MicroStockHub

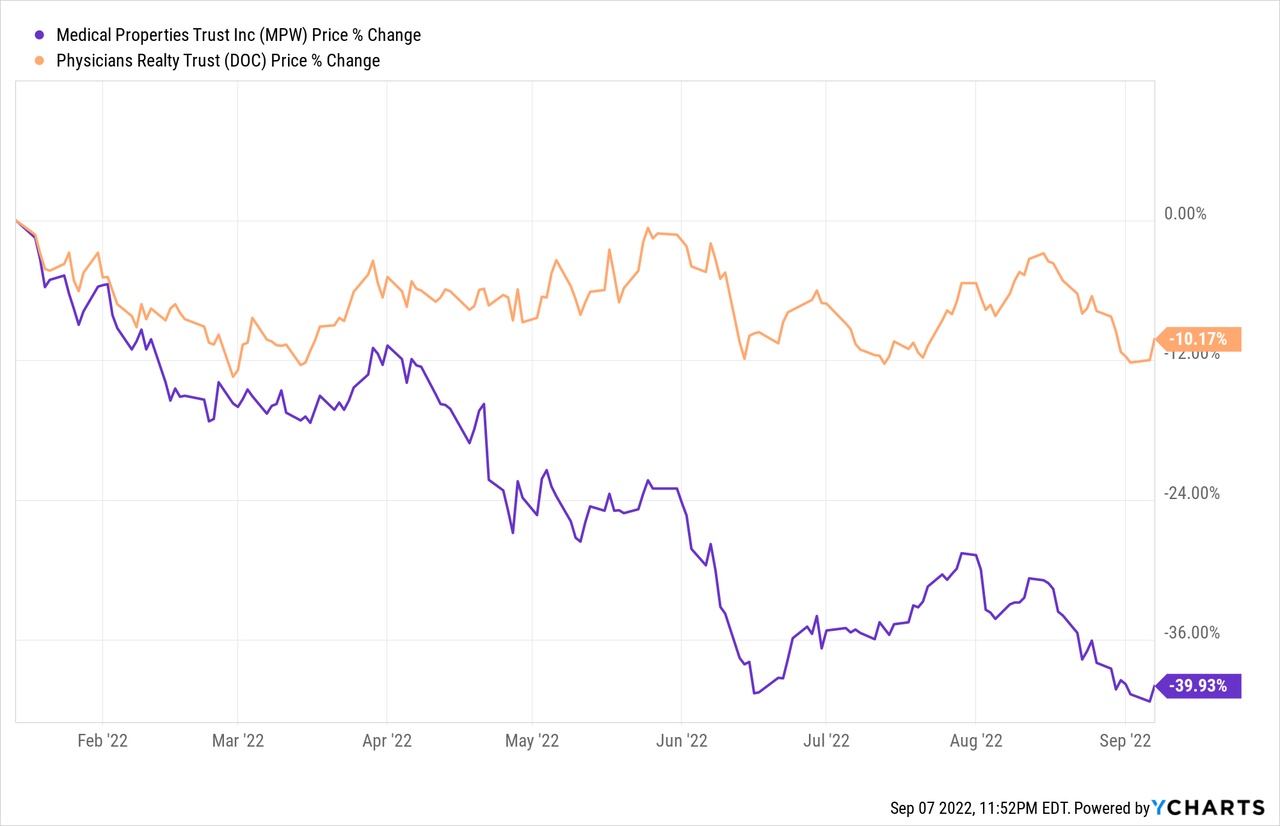

Medical Properties Trust (NYSE:MPW) and Physicians Realty Trust (NYSE:DOC) are both high yield triple net lease healthcare REITs that have fallen this year:

While we can see the case for owning DOC, we prefer MPW at the moment. We share three reasons why in this article.

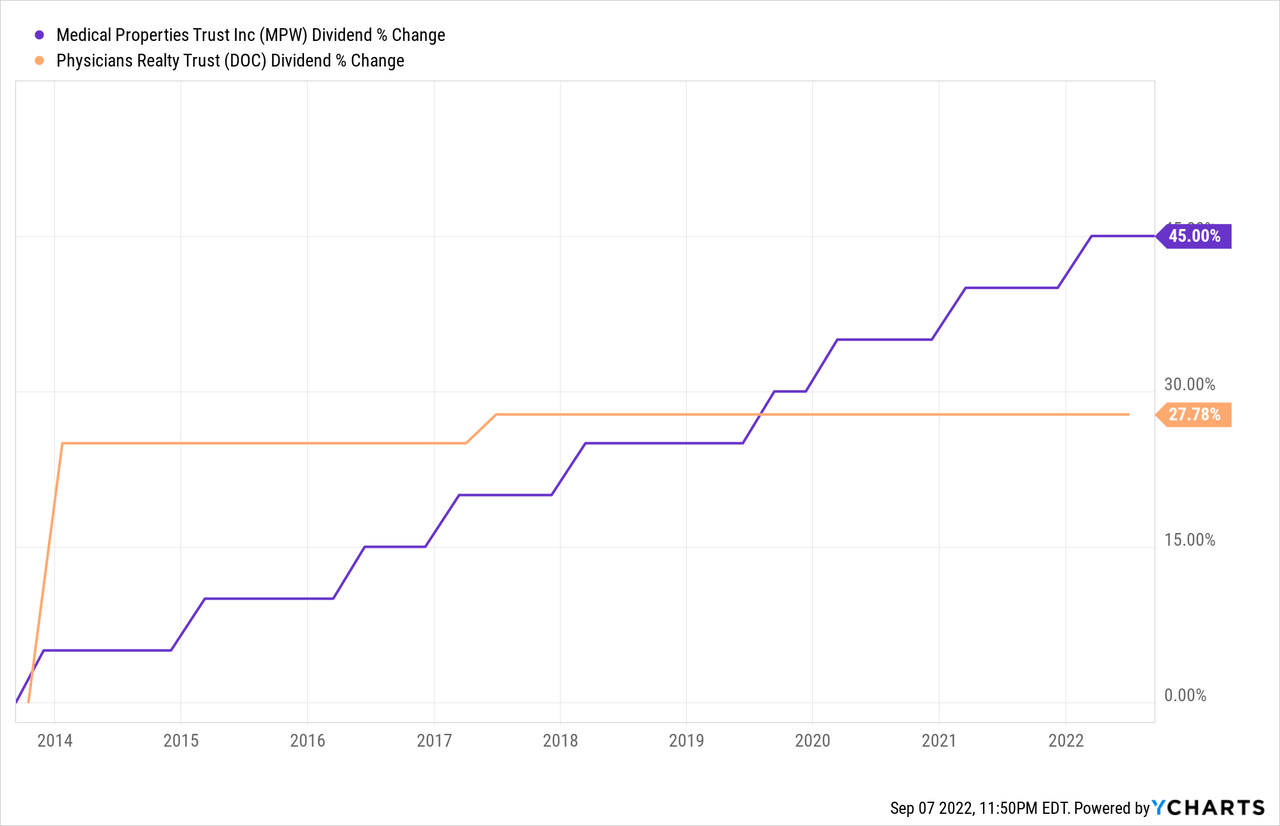

#1. MPW Is A Superior Dividend Grower

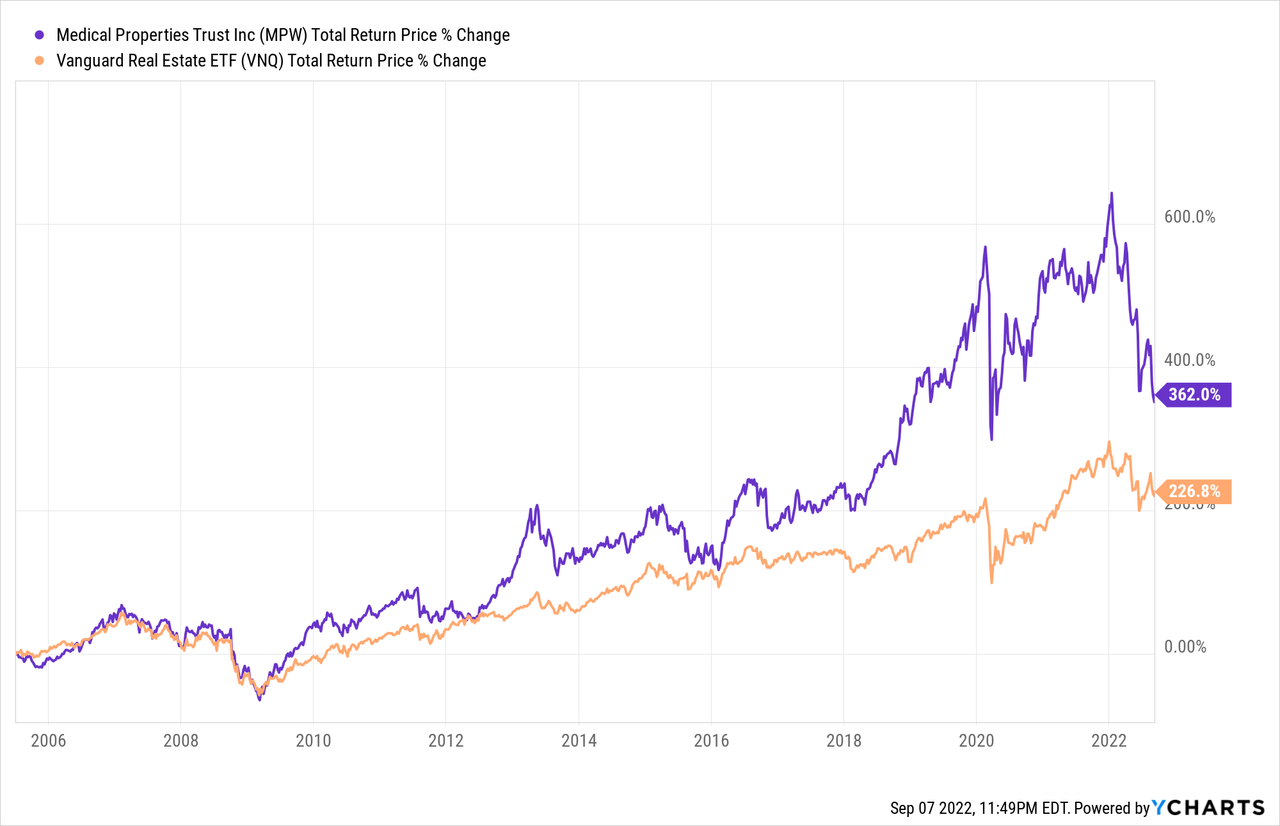

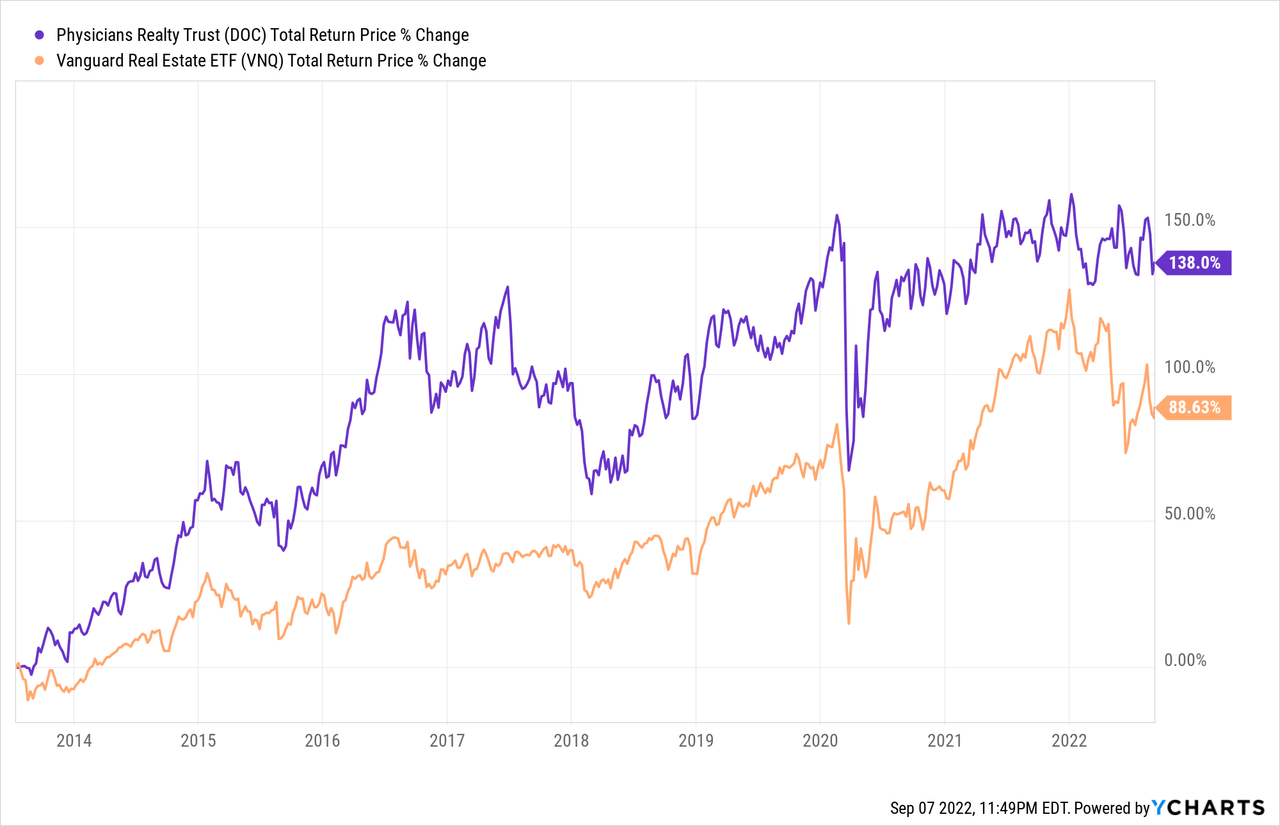

While both REITs have generated significant outperformance of the broader REIT sector (VNQ) since going public:

MPW has proven to be a much more consistent and dynamic dividend grower:

This matters a lot to us because REITs – especially triple net lease REITs – are primarily income vehicles. When a REIT is able to consistently and aggressively grow its dividend like MPW has for years, it speaks volumes to its management’s skill, the strength of its business model, and ultimately its commitment to compounding value and returning cash to shareholders. Nothing proves a triple net lease REIT’s value more than it growing its dividend consistently and aggressively.

#2. MPW Is Significantly Cheaper

While neither stock is expensive at the moment, MPW is the clear winner when it comes to valuation.

DOC looks fairly valued and even cheap based on several metrics. For example, its EV/EBITDA of 17.71x is slightly above its five year average of 17.57x. However, its price to FFO ratio is 15.58x at the moment, below its five year average of 16.05x, its price to AFFO ratio is 16.42x compared to its five year average of 17.59x, its forward dividend yield is 5.48% which is above its five year average of 5.31%, and its price to NAV is 0.93x, below its five year average of 0.99x.

In contrast, MPW is vastly cheaper on both a comparative basis as well as relative to its own historical averages. Its EV/EBITDA of 13.42x is well below its five year average of 14.45x. Furthermore, its price to FFO ratio is 7.98x at the moment, below its five year average of 11.31x, its price to AFFO ratio is 10.08x compared to its five year average of 13.94x, its forward dividend yield is 8.14% which is significantly above its five year average of 6.07%, and its price to NAV is 0.77x, way below its five year average of 1.16x.

Now, there are concerns surrounding the viability of its largest tenant (Steward) and some investors question the alignment of the external management with shareholders. However, MPW’s track record of generating outstanding dividend growth and index-beating total returns speaks for itself, reflecting that external or not, MPW’s management has served shareholders very well over the long-term. MPW also recently sold some Steward operated hospitals to a sophisticated institutional investor at a low 5.8% cap rate, implying that the viability of the Steward leases are not nearly as risky as MPW bears imply. Finally, MPW raised the dividend once again this year by the same amount as it has for years. If the company was in the trouble that its stock price’s epic decline and its dirt cheap valuation imply, it likely would not have sustained its dividend growth pace this year.

In fact, analysts expect MPW to grow its AFFO per share by 3.2% this year, 3% next year, and 3.9% in 2024. Furthermore, the dividend per share is expected to grow at a 4.4% CAGR through 2026. Given how cheap the stock is right now, this implies that MPW is a tremendous value right now.

Meanwhile, DOC – trading at a massive valuation premium to MPW – is only expected to grow its dividend at a 1.6% CAGR through 2026 and its AFFO per share is only expected to grow at a 1.6% CAGR through 2026 as well. DOC is not a bad buy per se, at least for conservative risk-averse investors, but the growth is just not inspiring, especially when you consider that multiple expansion is unlikely and the yield is not nearly as juicy as MPW’s.

#3. MPW Is More Inflation Resistant

Given that a growing number of economic indicators (i.e., inflation rates at four decade highs, slowing economic growth across the globe, and headwinds such as the war in Ukraine, lingering supply chain issues, and geopolitical unrest in the Taiwan Straits) imply that we are headed for a period of stagflation, we place a premium on business models that are both defensive and inflation resistant in nature.

DOC is certainly defensive, boasting an investment grade credit rating, enjoying healthy occupancy levels, and generating a majority of its cash flow from investment grade tenants. Furthermore, its triple net lease format in a defensive sector makes its cash flows very reliable. However, while it is insulated pretty well from inflationary cost pressures due to its triple net lease structure, its rent escalators are generally not inflation linked, so its cash flows do not increase in-line with inflationary forces.

In contrast, MPW is both defensively positioned against recessions as well as positioned to benefit from inflation. Its mission-critical hospital portfolio with triple net leases attached to them positions it well to weather a recession, and its differentiated rent escalators position it well for inflation.

Its CPI-linked lease adjustments give it solid inflation protection, combining with its defensive leases and asset portfolio to position it well for these stagflationary times. As management said during MPW’s recent Q2 earnings call:

We estimate that our cash rents will increase in 2023 over 2022 by about $57 million as a result of our inflationary escalators. That’s an average increase across the portfolio of approximately 4.4%. Applying an estimated and arbitrary blended capitalization rate of 6.5% to this incremental cash results in the equivalent of about $875 million of additional leased real estate, for which we have 0 cost of capital.

So in capital markets that are temporarily squeezing investment spreads, we are very pleased with the built-in improvements in yield that we expect beginning early in 2023. And of course, that’s on top of the previously disclosed 2022 escalation.

In contrast, most other triple net lease REITs are only getting 1-3% annualized rental bumps under fixed terms.

Investor Takeaway

DOC is a solid bet for conservative income investors looking for a recession resistant REIT that pays out a safe 5.5% dividend yield. However, it is not particularly cheap at the moment, its long-term track record as a dividend grower is relatively unimpressive, and it is not positioned to benefit from rising inflation.

In contrast, MPW – as a triple net lease REIT in the healthcare sector – is also well positioned for recession. However, it is also well positioned for inflation thanks to its CPI-linked rent escalators. Furthermore, management has proven adept at generating strong dividend growth on a very consistent basis and the stock is trading at a deep discount to its historical averages as well as relative to DOC.

Overall, we rate MPW a Strong Buy and DOC a Hold.

Be the first to comment