sale of Grubhub

In April 2022, Just Eat Takeaway mentioned that they are considering a full or partial sale of Grubhub “after facing pressure from investors to explore strategic deals” and to “refocus its business on Europe.” In May, the company confirmed that it was exploring divestment options. Therefore, we believe that Just Eat Takeaway might not benefit from the Amazon partnership if it decides to sell its remaining stake in Grubhub.

Verdict

To conclude, we believe that Amazon’s partnership with Grubhub could provide an incremental user growth opportunity for the company which we estimated to be 12.39 mln per year from 2023 through 2026 and forecasted its total order volume to increase by $3.41 bln per year until 2026. Based on our forecasted revenue for all companies, we expect Grubhub’s market share to increase to 8.74% compared to 8.2% market share without partnership in 2022.

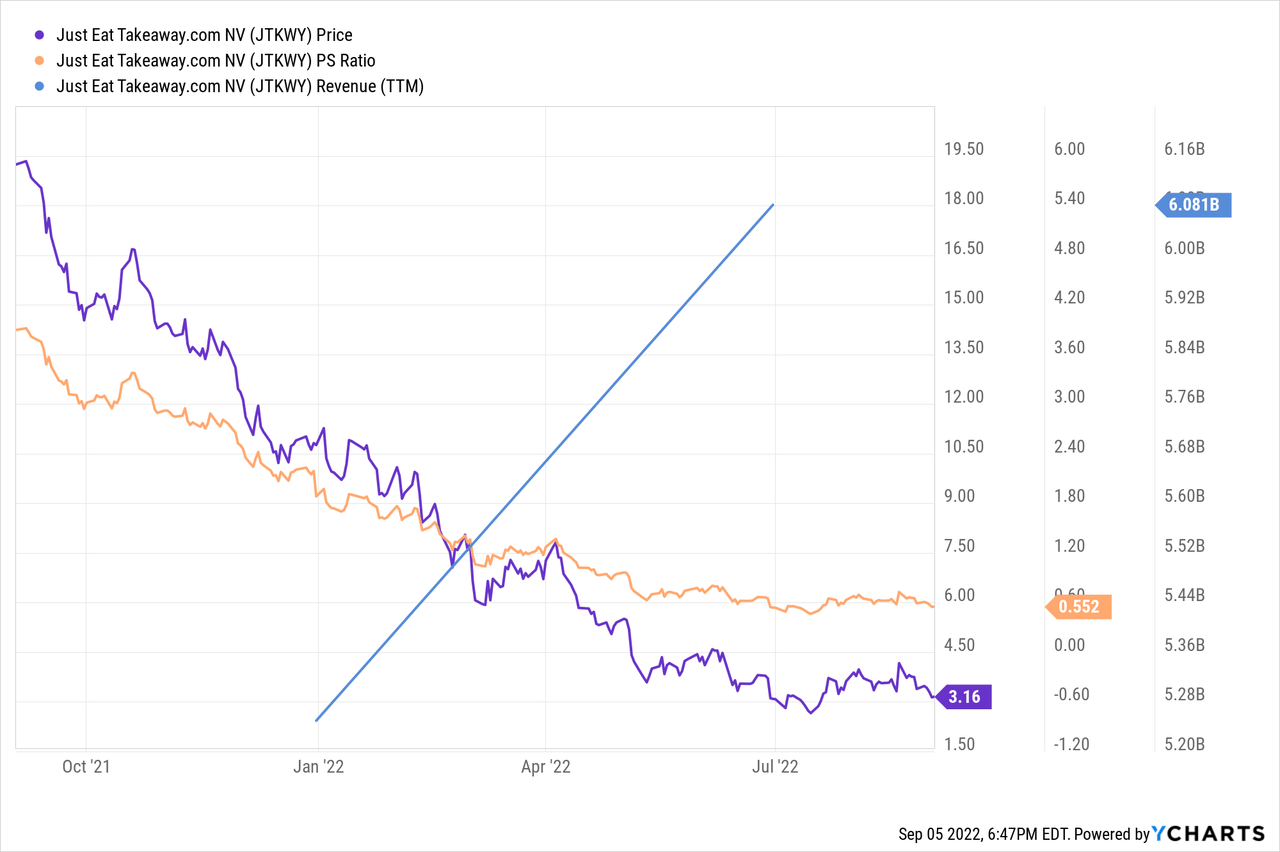

The company’s stock price had declined by 78% over the past 1 year, while its revenue had continued to increase. This translated to the company becoming more undervalued in terms of its P/S ratio declining.

Based on analyst consensus, Just Eat Takeaway has an average analyst consensus upside of 99.9% translating to a price target of $7.16 with a Strong Buy rating for Just Eat Takeaway.com.

Be the first to comment