Galeanu Mihai

A Quick Take On Varonis Systems

Varonis Systems (NASDAQ:NASDAQ:VRNS) reported its Q2 2022 financial results on August 1, 2022, beating expected revenue and EPS estimates.

The company provides automated data security and compliance software.

Given the worsening economic conditions, foreign exchange risks and the company’s continued high operating losses, I’m on Hold for VRNS for the near term.

Varonis Systems Overview

New York, NY-based Varonis was founded in 2004 to develop a family of data protection software and related products for organizations of all types worldwide.

The firm is headed by co-founder, Chairman and CEO Yaki Faitelson, who previously held senior positions at NetVision and Network Appliance.

The company’s primary offerings include:

-

Data protection

-

Threat detection and response

-

Privacy and compliance

-

Cloud security

-

Integrations

The firm acquires customers from its sales and marketing teams and from its channel partners, resellers and technology partners.

Varonis Systems’ Market & Competition

According to a 2022 market research report by Straits Research, the global market for big data security was an estimated $24 billion in 2021 and is expected to reach $115 billion by 2030.

This represents a forecast CAGR of 19% from 2022 to 2030.

The main drivers for this expected growth are increasing security threat vectors, growing demand for data security from governments and the growing use of data-dependent devices by consumers.

Also, the North American region has dominated the market in terms of market share, but the Asia Pacific region is expected to produce the highest rate of growth through 2030.

Major competitive or other industry participants include:

-

IBM Corporation

-

Oracle Corporation

-

Microsoft Corporation

-

Google LLC

-

Amazon Web Services

-

HPE

-

Talend

-

Micro Focus Plc

-

Checkpoint Software Technologies

-

FireEye

Varonis Systems’ Recent Financial Performance

-

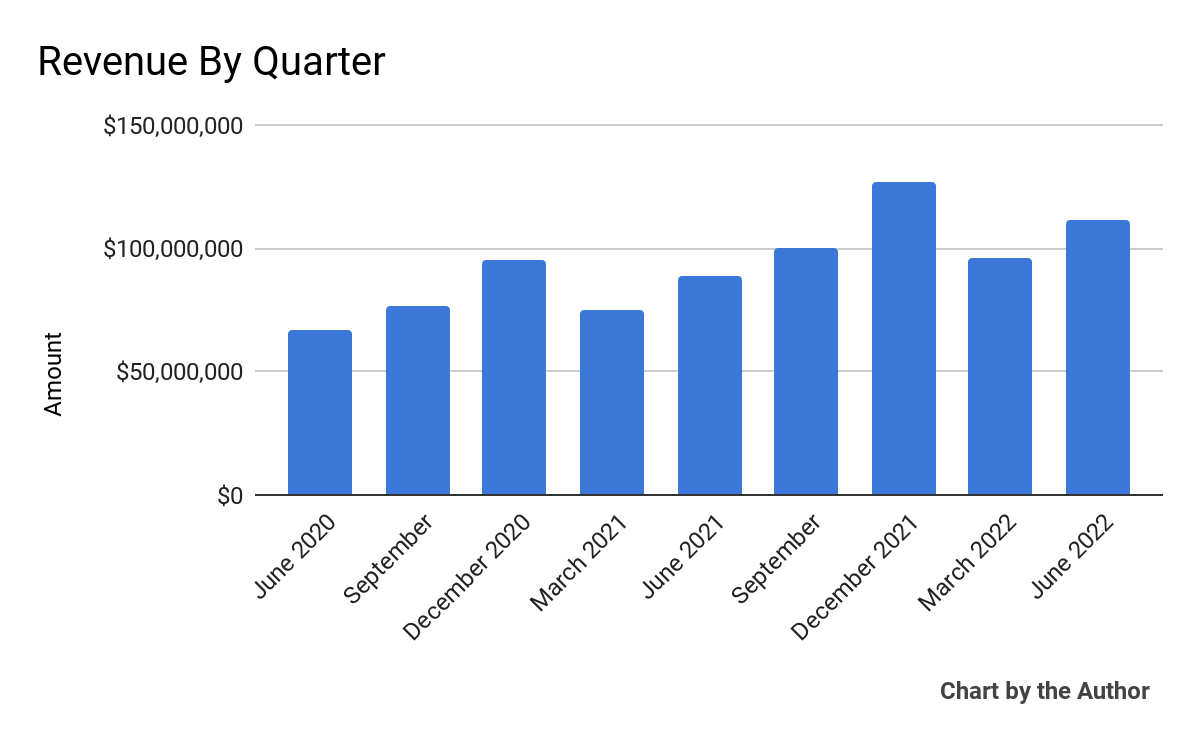

Total revenue by quarter has trended higher in recent quarters:

9 Quarter Total Revenue (Seeking Alpha)

-

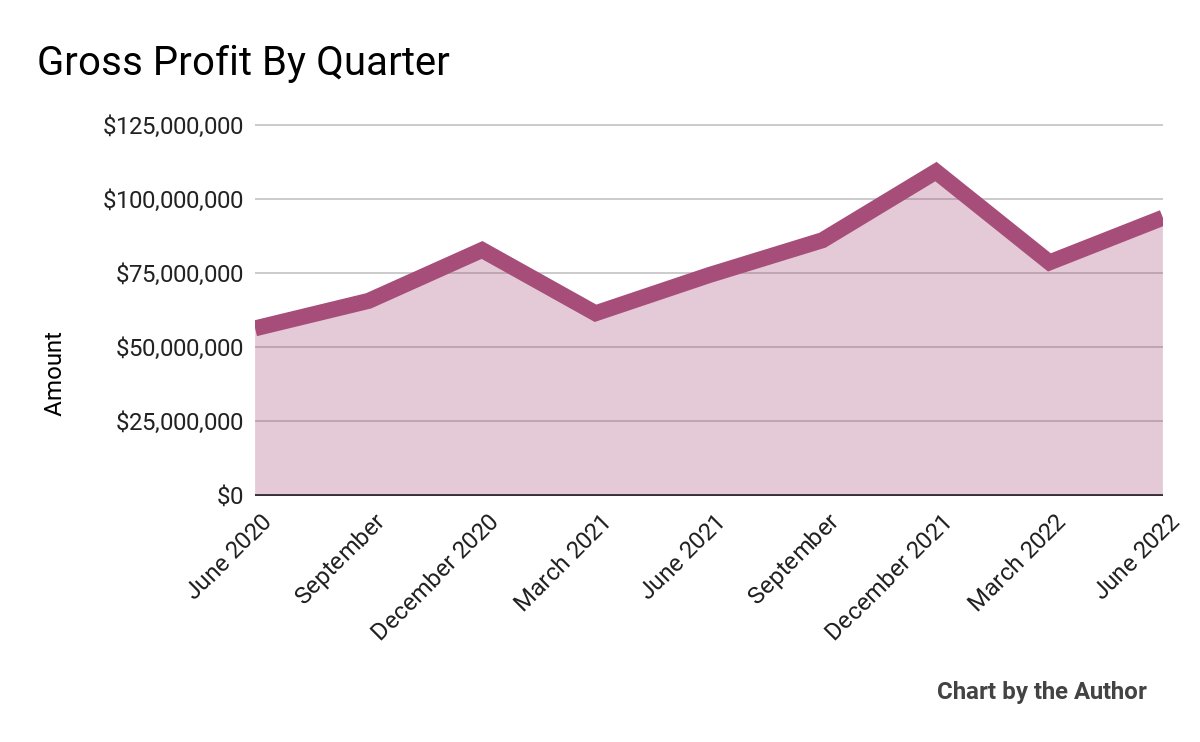

Gross profit by quarter has followed a similar trajectory to that of total revenue:

9 Quarter Gross Profit (Seeking Alpha)

-

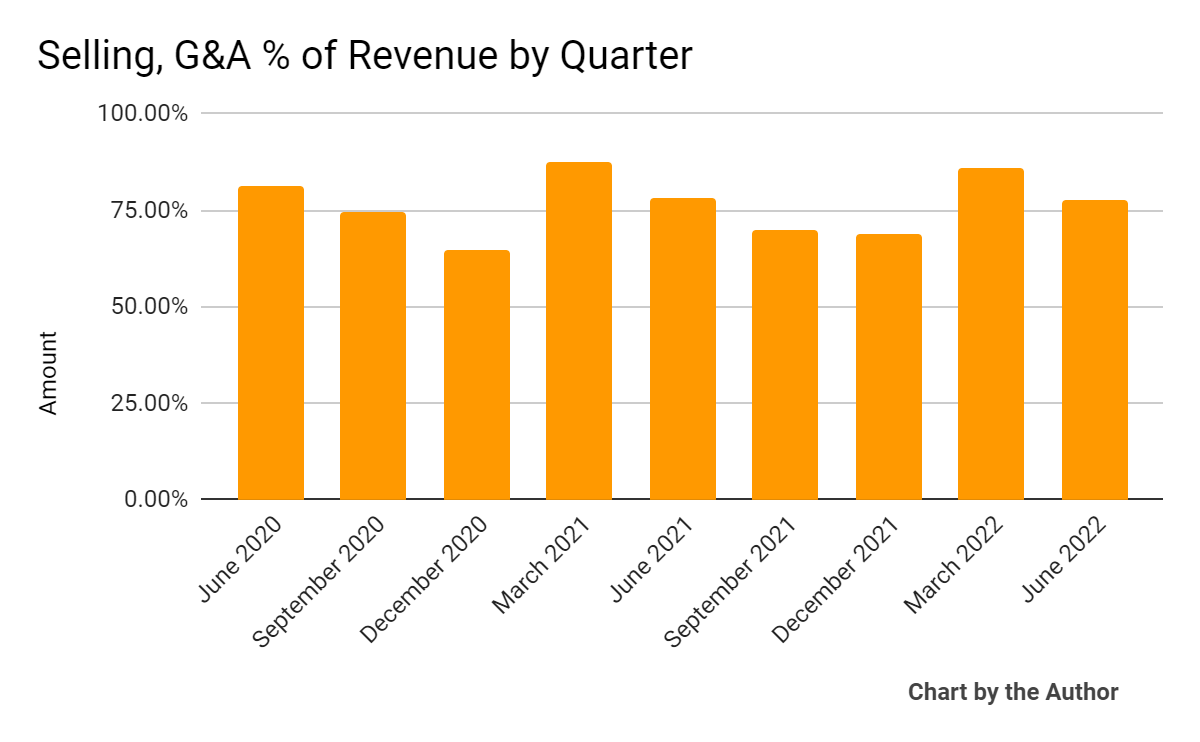

Selling, G&A expenses as a percentage of total revenue by quarter have remained stable as revenue has grown:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

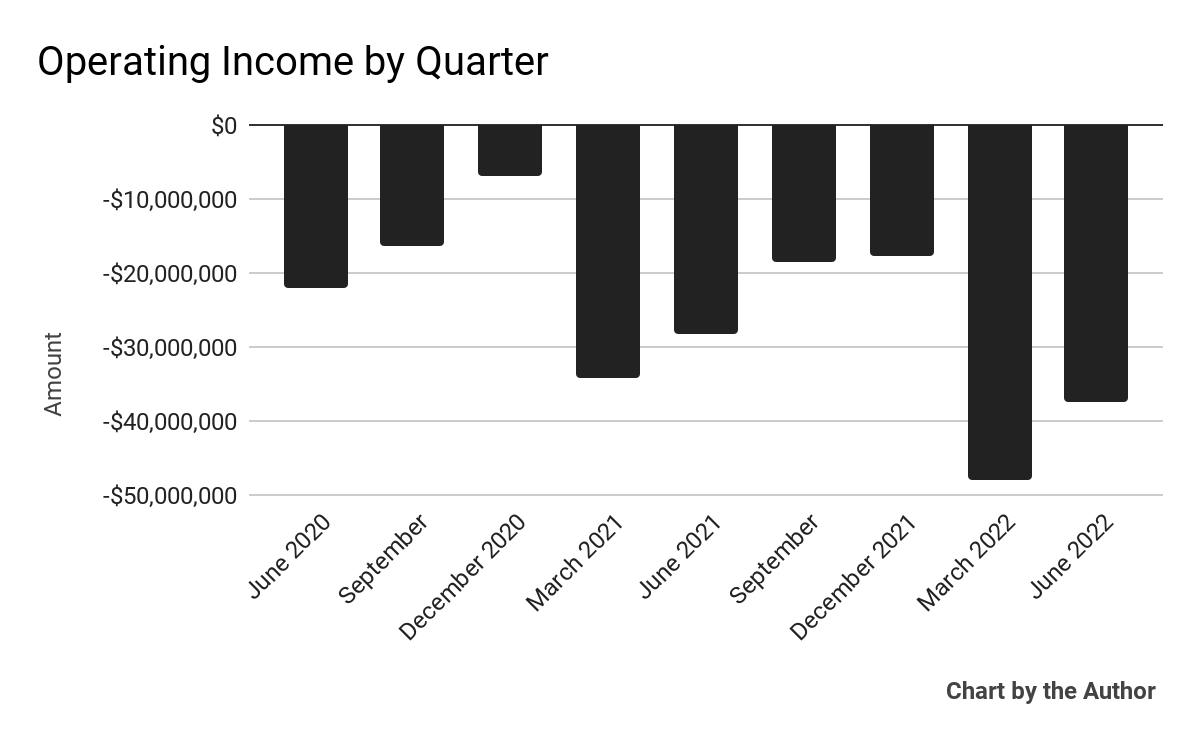

Operating losses by quarter have worsened in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

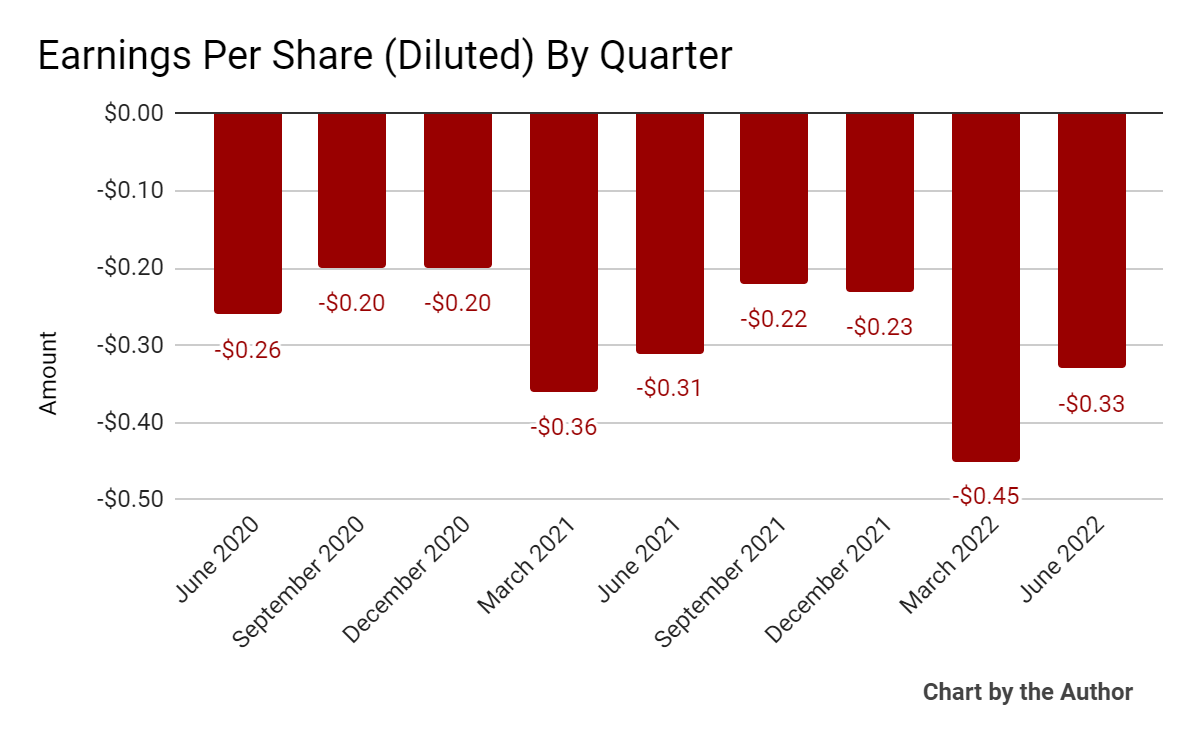

Losses per share (Diluted) have similarly worsened recently:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

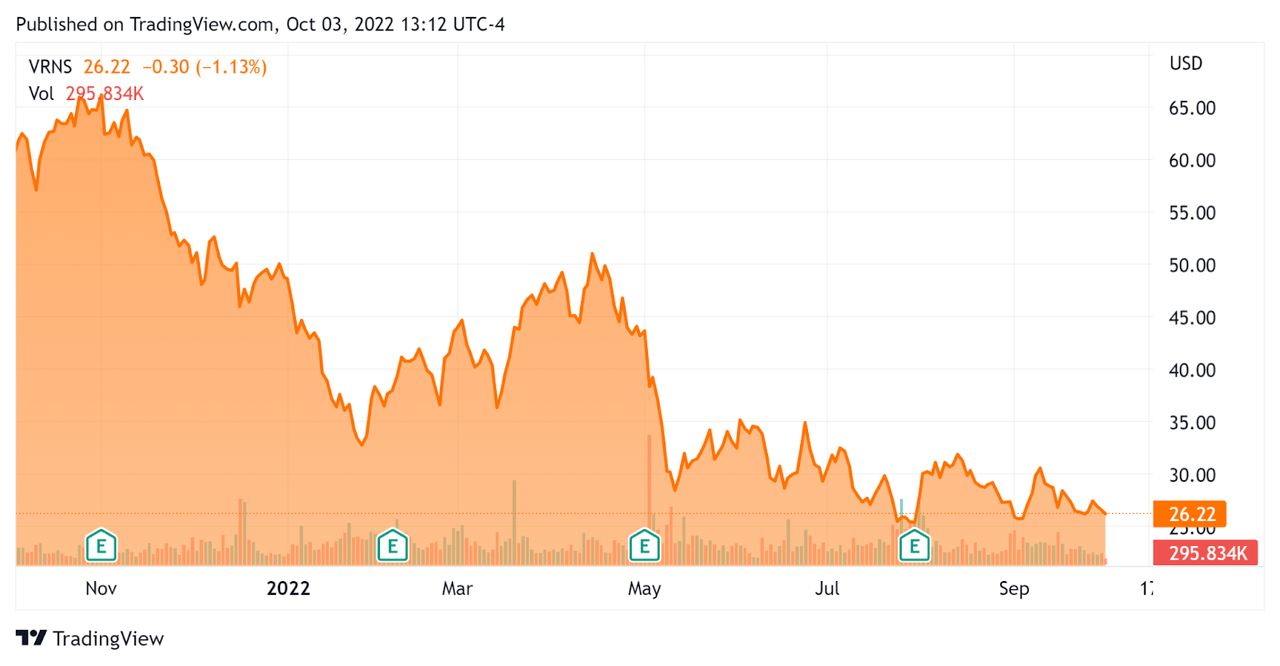

In the past 12 months, VRNS’s stock price has fallen 56.5% vs. the U.S. S&P 500 index’ drop of around 15%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Varonis Systems

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

5.63 |

|

Revenue Growth Rate |

29.7% |

|

Net Income Margin |

-30.7% |

|

GAAP EBITDA % |

-25.6% |

|

Market Capitalization |

$2,910,000,000 |

|

Enterprise Value |

$2,450,000,000 |

|

Operating Cash Flow |

$6,110,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.23 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Check Point Software (CHKP); shown below is a comparison of their primary valuation metrics:

|

Metric |

Check Point Software |

Varonis Systems |

Variance |

|

Enterprise Value / Sales |

4.63 |

5.63 |

21.6% |

|

Revenue Growth Rate |

6.7% |

29.7% |

345.0% |

|

Net Income Margin |

35.2% |

-30.7% |

–% |

|

Operating Cash Flow |

$1,180,000,000 |

$6,110,000 |

-99.5% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

VRNS’s most recent GAAP Rule of 40 calculation was 4.0% as of Q2 2022, so the firm is in need of significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

29.7% |

|

GAAP EBITDA % |

-25.6% |

|

Total |

4.0% |

(Source – Seeking Alpha)

Commentary On Varonis Systems

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the growth in the company’s annual recurring revenue of 30%, with North America being a strong region.

Leadership also made the case for the firm’s positioning as hybrid work becomes more prevalent and government regulations more extensive, thus increasing the need for cloud data protection capabilities.

As to its financial results, total revenue rose 26% year-over-year, with annual recurring revenue [ARR] growth at 30%.

Management didn’t disclose the company’s net dollar retention rate, which is an important metric indicating product/market fit and sales & marketing efficiency.

VRNS’ Rule of 40 results have been poor, with the firm barely in positive territory.

Also, its European results significantly trailed overall company results, in part due to a much stronger U.S. dollar against the Euro and British Pound as well as the company exiting the Russia market.

Non-GAAP gross margin rose slightly, while GAAP operating losses moderated slightly and earnings continued heavily negative.

For the balance sheet, the company finished the quarter with $789 million in cash, equivalents, short-term deposits and marketable securities.

Over the trailing twelve months, free cash used was $8.4 million. Looking ahead, management reaffirmed forward full year guidance.

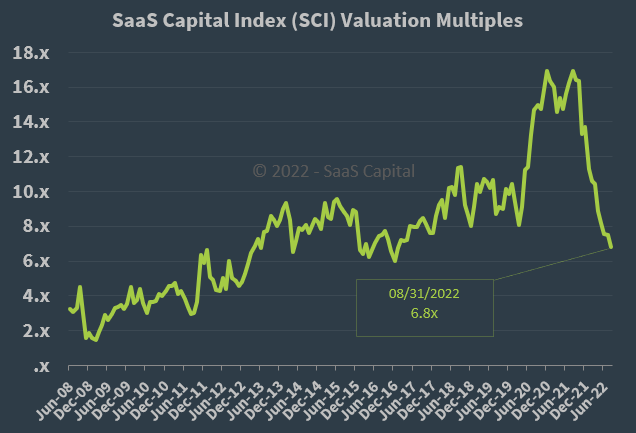

Regarding valuation, the market is valuing VRNS at an EV/Sales multiple of around 5.6x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.8x at August 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, VRNS is currently valued by the market at a discount to the broader SaaS Capital Index, at least as of August 31, 2022.

The primary risk to the company’s outlook is a growing macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth trajectory.

Also a strong U.S. dollar may continue to strengthen against European currencies, creating FX headwinds.

Given worsening economic conditions, foreign exchange risks and the company’s continued high operating losses, I’m on Hold for VRNS for the near term.

Be the first to comment