hapabapa

Thesis

We updated in our late June article on PayPal Holdings, Inc. (NASDAQ:PYPL) that the worst was likely over, encouraging investors to add exposure. We also emphasized its valuation was attractive after the massive battering from its 2021 highs.

Accordingly, PYPL has outperformed the market significantly since our last update, as it surged toward its post-Q2 earnings high. As a result of the massive surge, PYPL’s valuation is more well-balanced now. While we are confident its June lows should hold robustly, we surmise that the current entry levels could do with further digestion.

Management is also on the right side with activist investor Elliott Investment Management. Therefore, PayPal’s renewed focus on driving operational efficiencies and shareholder value should help it improve its margins through FY23.

Notwithstanding, investors also need to assess whether PYPL still deserves the premium valuation that saw it surge unsustainably to its 2021 highs. We surmise that the company’s revenue growth should normalize over the medium-term as management focuses on recovering its profitability and reprioritizing capital allocation toward buybacks. As a result, a lower valuation multiple is appropriate to be attached to PYPL moving ahead as PayPal recovers from its malaise.

Given the sharp momentum spike and its more well-balanced valuation, we deduce some near-term caution is warranted. We posit an entry level closer to $80 seems more attractive if the bottoming process is robust.

Accordingly, we revise our rating on PYPL from Buy to Hold.

PayPal’s Profitability Should Improve Through FY23

We postulate that the market had anticipated a solid Q2 release from PayPal, as PYPL surged nearly 40% from our previous article to its August highs.

Therefore, we believe positive commentary from management further corroborated the market’s conviction, as PayPal remains focused on recovering its profitability growth.

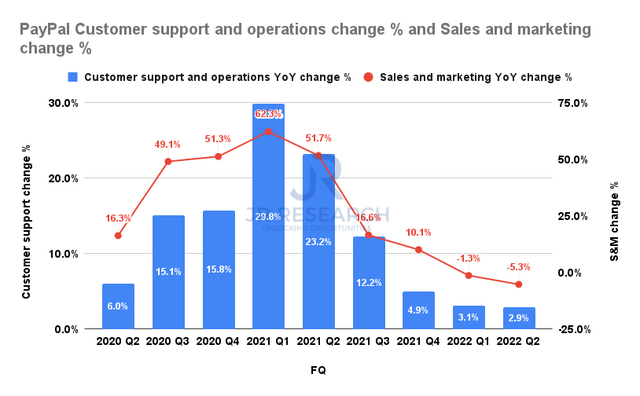

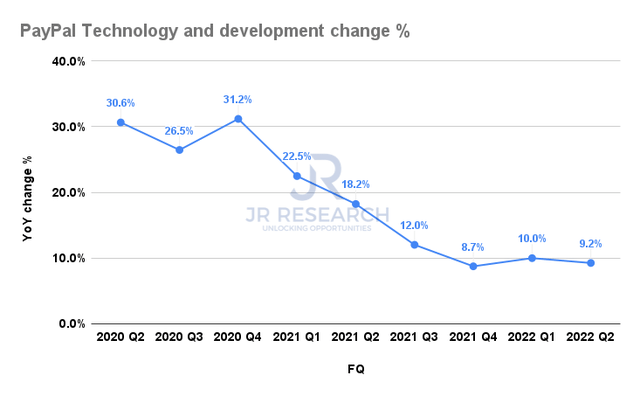

PayPal customer support and S&M change % (Company filings) PayPal technology and development change % (Company filings)

As a result, the company has continued to reduce its non-transaction-related expenses growth in Q2, as seen above. Given PayPal’s excesses in the pandemic-driven years of 2020/21, such a slowdown is not unexpected, as these tailwinds wore off dramatically. However, management’s ability to tweak its operating model to refocus on driving efficiencies should be given due credit.

We believe it has helped PayPal tremendously to recalibrate its operating model in the post-pandemic era, as its e-commerce drivers normalized markedly. As a result, PayPal has gained share despite the harsh macros, demonstrating management’s keen foresight.

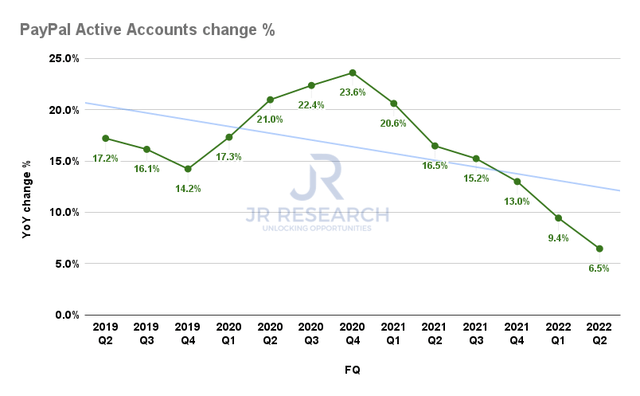

PayPal active accounts change % (Company filings)

PayPal’s priority in focusing on monetization meant it was no longer focusing on driving active accounts growth beyond what is necessary according to its strategy. Still, it remains confident of a 10M net new active accounts for FY22.

We also believe the dramatic slowdown in the growth of its active accounts should moderate moving forward as PayPal laps less challenging comps.

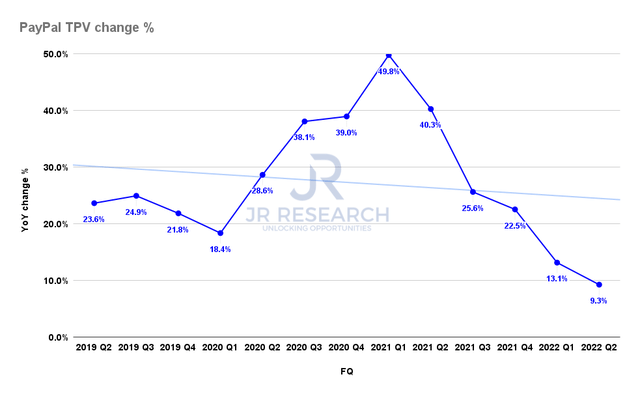

PayPal TPV change % (Company filings)

Still, the good old days of the pandemic should be well over, as it drove PayPal and its e-commerce peers to believe the e-commerce tailwinds should sustain. As seen above, PayPal’s total payment value (TPV) growth has fallen to just 9.3% in Q2, down from Q1’s 13.1%. It was also down markedly from Q2’21’s 40.3%, highlighting to investors how the market has gotten its valuation on point as it pummeled PYPL.

However, we are also confident that its TPV growth should normalize moving forward, as PayPal laps less challenging comps and continues to gain share ahead of its less competitive peers. In addition, management recognizes that PayPal’s robust profitability and network scale is a significant competitive moat, leveraging it to capture more efficiencies and drive share gains.

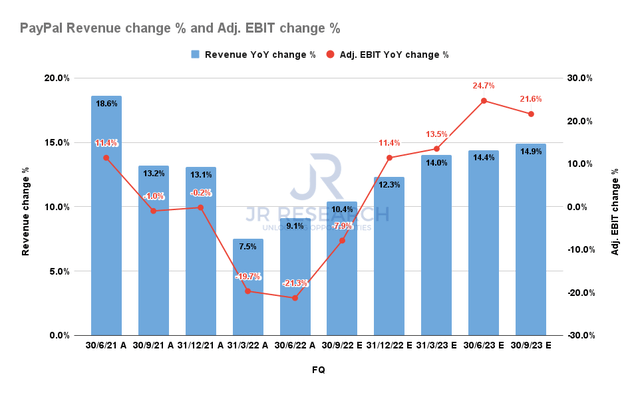

PayPal revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) suggest that PayPal’s revenue and adjusted EBIT growth should have reached a nadir Q1/Q2 before inflecting higher. Therefore, we surmise that the market had anticipated PayPal’s recovery in its growth cadence, corroborated by management’s confidence in its Q2 earnings commentary.

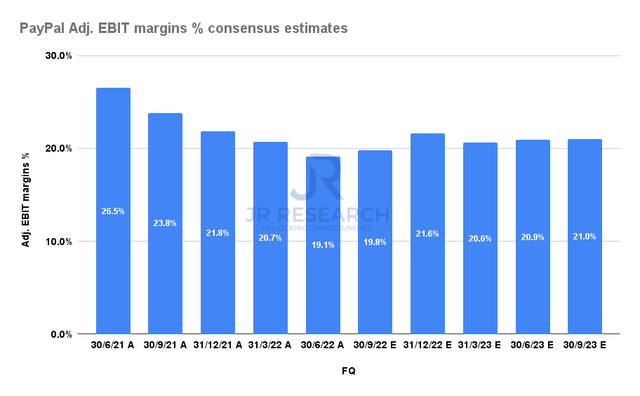

PayPal adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Furthermore, management reiterated its confidence that investors should expect PayPal to recover its profitability through FY23, with significant gains in Q4’22. Hence, we are not surprised that drove the outperformance of PYPL since its June lows.

PYPL’s Valuation Seems More Well-Balanced

Management highlighted that its board authorized a new $15B share repurchase program on top of its previous authorization. Therefore, PayPal has an $18B war chest at its disposal to deploy as of Q2 to further drive shareholder value through buybacks in its capital allocation strategy. Management also indicated that it expects to utilize $4B of buybacks for FY22, consistent with its TTM repurchase of $4.471B. In addition, its buyback yield reached 4.1% in Q2, a 5Y high. Therefore, PayPal has been utilizing its authorization aggressively to drive buybacks, given the attractive valuation in Q2.

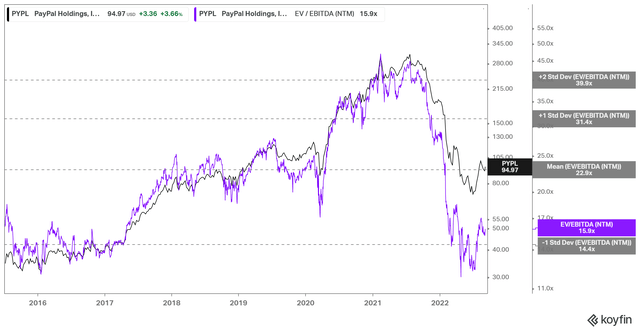

PYPL NTM EBITDA multiples valuation trend (koyfin)

Notwithstanding, we surmise that the market has de-rated PYPL. We are confident that investors will unlikely see the highs in 2021 revisited anytime soon. PYPL’s buying upside has consistently been rejected around its all-time NTM EBITDA multiples mean of 23x, corresponding to an enterprise value of about $162B, approximately 50% higher.

However, its all-time mean also included the pandemic-driven excesses, culminating in a TTM 5Y revenue CAGR of 18.5%. Based on the revised consensus estimates, we don’t expect PayPal’s forward annualized revenue growth rates to come close to its TTM 5Y revenue CAGR, suggesting that investors should expect a slower-growing PayPal and, therefore, a markedly lower valuation.

Therefore, we urge investors to apply a generous discount in their assessment of PYPL’s fair value estimates to derive an appropriate margin of safety. We prefer to base our estimates closer to a 25% discount from its EBITDA multiple mean of 23x, suggesting a 17.3x multiple seems appropriate. PYPL last traded at around 15.3x NTM EBITDA, suggesting a potential upside of just 13% from the current levels.

Is PYPL Stock A Buy, Sell, Or Hold?

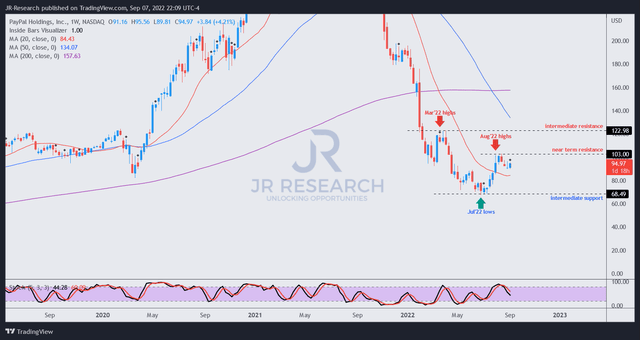

PYPL price chart (weekly) (TradingView)

We remain confident of PYPL’s June long-term bottom. However, we noted a menacing rapid run-up from its June lows as it formed its August highs.

The market appears to be digesting its post-Q2 gains, even though PYPL’s momentum has remained resilient through the broad market pullback.

However, we posit that further downside volatility should be expected, improving the reward-to-risk profile for investors looking for outperformance potential.

As such, we believe revising our rating on PYPL from Buy to Hold is appropriate.

Be the first to comment