ablokhin

One of the greatest things about the stock market is also one of the worst. This is that, when the market moves down significantly, it can often take quality companies that are trading on the cheap down with it unjustifiably. A great example of this can be seen by looking at Sally Beauty Holdings (NYSE:SBH), a business that’s focused on providing hair styling services and products to a large global network of stores and to various salons and licensed beauty professionals. fundamentally speaking, it would be unfair to say that any decline was unwarranted. Because in truth, the company has seen a little bit of downside pressure from a revenue perspective and some of its profitability metrics have been mixed recently. But on the whole, shares of the business look cheap and it’s likely that the long-term outlook for investors will prove positive.

A stylish prospect for your portfolio

Back in January of this year, I wrote an article following up on Sally Beauty Holdings. In that article, I said that the company’s performance had been positive in the months leading up to that time. I did not shy away from the fact that the firm does have some problems. But ultimately, I felt as though it offered attractive long-term upside and this was driven, in large part, by how cheap shares were. This led me to keep my ‘bullish’ rating on the firm, reflecting my belief that the business would likely continue to outperform the broader market moving forward. Unfortunately, that has not been the case this year. While the S&P 500 is down by 17.7% since the publication of that article, shares of Sally Beauty Holdings have generated a loss for investors of 29.2%.

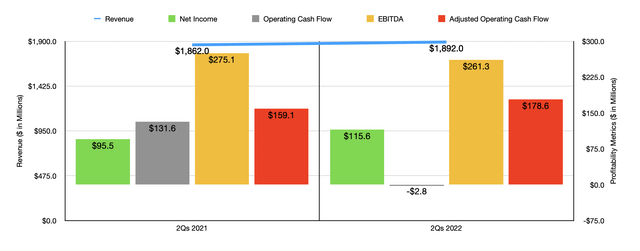

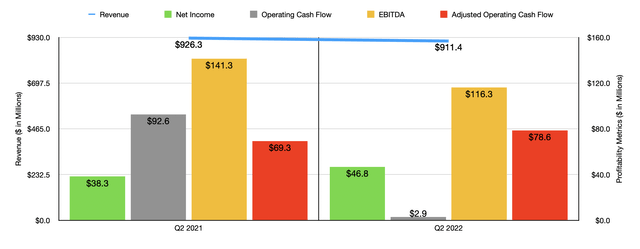

To be fair, some of this downside was definitely warranted given changes in the company’s fundamental condition. Consider recent financial figures. In the first half of 2022, revenue came in at $1.89 billion. That’s marginally higher than the $1.86 billion generated the same time one year earlier. On the other hand, for the latest quarter loan, sales of $911.4 million were lower than the $926.3 million generated in the second quarter of 2021. This came at a time when consolidated comparable sales actually improved to the tune of 0.2% year over year and was driven In large part by lower sales volume associated with its SBS segment to the tune of $10.4 million. The company was also hit to the tune of nearly $4 million across both segments combined as a result of foreign currency fluctuations. When it comes to the sales volume, management attributed that largely to fewer stores that had an operation compared to the same time one year earlier, as well as lower traffic and conversion because of the COVID-19 pandemic and supply chain disruptions. Other issues, like the temporary impact caused by stimulus and inflationary pressures, have also proven to be problematic for them.

When it comes to the company’s bottom line, results have been similarly mixed. Net income remains strong, totaling $115.6 million for the first half of the year compared to $95.5 million one year earlier. Even in the second quarter alone, when sales dropped, net income rose by 22.2% from $38.3 million to $46.8 million. On the other hand, other profitability metrics have suffered. For the first half of the year, operating cash flow was negative to the tune of $2.8 million. That compares to the $131.6 million reported one year earlier. Though if we adjust for changes in working capital, it would have risen from $159.1 million to $178.6 million. But at the same time, EBITDA for the company worsened, dropping from $275.1 million to $261.3 million. And as you can tell from the charts shown here, much of this bottom line pain came during the second quarter of the year. According to management, a good portion of the increase in costs that led to mixed financial performance from a cash flow perspective related to higher compensation costs and inflationary pressures.

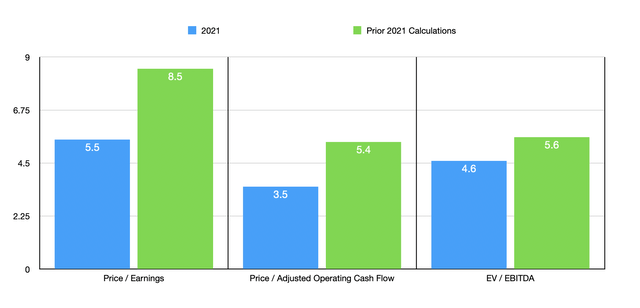

Management has not been all that clear when it comes to guidance for the current fiscal year. They did say the net sales will range between flat and down 2%. And they also said that the operating margin for the company will be around 11%. The company should also benefit from lower interest expense thanks to its decision, in May of this year, to re-pay $300 million in 8.75% senior secured notes that were originally due in 2025. It did this using cash on hand plus $150 million from its revolving credit facility. But this does not give me enough faith to accurately forecast financial performance for the year. So instead, I have decided to value the company using 2021 results. Doing this, we can see that the firm is trading at a price-to-earnings multiple of 5.5. This is down from the 8.5 reading that I got when I last wrote about the company. The price to operating cash flow multiples should drop from 5.4 in my prior article to 3.5 now. And the EV to EBITDA multiple should decline from 5.6 to 4.6.

As part of my analysis, I also decided to compare the company to one other firm. This company is Ulta Beauty (ULTA). Although a case could be made that Ulta Beauty’s track record is more robust, and therefore deserves a premium, the disparity in pricing is still significant. The price-to-earnings multiple of the company right now is 19. The price to operating cash flow multiple comes in at 17.2. And the EV to EBITDA multiple is 12.3. By comparison, Sally Beauty Holdings is much cheaper.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Sally Beauty Holdings | 5.5 | 3.5 | 4.6 |

| Ulta Beauty | 19.0 | 17.2 | 12.3 |

Takeaway

Right now, the fundamental picture for Sally Beauty Holdings is somewhat mixed. But overall, the company seems to be in pretty solid shape. At present, shares look incredibly cheap on an absolute basis and they are also cheap relative to a similar company. It also helps that, in the first quarter of this year, the company purchased $75 million of its own shares on the market. Due to these factors, I cannot help but to retain my ‘buy’ rating on the company at this time.

Be the first to comment