Bet_Noire/iStock via Getty Images

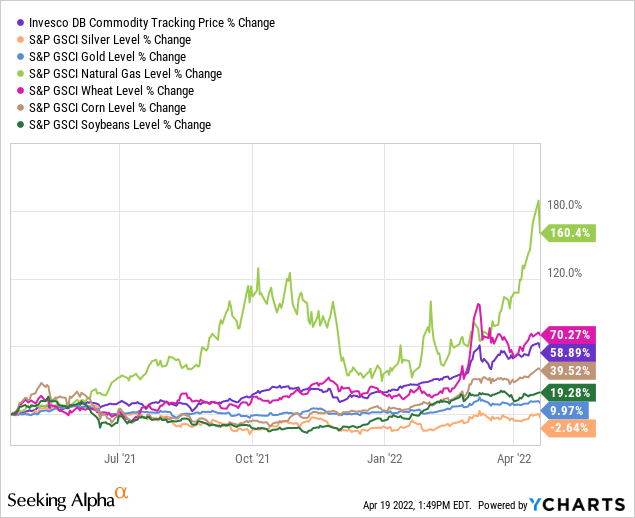

Aside from geopolitical issues, inflation and the consequential rise in interest rates continue to be the hot topics in the markets today. While most commodities have experienced a spike in price in the past several months, one particular component of the basket has been a rare loser over the last year: silver (see 12-month chart below, orange line).

Today, I make a cautious, speculative argument for seeking exposure to silver inside a diversified, multi-asset portfolio. My instrument of choice in this case is the esoteric ProShares Ultra Silver ETF (NYSEARCA:AGQ), a leveraged fund that targets twice the daily movements of the precious metal price.

What is AGQ?

I reviewed this ETF in more detail about 18 months ago. In a nutshell, AGQ “seeks a return that is twice the return of its underlying benchmark”, the Bloomberg Silver Subindex, for a single day. The fund trades an average of over 1 million shares per day, making the ETF highly liquid and bid-ask spreads, narrow. The management fee is high, at 95 basis points, but perhaps in line with a more complex and highly volatile instrument.

Importantly, the ProShares Ultra Silver ETF has done a very good job at meeting its stated goals of 2x the daily movements in the price of silver. Even in the long term – which, to be very clear, is not the focus of this leveraged fund – AGQ has decently mimicked twice the performance of silver.

Since the fund’s 2008 inception, a 50/50 blend of AGQ and cash that is rebalanced monthly would have returned 3.6% per year. This figure is only about two percentage points lower than the returns in iShares Silver Trust ETF (SLV), with the gap likely reflecting the higher management fee, possibly some volatility drag, and a bit of tracking error.

The case for owning silver

Fundamentally, it is not too hard to build a case for owning silver in the current environment of currency devaluation and rampant inflation. Like gold, silver has historically been treated as a store of value when investors fear for loss of purchasing power. But unlike its counterpart, silver benefits more from industrial applications: an estimated half of the demand for silver is associated with electronics manufacturing, from old-school photography to the higher-growth renewable energy and automotive spaces.

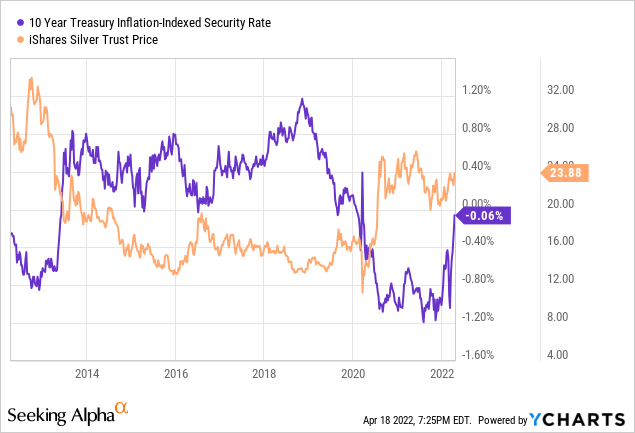

Historically, silver prices have also benefited from an environment of low real interest rates. The inverse relationship is visually evident in the graph below. Notice how, in the past ten years, silver performed better when inflation-adjusted yields were low – although the negative correlation has weakened since the start of the pandemic. Real rates are still near all-time lows, even though they have started to recover quickly in the past few weeks.

Despite the current landscape that most would defend should be bullish for silver, the precious metal has underperformed, as highlighted above in the introduction. I hypothesize that the uncertain macro environment introduced by the pandemic and its aftermath may have driven investors away from the more speculative investments, which hurt demand for silver – an asset that has produced very rich annualized volatility of 32% and painful maximum drawdowns of 72% in the past couple of decades.

Maybe now could be the time to make a long bet on the precious metal, especially if one sees a buy-the-weakness opportunity here.

But why AGQ?

Seeking exposure to silver via a plain fund, such as SLV, could make the most sense to many. However, I think that AGQ can play an important role in limiting a portfolio’s exposure to such a risky asset class, while still offering investors the upside opportunity in the short term.

Ordinarily, I tend to rely on certain groups of stocks, inflation-linked bonds, gold and diversified commodities to seek protection against rising producer and consumer prices. Due to high volatility and subpar historical risk-adjusted returns, silver has never been a component of my long-term, diversified strategy.

But with AGQ, I can add a very small, speculative position to my portfolio (say, a couple of percentage points in allocation) without significantly selling out of what I consider to be better investments for the long haul – say, growth stocks and other cash flow-producing assets. Should silver prices spike in the foreseeable future, my portfolio would benefit from the small position in AGQ. Should it move sideways or even decline instead, I can rest assured that my portfolio’s losses are limited to an amount that I can be comfortable with.

Be the first to comment