gustavomellossa/iStock via Getty Images

It is my firm belief that 80% of money managers can’t outperform the S&P 500 index over time due primarily to the fees they charge their clients. Each and every individual person intent on having the happiest retirement possible could and should take charge of their retirement portfolios and invest in simple index/mutual funds and/or a balanced portfolio like the one I have set up to maximize returns over decades of performance. My ratios and distributions are based on my book – Investing Better Than A Money Manager: The Rise Of Retail Investing.

Past Performance

Here is briefly how my portfolio evolved from its inception when I became more of an active investor in 2014 in the market until now. Notice, I spent several years before 2014 putting some funds into the market now and then at random as I finished school and got married and started a family, etc., which I didn’t really follow or record.

| Year | Welsh Portfolio | S&P 500 |

| 2014 | $77,053 | |

| 2015 | $81,233 | -0.81% |

| 2016 | $91,494 | 9.64% |

| 2017 | $142,363 | 19.38% |

| 2018 | $162,607 | -6.29% |

| 2019 | $230,093 | 29.01% |

| 2020 | $316,104 | 16.28% |

| 2021 | $402,037 | 27.04% |

Contributions

Contributions make up a vital component of your portfolio, especially when you are starting out, as they are the building blocks of tax advantaged savings for retirement. The more money you have, the more concern you should have with taxes. This is why when you start out investing, you should try to add to accounts like IRAs ASAP instead of putting the money into regular taxable investment accounts.

|

Contributions |

HSA |

IRAs |

401(K) |

|

Jan 2022 |

$0 |

$0 |

$0 |

|

Feb 2022 |

$0 |

$0 |

$500 |

|

Mar 2022 |

$0 |

$0 |

$3,760.44 |

|

Apr 2022 |

$0 |

$0 |

$500 |

|

May 2022 |

$10,000 |

$0 |

$2,000 |

|

Jun 2022 |

$0 |

$0 |

5,205.53 |

|

Jul 2022 |

$0 |

$0 |

$500 |

|

Aug 2022 |

$0 |

$0 |

$2627.77 |

|

Sept 2022 |

$0 |

$0 |

$4,000 |

|

YTD CONTRIBUTIONS |

$10,000 |

$0 |

$19,093.74 |

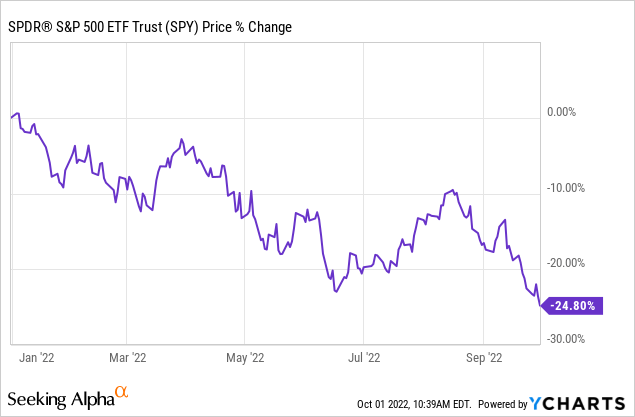

Here is how my portfolio is performing compared to the SPDR S&P 500 Trust (SPY) over the three quarters of 2022.

|

Fund |

SPY |

Welsh |

Welsh Minus Contributions |

|

% Gain Jan 2022 |

-5.32% |

-8.12% |

-8.12% |

|

% Gain Feb 2022 |

-3.62% |

-0.88% |

-10.15% |

|

% Gain Mar 2022 |

3.59% |

3.3% |

2.3% |

|

% Gain Apr 2022 |

-9.03% |

-6.2% |

-6.4% |

|

% Gain May 2022 |

0.24% |

1.3% |

-2.09% |

|

% Gain Jun 2022 |

-9.02% |

-6.21% |

-7.66% |

|

% Gain Jul 2022 |

9.91% |

13.66% |

13.51% |

|

% Gain Aug 2022 |

-3.79% |

-5.32% |

-6.01% |

|

% Gain Sept 2022 |

-9.9% |

-7.8% |

-8.9% |

|

YTD GAINS |

-24.80% |

-9.9% |

-24.16% |

Regular contributions to your retirement portfolio help your portfolio to grow even during less than ideal months where you fail to outperform the S&P 500. Not every month will be a winner, but regular contributions can help make anyone’s performance look great over time.

My portfolio is divided up to start 2022 at around 73% stocks and around 27% mutual and index funds with the goal to increase stocks to over 80% of my portfolio over time. My current setup has swayed to 71% domestic exposure and 29% international as I have pushed in a lot of my chips in on Petrobras (PBR). I have about 2.5% of my portfolio in bond mutual funds so that I know how they work and to have at least a little exposure to this sector over time. I plan to have bonds be a very small portion of my portfolio up to right around age 65. Diversification lifts my whole portfolio’s returns over time, so finding the best stocks in every sector is a goal for me each and every year. Here are some of the main changes since my last portfolio article in August of 2022.

|

Welsh Portfolio |

Stocks |

Index/Mutual Funds |

Bonds |

Domestic |

International |

|

Jan 2022 |

73% |

27% |

2.6% |

82% |

18% |

|

Feb 2022 |

74% |

26% |

2.6% |

93% |

7% |

|

Mar 2022 |

74% |

26% |

2.4% |

94% |

6% |

|

Apr 2022 |

75% |

25% |

2.5% |

96% |

4% |

|

May 2022 |

73% |

27% |

2.5% |

62% |

38% |

|

Jun 2022 |

73% |

27% |

2.6% |

77% |

23% |

|

Jul 2022 |

75% |

25% |

2.3% |

71% |

28% |

|

Aug 2022 |

74% |

26% |

2.4% |

70% |

30% |

|

Sept 2022 |

75% |

25% |

2.5% |

71% |

29% |

Here are the details of my personal~$334K portfolio then, based on values of approximately $40K, $400K, and $4 million broken down by sectors with brief descriptions of each stock in each sector. The best thing about my portfolio setup is that it is scalable so that people interested in following a similar path can set up their portfolios to follow my path no matter how small or large their holdings are. With fee-free trading and the advent of fractional shares, investors are more capable than ever in setting up amazing portfolios even when starting from scratch.

The Welsh Portfolio Spreadsheet

The Information Technology Sector

Aim = 8% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

QCOM |

$720 |

$7,200 |

$72,000 |

|

DELL |

$190 |

$1,900 |

$19,000 |

|

VMW |

$250 |

$2,500 |

$25,000 |

|

AMD |

$1,900 |

$19,000 |

$190,000 |

|

RBLX |

$350 |

$3,500 |

$35,000 |

|

% Portfolio |

13.7% |

1. QUALCOMM (QCOM) is a major technology solutions provider for companies like Apple (AAPL) and will be an integral part of upcoming transformational secular revolutions like 5G. Its recent victories against Apple in court have boosted its value as Apple can’t shake the company by trying to make its own chips. I always like to have at least one chip company in my portfolio at all times with a couple never a bad idea.

ACPS = $61.92

2. Dell (DELL) is a legacy holding which continues to aggressively seek M&A opportunities like the value acquisition of the $67B EMC deal and the spin-off of the hybrid cloud giant VMware (VMW) at the end of October 2021, which it formerly owned ~80% of the stock of. Michael Dell is a shareholder winner through and through, and following in his stock footpaths I think is a good long-term decision. The VMware spinoff should allow Dell to deleverage significantly while allowing the free cash flow to hit its remaining debt burden opportunistically before Michael Dell moves on to his next future M&A opportunity. The sale of VMware to Broadcom (AVGO) potentially next year in 2023 could open up Michael Dell and Dell itself to lots of new opportunities now that it can officially cut all ties with VMware besides what is truly mutually beneficial to both parties.

ACPS = $21.52

3. VMware: I acquired VMware as a spin-off from Dell. Now I get to hopefully enjoy it being acquired by Broadcom for ~$61B. I plan at this time to opt in for receiving all Broadcom stock when the deal closes, but that won’t be until 2023 most likely. When I do my IRAs later this year, I might opt in to beef up this position markedly to take advantage of the arbitrage and for future Broadcom shares.

ACPS = $51.57

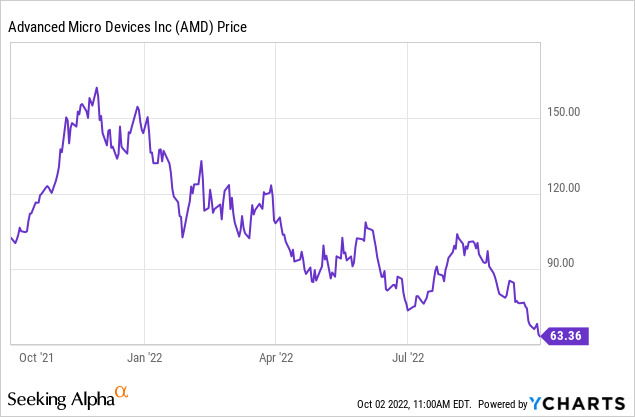

4. Advanced Micro Devices (AMD): Bought back into this stock as one of my favorite chip companies at a tremendous value in my opinion as the stock is about half off of 52-week highs. I love the CEO Lisa Su and also its most recent deal to acquire Xilinx for ~$35B which closed early in 2022. AMD continues to bully incumbents like Intel (INTC) relentlessly and I see AMD continuing to eat Intel’s lunch in the coming years as well. More than doubled my shares of AMD in September as I work to rapidly build this position up over the back half of the year. AMD was one of the primary beneficiaries from my Petrobras dividends and is now one of my largest positions as I build my tech sector back up again.

ACPS = $85.17

5. Roblox (NYSE:RBLX) is a teen gaming platform that came public through a direct listing in March of 2021. My hope was that it did not come out of the gate as hot as earlier IPOs DoorDash (NYSE:DASH) and Airbnb (NASDAQ:ABNB), which were too expensive for investing in for me personally when they first premiered. I was very happy to get in at the IPO price of $64 a share when it premiered for a large holding in my portfolio. I always try to have an eye on what younger generations are loving and this platform is expanding and growing phenomenally. Also note that Facebook (META) at the end of October announced that it was changing its name to Meta Platforms, Inc. to embrace the future of the Metaverse that is central to what Roblox is. Give me one of the originators and pioneers in the space any day personally over Facebook and its social concerns. Sold the stock to finance my Novavax (NVAX) and Twitter (TWTR) purchases of earlier months, but starting a position again at a much lower share price as I still believe in the long-term potential of the stock even during a recession.

ACPS = $48.00

The Health Care Sector

Aim = 15% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

ARWR |

$2,310 |

$23,100 |

$231,000 |

|

MDT |

$320 |

$3,200 |

$32,000 |

|

PFE |

$360 |

$3,600 |

$36,000 |

|

SMMT |

$470 |

$4,700 |

$47,000 |

|

LLY |

$160 |

$1,600 |

$16,000 |

|

% Portfolio |

14.5% |

6. Arrowhead Pharmaceuticals (ARWR) is a permanent large stock position in my portfolio as an RNAi juggernaut entering key Phase 2 and 3 trials in 2022. A lovely balance sheet with key partnerships with Johnson & Johnson (JNJ), Amgen (AMGN), Takeda (TAK), Horizon (HZNP), and a new ~$1 Billion licensing deal in November of 2021 with GSK (GSK) significantly de-risks its TRiM platform as it continues to expand into additional cell types. Amgen continues to slowly progress Olpasiran (AMG 890), its collaboration candidate with Arrowhead along with a successful Johnson & Johnson update in November 2021 on JNJ-3989 for hepatitis B virus. Takeda will help co-develop and co-commercialize Arrowhead’s lead candidate ARO-AAT preparing Arrowhead for independent commercialization of its wholly owned candidates while it continues to find partners for new candidates like the recently revealed ARO-XDH with Horizon. Arrowhead partnered with GSK for its NASH candidate ARO-HSD, proving once again its TRiM platform is in big demand as it continues to expand its pipeline so fast that it can’t progress all of its candidates by itself as a smaller sub $5B company.

A setback in its ARO-ENaC candidate led to a tremendous buying opportunity in the stock in 2021, which is still in effect in my opinion. ARO-ENaC is neither the company’s lead product nor a very important one in Arrowhead’s ever growing pipeline of candidates. Investors will have gotten an update on Arrowhead’s pulmonary plans at the Pulmonary R&D day on May 26, 2022.

I originally used the ARO-ENaC debacle to expand my shares of Arrowhead from 410 shares up to 530 shares. I expanded my shares in Arrowhead again in January of 2022 by buying an additional 70 shares to bring my total up to 600 shares. I bought an additional 100 shares in May of 2022 bringing me up to 700 total shares. I am fine sitting on my current shares for a while as one of my largest positions especially with a potentially exciting November on the horizon as a big month for new data. Here’s a recent article I did on the potential data release at AASLD this fall between Johnson & Johnson and collaboration partner Arrowhead.

ACPS = $45.56

7. Medtronic (MDT): Health care device maker that I think has significant upside from COVID-19 variants for years to come. Hospitals will need the best equipment companies like Medtronic provides as health issues from COVID-19 could and seem poised to persist for years.

ACPS = $83.13

8. Pfizer (PFE): A healthcare behemoth with a big stake in the fight against COVID-19. Seems like a great potential long-term winner at a great value compared to some of its peers. Brand new deals like its latest ~$3.2B deal with the government mean excess cash flows should continue to shower down on stockholders.

ACPS = $35.86

9. Summit Therapeutics (SMMT) did a very suspicious move in August of 2021 by combining its two Phase 3 blinded pivotal trials for its ridinilazole candidate for clostridioides difficile into one study. This was doable as both studies were at ~ 50% enrollment but were apparently not enrolling fast enough for management’s liking. However, in September 2021, investors found out that this change in the study was not pre-approved by the FDA, so the trial results won’t be enough for the FDA moving forward.

On top of all this, Summit investors found out in late December of 2021 that the company’s data results for its ridinilazole candidate didn’t meet all of the hoped for primary endpoints, resulting in another deep drop in the company’s share price.

Did a massive stock buy in January of 2022 as it settled around $2.00 a share. Went from 850 shares up to 2,850 shares as I think the stock’s upside is attractive now again. With its ability to raise cash on will with Rights Offerings backed by company Chairman and CEO billionaire Robert W. Duggan, with a 70+% ownership of the company, downside risk is markedly mitigated in my opinion.

I started to add shares of Summit again in April of 2022 as it headed south of $2 a share again along with the general continued malaise in the biotech sector. Buying shares around $1 a share now with the company’s latest rights offering on tap to bolster its cash reserves as I move up to 4,000 shares.

ACPS = $2.90

10. Eli Lilly (LLY): A favorite healthcare stock of mine that I easily jump back into and rarely sell except when I see big opportunities arise for a short-term trade. Great collection of commercialized drugs and a great developmental pipeline of possibilities, including Alzheimer’s candidate donanemab.

ACPS = $328.22

The Communication Services Sector

Aim = 10% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

DIS |

$1,030 |

$10,300 |

$103,000 |

|

GOOGL |

$570 |

$5,700 |

$57,000 |

|

% Portfolio |

6.4% |

11. Disney (DIS) will crush Netflix (NFLX) in growth over the coming decades in my opinion as its streaming platform continues to grow by leaps and bounds. The company has its ups and downs, but I think it’s a major force moving forward for decades to come so I’m in.

ACPS = $171.78

12. Alphabet (GOOGL, GOOG): One of the FAANG names producing amazing results as always even in a bear market. I have a decent amount of exposure to the FAANG names with my mutual funds, but it is hard to have too much of these juggernauts.

ACPS = $104.94

The Financial Sector

Aim = 15% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

GBTC |

$2,280 |

$22,800 |

$228,000 |

|

HSBC |

$200 |

$2,000 |

$20,000 |

|

% Portfolio |

10% |

13. Bitcoin (BTC-USD) is digital gold in my opinion and the future of finance as a potential bedfellow to or eventual replacement of not only the U.S. dollar, but to all fiat money in the coming decades. I plan on holding Bitcoin stock for the next 20+ years and to very rarely if ever sell shares, so month-to-month performance means little to me at this point. I plan on it being a long-term top 3 stock position in my portfolio at all times and will consider adding significant shares to my position if the coin drops below the $15K level. I added 100 more shares of Grayscale Bitcoin Trust (OTC:GBTC) stock again in August of 2022 as it continues to hover around $20k a coin.

ACPS = $27.95

14. HSBC Bank (HSBC) is a legacy holding that might finally see some upside if the United Kingdom can ever get Brexit resolved and new trade opportunities sorted out in the midst of Russia’s invasion of Ukraine. That, of course, might be a big if. Looks to be a stock on the chopping block when I do my IRA contributions for 2022.

ACPS = $48.91

The Consumer Discretionary Sector

Aim = 8% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

TSCO |

$560 |

$5,600 |

$56,000 |

|

TSLA |

$1,590 |

$15,900 |

$159,000 |

|

% Portfolio |

8.6% |

15. Tractor Supply Company (TSCO) quietly continues to perform as one of the best companies in retail, mostly immune to Amazon’s (AMZN) dominance. Its acquisition of Petsense makes a lot of sense now, especially with the explosive growth of everything pet in the wake of COVID-19.

ACPS = $79.76

16. Tesla (TSLA) is a newer position again for me after selling the proceeds from my Twitter trades. It was originally not on my buy list, but Elon Musk selling ~$8.4B of Tesla stock to help fund his upcoming potential purchase of Twitter allowed the high-flying Tesla stock to trade under $800 a share. After a phenomenal earnings report, I’m more than happy to buy back into Tesla’s story as I have made great money on it in the past. An extra large position now as I doubled my stock position in July. Tesla’s stock had a 3-1 split in August which I see as bullish for the company long-term especially with its potential as a former meme stock.

ACPS = $255.37

The Consumer Staples Sector

Aim = 6% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

PG |

$490 |

$4,900 |

$49,000 |

|

PEP |

$530 |

$5,300 |

$53,000 |

|

GIS |

$190 |

$1,900 |

$19,000 |

|

% Portfolio |

4.9% |

17. Procter & Gamble (PG) is a legacy holding that sports a decent growing dividend along with many best-in-class brands like Olay, Head & Shoulders, Dawn, and Charmin. Always nice to have some stalwarts for the upcoming recessions and depressions.

ACPS = $92.59

18. PepsiCo (PEP) is a phenomenal drink company with brands like Pepsi-Cola, Gatorade and Tropicana, along with amazing growth in the snack category with Frito-Lay that, in my mind, sets it apart from competitors like Coca-Cola (KO).

ACPS = $106.77

19. General Mills (NYSE:GIS) is a legacy holding for me with a great dividend that experienced a huge turnaround during COVID-19 with its brands, including its $8B acquisition of Blue Buffalo in 2018. Its former debt concerns have mostly evaporated as it has shored up its balance sheet and continues to benefit from the stay-at-home movement. Added this position back into the portfolio in August with the sale of Novavax and plan to add to it slowly over time to keep this sector around where I would like it to be.

ACPS = $76.72

The Industrials Sector

Aim = 6% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

|

J |

$970 |

$9,700 |

$97,000 |

|

|

SPCE |

$170 |

$1,700 |

$17,000 |

|

|

% Portfolio |

4.6% |

20. Jacobs Solutions (NYSE:J) is a legacy holding I have loved for years. A long-time no-debt company that makes super-smart acquisitions. It now has very low-debt and initiated a small dividend which it should be able to grow annually over the coming years like it did in January of 2022 by 10%. Its focus on carbon neutrality and diversity in its workforce makes it a prime target for the younger generation. Jacobs could also experience sustained tailwinds for years due to Biden’s infrastructure and spending bills.

ACPS = $68.41

21. Virgin Galactic (SPCE) looks ripe and tasty for another re-entrance at its current price. I love Virgin Galactic’s volatility as I have made good money in the past buying low and selling high. Commercial space flight for Virgin Galactic looks probable for the beginning of 2023, so it is a long buy-and-hold scenario but one I’m willing to wait on as a small position.

ACPS = $13.21

The Materials Sector

Aim = 12% of my Stock holdings

| Stock | $40K | $400k | $4M |

| CLF | $160 | $1,600 | $16,000 |

| % Portfolio | 0.6% |

22. Cleveland-Cliffs (CLF) is a favorite material stock for me and is a good value again trading about half off of its recent 52-week highs. It is still making money hand-over-fist and has fixed its former debt problems means it can handle the upcoming recession easily enough. Just a teeny tiny position to start as I think it could easily drop more as I slowly build this position back up. I am still hugely overweight in energy and oil so no big hurry to get my materials sector up to previous levels again means I see oil itself as a material. Added shares of Cliffs again in August taking it from a microscopic holding to a small one at this time in my portfolio.

ACPS = $18.23

The Energy Sector

Aim = 12% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

HAL |

$390 |

$3,900 |

$39,000 |

|

PBR |

$6,170 |

$61,700 |

$617,000 |

|

OILU |

$1,450 |

$14,500 |

$145,000 |

|

% Portfolio |

32.1% |

23. Halliburton (HAL) is a U.S.-based oil service company that dominates services in the North American market. Small position with no real plans to expand even though it has been on fire to start 2022 but has cooled off lately.

ACPS = $36.48

24. Petrobras is a dividend legend. Last quarter’s dividend measured out to an ~40% dividend yield when it was announced and this quarter’s dividend announcement at the end of July measured out to around an ~80% dividend yield as Brazil’s government requested an especially juicy dividend before upcoming fall elections. The reason this stock trades at such an incredible value is because of the political uncertainty that has led to value destruction for the company in past years. However, Petrobras has fixed most of its legacy debt issues meaning that its massive dividend is essentially fully financed with cash from the quarter instead of debt fueled. I can’t imagine a more interesting value proposition in the market at this time which is why it continues to be my largest holding even after selling some shares.

Here’s a list of current and upcoming dividends since I made Petrobras a top holding in my portfolio in May of 2022 when I bought 6,450 shares. My portfolio’s performance in September will be in line for some nice outperformance based on receiving these upcoming dividends alone which always makes me happy.

| Date | Shares owned before Ex-Date | Dividend |

| Jun 27, 2022 | 6,450 | $4,451.19 |

| July 27, 2022 | 6,450 | $4386.24 |

| Sept, 8, 2022 | 5,000 | $6,337.89 |

| Sept 27, 2022 | 5,000 | $6,472.02 |

Petrobras stock itself is also outperforming its usual dividend cycles at this time perhaps because the market is seeing less election risk this October than previously feared as well. I attribute this to Petrobras being able to drop domestic Brazil oil and diesel prices as well as giving the state tons in tax and dividend revenue, which fund quite a lot of the country’s social needs.

ACPS= $13.18

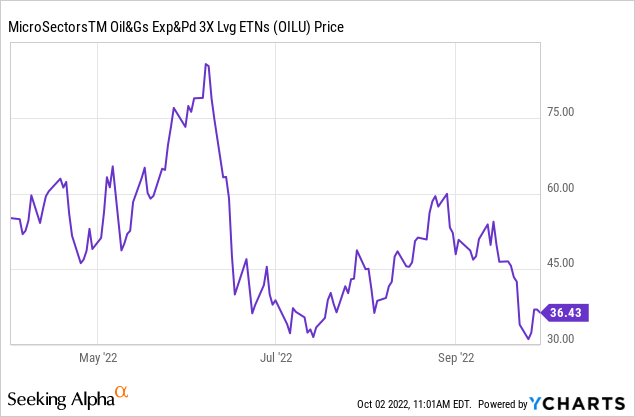

25. MicroSectors Oil & Gas Exploration & Production 3X leveraged ETN (OILU) Added a leveraged ETN for the oil and gas industry in August with oil prices hovering around $80 a barrel. I believe that after Labor Day there is a much better chance of oil heading towards $120 a barrel compared to the risk that it drops down towards $60 a barrel so I bought this ETN to try and capture outsized gains if this is what happens over the back half of the year. I see lots of people having to return to work and driving after Labor Day as Covid-19 restrictions evaporate across much of the country. Russian sanctions from Europe happening at the end of the year could help create a spike in global prices depending on how the world reacts. China is as always a mystery concerning its demand as it reopens and closes with its 0-Covid policy and Taiwan is always a wildcard. I’ll take the upside this fall and even wrote an article about it. Added more shares in September as oil continues to trend down for now at least.

ACPS=$40.09

The Utility Sector

Aim = 3% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

| DUK | $460 | $4,600 | $46,000 |

|

% Portfolio |

1.9% |

26. Duke Energy (DUK) A quality utility company and one of the largest in the space making it hopefully one of the safest with an attractive dividend. I put my Petrobras dividends and some extra cash back into this position at the end of July as I had no other buying wants at that time that superseded just building up my reserve buying power again. Sold off some of my Duke shares to buy some additional stocks on sale from the September sell-off. Smaller position and might go down to nothing if October is a bad month for the market as well and decide to buy additional beaten up stocks.

ACPS = $99.61

The Real Estate Sector

Aim = 3% of my Stock holdings

|

Stock |

$40K |

$400K |

$4M |

|

AMT |

$680 |

$6,800 |

$68,000 |

|

% Portfolio |

2.7% |

27. American Tower (AMT) is a premier U.S. cell phone tower company aggressively expanding globally across a few more continents. 5G evolution could be a lucrative tailwind for years to come. Can’t think of a reason to add another real estate play, so I just plan to keep adding to this holding over time.

ACPS = $111.38

Bonds (2% of my Stock holdings)

This asset class is currently satisfied by my mutual fund holdings.

My top 10 Holdings and Percentage of my Portfolio

|

Stock |

Sector |

% Portfolio |

|

Petrobras |

Energy |

18.3% |

|

Arrowhead |

Health Care |

6.9% |

|

Bitcoin |

Financials |

6.8% |

|

Advanced Micro Devices |

Info Tech |

4.8% |

|

Tesla |

Cons Disc |

4.4% |

| OILU |

Energy |

4.3% |

|

Disney |

Com Serv |

3.0% |

|

Jacobs Solutions |

Industrials |

2.9% |

|

QUALCOMM |

Info Tech |

2.2% |

| American Tower |

REIT |

2.0% |

|

Total % of Portfolio |

~55.6% |

Stock Watch List:

Stocks I am looking to add to my portfolio or add shares to in the coming months.

GBTC and AMD.

Best of luck :).

Be the first to comment