jhorrocks

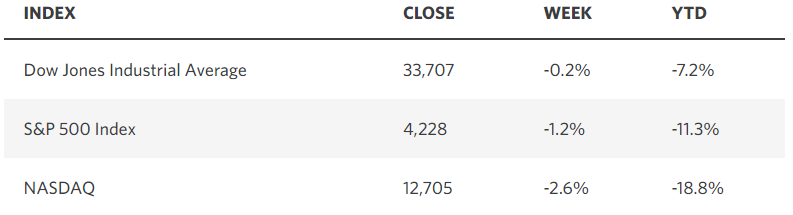

A phenomenal four-week run in stock prices that retraced more than 50% of the S&P 500’s bear-market losses came to an end last week. That should come as no surprise, nor the reason why. A week ago, I warned that should the S&P 500 continue its ascent, we should also expect to hear Fed officials warn about tighter monetary policy conditions in an effort to suppress speculation and slow the market’s advance. That is what happened mid-week with speeches from several Fed presidents delivering a more hawkish tone than the consensus was expecting. This was the perfect excuse to take profits, especially after running up to a key technical resistance level for the S&P 500. The modest pullback seems to have reinvigorated the bears, but for no good reasons that I can see.

Edward Jones

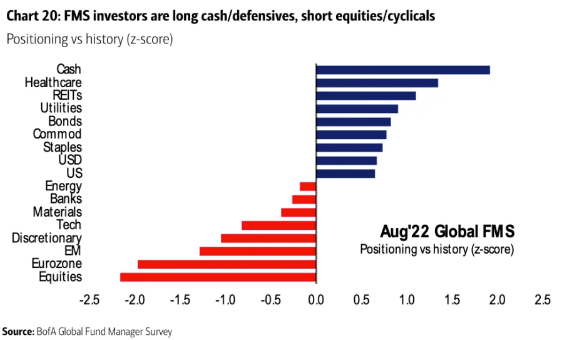

Strategists at Bank of America call the recent advance a “classic” bear-market rally, because the S&P 500 has risen 17.4% over the past 41 trading days. They purport the relevance of this to be that in 43 bear-market rallies of 10% of more since 1929 the average gain was 17.2% over 39 days. In my view, the extent of the similarities end with that statistic, as their fundamental rationale is flimsy at best. They assert that the rebound has been based on a “pivot” trade whereby investors are banking on the Fed cutting rates in 2023. Yet there has not been much of a pivot when looking at the bank’s own positioning survey for institutional fund managers for August. They are still heavily weighted in cash and defensively positioned. No wonder the pros want to see the S&P 500 retest the low. The train left the station without them.

Yahoo Finance

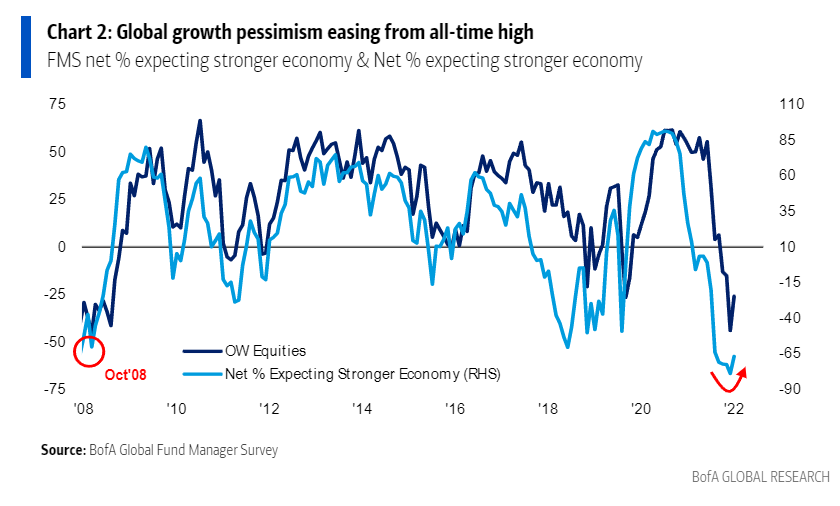

In my view, this rebound is not based on expectations for a “pivot” from the Fed. It is based on the positive developments we have seen in recent weeks in the market fundamentals and macroeconomic landscape. Corporate profits have not collapsed. To the contrary, they were better than expected in the second quarter, and guidance has held up relatively well. The labor market has not deteriorated. In fact, the unemployment rate remains near its all-time low and wage growth has been strong. A consensus is starting to build around the belief that the rate of inflation has peaked, and now we are seeing a positive rate of change on that front, which should continue moving forward. The impact from the war in Ukraine and the pandemic in China on commodity prices and the supply chain is waning. At the same time, the recession that was supposed to hit the U.S. never materialized. These are the reasons that the S&P 500 recovered more than 50% of its losses from the first half of this year. The bearish consensus that missed these developments or underappreciated them is now looking for excuses, such as the anticipation of a “pivot” by the Fed.

The Fed will remain overly hawkish to keep a lid on this rally, because it does not want financial conditions to loosen to the extent that it increases demand and unwinds the progress to date on bringing down the rate of inflation. The most positive aspect of the market’s rebound is that sentiment remains abysmal. We have seen some improvement from multi-decade lows in consumer and investor sentiment, but both are still consistent with bear-market lows of the past. This means there is still a tremendous amount of fuel for risk assets in front of us in the form of pent-up demand.

Bloomberg

If sentiment had fully recovered, it would be far more difficult for the market to continue its recovery. I think investors should expect the bears to start pounding their chests again, as we see the major market indexes pull back from technically overbought conditions. That should shake out weak shareholders in a pause that refreshes the new uptrend for the fall of this year. It will also provide investors with another opportunity to add to stocks that are best positioned to perform well in this mid-cycle slowdown for the economy.

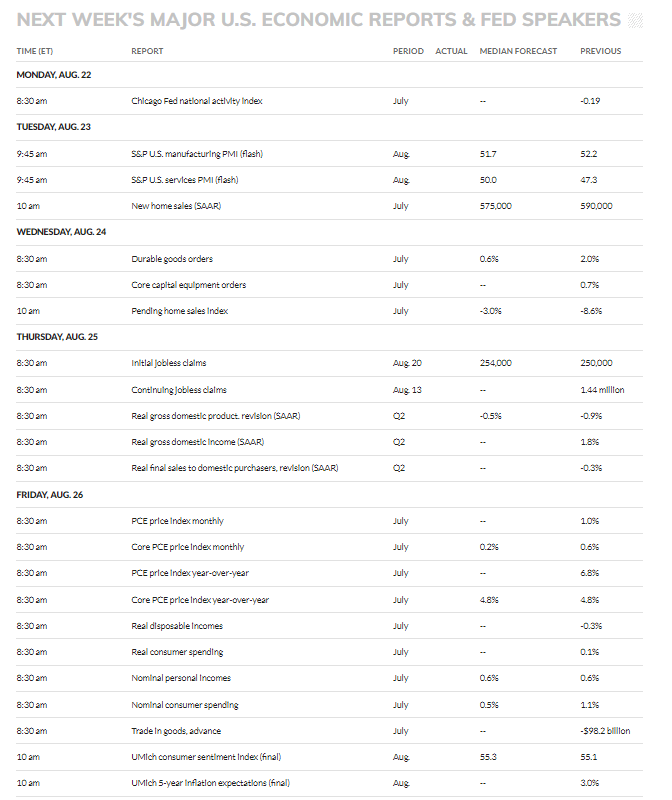

Economic Data

All of the action comes on Friday with the Fed’s preferred inflation gauge for July being reported. I expect to see the Personal Consumption Expenditures price index (PCE) confirm what the CPI told us, which is that inflation has peaked. On the same day, Chairman Powell will be speaking at the Fed’s annual Jackson Hole symposium. That combination should result in a sharp increase in volatility.

MarketWatch

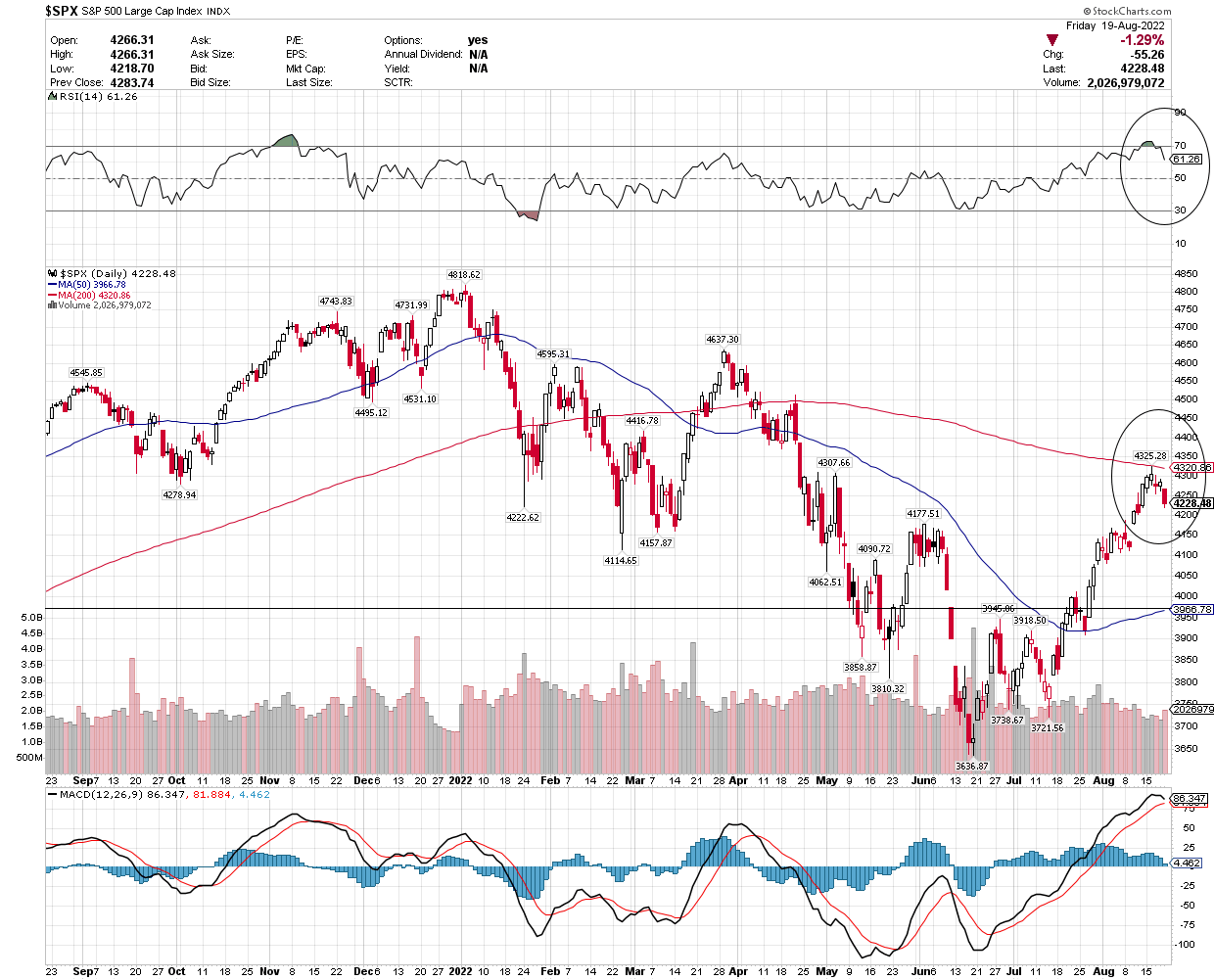

Technical Picture

No surprises here, as I discussed more than once how overbought the market was getting last week as we approached the ceiling that is the 200-day moving average. Note that the Relative Strength Index (top of chart) is rolling over after climbing well above 70, while the index peaked exactly at the 200-day (red line) and is doing the same. I’m prepared to see us revisit the rising 50-day at 3,966. That would be a healthy pullback.

Stockcharts

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment