shaunl/iStock Unreleased via Getty Images

Introduction

It is time to discuss Deere & Company (NYSE:DE), one of my all-time favorite dividend growth stocks. However, in this case, we’re not talking about its dividend qualities – I did that last month – but its just-released earnings and the bigger picture. The company reported blowout revenue numbers but came in short on earnings per share as a result of supply chain issues and inflation. I have to admit that it ruined the mood as investors caused a steep post-earnings sell-off of almost 7%. However, that’s where the bad news ends. The good news is that the company’s order books are filled. Its market share is rising. Large agriculture equipment is flying off the shelves and its investments in precision agriculture are paying off. Moreover, the company sees strong customer fundamentals like sustained agriculture price strength and a strong equipment replacement cycle. Hence, the stock erased all losses to close up almost 0.5% despite market selling.

In this article, I will give you the details and explain the strategy that goes with my “bullishness”.

So, let’s get to it!

Fantastic Agriculture Fundamentals

Shortly after the earnings release, I wrote a Twitter thread to share my thoughts on the company for two major reasons:

- I have been bullish on agriculture since early 2020 (people expect an update).

- Deere is dependent on a wide range of supply chains to turn orders into finished products (info on agriculture and supply chains).

This article is structured around these issues as we’re clearly seeing that a bullish agriculture environment is meeting severe supply chain and related inflation issues.

Without supply chain problems, Deere would be trading much, much higher. However, the stock would be far below current levels without strong agriculture tailwinds.

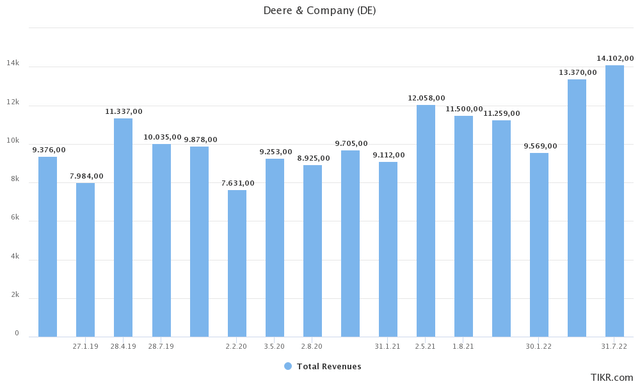

In order to figure out what happened, we need to start at the very top of the company’s 3Q22 results: its revenues.

In 3Q22, total revenues came in at $14.1 billion. That’s 22.3% higher compared to the prior-year quarter and $1.26 billion higher than expected.

This sales number is basically based on every reason why I’m bullish on the agricultural sector as Deere’s products were flying off the shelves.

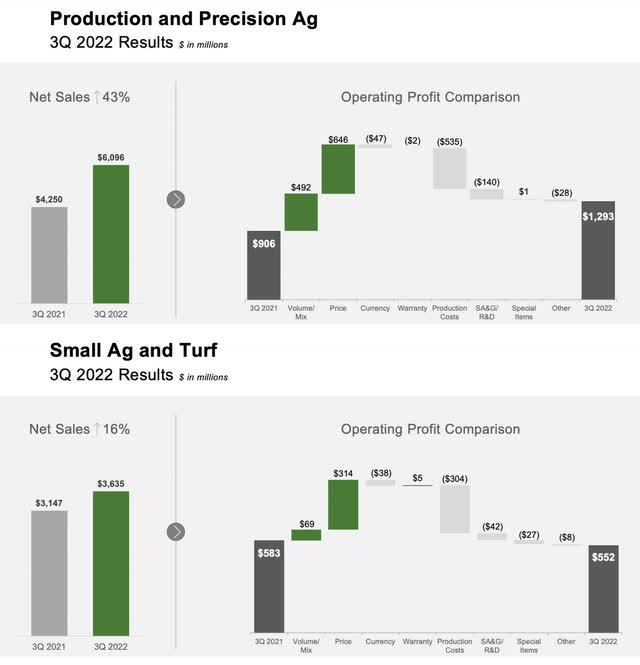

In its largest segment, production and precision agriculture (large tractors, combines, and equipment), the company saw 43% net sales growth to $6.1 billion.

Deere mentioned strong agricultural fundamentals in its earnings call. For example:

Overall, ag fundamentals remain really strong. Corn and soy prices have declined from a few months ago, but so of inputs like fertilizer and others. Also when you look at global stocks to use, it’s tight and it’s expected to decline again, continuing to support elevated crop prices. May also take a couple of seasons to recover those grain stocks to normal levels.

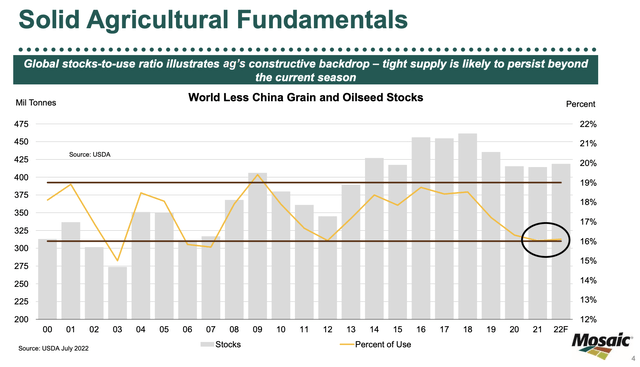

The graph below displays market tightness based on data collected by fertilizer giant Mosaic (MOS).

Tightness hasn’t been this bad since 2012 and the early 2000s, which were both very bullish periods for crops and related investments. Moreover, I expect tightness to last due to high energy prices (impacting production costs), fertilizer shortages, droughts preventing supply from bouncing back, and the ongoing war in Ukraine, which is pressuring global wheat and sunflower exports – among other products.

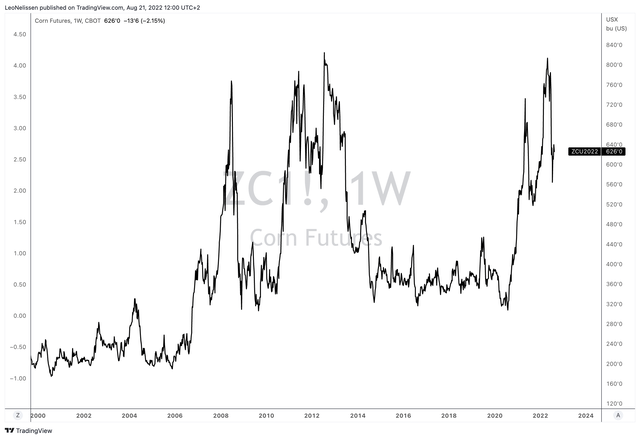

Using corn as a proxy – as I usually do – crop prices remain elevated, despite falling from recent highs caused by Ukraine war-related panic.

Deere is obviously witnessing these trends as it did mention that (farm/customer) profitability has come down from peak 2022 levels. However, customers are still very profitable, which is supportive of high replacement demand. According to Deere:

[…] farmers haven’t been able to replenish their fleets as much as they wanted to this year. The age of the fleet remains above average. Additionally, dealer inventories remain at historic lows since the industry shorted demand the last couple of years due to supply constraints. These factors should help extend the duration of the replacement cycle.

This explains blowout sales growth in the company’s “large agriculture” segment.

The small agriculture and turf segment also did well as net sales soared by 16% to $3.6 billion. However, this is mainly due to pricing as the company believes that small agricultural demand will continue to be flat this year. This is in line with what I’ve seen and heard from my sources in various continents who make the case that smaller farmers struggle with input costs – especially farmers in Europe. Most are not looking to invest in equipment for now.

That’s why it’s so important that Deere has a significant footprint in large equipment, which is still doing extremely well. In that segment, the company benefits from high demand (volume), pricing, and rising market share.

Relative to the industry, we’ve had our strongest results in high horsepower row crop tractors, and we plan to end the year approaching our highest market share on record. Our order books for the remainder of the current fiscal year are full, and we see signs of robust demand into 2023 with some order books already full through the first half of next year.

Especially the new 9R tractor (the largest it offers for heavy-duty demand) and the X9 combine saw their highest production rates this year in several factories.

In this case, we also need to discuss construction and forestry, which accounted for $3.3 billion of total sales in 3Q22. That’s 8% higher compared to the prior-year quarter. Sales were only up due to higher pricing as the company continues to be unable to satisfy demand due to supply constraints. In other words, demand is strong, but it did not translate to a higher sales volume.

That brings me to the next part of this article.

Supply Issues Were A Drag

Now onto the bad news. Despite a huge revenue surprise, earnings came in lower than expected. 3Q22 GAAP EPS came in at $6.16. That’s $0.53 below estimates, which is significant.

Moreover, the company lowered its full-year guidance.

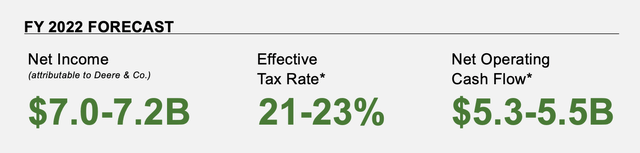

The company is now expecting between $7.0 and $7.2 billion in net income and between $5.3 and $5.5 billion in net operating cash flow.

Last quarter, the company expected between $7.0 and $7.4 billion in net income and at least $5.6 to $6.0 billion in operating cash flow. This means the top-line of net income guidance has been lowered by 2.7%.

As reported by Seeking Alpha:

The company now sees Small Ag & Turf net sales rising 10%-15% vs. its prior outlook of ~15% growth, and now sees Construction & Forestry net sales +10% compared to its previous view of 10%-5% growth; guidance for Production & Precision Ag net sales remains at 25%-30% growth.

The overview below shows the operating income bridges of the company’s two agricultural segments. What we see is that small agriculture saw declining operating income despite higher sales. Large agriculture was able to avoid that thanks to extremely good sales.

Note the “production costs” item in the charts below, which highlights the severe impact of the supply chain and related inflation problems.

Production costs were elevated due to materials and freight. Overhead spending was also higher due to production inefficiencies related to supply chain problems. However, the company still achieved high production rates, which shows how efficient its operations have become. Lost production will be worked on in the fourth quarter, which should help productivity going into the FY23 year.

Going forward, the company will make sure that it doesn’t add too many new unfinished tractors to its inventory. It will work on existing inventory, which will be smoother thanks to a higher parts inventory.

Adding to that, the company is optimizing its supply chains as it is slowly moving away from a situation where it dealt with too many unfinished products:

We’re proactively working with our supply base to obtain allocations and improve on-time deliveries of parts, looking for opportunities to dual-source or providing resources to address constraints. Again, also we can get equipment out to our dealers and customers.

Moreover, we’re now moving into a situation where economic growth is declining, which is lowering supply chain problems as demand for parts is simply lower.

Lower Economic Growth And Valuation

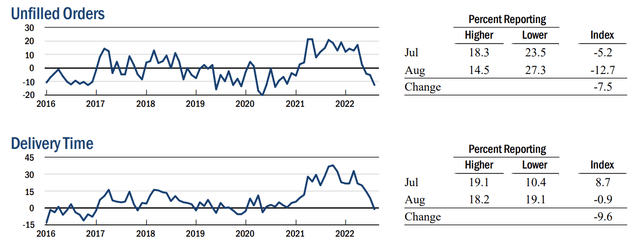

Using numbers from the Empire State Manufacturing Survey – conducted by the New York Fed – we see that unfilled orders and delivery times have come down a lot. We’re now far past peak supply chain problems, which I expect to translate to higher margins for companies like Deere in the current quarter.

Empire State Manufacturing Survey

It may be harder for companies without high demand as the decline in the indicators above is partially caused by a severe deterioration in general economic conditions.

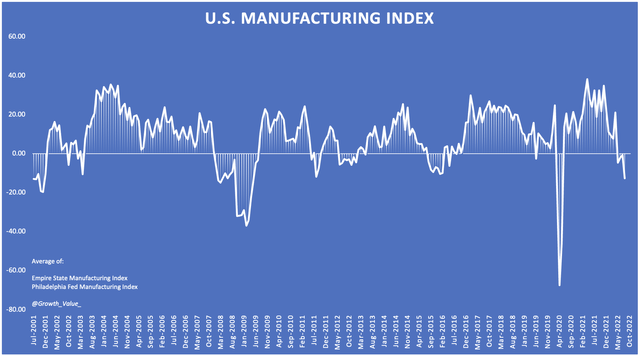

The chart below includes Empire State Manufacturing data. In this case, we see that the Federal Reserve is “winning”. By hurting demand, it is slowly suppressing supply chain problems and, as a result, inflation.

Author (Empire State/Philadelphia Fed)

But then again, it is hurting economic demand as we’re now headed for a manufacturing recession – along with a consumer/services recession.

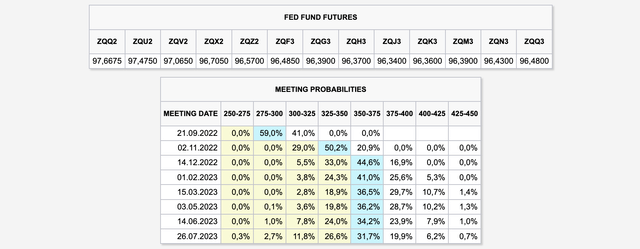

And unlike in prior cycles, the Fed isn’t easing but tightening as rates are expected to continue to rise to roughly 3.50% based on Fed Funds Futures as displayed in the table below.

So, what does this mean for Deere?

On the one hand, it’s terrific news that supply chain problems are slowly easing. Availability of parts is improving and even pricing may come under pressure as demand slows from customers that suffer from a decline in demand.

If countries around the world refrain from using new lockdowns in the winter, I think supply chain problems will ease significantly in 2023, providing a great basis for Deere to work on its backlog and orders – after all, its orders remain strong and should provide the company with strong sales growth in 4Q22 and beyond.

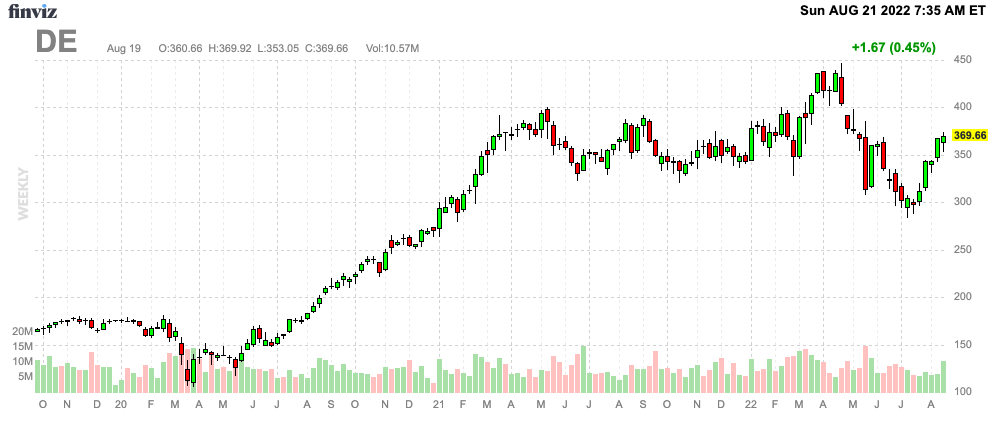

Hence, Deere erased the entire 7% decline after earnings (most of its pre-market) to end the day in green territory. The S&P 500 sold off 1.3% on Friday.

FINVIZ

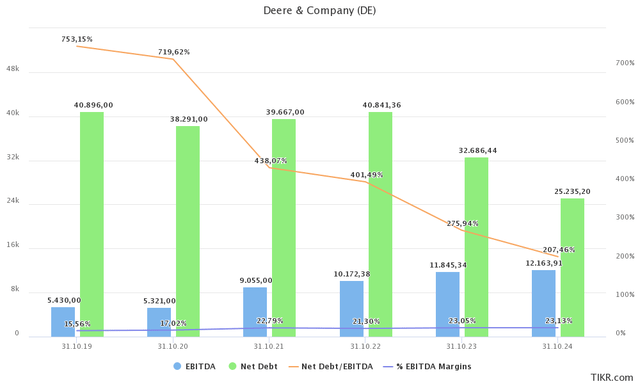

Deere is now back at a market cap of $113 billion. When adding $32.7 billion in expected 2023 net debt (less than 2.8x EBITDA), and $2.9 billion in pension liabilities give the company an enterprise value of $148.6 billion. That’s 12.6x 2023E EBITDA of $11.8 billion. Note that adjusted EBITDA margins are set to recover to 23.0% as supply chain issues fade.

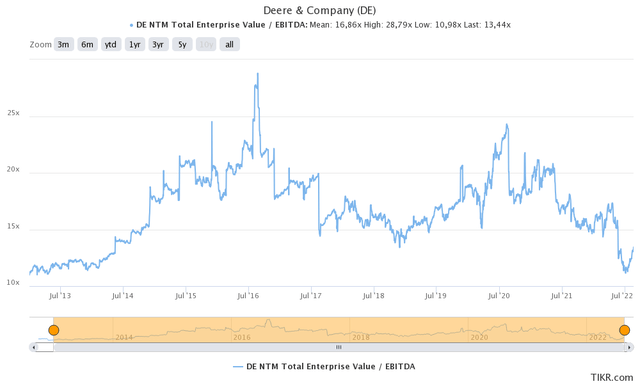

What this means is that the valuation is at its lowest level since late 2014 when looking at the EV/EBITDA (next twelve months EBITDA) valuation range below.

The problem is demand, if the company continues to see strong demand in a weakening economy, it will more than likely soar way above $450 when it breaks out to the upside.

However, due to economic conditions, I remain vigilant. Investors are likely to dump cyclical investments simply for the sake of portfolio de-risking.

So, here’s the bottom line.

Takeaway

I made Deere a core position in my dividend growth portfolio in 2020. It’s one of my best investments and also one of my all-time favorite dividend growth picks.

As a long-term investor, I liked the 3Q22 earnings despite a significant EPS miss. While it’s a red flag when companies are unable to grow operating income (in some segments) despite high sales growth, Deere did rather well. Demand is high in all segments and only supply chain problems caused sales growth to be subdued in small agriculture and construction. Large agriculture also suffered from supply chain issues, yet sales were still up more than 40%.

The company remains incredibly well-positioned thanks to a high and further rising market share (proof that investments in next-gen applications are paying off) and filled order books.

Moreover, supply chain issues are slowly fading, which is helping the company on top of supply chain diversification and the decision to focus on finishing the existing backlog for now.

Hence, the company remains in a great spot to boost both sales and earnings in 2023 and beyond.

The only problem is that general economic conditions are not supportive of cyclical investments. Hence, I remain bullish, but I warn investors that we could see up to 15-20% downside again – like we did earlier this year when the stock briefly dropped more than 30%.

However, I wouldn’t even mind a new move lower due to portfolio de-risking as I would love to buy more aggressively when shares get closer to $300.

As the title says, I remain very bullish and I have little doubt that Deere rises past $450 (likely towards $520) during the next economic upswing, which may start when the Fed pivots (likely) early next year.

In other words, keep the downside in mind when deciding if DE shares are right for you. Other than that, I think there’s not a lot stopping Deere from doing what it does best: generating shareholder value backed by a stellar business.

(Dis)agree? Let me know in the comments!

Be the first to comment