Chainarong Prasertthai/iStock via Getty Images

Investment Thesis

RingCentral (NYSE:RNG) has shown strong and consistent revenue growth over the past few years. Their enterprise segment has been especially strong. I like their customer acquisition strategy of using partners to close new deals.

However, the valuation looks quite expensive. The company’s operating costs have grown faster than its revenue. I want to see better signs that the core business has operating leverage. Until then, I wouldn’t recommend buying or holding shares.

High ARR and enterprise growth

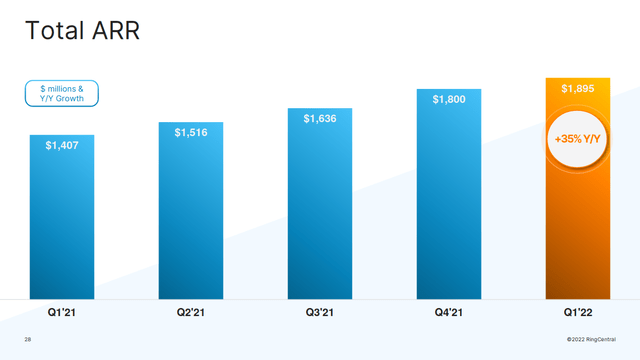

RingCentral’s revenue growth has continued to be impressive. The company is posting revenue numbers up 35% year over year. The company is growing at a high single digit rate quarter over quarter.

RingCentral Q1 2022 Earnings Presentation

This revenue is generated from subscriptions, which are typically more sustainable than single purchases. This should give the company some protection from a short downturn in the economy.

The fastest ARR increases have been in RingCentral’s higher paying customers. Some of the company’s strongest growth was from the mid-market and enterprise segments. Management defines “enterprise” as customers contributing over $100,000 ARR. Annual recurring revenues from this group are up by 53% year over year.

This is impressive since the segment has already shown similar growth for multiple years. This level of top line growth is very surprising for a company that has been public for almost a decade.

Channel partnerships drive more growth

I like how RingCentral uses their channel partners to sell extra seats. A range of third party companies market and sell RingCentral’s products. These include co-branded solutions.

RingCentral Q1 2022 Earnings Presentation

I think that sales made through partners can generate solid growth for the company. RingCentral announced and launched some of its first strategic partnerships in 2020. These were Avaya (AVYA), Atos, and Alcatel-Lucent Enterprise. Since then, they have contributed about 500,000 seats to RingCentral’s top line.

Customers acquired through these channels have much better unit economics than usual. Management discussed these dynamics on their last earnings call:

When we book a deal through our direct, the cost to book is the highest because we are paying for the lead gen and for our sales force. So we are paying kind of end-to-end for getting the sale as we utilize our channel partners, we are only paying for wins. And as the partner — the strategic partner-led motion take share, it’s even more accretive on 2 fronts. One is in terms of the upfront cost to book, we are able to leverage the sales forces of our partners and their marketing motions. So we get efficiencies there that results in a lower cost of book.

And then on the other hand, because these partners have had long-standing relationships with these customers, and they are incentivized for the customers to stay on the platform, churn is lower and it drives higher lifetime values. So when you kind of put the sum of the parts together, the LTV to CAC ratios are incrementally better on the direct — on the partner-led motions when compared to the overall business.

This strategy shifts a lot of customer acquisition costs from RingCentral to its partners. The types of customers that come from these channels will likely have lower churn rates, too. Revenue from these sources saves money on sales and marketing costs. I think this pushes the company towards profitability. Sales and marketing currently account for over half of RingCentral’s operating expenses.

RingCentral is expanding their relationships, especially with global service providers. The company provided more updates on their latest earnings call about these relationships. At the end of last year, RingCentral had 12 contracted relationships with GSPs. Only three were generating meaningful revenue. By the end of the year, the company plans to have 18 contracted relationships. Management expects nine of these to generate revenue. Scaling these partnerships allows access to a large base of customers at lower customer acquisition costs.

The company also has a strong integration with Microsoft Teams. Management identified the segment as a “long-term growth driver” on its last earnings call. I can’t find any direct metrics from this channel, but management said sales are up 500% year over year.

The valuation is surprisingly expensive

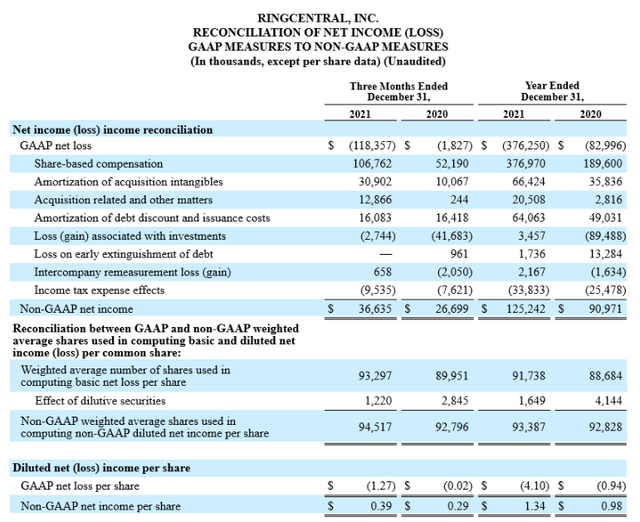

RingCentral’s business case is strong, and its growth is impressive. Its adjusted P/E is under 30. This seems low for a company growing more than 25% year over year. However, its valuation is more expensive than it may seem at first glance. The company’s adjusted metrics may look solid, but their GAAP profitability paints a different picture.

RingCentral Q4 2021 Earnings Presentation

RingCentral’s stock-based compensation is extremely high. Last quarter, RingCentral paid out more than $100 million in shares. This number is up more than 60% year over year. Almost one quarter of the company’s operating expenses are paid out in stock. This is one of the primary drivers of the company’s widening net losses.

The company is still generating sustainable positive free cash flow. This reduces the risk of the company having difficulties funding operations. But it may come at the cost of significant dilution to current shareholders.

This is where I see the primary risk in this investment. I don’t know how much operating leverage the company has. Their long term growth may be limited if increased revenue growth requires increased sales and marketing spend.

I’d be more interested in buying if RingCentral manages to show more leverage over its expenses. But even after a significant drop, the company is still trading at a P/FCF of about 55 times. Its forward EV/Sales is 3.5 times. I don’t feel this valuation adequately covers the downside risks if the company’s expenses keep growing.

Final Verdict

RingCentral’s business is strong and growing at a high rate. However, the company’s expenses have increased very quickly as well. The company is unprofitable on a GAAP basis and has diluted its shares by almost 27% over the past five years.

I would recommend that GARP investors add this to their watchlist. The company reports its next earnings on August 2nd. If the company shows moderating expenses along with solid revenue growth, they may be worth buying. However, I recommend staying on the sidelines until then.

Be the first to comment