Justin Sullivan/Getty Images News

Warren Buffett’s Berkshire Hathaway (BRK.A) has been accumulating stock in Occidental Petroleum (NYSE:OXY), and recently got approval to add to its position up to 50% of the company by FERC. Many investors are following along and buying Occidental stock too, perhaps hoping for a buyout. However, history indicates that buying other lower valuation, oil and gas stocks could be more compelling than buying the same company that Berkshire might buy out, to the extent that they do so.

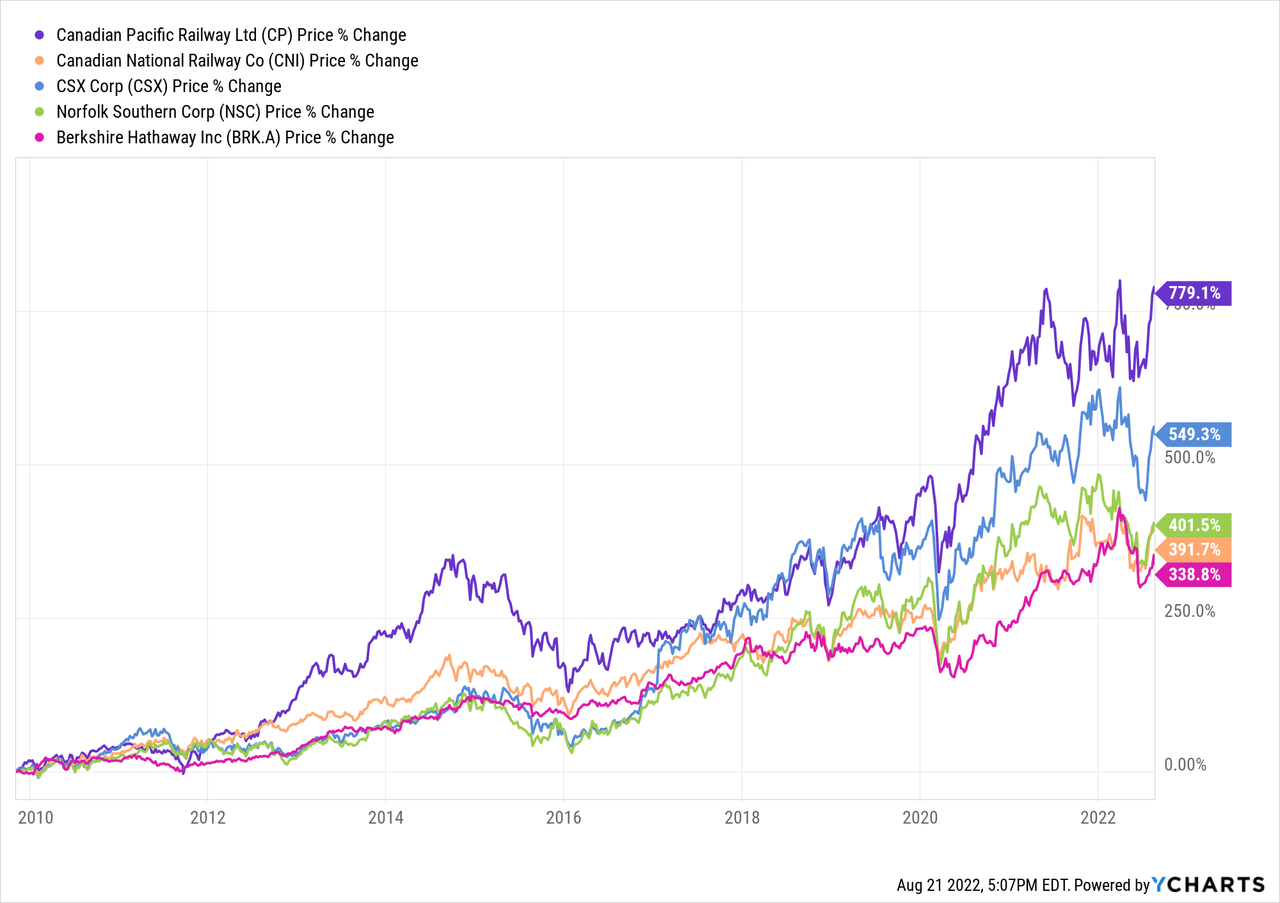

A similar dynamic played out with Burlington Northern Railroad stock more than a decade ago. Berkshire accumulated Burlington stock, it outperformed peers, and it was bought out for a 31.5% premium in November 2009. However, looking at a chart of railroad industry peers from the time of Berkshire’s takeover offer for Burlington to today, it is apparent holding on to railroad stocks from the time of Berkshire’s purchase was a better bet than selling to Berkshire, and a better bet than Berkshire stock itself!

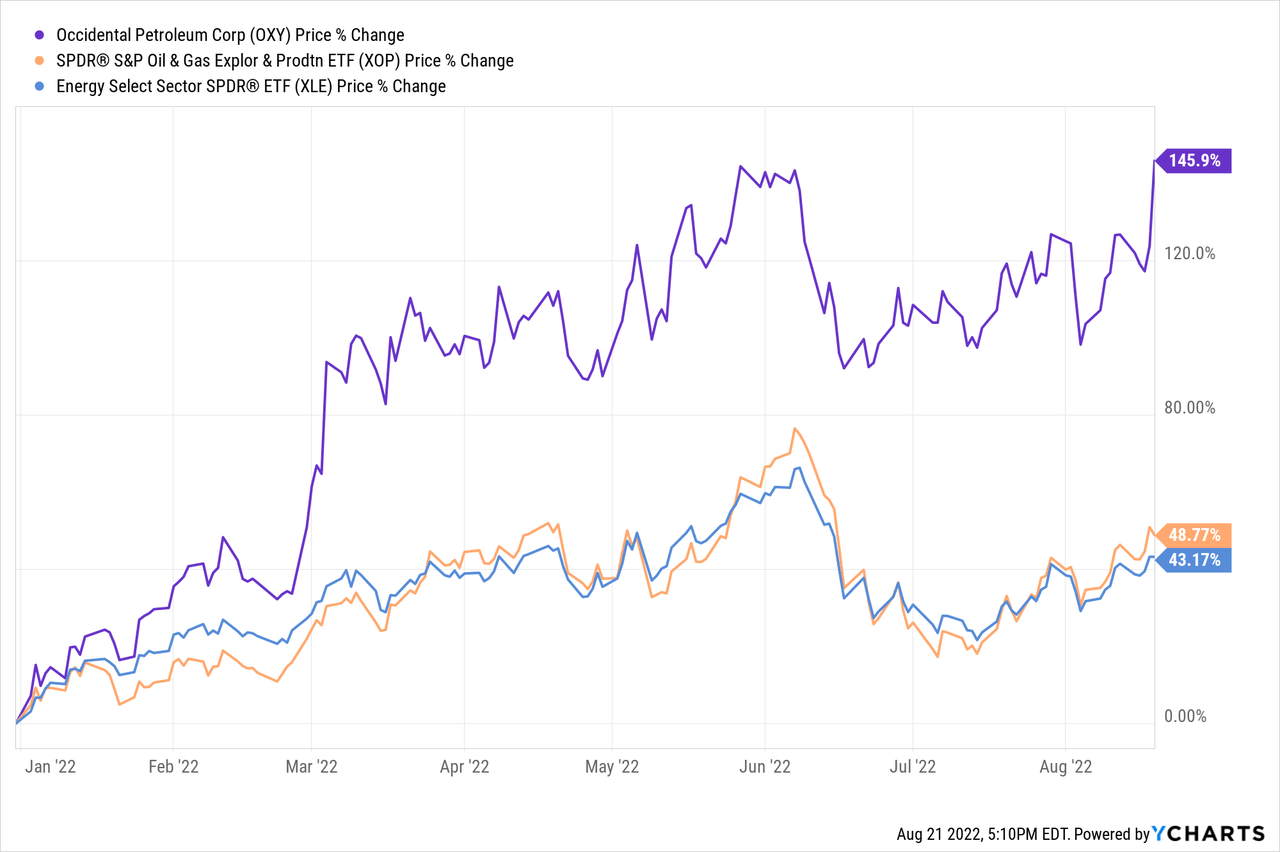

Berkshire hasn’t sought or arrived at a deal with OXY, and there is no guarantee that it will do so. If it were to fully buy out OXY, it is not clear that it would pay a 30%+ premium, as the stock has appreciated substantially (versus relevant ETFs XOP and XLE) and has outperformed on recent purchases by Berkshire:

One of my observations from the very strong relative performance of railroads subsequent to Buffett’s buyout of Burlington Northern is that Buffett’s general investment skill is particularly acute in finding good companies in industries that have promising long term tailwinds. This is promising for oil and gas stocks, but it doesn’t necessarily need to be expressed through buying the same stock Buffett is buying. And I think there is a particularly compelling opportunity in the shares of companies that trade at substantial discounts to Occidental on cash flow and reserve value.

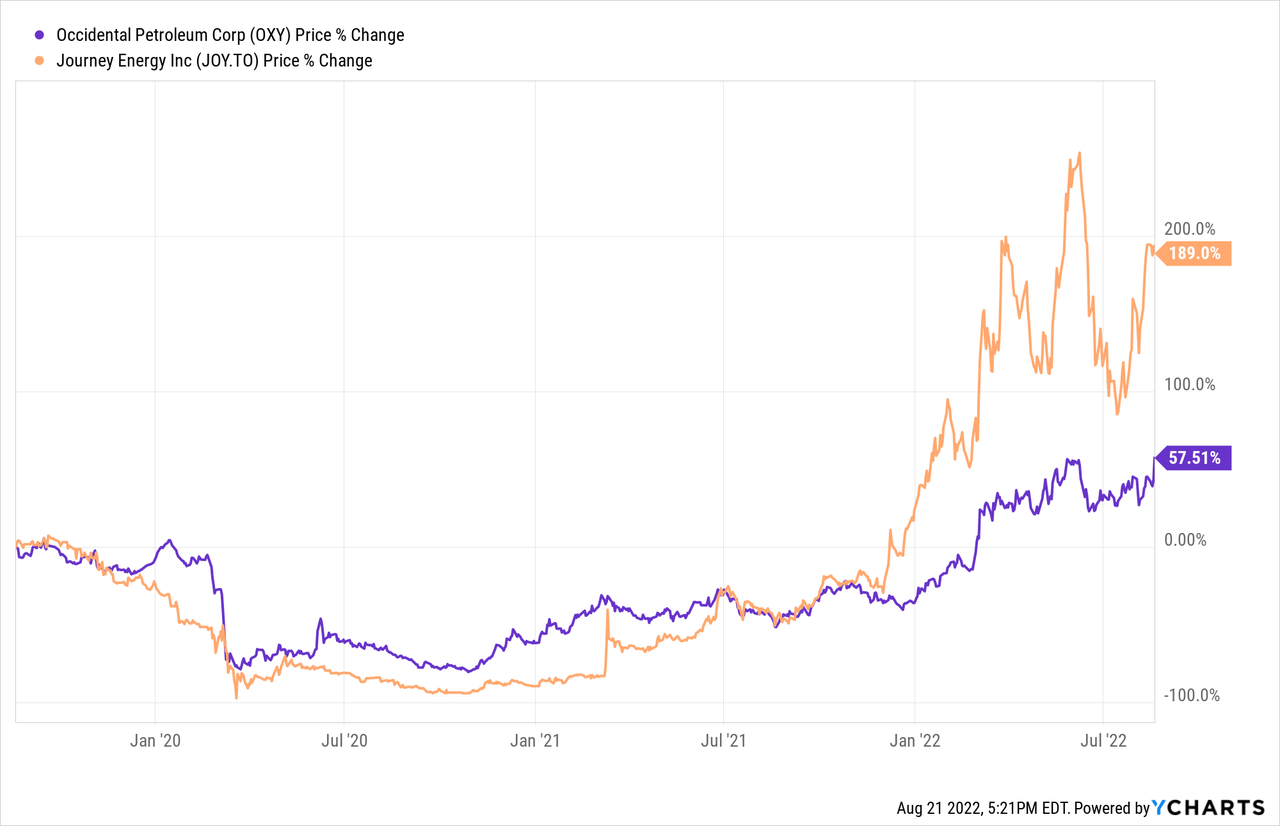

One such company is Journey Energy (OTCQX:JRNGF). I have discussed Journey previously on Seeking Alpha and elsewhere, and it is still remarkably cheap versus the sector and particularly versus OXY. And unlike OXY, Journey is actively acquiring assets accretively, offering compounding value to shareholders through intelligent capital allocation in a temporarily distressed industry. At less than half of the cash flow per share and proved producing reserve value per share metrics versus OXY, it seems like a compelling alternative to shares being bid up because of Buffett’s involvement – perhaps a future Canadian Pacific versus Berkshire or peers.

The obvious downside of a company like Journey versus Occidental is that, in a downturn, Occidental could benefit from a “Berkshire put” as the share price could be supported despite deteriorating fundamentals. However, with good management and intelligent capital allocation, even without the involvement of famous investors like Icahn and Buffett, Journey substantially outperformed versus OXY over a multi-year period, albeit with more volatility:

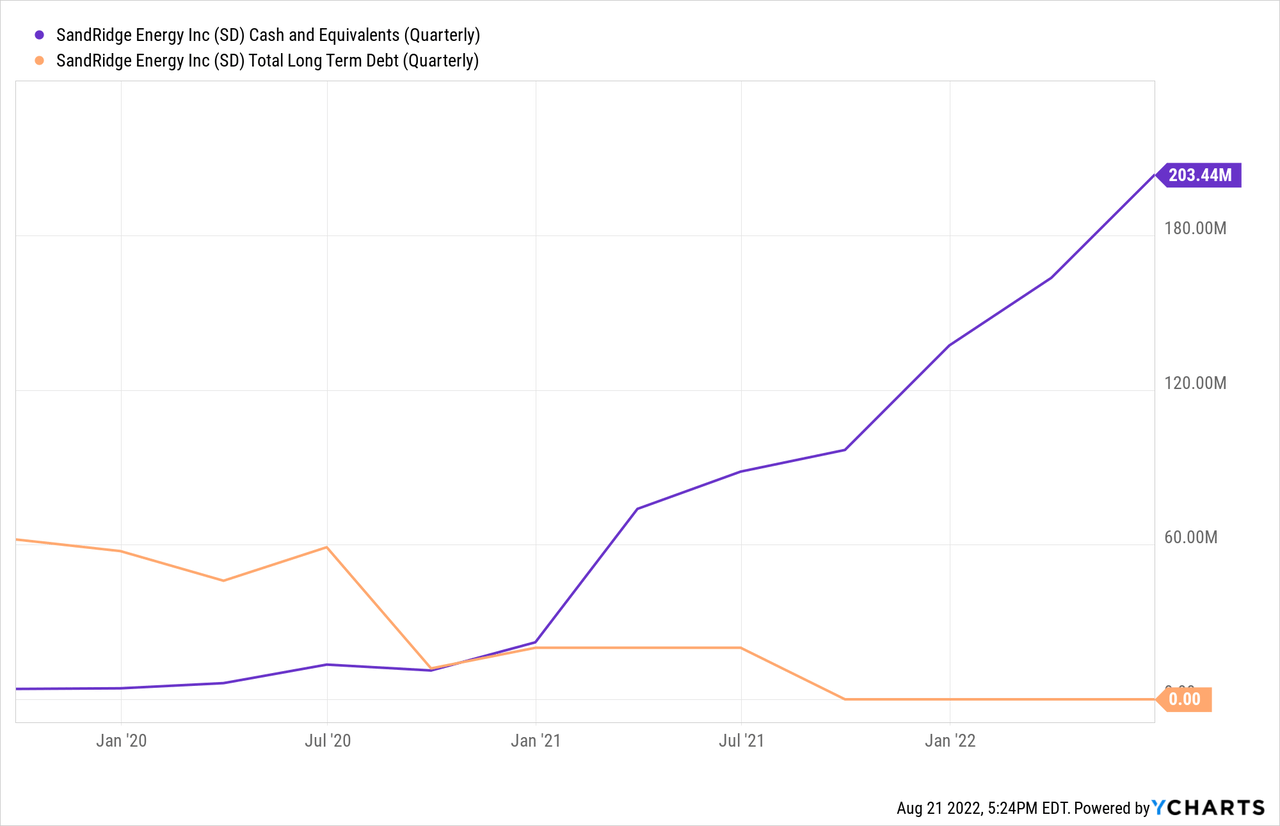

Another company that I discussed recently that offers similar potential higher upside is Sandridge Energy (SD). The big unknown with SandRidge is “what will they do with all of that cash” – they have paid off all of their debt and have rapidly built substantial net cash:

SandRidge is relevant to the OXY conversation because Icahn was a large shareholder of OXY and sold his entire position, while he is still the largest shareholder of SandRidge. With great recent wells, continuing substantial cash build, an $1.6 billion of NOL tax shield, the company is well positioned to pay a large dividend, buy back shares or acquire nearby assets accretively. And with such a large and rapidly growing cash position, SandRidge may offer a margin of safety not available in a heavily indebted company like OXY.

There are many other oil and gas stocks worth considering as alternatives to OXY, considering OXY’s outperformance versus its indexes and the history of the performance of the railroad equities versus Berkshire’s shares since his railroad buyout. My takeaway: thinking outside the box and following great investors’ thinking without directly following them into higher valuation equities offers potential outperformance. Or in other words: what would a young Warren Buffett do?

Be the first to comment