President Trump Delivers Statement at the Whitehouse.

Mark Wilson/Getty Images News

Digital World Acquisition Corp.’s (NASDAQ:DWAC) adjourned their Shareholder Meeting today until September 8. DWAC was to take up a shareholder vote to decide if the DWAC could extend the time it has to complete its merger with the Trump Media and Technology Group. It seems clear that DWAC did not have enough votes to extend the deadline and have delayed the decision for two days hoping they receive more positive votes for the extension. 65% of DWAC shareholders are needed to grant the extension, with “no” votes counting as opposed to the proposal.

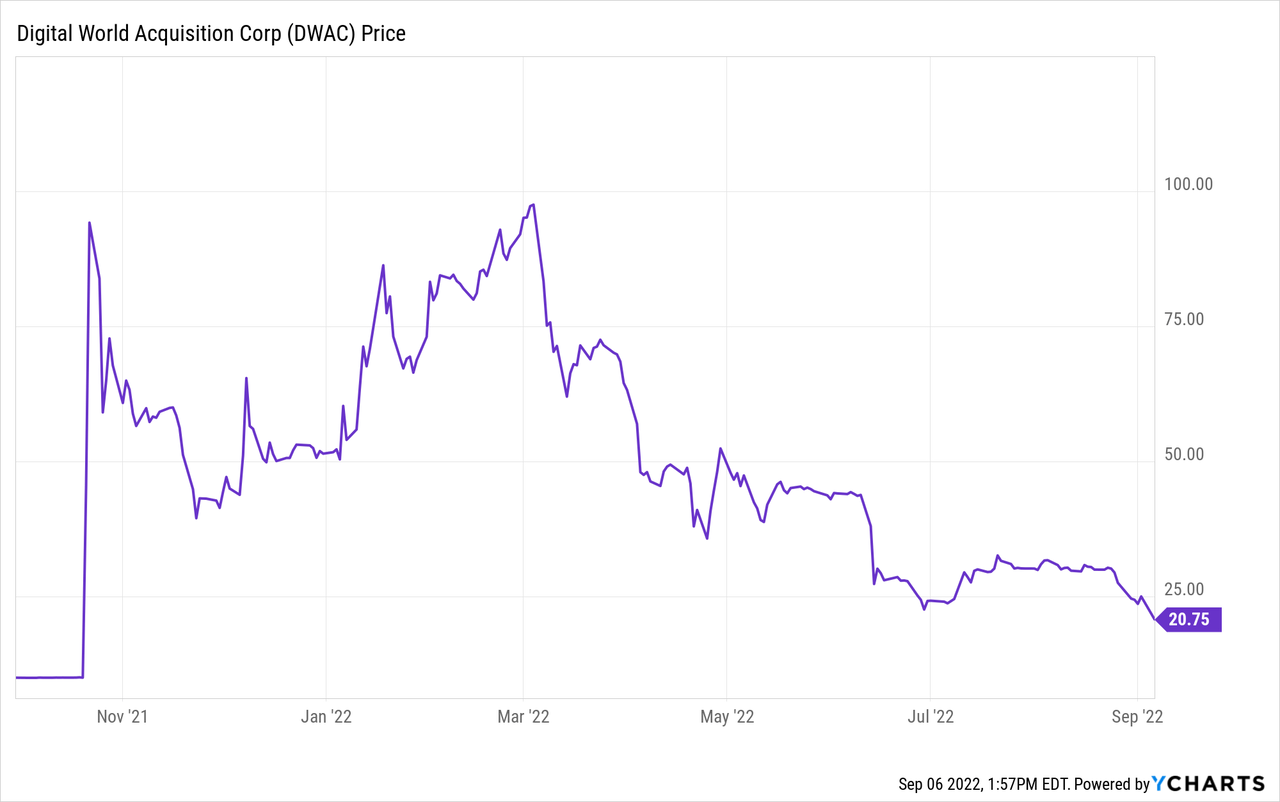

Investors have a difficult choice to make. They must decide whether DWAC should be given an additional year to complete its merger with the Trump Media and Technology Group or not. If the shareholders vote to give DWAC another year, they will still have shares worth around $25 per share as of last Friday, around $20 as of today. If the vote goes against a one-year extension, then it is possible that DWAC will have to shutter, and they will receive around $10 per share. Which would you choose?

DWAC also has outstanding warrants (NASDAQ:DWACW), which give the owner the right to buy one share of DWAC, after the merger is complete, for $11.50 per share. If the merger extension agreement does not go through, these warrants will become worthless. On Friday these warrants were trading around $6.40 apiece and their price has fallen throughout today, they are currently trading for around $4.40. Because these warrants can only be executed if the merger deals goes through, embedded in the warrants’ price is a market expectation of the completion of a merger deal. The Black-Scholes option pricing model estimates the price of the warrants should be around $13.50, given a one-year expiration date. Given that the warrant’s price is below this indicates that, by my calculations, the market is assigning a probability that the merger will be completed at less than 25%, given today’s prices.

The founders of DWAC can decide unilaterally to extend the merger deadline for another 6 months, if they are willing to put up around $3 million for a three-month extension and then another $3 million for another three months. This money would be lent to DWAC and would be put into a trust account, so it not clear if this money would be put at risk.

So, whether the merger deal will go forward or not is still up in the air. Furthermore, even if the vote is in favor of the extension, the deal still faces scrutiny from the Security and Exchange Commission (SEC). DWAC and Trump Media are being investigated for allegedly discussing the merger deal amongst themselves prior to the listing of the SPAC, which is against regulations. It is not clear how long it will be until the SEC investigation concludes and hence the uncertainty about the timeline until the merger can close, or not.

One would expect that Former President Trump would want the DWAC merger deal to collapse. If the merger deal with DWAC stays open, Trump Media cannot link itself with another SPAC for a quicker merger. If the shareholder vote closes the merger deal down, it might also make the SEC investigation moot; thereby, Trump might be able to avoid any consequences from the SEC investigation. Furthermore, given that Trump Media is reportedly behind on its payments to one of its vendors, you would assume Trump Media needs immediate cash. These reasons are most likely why we saw no promotion of the proxy vote by Trump or Trump media.

Note that Trump is actually no longer a director of Trump Media, having submitted paperwork in Florida stating he is not, which occurred a few weeks prior to the announcement of the SEC investigation. Trump continues to claim he is Chairman, but that is not possible since he is no longer a director. Trump Media’s website used to have a page titled “Board of Directors,” but you cannot find it directly via its webpage. But a Google search can find it and the page links to an old SEC filing for Form S-4 pertaining to the merger agreement from May that lists Trump as Chairman, but of course, that is not the case anymore.

The deal is structured such that Trump Media shareholders will receive a consideration of $845 million worth of the merged entity’s stock. How many shares this translates into depends on the merged entities’ stock price at the time of the merger. A group of institutional investors (private investment in private equity (PIPE) investors) signed special security purchase agreements with DWAC to purchase an additional $1 billion of the merged entities’ equity, at a price that depends on the price of merged entity’s stock price for the 10 days after the merger. The PIPE deal is structured as a death spiral, whereby the PIPE investors can potentially purchase the merged entities equity at up to a 40% discount, but at the low end for $10 per share.

The PIPE investors have until September 20 to walk away or renegotiate their deal. There is no contingency in the merger agreement to take into account what the PIPE investors will do. The original presentation by Trump Media indicated that the PIPE’s investment would go towards the capital of the merged entity. It is not clear how the merger deal will move forward if some of PIPE investors walk away, or if a new deal is structured with them.

What to watch for now is whether they can get the sufficient votes for the merger extension by Thursday, or will the founders put up the money for a three-month extension? If DWAC has an extension of the timeline for its merger to be completed, the next question is, what will the PIPE investors do? I would be surprised if the PIPE investors did not negotiate a better deal or walk away completely.

Be the first to comment