hapabapa

Investment thesis

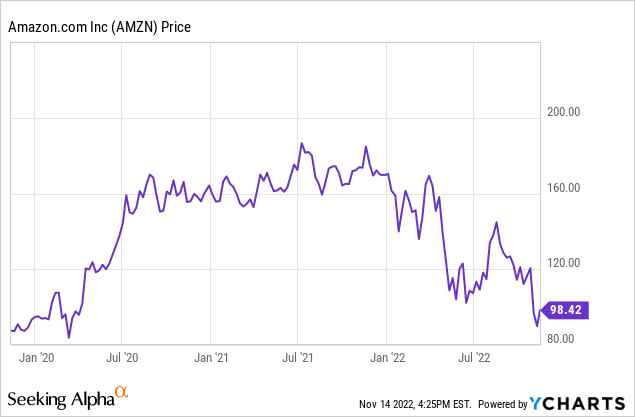

After two years of being in a bull market, Amazon’s (NASDAQ:AMZN) stock price has eventually fallen to pre-covid levels. This is mainly because of the current bear market that we are experiencing as the Federal Reserve raises interest rates quickly to battle inflation, causing uncertain prospects for every business.

Amazon has a market cap of more than USD 1 trillion and analysts are expecting this company to grow at a rate of 10% to 15% when it comes to revenue. So the question seems to be: How could an organization the size of Amazon that is growing at this pace multiply your investment?

Keep reading to find out…

The Cloud And Advertising Segments

At the moment both the cloud and advertising segments combined contribute about 22% to the revenue and although they might seem to be two small businesses compared to the giant called Amazon, they come with two important features:

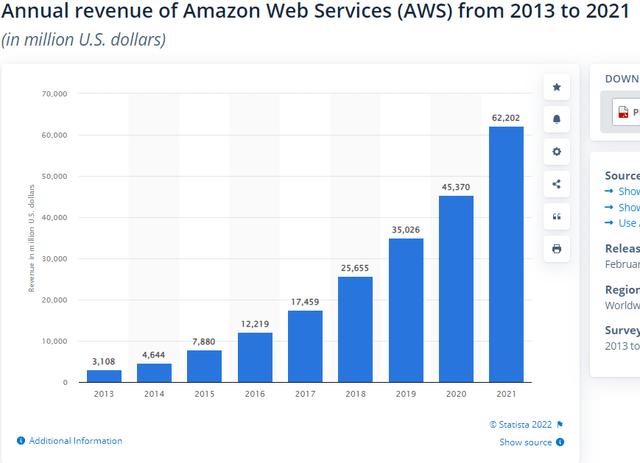

The cloud business and even the advertising business, can both easily grow by 20%-30% yearly in my view.

As a matter of fact, the cloud business has had a CAGR of almost 45% since 2013 and the company already has an order book for the next three to four years.

The cloud and advertising businesses both have 20%-30% operating margins.

Amazon’s Most Underrated Business Segment

The advertising business segment is probably the most underrated business segment that Amazon has. As many advertising companies, like Snapchat (SNAP) and Meta (META), have mentioned before, the advertising industry has changed mainly due to the new IOS changes that don’t let them track their users anymore and this has led to these companies going through several budget cuts and dealing with declining revenue growth.

But the story is different when it comes to Amazon. This company not only gained even more market share but also managed to grow its revenue by double digits. The main reason that this happened is that Amazon has a different approach to advertising than Meta and Snapchat; the search engine. Instagram for example has to predict what its users would like to purchase based on their behavior and then show them relevant ads, and this has become harder as they cannot track them anymore due to the IOS changes. Amazon on the other hand does not have to guess anything because its customers search for what they want by themselves. When somebody is interested in buying something through Amazon, they type it in the search bar and the company can show them relevant ads as they already have the data given by the customer to know what to show him.

Moreover, this kind of advertising yields an extremely high return on investment for the shops that advertise on Amazon as the ad is really targeted and therefore effective. This gives the company the ability to charge a premium for these ads, especially in this environment where competitors struggle to offer efficient ads, and thus profit even more from them.

Amazon’s E-commerce Business

At first sight, Amazon’s e-commerce business seems to be capital-intensive, as the company needs warehouses and huge reinvestments to operate, and even then it still has quite low margins. However, if you dig a little bit deeper, you will find out that this segment is also decently profitable.

In the case of Amazon, the e-commerce business can be divided into three categories:

1. Amazon Prime

billboard.com

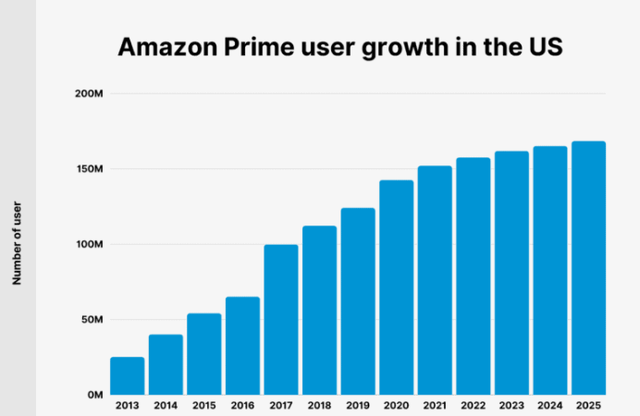

Amazon prime has been described as one of the best offers out there by many customers and this is depicted in its numbers as the company has managed to increase this business every year by double digits and it estimates that it will keep growing at a decent pace until 2025.

The main reason behind Amazon prime’s success is pricing. Although the company could most likely easily increase the price of the service every year and still have customers coming in, they don’t do it. Instead, they only increase the prices almost every three years. At this point, I have to mention that although for the company’s customers this is a great business, for its investors it is not the same, as it is still unprofitable.

2. Amazon’s First-Party (1P) Business

The first-party business is made up of the products that are sold by Amazon. The company doesn’t make any money from this category although it has gained almost 50% of the market share. Personally, I don’t think that they even aim to make any money there as this segment is just to attract customers. However, there is a lucrative business in the e-commerce segment and that is Amazon’s third-party (3P) business.

3. Amazon’s Third-Party (3P) Business

When somebody sells a product through the Amazon site, Amazon takes a cut of the revenue that the seller made in exchange for using its platform. This is known as the take rate and in the case of Amazon, 7 years ago it used to be 19% but has now reached over 30%. This means that if you sell something on Amazon, you make less than $70 for every $100 of goods you sell. Although this take rate might seem a bit high, a big portion of it goes into advertising. Advertising is optional for sellers, as anyone could just list a product and, if sold, pay Amazon a 15% commission. However, sellers generally choose more features in order to sell more and faster and this is what drives up the take rate.

This third-party business is the one that drives profit to the company mainly through commissions and advertising as it is a high-growth business with high margins. However, this is not disclosed by the company as it decides to group everything into one category. Although the prime business is losing money, the third-party business is very profitable and it keeps growing.

Concern

Amazon has been investing heavily back in its business since the day it started and this has been preventing the company from showing its full potential as it keeps its margins low. At some point, I think all these investments will pay off and the company will eventually enjoy high margins, but the problem is that nobody knows when this is going to happen. As long as the company doesn’t show what it can be and keeps staying in this reinvestment phase, I don’t think that it can offer its shareholders a market-beating return. This translates to having your money attached to a stock for a long time without seeing any good returns.

However, if you consider yourself to be a long-term investor such short-term problems should not be a big deal in my view.

Conclusion

Amazon is going through a hard phase as it reinvests a big portion of its profits back into the business in order to grow and this keeps the margins low and the investors wondering when and if the company will ever have the margins that most e-commerce businesses have. I believe that at some point, near the future, every investment that Amazon makes will pay off eventually and when this happens both margins and profitability are going to be way higher than they currently are driving the stock price to new all-time highs.

Bearing in mind everything above, I feel confident to say that at this price, I rate Amazon as a BUY.

Be the first to comment