kameraworld/iStock Editorial via Getty Images

In a previous report, I discussed the Q1 2022 results of American Airlines (NASDAQ:AAL). What I liked about American Airlines was their attention for balance sheet repair whereas United Airlines (UAL) used its earnings presentation as a billboard for stock investments. However, shares of American Airlines despite a strong outlook have not particularly thrived as fears of recession and industrywide concerns on staffing issues and labor costs directed share price performance. In this report, I will be analyzing the second quarter results and pay close attention to the third quarter guidance and management comments on some of the issues that are common in the industry today.

American Airlines Sees Higher Revenues, Higher Costs

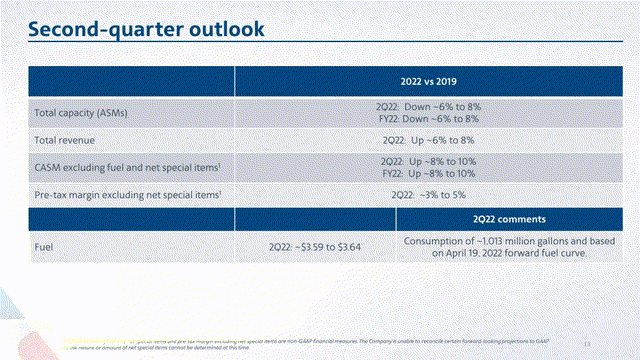

American Airlines Q2 2022 outlook (American Airlines )

For the second quarter, American Airlines guided for capacity down 6 to 8 percent and later on updated to the 7 to 8 percent range, but in line with its most recent Q2 guidance, the company realized capacity down 8.5%. So, during the quarter, we saw the capacity guidance coming down twice.

At the same time, total revenue was up 12.2% whereas 6 to 8 percent was guided for initially and 12% in the most recent guide. So, partially helped by the capacity constraints seen throughout the industry and continued demand for air travel, total revenues exceeded expectations setting a record-breaking revenue figure for the airline. CASM excluding fuel and special items was up 11.8% whereas an increase of 8 to 10 percent was guided for driven by lower capacity, higher labor costs and investments to improve operational reliability. This was later altered to 12%. The fuel cost per gallon that American Airlines expected was in the $3.59-$3.64 range, but it ended up being $4.03 per gallon in line with the most recent guidance. This brings us to the challenges airlines are facing now. You either need a fuel-efficient fleet or you need some strong hedging mechanism. American Airlines does not hedge its fuel requirements, but 16.5% of its fleet consists of next generation aircraft which are more fuel efficient. So, that is quite appreciable. Pre-tax margins were initially guided for to be in the 3 to 5 percent range, increased to 4 to 6 percent in the June guidance update and 5% in the July update. Pre-tax margins excluding special items ended up being 5.1%.

What the results and the guidance updates from American Airlines portray, likely more than most other updates we have seen, is that the guidance was way too bullish when it comes to capacity recovery and fuel prices were underestimated offset by stronger than expected revenues.

Operating revenues grew $5.9 billion year-over-year while operating expenses grew by $5.3 billion, providing a positive $2 billion swing in profitability on adjusted levels as payroll support was provided in the second quarter last year and had to be adjusted for. Realistically, the guidance from American Airlines was off quite a bit but its margins were stronger than initially guided for.

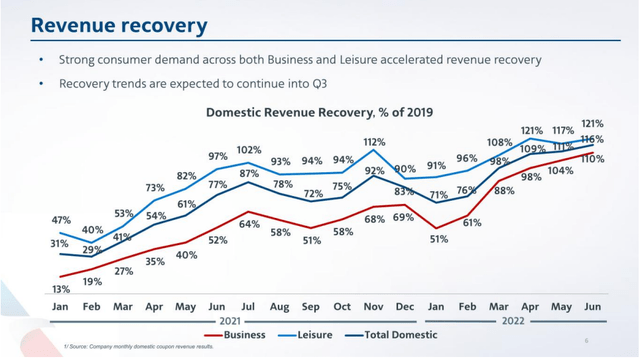

Revenue recovery American Airlines (American Airlines)

On the revenue recovery trajectory, we see that domestic revenues continued to grow throughout the quarter. We see strong recovery and actually revenues exceeding 2019 levels on the business travel segment and leisure travel dipping a bit in May. Overall, domestic revenues now exceed 2019 levels by 16%. So, we have domestic business as well as domestic leisure exceeding 2019 levels while short haul international is achieving 120% of 2019 levels but long-haul recovery is not quite there yet. Obviously that provides a growth opportunity and could offset some weakening in pricing in case demand in the other segments falls. However, American Airlines has not provided detail on how far that recovery is at the moment and it is in fact one of the wildcards in the company’s earnings.

During the quarter, American Airlines had pre-tax margins of little over 5%. That is of course pressured by fuel, but another element is that except for pilots American Airlines has the costs in place to fly another 150 aircraft so as those aircraft are currently not adding to production, that is a cost burden without any return on it and that provides a headwind to margins and CASM. Nevertheless, the company generated $800 million in free cash flow. The airline made scheduled debt and lease payments of $1 billion during the quarter including a payment to retire the $750 million unsecured senior notes maturing in June. That brings American Airlines to a debt reduction of $5.2 billion with a targeted reduction of $15 billion which will accelerate when American Airlines will reduce its liquidity levels it holds and next to that the continued business operations should also allow American Airlines to reduce its debt by $15 billion in 2025 with another $375 million scheduled debt reduction in Q3 2022.

AAL’s Guidance Is Realistic But Soft

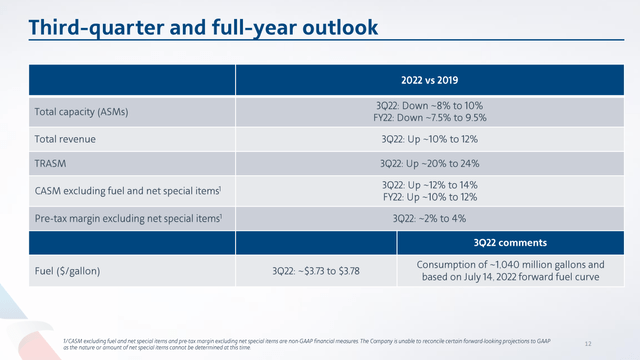

Q3 outlook American Airlines (American Airlines)

The guidance that American Airlines provided does not fill me with joy. Capacity is expected to be down 8% to 10% which really suggests that the capacity recovery is not improving as one would have hoped. While revenues will be up 10 to 12 percent, the margins are expected to be quite slim at just 2 to 4 percent. Q3 for airlines largely points at a margin contraction, but for a company to have 2 to 4 percent in margin contractions while unit revenues are extremely high (and so are fuel costs), one can wonder how efficient the cost structure is and what will happen when to the pre-tax margins when the demand environment weakens. American Airlines said they can simply size the fleet according to their needs. That sounds like a flexible answer and indeed they have planned deliveries they can postpone and leases they may decide not to renew, but there are other cost components such as fuel and most at this point labour costs as well that are increasing the costs and American Airlines hasn’t been able to provide a lot of insights in how much of the CASM increase can be burned off in case the demand environment weakens.

When the pandemic grounded the airline industry, airlines were focused on building towards a lean structure. American Airlines focused its network for 70-75 percent in regions where it can create customer value, so it is cherry picking where to deploy its resources, but we are also seeing that rebuilding airlines doesn’t happen in a lean structure as airlines are basically hiring what they can and pilots while they got their job back now are demanding higher pay. So you can really wonder how much strength American Airlines will have when the strong demand environment will weaken.

Conclusion

In my Q1 2022 analysis, I marked American Airlines a buy based on a strong outlook and management in my view has been focused on debt reduction and balance sheet repair which I like. We haven’t seen a lot of companies in the airline industry making that connection. Since I highlighted the diligent approach of American Airlines, shares have lost over 30% of their value on the back of recession fears and we are now seeing that the Q3 outlook points at further slimming in the margins and one can really wonder whether American Airlines did a good job with its cost structure if demand softens. Fuel cost is likely going to come down at some point if we get to a recession, but on labor we are seeing higher costs and if demand softens the airline is going to be experiencing some pressure from that.

For American Airlines, the good thing is that they are operating on elevated liquidity levels, and if they get towards more normal levels, it means they can use the excess $6 billion to complete another 40% of its debt reduction target but that requires demand to remain high and I believe that a company such as American Airlines would need at least another 12 to 18 months of current elevated demand levels to operate more comfortably and with fears of a recession one can wonder whether that will be the case. If American Airlines shares would have been roughly flat compared to the price when I published the Q1 2022 piece, I would probably have marked it a strong sell. Right now, in the most positive case, I am changing that rating from buy to hold, and if you consider that there are other airlines that might do a better job keeping their margins up, you might even consider American Airlines a sell.

I like how American Airlines connects the recovery trajectory to balance sheet repair and their plan for debt reduction, what I am not particularly impressed with at this point is their plan with the cost structure in case demand falls and unit revenues soften and on long-haul recovery the airline has given too little information to project that into the future. We basically have a $6 billion cushion and lease terminations that American Airlines has to get through a recession. That might be enough, but doesn’t make American Airlines extremely comfortable for investment.

Be the first to comment