We Are

JBS S.A. (OTCQX:JBSAY) appears to be investing a lot of money in sustainable development as well as research and development, which may bring equity demand. Among the initiatives, I am optimistic about the company’s Net zero 2040 plan. Besides, already with well-known brands in the Latin American market, I believe that future free cash flow would easily justify a market valuation higher than the current market price. Even considering inflation and potential corruption scandals about deforestation-linked products, I think JBSAY is significantly undervalued.

JBS

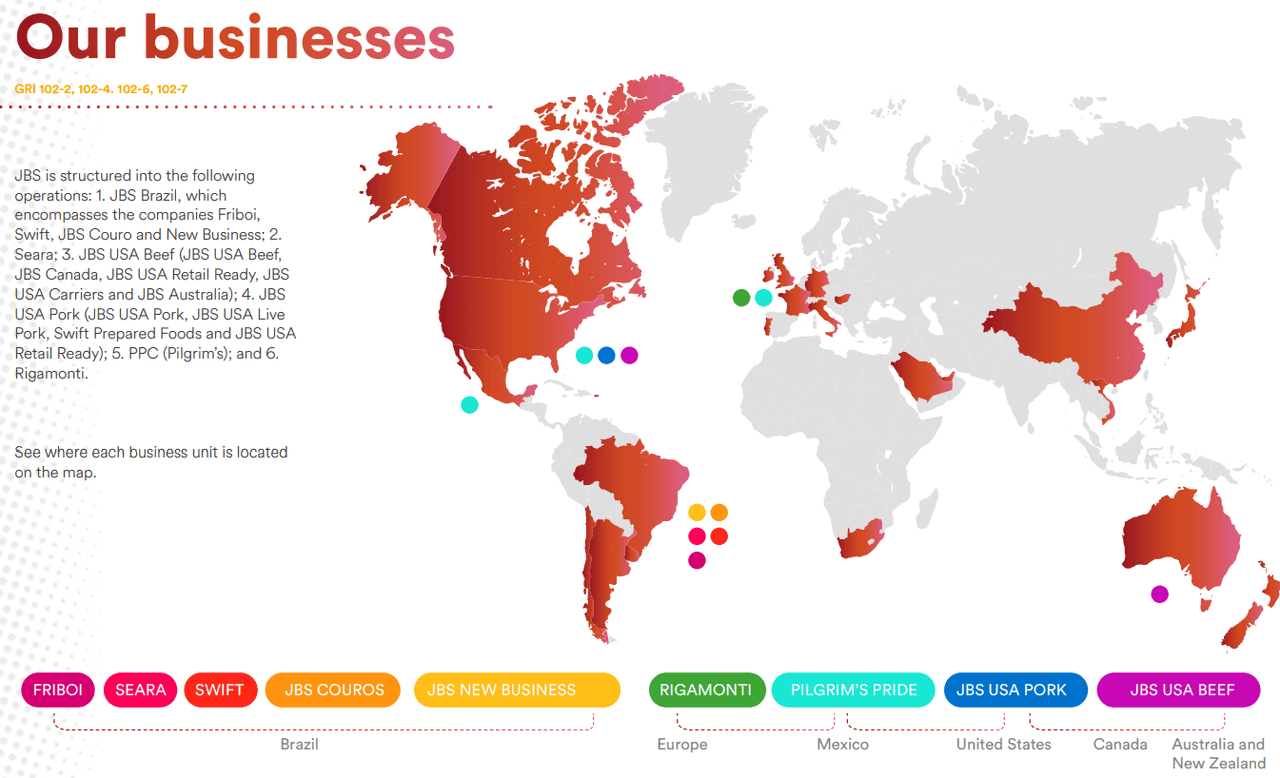

When it comes to the international trade of protein-based foods, JBS appears to be one of the reference corporations for its quality and production flow as well as its projected sustainability model. Headquartered in the city of Sao Paulo, in Brazil, and currently operating in 20 countries, the company currently has close to 250,000 employees.

Sustainability Report

Among its best-known products is the production of food based on cattle and pork, the production of poultry food, plant-based food, and the development of leather for the clothing industry.

For the sustainable development of its production and international trade, JBS works with a disciplined environmental sustainability plan, whose strongest points are the sustainable development of the food sector, the conservation and recovery of native forests, the support to the communities in which they are present, and the drive for the modernization of the business sector in relation to the sustainability objectives of JBS.

With regards to food production, some of its most recognized global brands, especially in the Latin American market, are Swift, Rezende, Friboi, Seara, Marba, and Primor. In my view, investors from Latin America will recognize some of these names. The company’s business model appears quite diversified.

Company’s Website

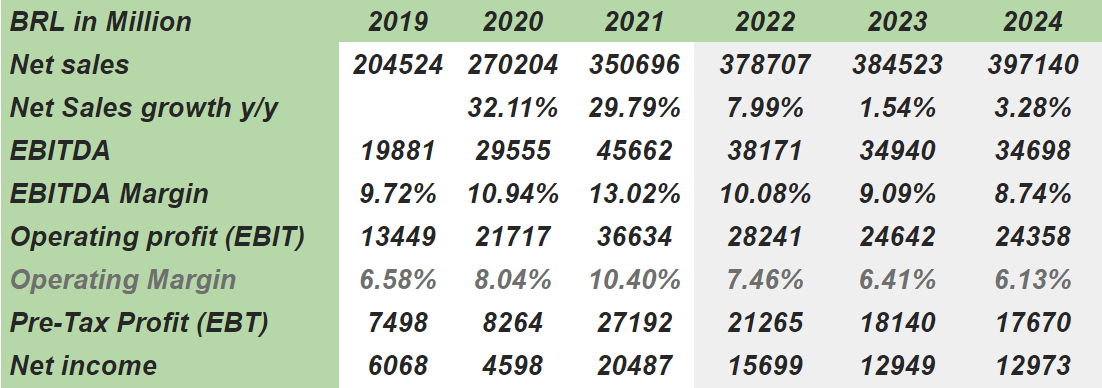

Market Estimates Include 2022 Sales Growth of 7.99% And An EBITDA Margin Close to 10%-8%

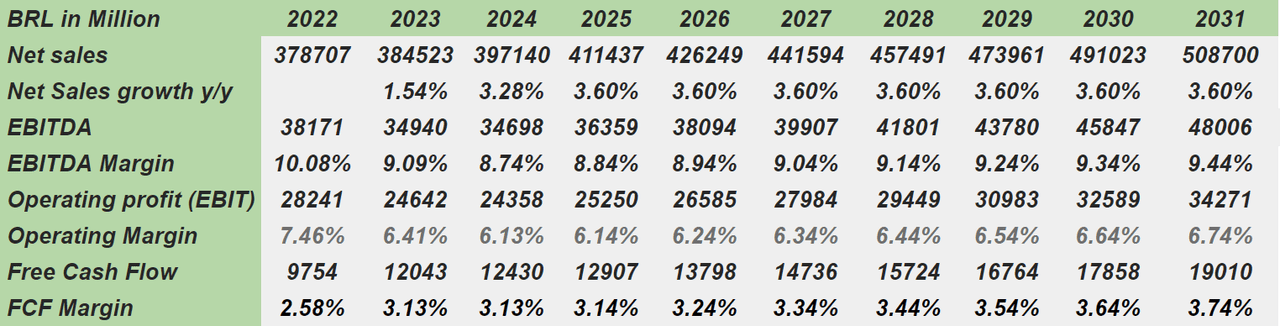

Expectations from analysts include a small decrease in sales growth but stable EBITDA margin. 2024 net sales would stand at BRL397.14 billion, with net sales growth of 3.28%. 2024 EBITDA would be BRL34.698 billion, with an EBITDA margin of 8.74%. 2024 operating profit is expected to be around BRL24.358 billion. Finally, pre-tax profit would stand at BRL17.670 billion, and the net income would likely be close to BRL12.973 billion.

Marketscreener.com

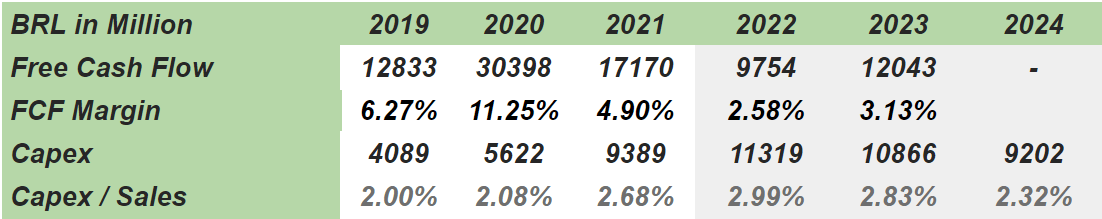

The cash flow statement appears more stable than the income statement. JBS is expected to deliver a 2023 free cash flow of BRL12.043 billion, with a 2023 FCF margin of 3.13% and 2023 capex of BRL9.202 million.

Marketscreener.com

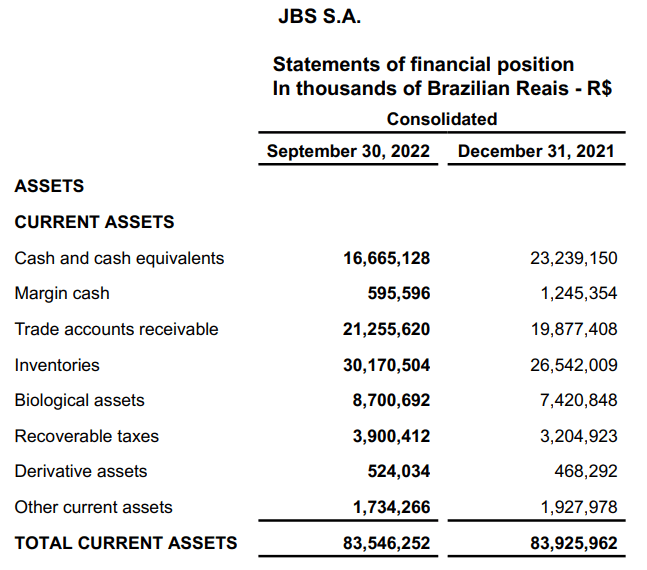

Balance Sheet: I Didn’t See Large Liquidity or Solvency Risks

As of September 30, 2022, JBS reported cash of BRL16.665 billion with trade accounts receivable worth BRL21.2 billion and inventories worth BRL30.17 billion. Biological assets stood at BRL8.7 billion, together with recoverable tax of BRL3.900 billion. The total current assets were equal to BRL83.5 billion, close to 1.45x the total amount of current liabilities. In sum, I don’t believe that JBS could have a liquidity crisis anytime soon.

Quarterly Report

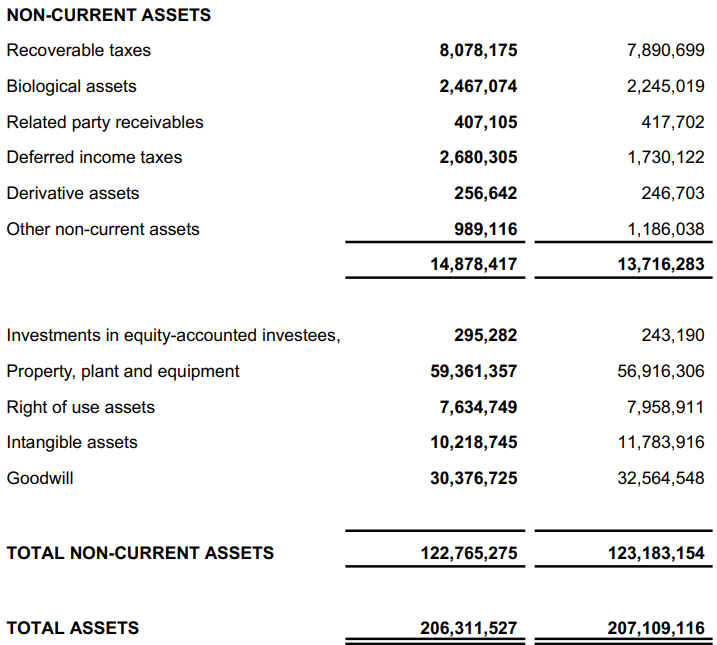

Regarding non-current assets, management noted recoverable taxes worth BRL8.07 billion together, with biological assets worth BRL2.46 billion and deferred income taxes worth BRL2.68 billion. Property, plant and equipment was BRL59.36 billion with a right of use assets of BL7.634 billion and intangible assets worth BRL10 billion. Finally, with goodwill worth BRL30.3 billion, total assets are equal to BRL206.3 billion, more than 1x the total amount of liabilities.

Quarterly Report

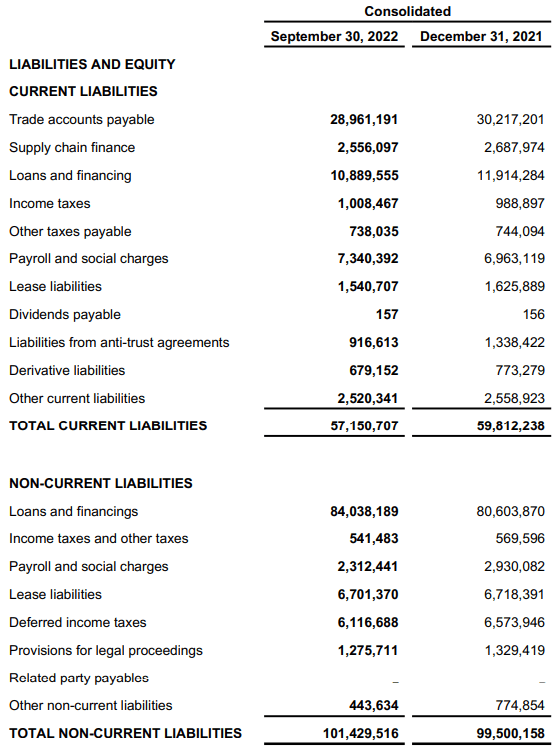

As of September 30, 2022, liabilities included trade accounts payable worth BRL28.9 billion, loans and financing of BRL10.88 billion, and total current liabilities worth BRL57 billion.

The non-current liabilities included loans and financing of BRL84.03 billion, payroll and social charges of BRL2.31 billion, and lease liabilities of BRL6,701,370 million. The provisions for legal proceedings would be BRL1.27 billion, and the total non-current liabilities were reported to be BRL101 billion.

Quarterly Report

Sustainability Plans And Further Research And Development Could Bring Significant Demand For The Stock

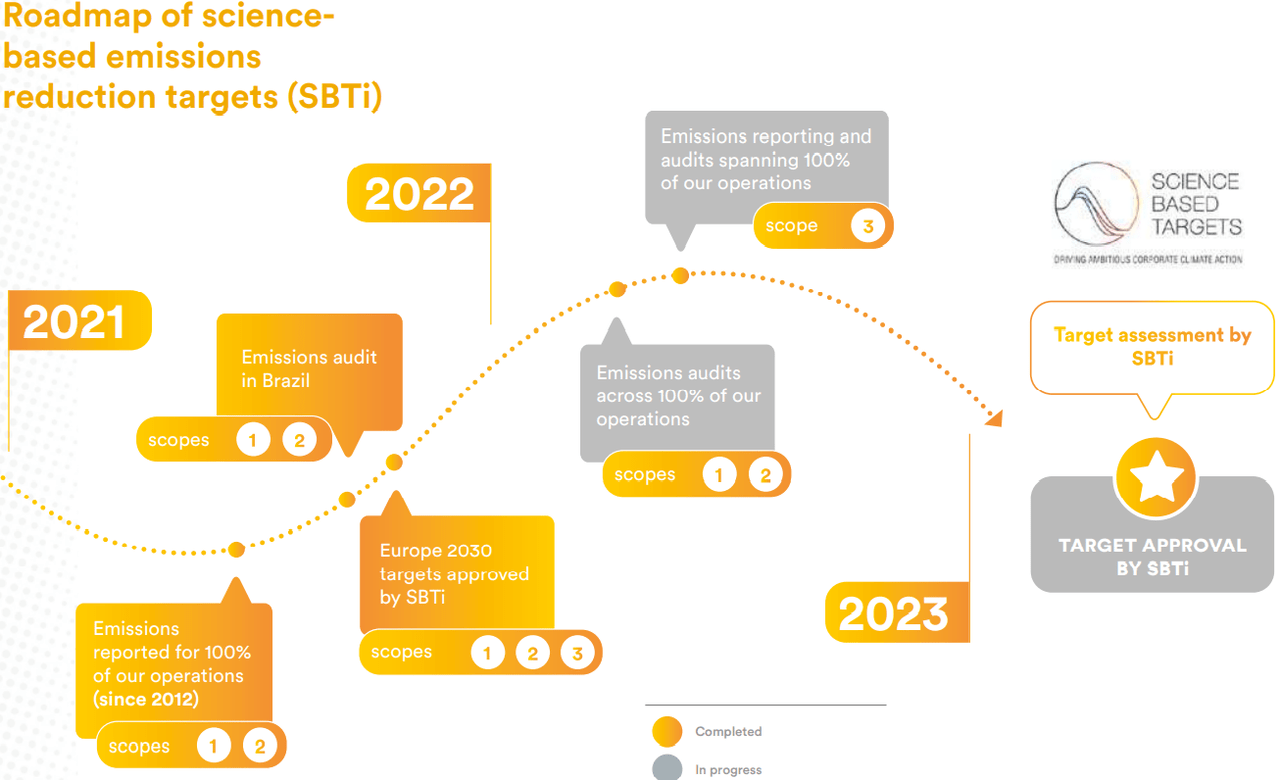

Let’s note that JBS signed agreements for the Net Zero 2040 plan, which promises to reduce its carbon emissions to zero by 2040.

The third quarter of 2022 marked a period of solid results and further sustainable evolution towards our global Net Zero 2040 goal. Against a backdrop of higher operational costs and economically challenging environments in different business segments, we exceeded our sales in the period and recorded the highest quarterly net revenue in our history. Source: Earnings Presentation

For this development plan, the company has clear objectives. For example, by the year 2025, JBS expects that none of its supply chains will be sustained by the illegal deforestation of native forests in Brazil. Also, by 2030, management expects to reach 60% of its energy sustained by electricity besides achieving a 15% reduction in the use of water for its industrial plants.

Sustainability Report

I also believe that the impressive research and development efforts announced recently could bring significant financial benefit to JBS. Let’s keep in mind that the company has allocated BRL568.4 million exclusively to research and development in 2021, and further R&D efforts for sustainability plans are expected to increase.

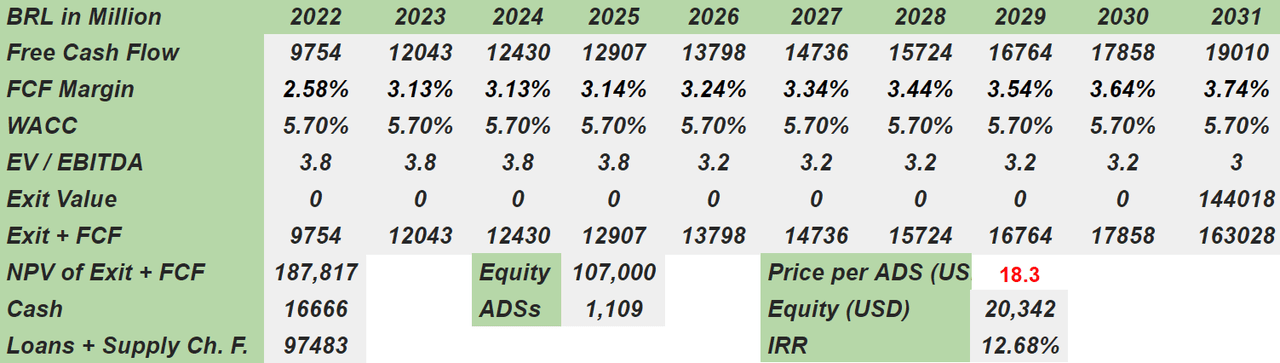

Under the previous conditions, I forecasted, for 2031, a net sales of BRL508.7 billion with a net sales growth of 3.60%, which I believe is conservative. Experts believe that the global food and beverages market is expected to grow at a CAGR of 9.7%.

The global food and beverages market is expected to grow from BRL5,817.4 billion in 2021 to BRL6,383.49 billion in 2022 at a compound annual growth rate of 9.7%. The market is expected to grow to BRL8,905.5 billion in 2026 at a compound annual growth rate of 8.7%. Source: Global Food and Beverages Market Report to 2031

I also included 2031 EBITDA of BRL48.006 billion with an EBITDA margin of 9.44%. In addition, the operating profit will likely be BRL34.271 with an operating margin of 6.74%. Finally, 2031 free cash flow could be close to BRL19.010 million, which would imply an FCF margin of 3.74%.

Author’s Work

Considering a WACC of 5.70% and an EV/EBITDA multiple of only 3x, the implied enterprise value would stand at BRL187.817 billion. I also added cash of BRL16.666 billion and subtracted debt of BRL97.483 billion, which implied an equity valuation of BRL107.000 billion. Finally, I obtained a fair price of $18.3 per ADS.

Author’s Work

My Bearish Case Scenario Implied A Valuation Of $5.65 Per Share

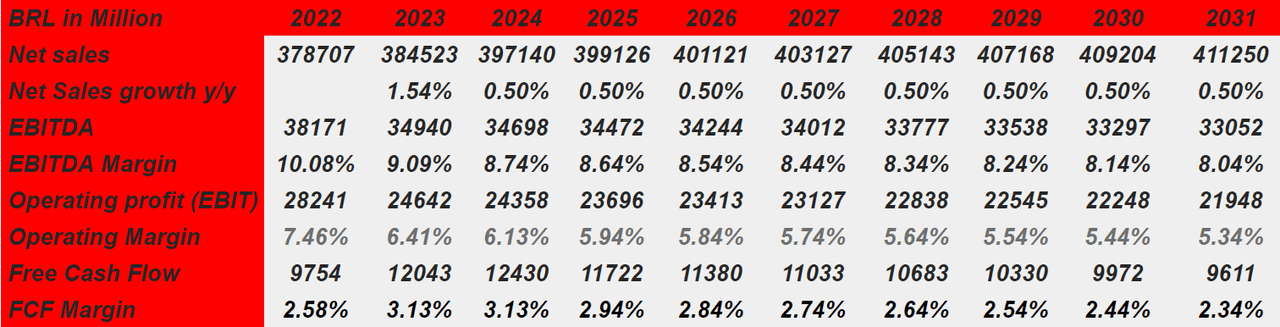

In my view, the largest risks for JBS would come from corruption scandals or sale of deforestation-linked products. In my view, if consumers dislike some of the brands because of detrimental articles about JBS’ suppliers, revenue growth may decline. There are researchers out there talking about these issues.

JBS has a long history of corruption and charges of deforestation in its supply chain. Chain Reaction Research found, in investigative reports, that major Brazilian retailers were purchasing deforestation-linked products from slaughterhouses owned by JBS and other meatpackers. Source: The Chain: JBS Backtracks on Transparency

Investors in the United States may also suffer from decreases in the Brazilian currency against the US Dollar. Even if the company delivers magnificent free cash flow, investors in the United States could lose money.

I would assume that inflation may erode some of the company’s FCF margins. If the price of commodities increases, and JBS can’t increase its prices in the supermarkets, the company’s free cash flow would decline. As a result, JBS’ fair valuation could decline.

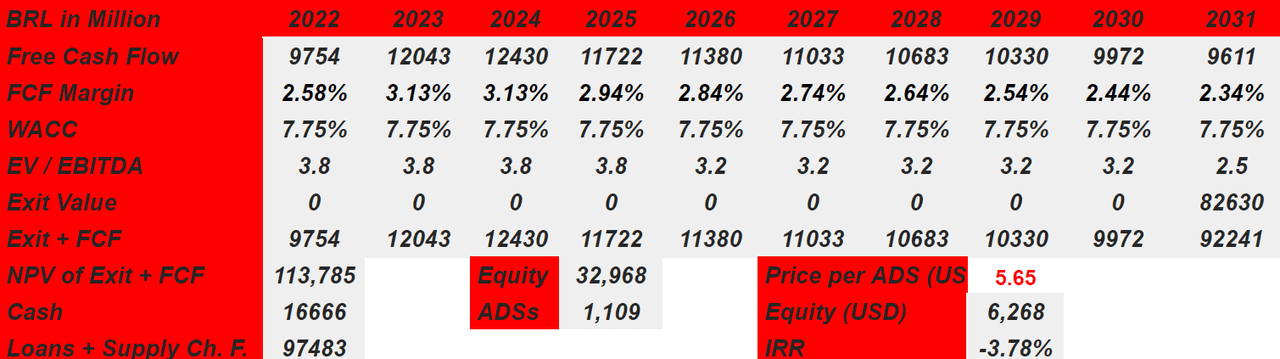

Under the previous conditions, I included 2031 net sales of BRL411 billion and 2031 net sales growth of 0.50%. I also assumed an EBITDA of BRL33.052 billion, an EBITDA margin of 8.04%, operating profit of BRL21.948 billion, and an operating margin of 5.34%. 2031 free cash flow would be BRL9.611 billion with an FCF margin of 2.34%.

Author’s Work

Under this case, I also included a discount of 7.75% and an EV/EBITDA multiple 2.5x, which implied an enterprise value of BRL113.7 billion. I would also expect an equity valuation of BRL32.968 billion. Finally, the fair price would be $5.65 per ADS.

Author’s Work

Conclusion

With well-known brands and a significant amount of know-how accumulated, JBS’ new sustainability plans and R&D efforts may be appreciated by the market participants. In my opinion, future free cash flow would justify higher valuations. My DCF model with very conservative assumptions indicated a price of $18.3 per ADS. Risks like inflation, corruption scandals, and detrimental publicity could send each ADS to $5.65, but in my view, it wouldn’t go lower.

Be the first to comment